- Home

- »

- Next Generation Technologies

- »

-

Air Defense Systems Market Size And Share Report, 2030GVR Report cover

![Air Defense Systems Market Size, Share & Trends Report]()

Air Defense Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Weapon System, Fire Control System), By Type (Missile Defense System, Anti-Aircraft System), By Platform (Land, Naval, Airborne), By Range, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-413-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Air Defense Systems Market Summary

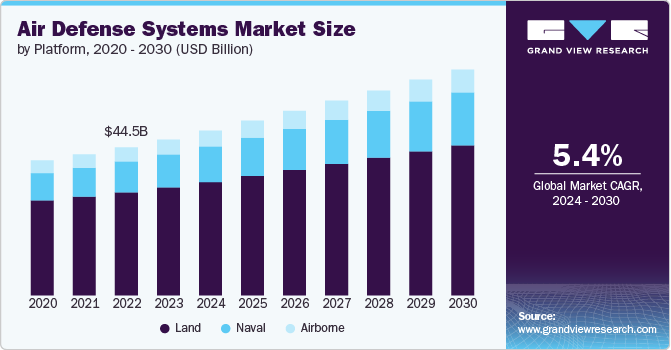

The global air defense systems market size was estimated at USD 46.89 billion in 2023 and is expected to reach USD 67.93 billion by 2030, growing at a CAGR of 5.4% from 2024 to 2030. Increasing geopolitical tensions, the proliferation of unmanned aerial vehicles (UAVs), and the evolving nature of warfare have necessitated advanced air defense capabilities, contributing to the market growth.

Key Market Trends & Insights

- North America accounted for the largest revenue share of around 41.0% in 2023.

- By component, the weapon system segment accounted for the largest revenue share in 2023.

- By platform, the land segment accounted for the largest revenue share of over 69.0% in 2023.

- By type, the missile defense system segment accounted for largest revenue share in 2023.

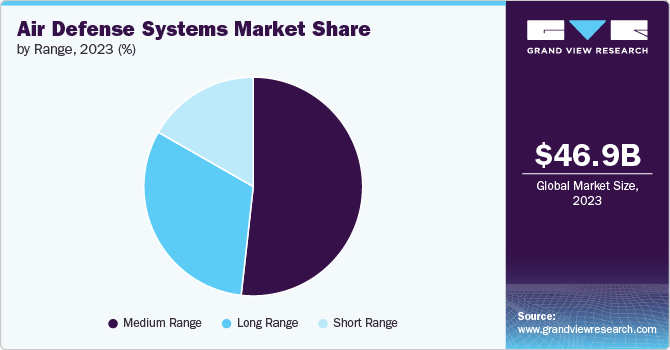

- By range, the medium range segment accounted for highest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 46.89 Billion

- 2030 Projected Market Size: USD 67.93 Billion

- CAGR (2024-2030): 5.4%

- North America: Largest market in 2023

Moreover, increasing technological advancements in radar, sensors, and missile systems are enabling the development of more effective and efficient military infrastructure, further driving the growth of the market.

The expansion of the market is being further driven by the rising demand for sophisticated systems driven by the rising need to protect critical infrastructure coupled with increasing defense budgets across various countries. For instance, the President's Fiscal Year 2024 Defense Budget released by the U.S. Department of Defense in March 2023 encompassed USD 1.8 billion for AI and USD 1.4 billion for Joint All-Domain Command and Control (JADC2) initiatives.

In addition, increasing collaboration between air defense systems providers and defense organizations is also expediting the market growth. For instance, in January 2024, RTX Corporation partnered with the Kongsberg Defense & Aerospace and U.S. Air Force Research Laboratory's Strategic Development Planning and Experimentation (SDPE) office to demonstrate the performance of the GhostEye MR sensor for the National Advanced Surface to Air Missile System (NASAMS). The GhostEye MR has been integrated with NASAMS' Air Defense Console and the Battlespace Command and Control Center (BC3). Such developments are expected to create significant growth opportunities for the market.

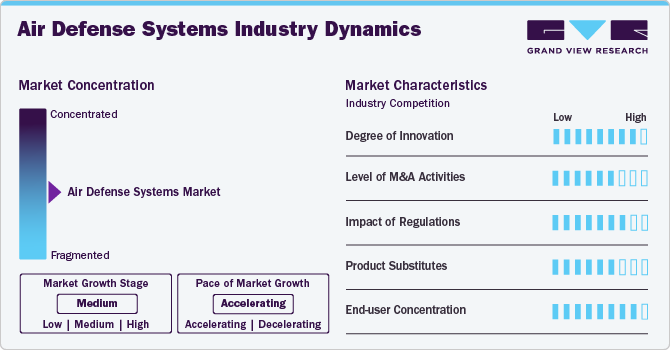

Market Concentration & Characteristics

The market is characterized by high growth with an accelerating pace of market growth. The degree of innovation is high in the market with rapid technological advancements, including integration of artificial intelligence and machine learning, coupled with increased military investments to bolster air defense infrastructure is contributing to the market growth.

