- Home

- »

- Automotive & Transportation

- »

-

Air Cargo And Freight Logistics Market Size Report, 2030GVR Report cover

![Air Cargo And Freight Logistics Market Size, Share, & Trends Report]()

Air Cargo And Freight Logistics Market Size, Share, & Trends Analysis By Destination (Domestic Destinations, International Destinations), By Service, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-337-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The global air cargo and freight logistics market size was estimated at USD 61.72 billion in 2023 and is anticipated to grow at a CAGR of 12.5% from 2024 to 2030. Air transportation is one of the fastest modes of transportation available, making it ideal for transporting time-sensitive products, such as perishable goods and high-value items requiring urgent delivery. The primary advantage of air transport in logistics is the speed of delivery.

Logistics providers specializing in air transportation management offer several services to their clients, including carrier selection, route optimization, and customs brokerage. These services ensure that goods are transported quickly and efficiently while complying with all regulatory requirements. The rapid growth of the global e-commerce sector and the development of new technologies are significant drivers of demand in the logistics market. Emerging economies, such as India, often lack the internal infrastructure to address logistics challenges effectively, further boosting the industry’s growth. The rise of online shopping has increased the need for efficient logistics solutions to handle the surge in delivery volumes.

The outbreak of COVID-19 has had a substantial impact on the logistics industry. Many manufacturing plants were temporarily shut down, and production units faced labor shortages, causing significant disruptions in the supply chain during the first two quarters of 2020. During the early stages of the pandemic, movement restrictions, supply and demand imbalances, limited capacity for long-haul and last-mile fulfillment services, and international border closures hampered cross-border sales, negatively affecting the market growth. However, the pandemic also accelerated the adoption of digital solutions and innovations in logistics, leading to long-term benefits for the industry.

Moreover, the increasing focus on sustainability and reducing carbon footprints is pushing logistics providers to adopt greener practices and technologies. The integration of artificial intelligence, big data analytics, and IoT in logistics operations is enhancing efficiency, predictive maintenance, and real-time tracking, thereby driving market growth.

Destination Insights

The domestic segment held the largest revenue share in 2023. Primarily, the high demand for quick and reliable delivery within national borders fuels this segment's growth. Businesses and consumers increasingly expect same-day or next-day delivery, especially for high-value and time-sensitive goods like electronics, pharmaceuticals, and perishables. The robust infrastructure in developed countries, including extensive airport networks and advanced logistics facilities, further supports efficient domestic air cargo operations. Additionally, the rise of e-commerce has significantly boosted the need for fast and reliable delivery services within countries. E-commerce giants and retailers rely heavily on air transport to meet the high expectations of their customers for rapid delivery.

The increase in urbanization and the concentration of economic activities in metropolitan areas have also contributed to the segment's dominance. Cities often serve as hubs for manufacturing, warehousing, and distribution, making air transport a crucial link in the supply chain for timely deliveries. Furthermore, domestic air cargo is less susceptible to the complexities of international trade regulations, customs procedures, and geopolitical issues, leading to smoother operations. The presence of well-established domestic airlines offering cargo services and the integration of advanced technologies, such as real-time tracking and automated warehousing, enhance the efficiency and reliability of domestic air cargo logistics. These factors combined ensure that the domestic destinations segment remains the dominant force in the market.

The international destinations segment is anticipated to experience growth at the fastest CAGR from 2024 to 2030, driven by several pivotal trends and factors. Globalization and the increasing interconnectedness of markets have significantly boosted the demand for international air cargo services. Businesses are expanding their reach across borders, necessitating efficient and reliable logistics solutions to support global supply chains. The growth of cross-border e-commerce has also played a crucial role in the segment's expansion. Consumers worldwide are increasingly shopping from international retailers, leading to a surge in demand for air freight services to facilitate timely and secure delivery of goods. Technological advancements in logistics, such as enhanced tracking systems, automated customs clearance, and sophisticated route optimization, have improved the efficiency and reliability of international air cargo operations.

