AI Productivity Tools Market Size, Share & Trends Analysis Report By Offering, By Deployment, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-315-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

AI Productivity Tools Market Size & Trends

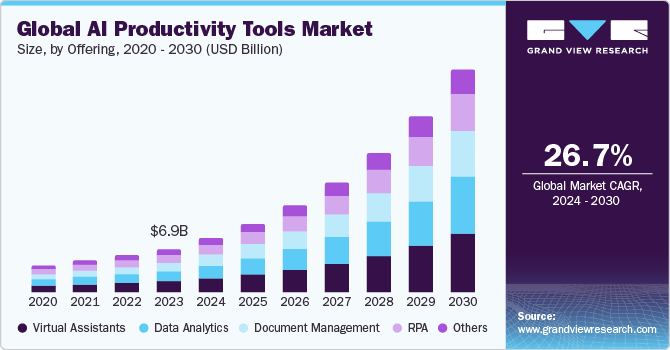

The global AI productivity tools market size was estimated at USD 6,948.3 million in 2023 and is projected to grow at a CAGR of 26.7% from 2024 to 2030. Businesses can benefit from AI productivity tools as these technologies streamline operations, enabling employees to accomplish more tasks in less time through automation. These tools also enable cost savings by reducing labor requirements while maintaining productivity levels. Moreover, rapid processing of large datasets unveils valuable patterns and trends, facilitating informed, data-driven choices. For instance, in September 2023, Microsoft launched the Microsoft 365 Copilot Early Access Program in Australia, aiming to empower organizations with AI productivity tools.

This program introduces Microsoft 365 Copilot, a powerful generative AI service combining large language models with Microsoft 365 data. Participating businesses gain access to advanced AI technology, enhancing productivity across Microsoft Teams, Word, PowerPoint, and Excel.

AI productivity tools enhance IoT systems by analyzing vast data streams from IoT devices, identifying patterns, predicting issues, and automating tasks. This enables real-time adjustments, operational optimization, and reduced downtime in IoT environments. Cloud-based AI solutions make large-scale data processing affordable for businesses of any size, driving significant growth in the AI productivity tools market. The surge in IoT adoption shows the crucial importance of efficiently handling the generated data, propelling the demand for such tools. Overall, these advancements signify a pivotal change towards more efficient and proactive management of IoT ecosystems.

NLP advancements empower AI productivity tools to understand and generate human language, thus enhancing communication and content creation capabilities. In email management, these tools effectively categorize, prioritize, and autonomously compose responses, streamlining the handling of incoming messages. Moreover, AI-driven document summarization efficiently extracts key information, offering time-saving benefits to users. Virtual assistance benefits from NLP by enabling more natural interactions, which enhance user experience and productivity. NLP significantly contributes to streamlining workflows and increasing overall efficiency in various domains by automating language-related tasks and offering intelligent insights. For instance, Google LLC, with its G Suite offerings, Microsoft through Office 365, and International Business Machines with Watson Workspace, are actively integrating NLP advancements into their AI productivity tools, enhancing communication and content creation functionalities.

Market Concentration & Characteristics

The AI productivity tools industry is experiencing rapid innovation, with advancements in automation, data analytics, and cloud integration. These innovations include the development of AI-powered assistants, predictive analytics for proactive decision-making, and seamless integration with existing workflows and systems. Moreover, there is a growing focus on user-friendly interfaces and scalability to meet the needs of businesses of all sizes. As the demand for efficient data management and optimization grows, the market is poised for continued expansion.

The AI productivity tools industry is witnessing significant merger and acquisition activities as companies seek to consolidate capabilities and expand their offerings. Key players are acquiring specialized AI technology firms to enhance their product portfolios and gain a competitive edge. These mergers and acquisitions are driven by the increasing demand for comprehensive AI solutions that address diverse business needs, such as automation, data analysis, and optimization. For instance, in August 2023, IFS AB, an enterprise software company in Sweden, acquired Falkonry, a U.S.-based AI-based time-series data analytics tool developer, to strengthen its enterprise asset management services portfolio. This acquisition enhances IFS's capabilities in utilizing AI for predictive maintenance and optimization of manufacturing equipment, contributing to increased productivity in industrial operations.

Regulations can significantly impact the market by influencing factors such as data privacy, security standards, and ethical considerations. Stringent regulations may require companies to invest in compliance measures, potentially increasing costs and affecting market dynamics. Clear and favorable regulations can cultivate trust in AI technologies, driving adoption and innovation within the market. Moreover, regulations designed to promote fair competition and prevent monopolistic practices influence the structure of the market.