The market is characterized by a high level of merger and acquisition (M&A) activities by the leading market players aimed at expanding their global footprint, and enhance technological capabilities, to gain a competitive edge in the industry.

The competition from product substitutes in the market is expected to be low. The unique nature of air defense systems, designed to protect against a specific set of threats (missiles, aircraft, drones), limits the availability of direct substitutes. While other military systems, such as fighter jets or electronic warfare systems, can complement air defense, they do not directly replace its function.

Regulations have a significant impact on the market due to the growing importance of security and compliance of these advanced systems among governments and defense agencies. The regulations are aimed at addressing concerns related to data privacy, cybersecurity, and ethical use of emerging technologies involved in air defense.

End-user concentration is moderate in the market, as the major industries requiring air defense systems are limited to government, defense, and commercial companies operating in aerospace, land, space, and maritime sectors.

Component Insights

The weapon system segment accounted for the largest revenue share in 2023, largely driven by the advancements in missile technology, including increased range, precision, and lethality. The evolving warfare landscape, characterized by the proliferation of drones and hypersonic missiles, necessitates the development of countermeasures, further stimulating the market growth. In addition, the integration of weapon systems with command and control systems to build comprehensive air defense networks is also contributing to the market expansion.

The command and control system segment is expected to record the highest CAGR from 2024 to 2030 with rising demand for such advanced solutions in light of increasing complexity on the battlefield, increasing number of threats, and the need for real-time decision-making. These systems are a vital center of air defense operations, integrating data from multiple sensors, coordinating weapon systems, and enabling effective command and control. Moreover, the integration of artificial intelligence and machine learning capabilities into these systems is enhancing their effectiveness, further contributing to segmental growth.

Platform Insights

The land segment accounted for the largest revenue share of over 69.0% in 2023. The increasing threat from aerial platforms, including drones, missiles, and aircraft, necessitates robust ground-based defenses, which underlines the dominance of the segment within market. Furthermore, the versatility and adaptability of these systems to various threat scenarios is further driving their adoption, further favoring the segmental growth. Moreover, protection of military assets, such as command and control centers, logistics hubs, and forward operating bases, from aerial attacks is paramount, expediting the market expansion.

The airborne segment is expected to record the highest CAGR of more than 6.0% from 2024 to 2030 on account of significant technological developments. Advancements in sensor technology, radar systems, and data processing capabilities have enabled the development of sophisticated airborne early warning (AEW) platforms. These platforms provide critical situational awareness and command-and-control capabilities. Moreover, the increasing complexity of modern warfare, including the proliferation of drones and hypersonic missiles, is instigating the demand for airborne systems to detect and intercept threats at long ranges, thereby fueling segmental growth.

Type Insights

The missile defense system segment accounted for largest revenue share in 2023 owing to increased demand for these systems amid rising geopolitical tensions, advancements in missiles, and increasing threats from ballistic and cruise missiles. In addition, governments worldwide are investing heavily in these systems to protect critical infrastructure and civilian populations. For instance, in April 2024, Lockheed Martin Corporation signed a USD 330.9 million deal with the Department of Defense to develop a Joint Air Battle Management System as a part of AIR6500 Phase 1 project for Australia. This system will offer advanced integrated air and missile defense capability to combat high-speed threats. Such initiatives are expected to accelerate segmental growth in the coming years.

The Counter Rocket, Artillery and Mortar (C-RAM) segment is expected to record the highest CAGR from 2024 to 2030 within the market due to several factors. The increasing threat from rockets, artillery, and mortars (RAM) to critical infrastructure and civilian populations is necessitating the deployment demand for efficient C-RAM systems. Besides, advancements in radars, interceptors, and sensors that have enabled the development of more sophisticated and capable C-RAM solutions coupled with significant investments in defenses across various countries is also favoring the segmental growth.

Range Insights

The medium range segment accounted for highest revenue share in 2023. owing to increasing demand for these air defense systems as they offer a balance between long-range and short-range systems, offering protection against a wide range of threats. Moreover, improvements in radar, missile, and command-and-control technologies have enhanced the capabilities of these systems. The rising demand for medium range air defense systems due to increasing complexity of aerial threats, including drones and cruise missiles is creating positive growth prospects for the segment.

The long range segment is expected to record the highest CAGR from 2024 to 2030. The segment is witnessing significant growth due to evolving geopolitical landscapes and increasing threats. These systems are vital for defending against long-range ballistic missiles, cruise missiles, and advanced aircraft. The segmental growth is being further driven by factors such as rise of asymmetric warfare, proliferation of UAVs, and rising need to protect critical infrastructure, that are stimulating the demand for these systems. Moreover, increased capabilities of long-range air defense systems due to technological advancements in radar, missile guidance, and command-and-control systems is also contributing to market expansion.