These innovations help mitigate some of the challenges associated with cross-border logistics, such as customs delays and regulatory compliance. Additionally, the rise of emerging markets in Asia, Africa, and Latin America has opened new opportunities for international air cargo. These regions are witnessing rapid economic growth and industrialization, driving the need for efficient logistics solutions to support their expanding trade activities. The development of international trade agreements and partnerships has further facilitated smoother and more streamlined cross-border trade, boosting the demand for air cargo services. Furthermore, the COVID-19 pandemic highlighted the importance of air freight in maintaining global supply chains, especially for critical goods like medical supplies and vaccines. The pandemic-induced disruptions underscored the need for resilient and agile logistics networks, propelling investments in international air cargo infrastructure and capabilities. Consequently, the international destinations segment is poised for continued rapid growth in the market.

Service Insights

The forwarding is the largest service segment in 2023.The forwarding segment dominated the market due to its comprehensive range of services that streamline the transportation process for shippers. Freight forwarders act as intermediaries between shippers and carriers, offering a suite of services including transportation, warehousing, customs clearance, and documentation. This full-service approach significantly reduces the complexities and challenges associated with shipping goods, making it an attractive option for businesses. The expertise of freight forwarders in handling logistics operations allows them to optimize routes, consolidate shipments, and negotiate favourable rates with carriers, which can lead to cost savings for their clients.

Moreover, the growth of e-commerce and global trade has increased the demand for efficient logistics solutions that can handle the rapid movement of goods across various regions. Freight forwarders are well-positioned to meet this demand, leveraging their extensive networks and technological capabilities to ensure timely and reliable delivery. The ability of forwarders to provide tailored solutions to meet specific customer needs, including handling specialized cargo like perishables, hazardous materials, and high-value items, further cements their dominant position in the market. Additionally, the rise of digital freight forwarding platforms has enhanced the efficiency and transparency of logistics operations, providing real-time tracking, automated processes, and improved communication between shippers and carriers. These advancements have made forwarding services more accessible and efficient, contributing to their continued dominance in the market.

The airlines segment is expected to witness the fastest CAGR from 2024 to 2030, driven by the increasing demand for direct and expedited transportation services. Airlines offer unparalleled speed and efficiency for transporting goods, making them a crucial component of the global supply chain, especially for time-sensitive and high-value products. The rise of global e-commerce has significantly contributed to this growth, as consumers expect quick delivery times for their online purchases. Airlines, with their extensive flight networks and frequent schedules, are well-suited to meet these expectations by providing rapid and reliable transportation. Technological advancements in aircraft design and cargo handling systems have also enhanced the capacity and efficiency of air freight services, allowing airlines to handle larger volumes of cargo more effectively. Additionally, the development of dedicated cargo airlines and the expansion of cargo operations by passenger airlines have increased the availability and reliability of air freight services.

The COVID-19 pandemic further underscored the importance of air cargo, as airlines played a critical role in transporting medical supplies, vaccines, and other essential goods worldwide. This period saw significant investments in cargo infrastructure and innovations to improve efficiency and safety, driving further growth in the segment. Moreover, the ongoing recovery of global trade and the increasing emphasis on resilient and agile supply chains have bolstered the demand for air freight services. As businesses continue to expand their global reach and consumers demand faster delivery times, the airline segment is poised for sustained growth, solidifying its position as the fastest-growing segment in the market.

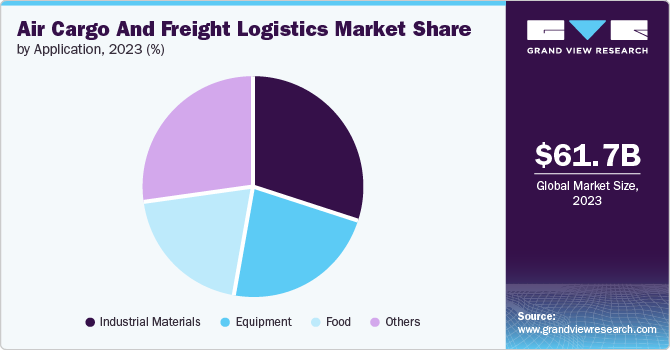

Application Insights

The industrial materials segment dominated the market in terms of revenue in 2023. This growth is due to the critical role these materials play in a wide range of industries, including manufacturing, construction, and energy. The transportation of industrial materials, such as metals, chemicals, and raw materials, is essential to maintaining uninterrupted production processes and meeting the high demands of various industrial sectors. The need for rapid and reliable delivery of these materials is crucial, as delays can significantly impact production schedules and operational efficiency. Air cargo provides the speed and reliability required to ensure that industrial materials are delivered promptly, reducing the risk of costly downtime and production halts.