Substitutes such as traditional software solutions or manual processes can create competition within the AI productivity tools industry, potentially impacting market size and growth. This dynamic pressures AI tools providers to innovate and differentiate their offerings to stay competitive. Providers may need to invest in educational efforts to showcase the advantages of AI-driven solutions over substitutes. Despite presenting challenges, substitutes drive innovation and contribute to the advancement of AI productivity tools, pressuring providers to differentiate their offerings and invest in educational efforts.

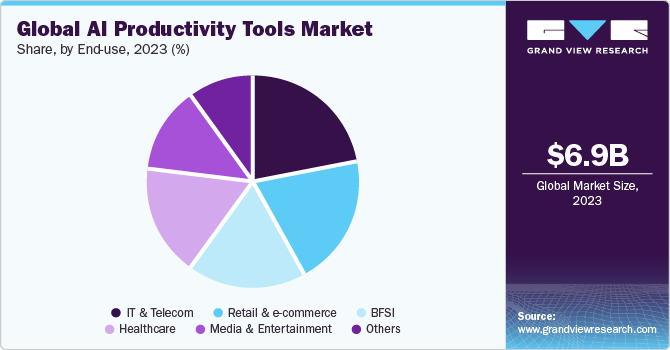

The market's end-user concentration is likely fragmented across various industries. AI productivity tools offer broad applicability, appealing to diverse sectors by streamlining workflows and optimizing processes. While there is widespread adoption potential, certain industries exhibit higher uptake due to the presence of data-intensive tasks. Early adopters include high-tech industries, finance and insurance, and manufacturing, where AI-driven automation and insights offer significant efficiency gains. Overall, as AI technology advances and becomes more accessible, broader adoption across industries is anticipated.

Offering Insights

The virtual assistant segment led the market and accounted for 25.3% of the global revenue in 2023. Virtual assistants' widespread accessibility and user-friendly interface across devices such as smartphones, computers, and smart speakers have propelled their adoption in both consumer and business settings. Ongoing advancements in artificial intelligence, including enhancements in natural language processing, speech recognition, and contextual understanding, have significantly improved virtual assistant capabilities. This progress enhances user experience and propels the growth of the market as virtual assistants drive efficiency and automation in various tasks and workflows. Moreover, virtual assistants seamlessly integrate with other software and applications, allowing users to automate tasks and access information from multiple sources with ease.

The data analytics segment is projected to grow significantly over the forecast period. The data analytics segment is poised for robust growth within AI productivity tools due to its ability to empower actionable insights. With advanced predictive analytics capabilities, these tools enable businesses to anticipate future trends and optimize operations proactively. Moreover, AI-powered data analytics tools streamline processes, automate tasks, and extract insights from large datasets, boosting efficiency and productivity. Businesses gain a competitive advantage by harnessing data analytics, enabling them to adapt quickly, innovate, and meet market demands effectively.

Deployment Insights

The on-premises segment held the largest market revenue share in 2023. Many organizations prioritize data security and compliance, preferring to keep their data on-premise to maintain control and meet regulatory requirements. Moreover, on-premises solutions offer greater customization and integration capabilities, enabling businesses to customize the tools to their specific needs and seamlessly integrate them with existing systems. Concerns about data privacy and sovereignty further motivate organizations to opt for on-premises solutions where they have full control over their data. For industries with legacy systems or infrastructure limitations, on-premises tools provide a straightforward and cost-effective option compared to transitioning to cloud-based solutions.

The cloud segment is predicted to foresee significant growth in the forecast period. Cloud-based solutions offer scalability, enabling businesses to easily adjust resources based on demand, which is particularly beneficial for handling large volumes of data and fluctuating workloads. Moreover, cloud-based tools follow a cost-effective subscription-based model, eliminating upfront hardware investments and making them accessible to businesses of all sizes. Their accessibility from anywhere with an internet connection fosters remote work and collaboration among teams, driving productivity in distributed work environments. Furthermore, cloud platforms provide robust integration capabilities, enabling seamless integration with other software and services and promoting innovation in AI productivity tools.

End Use Insights

The IT and telecom segment held the largest market revenue share in 2023. The IT and telecom segment dominates the market due to its expertise in technology adoption and innovation. These industries are pioneers in integrating new technologies to enhance operational efficiency and productivity. With vast amounts of data generated from customer interactions, network performance, and system logs, AI productivity tools are well-suited for optimizing operations and extracting insights. Moreover, the competitive landscape in these sectors drives companies to differentiate themselves, leading to increased adoption of AI tools for automating tasks and improving customer experiences.