Regional Insights

The air defense systems market in North America accounted for the largest revenue share of around 41.0% in 2023. The increasing significance among regional countries to modernize their defense and homeland security systems, is opening ample growth opportunities for the market. Moreover, increasing investment in air defense systems is favoring market growth. For instance, in February 2024, the Canadian government awarded a contract of approximately USD 165 million to Saab AB for RBS 70 NG, a short-range air defense system. This investment is aimed at strengthening defense capabilities against fixed-wing helicopters and aircraft within its range.

U.S. Air Defense Systems Market Trends

The U.S. air defense systems market is estimated to witness a significant growth rate of more from 2024 to 2030 as the country has a strong presence of some of the leading aerospace & defense companies, such as Lockheed Martin Corporation, Northrop Grumman, Boeing, RTX Corporation, etc. These companies have substantial research and development capabilities, enabling them to develop cutting-edge technologies and systems, which is pivotal to market expansion

Asia Pacific Air Defense Systems Market Trends

The air defense systems market in Asia Pacific is expected to record a notable growth rate of over 6.0% from 2024 to 2030. The increasing adoption of advanced air defense systems driven by geopolitical tensions and border disputes among countries in the region is accelerating the market growth. For instance, in March 2024, China announced USD 222 billion as defense budget, an increase of 7.2% as compared to last year. Besides, the ongoing initiatives by leading aerospace & defense companies to strengthen their presence in the region while engaging in strategic collaborations and construction of new manufacturing facilities is further proliferating the market growth.

India air defense systems market is estimated to record a notable growth rate from 2024 to 2030. The growth is attributed to India's growing defense expenditure with significant allocation for the modernization of its armed forces, including the acquisition of air defense systems. For instance, in April 2024, the Indian Army received its first batch of 24 Igla-S Man Portable Air Defense Systems (MANPADS) from Russia, along with 100 missiles that will improve the Very Short-Range Air Defense capabilities.

The air defense systems market in China accounted for a significant revenue share in 2023. The country’s focus on indigenous technology development and self-reliance in defense technologies is encouraging the proliferation of home-grown air defense systems, creating new growth avenues for the market.

Japan air defense systems market is expected to witness a notable CAGR from 2024 to 2030 owing to increasing focus on bolstering its defense capabilities on account of increasing regional tensions and evolving security landscape. Moreover, integration of advanced technologies such as artificial intelligence, radar, and missile systems to improve the effectiveness of air defense systems is also favoring the market growth.

Europe Air Defense Systems Market Trends

The air defense systems market in Europe accounted for a notable revenue share of in 2023 and is expected to grow significantly in the upcoming years. This can be attributed to the increasing awareness and implementation of the North Atlantic Treaty Organization (NATO) standards in member states that are raising interoperability and modernization of military assets, including air defense systems. Moreover, the mature aerospace & defense industry strengthened by the presence of major players such as Thales Group, BAE Systems plc, Saab AB, etc., is creating considerable demand for advanced air defense systems, enhancing the overall market outlook.

The UK air defense systems market is expected to witness a significant growth over the coming years. As a key member of NATO, the country is committed to maintaining a strong position in the defense sector with significant focus on the development of air defense capabilities, creating ample growth opportunities for the market.

Air defense systems market in Germany is estimated to record a notable CAGR from 2024 to 2030. The market growth is supported by the ongoing initiatives to transform the military infrastructure of the country through investments in research & development aimed at creating advanced solutions for defense applications.

Middle East & Africa (MEA) Air Defense Systems Market Trends

Middle East and Africa (MEA) air defense systems market is estimated to record a considerable CAGR from 2024 to 2030. The growth is attributed to significant investments in air defense capabilities owing to increasing geopolitical tensions and the threat of terrorism, coupled with the modernization of defense capabilities. Besides, the presence of some of the prominent market players in the region, including Israel Aerospace Industries Ltd. and Elibit Systems Ltd., which are engaged in the development of cutting-edge defense systems, is further accelerating the market growth.

Air defense systems market in Saudi Arabia is expected to witness significant growth in the coming years driven by government initiatives aimed at enhancing military capabilities amid rising geopolitical tensions and the increasing need to protect its critical infrastructure, including oil facilities.

Key Air Defense Systems Company Insights

Some of the key players operating in the market include Lockheed Martin Corporation, BAE Systems plc, Thales Group, Boeing, Northrop Grumman,Kongberg Gruppen ASA, Elbit Systems Ltd., and RTX Corporation among others.