Furthermore, the globalization of supply chains has increased the reliance on air freight for transporting industrial materials across long distances, particularly between regions with specialized manufacturing capabilities and resource-rich areas. The ability of air cargo to handle large volumes and heavyweight shipments also makes it an ideal mode of transportation for industrial materials. Additionally, advancements in logistics technology, such as real-time tracking and inventory management systems, have enhanced the efficiency and transparency of transporting industrial materials, allowing for better coordination and planning. The importance of maintaining robust and resilient supply chains has become even more apparent in the wake of global disruptions, such as the COVID-19 pandemic, further highlighting the dominance of the industrial materials segment in the air cargo and freight logistics market.

The equipment segment is anticipated to experience the fastest CAGR from 2024 to 2030, driven by the increasing global demand for advanced machinery, electronics, and high-tech equipment. The rapid pace of technological innovation and industrialization across various sectors, including manufacturing, healthcare, and telecommunications, has significantly boosted the need for efficient and timely transportation of sophisticated equipment. Air cargo is the preferred mode of transport for high-value and sensitive equipment due to its speed, reliability, and ability to maintain stringent handling standards. The growth of the healthcare sector, particularly with the expansion of medical technology and pharmaceutical industries, has also contributed to the surge in demand for air freight services to transport medical devices, laboratory equipment, and other specialized machinery.

Additionally, the proliferation of the Internet of Things (IoT) and smart devices has increased the need for quick delivery of electronic components and finished products to meet the market's dynamic demands. The global expansion of industries and the establishment of new production facilities in emerging markets have further fueled the demand for air cargo services to transport equipment necessary for setting up and maintaining these operations. The emphasis on reducing lead times and maintaining the competitiveness of businesses in fast-paced markets underscores the importance of air freight in the equipment segment. Innovations in packaging and handling techniques, as well as advancements in tracking and monitoring technologies, have enhanced the security and efficiency of transporting high-value equipment. These factors collectively drive the rapid growth of the equipment segment in the market.

Regional Insights

North America air cargo and freight logistics market is experiencing high growth, fueled by a combination of technological advancements, strong economic performance, and a thriving e-commerce sector. The United States and Canada are key players in this region, with well-established logistics infrastructure and major international airports that serve as critical hubs for air cargo operations. The region's advanced technology sector drives significant demand for the transportation of high-value and time-sensitive goods, such as electronics, pharmaceuticals, and automotive parts, contributing to the high growth rate of the air cargo market.

The rapid expansion of e-commerce in North America, particularly in the United States, has substantially increased the volume of air cargo traffic. Consumers' growing preference for fast delivery options has led to greater reliance on air freight services to meet the tight delivery schedules demanded by online shoppers. Additionally, the rise of omni-channel retailing, where businesses integrate their online and offline operations, has created more complex supply chains that require efficient and reliable air cargo solutions.

Moreover, the implementation of trade agreements, such as the United States-Mexico-Canada Agreement (USMCA), has facilitated smoother and more efficient cross-border trade, boosting the demand for air cargo services. As North America continues to leverage its technological capabilities and robust logistics infrastructure, the region is poised to sustain its high growth trajectory in the air cargo and freight logistics market.

U.S. Air Cargo And Freight Logistics Market Trends

The air cargo and freight logistics market in the U.S. is a crucial segment due to its robust economy, advanced logistics infrastructure, and extensive trade networks. The U.S. is home to some of the busiest cargo airports globally, such as Memphis International Airport and Anchorage International Airport, which serve as major hubs for air freight operations. The country's strong manufacturing base, particularly in sectors like automotive, aerospace, and pharmaceuticals, drives substantial demand for air cargo services to transport high-value and time-sensitive goods domestically and internationally.