The healthcare segment is projected to grow significantly over the forecast period. Amid mounting pressure to enhance patient outcomes and operational efficiency and reduce costs, healthcare organizations increasingly turn to AI solutions. These tools automate administrative tasks, optimize resource allocation, and support clinical decision-making processes, ultimately improving patient care. Moreover, the healthcare industry generates vast amounts of data from various sources, making it well-suited for AI-driven analysis and extraction of insights. AI tools also aid in compliance with regulatory requirements, billing accuracy, and patient data security measures. As AI technology advances and becomes more accessible, healthcare organizations can utilize these tools to drive productivity, improve decision-making, and transform care delivery.

Regional Insights

North America AI productivity tools market dominated the market in 2023 with a global revenue share of 33.2%. Businesses in North America prioritize innovation and efficiency to stay competitive in dynamic markets. This drive for innovation has led to the adoption of advanced technologies such as AI, which offer the potential to revolutionize various aspects of operations. Moreover, North American companies often benefit from access to substantial resources and investment capital, enabling them to make significant investments in advanced AI solutions. This financial capability allows businesses to deploy sophisticated AI tools to streamline operations, automate tasks, and enhance productivity across their organizations. Using these advanced AI solutions, businesses in North America can stay ahead, perform better, and grow in a fast-changing business environment.

U.S. AI Productivity Tools Market Trends

The AI productivity tools market in the U.S. is expected to grow significantly over the forecast period. The U.S. market witnesses continuous advancements in AI technologies such as machine learning, natural language processing, and computer vision, driving the development of more sophisticated productivity tools.

Europe AI Productivity Tools Market Trends

The AI productivity tools market in Europe is witnessing more and more businesses are embracing automation as a means to enhance employee satisfaction and focusing on higher-value tasks. Consequently, the adoption of AI productivity tools is on the rise across various industries, contributing to greater efficiency and innovation in the workplace throughout Europe.

The UK AI productivity tools market is thriving as businesses rapidly adopt digital solutions, creating a fertile ground for AI productivity tools. This trend is driven by the need for efficiency and innovation, prompting organizations across various sectors to integrate AI solutions into their workflows.

The AI productivity tools market in Germany held a significant share of the Europe market. In Germany, key sectors such as manufacturing, automotive, and healthcare are using AI productivity tools to streamline operations, optimize processes, and improve decision-making. Moreover, Germany's strong investment in research and development further supports the growth of the market in the country.

Asia Pacific AI Productivity Tools Market Trends

The Asia Pacific AI productivity tools market is anticipated to register the fastest CAGR over the forecast period. High smartphone and internet penetration rates in the Asia Pacific region contribute to the creation of a large user base for cloud-based AI tools. This widespread access to digital devices and connectivity enables businesses and individuals to leverage AI solutions for various purposes, from personal assistance to enterprise applications. Moreover, many governments across this region are actively promoting AI development and adoption through initiatives such as funding programs, regulatory frameworks, and public-private partnerships. These government efforts are driving awareness, investment, and collaboration in the AI ecosystem, fostering innovation and growth in the market.

The AI Productivity Tools market in China is expected to grow significantly over the forecast period. China boasts a significant and digitally engaged population, with millions of users actively embracing digital experiences. This vast user base provides an ideal environment for the adoption and expansion of AI productivity tools applications and services.

The India AI productivity tools market is expected to grow substantially over the forecast period. The country's rapidly expanding digital infrastructure provides a solid foundation for the adoption and utilization of AI technologies. There is a noticeable increase in the adoption of AI across various industries, driven by the need for efficiency and innovation. Moreover, government initiatives aimed at promoting digital innovation further fuel the growth of the market in India.

Middle East & Africa (MEA) AI Productivity Tools Market Trends

The AI productivity tools market in MEA is experiencing a surge in internet and smartphone penetration, laying the foundation for the widespread adoption of cloud-based AI tools. These tools offer businesses in the MEA region the opportunity to enhance efficiency and competitiveness on a global scale, reducing reliance on traditional sectors like oil and gas. By embracing AI technologies, businesses can optimize operations, improve decision-making, and drive innovation, paving the way for economic diversification and growth in the region.

Key AI Productivity Tools Company Insights

Prominent firms have used offerings, launches, and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in February 2024, NVIDIA Corporation, a U.S.-based software company, collaborated with Cisco Systems, Inc. to announce plans for AI infrastructure solutions to empower enterprises with the computing power needed for success in the AI era. This collaboration aims to enable businesses to deploy and manage secure AI infrastructure easily and effectively, supporting their digital transformation efforts.