-

Lockheed Martin Corporation operates as a global security and aerospace company principally engaged in the research, design, development, manufacture, integration and sustainment of advanced technology systems, products, and services. Its major business segments include aeronautics, missiles and fire control, rotary and mission systems, and space.

-

BAE Systems plc develops, delivers, and supports advanced defense and aerospace systems. The company manufactures military aircraft, submarines, surface ships, radar, communications, avionics, electronics, and guided weapon systems. Its major business segments include electronic systems, platforms & services, air, maritime, and cyber & intelligence.

-

Thales Group operates as a technology provider involved in digital and “deep tech” innovations - Big Data, artificial intelligence, cybersecurity, connectivity, and quantum technology. The major business segments of the company include aerospace, defense and security, digital identity & security, and ground transportation systems.

-

Kongberg Gruppen ASA is an international technology company dedicated to delivering cutting-edge and reliable solutions that ensure improved performance, security, and safety in extreme conditions and complex operations. The company caters to global customers from industries, including aerospace, defense, maritime, energy, fisheries, renewable, etc.

-

Elbit Systems Ltd. offers a wide range of defense, homeland security and commercial programs across the globe. The company has five major business segments, including aerospace, C4I and Cyber, Land, Intelligence, Surveillance, Target Acquisition and Reconnaissance (ISTAR) and Electronic Warfare (EW), and Elbit Systems of America (ESA).

Key Air Defense Systems Companies:

The following are the leading companies in the air defense systems market. These companies collectively hold the largest market share and dictate industry trends.

- Saab AB

- Israel Aerospace Industries Ltd.

- Leonardo S.p.A

- Lockheed Martin Corporation

- BAE Systems plc

- Rheinmetall AG

- Thales Group

- Kongberg Gruppen ASA

- RTX Corporation

- Northrop Grumman

- Boeing

- Aslesan A.S.

- Hanwha Corporation

- Elibit Systems Ltd.

- General Dynamics

- L3Harris Technologies Inc.

Recent Developments

-

In June 2024, BAE Systems plc announced the launch of Tridon Mk2, a next-generation 40mm anti-aircraft system, with unique ability to offer protection against ever-evolving aerial threats. This new solution is suitable for combat operations requiring high-precision and reliable anti-aircraft systems to protect military forces and civil infrastructure.

-

In May 2024, Lockheed Martin Corporation partnered with Poland’s local industrial partners to expand technical capabilities and deliver manufacturing expertise of components related to Patriot Advanced Capability - 3 (PAC-3) Missile Segment Enhancement, supporting air and missile defense of the country.

-

In February 2024, General Dynamics received a contract from the Australian Armed Forces for the delivery of more than 225 PANDUR 6x6 EVO wheeled armored vehicles. The contract also covers eight new variants of vehicles powered by a 120 mm mortar combat system, along with the ones based on electronic warfare and mobile air defense.

Air Defense Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 49.58 billion

Revenue forecast in 2030

USD 67.93 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, platform, range, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; and South Africa

Key companies profiled

Saab AB; Israel Aerospace Industries Ltd.; Leonardo S.p.A; Lockheed Martin Corporation; BAE Systems plc; Rheinmetall AG; Thales Group; Kongberg Gruppen; RTX Corporation; Northrop Grumman; Boeing; Aslesan A.S.; Hanwha Group; Elibit Systems; General Dynamics; and L3Harris Technologies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Defense Systems Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global air defense systems market report based on component, type, platform, range, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Weapon System

-

Fire Control System

-

Command and Control System

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Missile Defense System

-

Anti-Aircraft System

-

Counter Unmanned Aerial Systems (C-UAS)

-

Counter Rocket, Artillery and Mortar Systems (C-RAM)

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Land

-

Naval

-

Airborne

-

-

Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Long Range

-

Medium Range

-

Short Range

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global air defense systems market size was estimated at USD 46.89 billion in 2023 and is expected to reach USD 49.58 billion in 2024.

b. The global air defense systems market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 67.93 billion by 2030.

b. The North America region dominated the industry with a revenue share of 40.9% in 2023. This can be attributed to the increasing investment in air defense systems driven by growing significance among regional countries to modernize their defense and homeland security systems.

b. Some key players operating in the air defense systems market include Israel Aerospace Industries Ltd., Leonardo S.p.A, Lockheed Martin Corporation, BAE Systems plc, Rheinmetall AG, Thales Group, Kongberg Gruppen ASA, RTX Corporation, Northrop Grumman, Boeing, Aslesan A.S., Hanwha Corporation, Elibit Systems Ltd., General Dynamics, L3Harris Technologies Inc.

b. Key factors that are driving air defense systems market growth include the increasing geopolitical tensions, proliferation of unmanned aerial vehicles (UAVs), and the evolving nature of warfare necessitating advanced air defense capabilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.