The rapid growth of e-commerce has further boosted the demand for air freight, with consumers demanding quick delivery times for online purchases. Technological advancements in logistics, including automation and real-time tracking systems, enhance the efficiency and reliability of air cargo operations in the U.S. Despite challenges like regulatory changes and fluctuating fuel costs, the U.S. remains a pivotal player in the global air cargo market, poised for continued growth.

Europe Air Cargo And Freight Logistics Market Trends

Europe air cargo and freight logistics market plays a vital role in the global market, characterized by a sophisticated logistics infrastructure, strong regulatory framework, and diverse economic activities. Major European hubs like Frankfurt, Amsterdam, and Paris handle significant volumes of air cargo, serving as pivotal points for international trade routes. The region's automotive and manufacturing industries drive substantial demand for air freight services to transport components, machinery, and finished goods across Europe and globally.

The growth of e-commerce has also contributed to increased air cargo traffic, with consumers across Europe expecting fast and reliable delivery of goods purchased online. Europe's commitment to sustainability and reducing carbon emissions is influencing the development of greener logistics practices, such as the use of electric vehicles and alternative fuels in cargo transportation. Despite challenges posed by Brexit and regulatory complexities, Europe continues to innovate and expand its air cargo capabilities, ensuring its position as a key market in the global logistics landscape.

Asia Pacific Air Cargo And Freight Logistics Market Trends

The air cargo and freight logistics market in Asia Pacific dominated in 2023, accounting for a nearly 36% revenue share of the global market. The growth is driven by the region's rapid economic growth, robust manufacturing sector, and expanding e-commerce market. Countries like China, Japan, South Korea, and India are major contributors to this growth, with China being the world's largest manufacturing hub. The demand for efficient logistics solutions in these countries is immense due to the high volume of goods produced and the need for swift transportation to global markets.

The growth of e-commerce in the Asia Pacific, particularly in China and India, has significantly increased the volume of air cargo traffic as consumers demand faster delivery times for their online purchases. Additionally, the region's strategic location as a bridge between the West and emerging markets in Southeast Asia, the Middle East, and Africa enhances its importance in global trade. The development of advanced logistics infrastructure, such as state-of-the-art airports, free trade zones, and smart logistics technologies, further boosts the region's capacity to handle large volumes of air cargo efficiently. Government initiatives aimed at improving trade facilitation and reducing logistical bottlenecks, such as the Belt and Road Initiative, have also played a crucial role in strengthening the market in Asia Pacific.

Moreover, the rise of new trade agreements and economic partnerships, like the Regional Comprehensive Economic Partnership (RCEP), has facilitated smoother cross-border trade, contributing to the region's dominance and rapid growth. As businesses continue to expand their operations and consumer markets grow, the Asia Pacific region is expected to maintain its leading position in the air cargo and freight logistics market, driven by its dynamic economic landscape and increasing trade activities.

Key Air Cargo And Freight Logistics Company Insights

Some key companies operating in the Market include DSV Panalpina A/S., and DHL Global Forwarding, among others.

-

DSV Panalpina A/S is a global leader in the logistics industry, offering a comprehensive range of services including air freight, sea freight, road transport, and contract logistics. The company was formed through the merger of DSV and Panalpina in 2019, creating a significant player in the air cargo and freight logistics market. DSV Panalpina operates a robust air freight network that spans key global markets, providing efficient and reliable transportation solutions for various industries.

-

The company's services include air charter, express services, temperature-controlled logistics, and customs clearance. With a strong focus on customer satisfaction and operational excellence, DSV Panalpina continues to expand its global footprint and enhance its service offerings to meet the evolving needs of businesses worldwide. The company's extensive experience and infrastructure make it a trusted partner for complex logistics challenges, positioning it prominently in the competitive air cargo and freight logistics market.

Rosan Sea Air Services, and Lavin Star are some emerging market companies in the market.

-

Rosan Sea Air Services is an emerging player in the air cargo and freight logistics market, specializing in sea and air freight services. The company focuses on providing cost-effective and reliable transportation solutions for a diverse range of industries. Rosan Sea Air Services leverages its expertise in logistics management to offer tailored solutions that meet the specific needs of its clients, including freight forwarding, customs brokerage, and logistics consulting. As an emerging company, Rosan Sea Air Services aims to capitalize on the growing demand for efficient and timely logistics services, particularly in regions with expanding manufacturing and trade activities.