Key AI Productivity Tools Companies:

The following are the leading companies in the ai productivity tools market. These companies collectively hold the largest market share and dictate industry trends.

- Automation Anywhere, Inc.

- Blue Prism Limited

- Cisco Systems, Inc.

- Dropbox Inc.

- Grammarly Inc.

- Google LLC

- International Business Machines Corporation

- Microsoft

- UiPath

- Workato

Recent Developments

-

In April 2024, Microsoft partnered with Cloud Software Group, Inc., a U.S.-based software company, to deepen collaboration on cloud solutions and generative AI capabilities, aiming to empower over 100 million users with enhanced productivity and innovation. Through initiatives such as deploying GitHub Copilot and embedding Copilot assistant within Spotfire, the partnership focuses on using AI to drive efficiency and accelerate R&D efforts.

-

In March 2024, Microsoft and NVIDIA Corporation collaborated to integrate AI into healthcare and life sciences, focusing on enhancing patient care and expediting medical research and drug discovery. Their collaboration aims to use advanced technologies to transform the healthcare industry and drive innovation in patient treatment and outcomes.

-

In March 2024, Cisco added new AI features to its Webex platform, such as burn-out detection for contact center agents, as part of its efforts to enhance productivity across remote and hybrid work environments. Moreover, Cisco introduced new hardware devices, such as the Cisco Desk Phone 9800 and Cisco Board Pro G2, customized to the evolving needs of enterprises transitioning back to office settings.

-

In February 2024, Google launched Gemini for Google Workspace alongside two plans, Gemini Business and Gemini Enterprise, empowering businesses to utilize AI for growth. Gemini Business offers access to generative AI features, while Gemini Enterprise includes additional capabilities like AI-powered meetings and enterprise-grade data protection.

-

In October 2023, International Business Machines Corporation collaborated with Ernst & Young LLP, an accounting company in the UK, to launch EY.ai Workforce, an HR solution integrating AI into key HR processes, aiming to enhance productivity and streamline operations. By combining AI and automation, the solution provides required assistance to employees, facilitating a more efficient work experience.

-

In June 2023, Automation Anywhere introduced generative AI innovations into its Automation Success Platform, enhancing productivity across businesses. These tools streamline operations and facilitate automation development, offering efficient AI-driven solutions for diverse business needs.

AI Productivity Tools Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8,801.2 million |

|

Revenue forecast in 2030 |

USD 36.35 billion |

|

Growth rate |

CAGR of 26.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, deployment, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Automation Anywhere, Inc.; Blue Prism Limited; Cisco Systems, Inc.; Dropbox Inc.; Grammarly Inc.; Google LLC; International Business Machines Corporation; Microsoft; UiPath; Workato |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

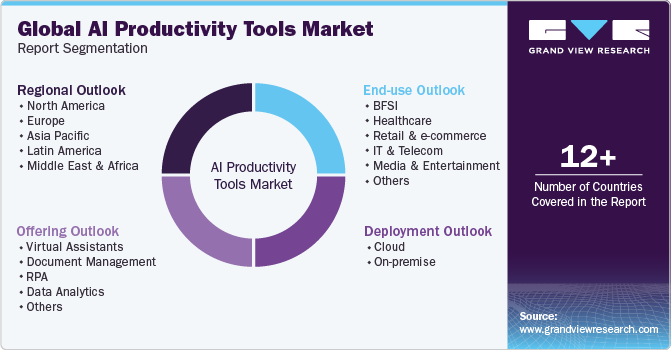

Global AI Productivity Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global AI productivity tools market report based on offering, deployment, end use, and region.

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Virtual Assistants

-

Document Management

-

RPA

-

Data Analytics

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premise

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Healthcare

-

Retail and e-commerce

-

IT and Telecom

-

Media and Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI productivity tools market size was estimated at USD 6,948.3 million in 2023 and is expected to reach USD 8,801.2 million in 2024.

b. The global AI productivity tools market is expected to grow at a compound annual growth rate of 26.7% from 2024 to 2030 to reach USD 36.35 billion by 2030.

b. North America dominated the AI productivity tools market with a share of 33.2% in 2023. This is attributable to the drive for innovation that has led to the adoption of advanced technologies such as AI, which offer the potential to revolutionize various aspects of operations.

b. Some key players operating in the AI productivity tools market include Automation Anywhere, Inc., Blue Prism Limited, Cisco Systems, Inc., Dropbox Inc., Grammarly Inc., Google LLC, International Business Machines Corporation, Microsoft, UiPath, Workato

b. Key factors that are driving the market growth include increasing need to manage workflow and tasks, advancements in AI and ML, and integration with emerging technologies

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."