-

The company's strategic approach to logistics and commitment to customer satisfaction are crucial factors driving its growth and establishing its presence in the competitive air cargo and freight logistics industry. As Rosan Sea Air Services continues to expand its capabilities and network, it is poised to capture new opportunities and enhance its position in the global logistics market.

Key Air Cargo And Freight Logistics Companies:

The following are the leading companies in the air cargo and freight logistics market. These companies collectively hold the largest market share and dictate industry trends.

- DSV PANALPINA A/S

- Rosan Sea Air Services

- Canada Air Cargo & Freight Logistics Inc

- Lavin Star

- Titan Sea & Air Services

- Horizon International Cargo

- DHL Global Forwarding

- Kuehne + Nagel International AG

- DB Schenker

- United Parcel Service (UPS)

- FedEx Corporation

- CEVA Logistics

- Bolloré Logistics

- C.H. Robinson Worldwide, Inc.

Recent Developments

-

In June 2024, C.H. Robinson broadened its presence in Southeast Asia by opening a new office in the Philippines. The US-based forwarder stated that the new Manila office aims to capitalize on the country's growing economy, which is projected to increase by 6% in 2024.

-

In August 2023, CEVA Logistics announced acquisition of 96% of Mumbai-based Stellar Value Chain Solutions from an affiliate of private equity firm Warburg Pincus and other shareholders. This acquisition includes approximately 7.7 million square feet of space spread across over 70 facilities in 21 cities throughout India. Additionally, CEVA will integrate nearly 8,000 full-time and temporary employees from Stellar, who bring extensive expertise and established relationships within India. This strategic move aims to diversify CEVA's footprint in India, enhancing its local workforce, assets, customer base, and operational capabilities. The acquisition aligns with CEVA's strategy to offer comprehensive end-to-end supply chain solutions to its clients.

Air Cargo And Freight Logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 67.71 billion

Revenue forecast in 2030

USD 137.10 billion

Growth rate

CAGR of 12.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

DSV PANALPINA A/S; Rosan Sea Air Services; Canada Air Cargo & Freight Logistics Inc; Lavin Star; Titan Sea & Air Services; Horizon International Cargo; DHL Global Forwarding; Kuehne + Nagel International AG; DB Schenker; United Parcel Service (UPS); FedEx Corporation; CEVA Logistics; Bolloré Logistics; C.H. Robinson Worldwide, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Cargo And Freight Logistics Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global air cargo and freight logistics market report based on destination, service, application, and region.

-

Destination Outlook (Revenue, USD Million, 2018 - 2030)

-

Domestic Destinations

-

International Destinations

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Forwarding

-

Airlines

-

Mail

-

Other Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food

-

Industrial Materials

-

Equipment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global air cargo and freight logistics market size was estimated at USD 61.72 billion in 2023 and is expected to reach USD 67.71 billion in 2024.

b. The global air cargo and freight logistics market is expected to grow at a compound annual growth rate of 12.5% from 2024 to 2030 to reach USD 137.10 billion by 2030.

b. Asia Pacific dominated the air cargo and freight logistics market with a share of over 36.0% in 2023. The growth is driven by the region's rapid economic growth, robust manufacturing sector, and expanding e-commerce market. Countries like China, Japan, South Korea, and India are major contributors to this growth, with China being the world's largest manufacturing hub

b. Some key players operating in the air cargo and freight logistics market include DSV PANALPINA A/S, Rosan Sea Air Services, Canada Air Cargo & Freight Logistics Inc, Lavin Star, Titan Sea & Air Services, Horizon International Cargo, DHL Global Forwarding, Kuehne + Nagel International AG, DB Schenker, United Parcel Service (UPS), FedEx Corporation, CEVA Logistics, Bolloré Logistics, C.H. Robinson Worldwide, Inc.

b. Key factors driving market growth include the high of e-commerce industry and the increasing requirement of time sensitive shipments are contributing to the market’s growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."