AI In Oil And Gas Market Size, Share & Trends Analysis Report By Application (Upstream, Downstream, Midstream), By Function, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-171-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

AI In Oil And Gas Market Size & Trends

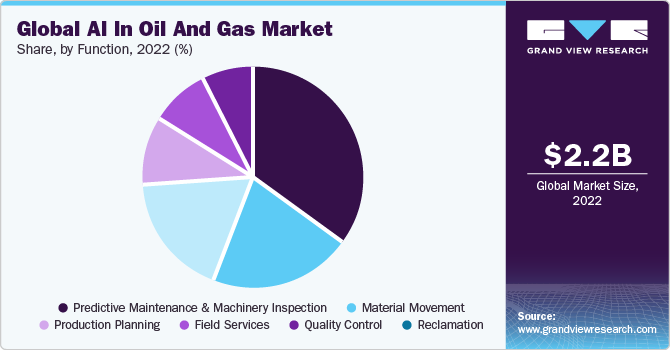

The global AI in oil and gas market size was valued at USD 2.16 billion in 2022 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 14.2% from 2023 to 2030. AI is prominently developing as a major factor in developing upstream, downstream, and midstream processes. With the implementation of AI, the safety and security standards of the oil and gas industry are strengthened.

The oil and gas industry is becoming more aware of the enormous effects that AI may have on every aspect of the value chain as it adopts the technology. AI can solve some of the crucial problems facing today's oilfields. It's noteworthy that AI promotes excellent security and safety standards throughout the industry. As a result of the very dangerous nature of oil and gas, which is characterized by flammability and the possible discharge of poisonous gases, AI systems are crucial in monitoring toxicity levels and identifying leaks, alerting users to urgent problems that require quick action. Another concern to safety is temperature variation, particularly given the yearly cycle of the seasons. Here, AI may dynamically modify heating and cooling systems to guarantee the items' safety.

AI is set to alter the oil and gas sector by tackling both operational and safety concerns, considering these transformational capabilities. Companies that successfully use AI technology to their benefit will have a clear competitive edge as they get a thorough understanding of their reservoirs, operating procedures, and production assets. This will result in more effective, secure, and lucrative operations.

Application Insights

Based on application, the market is segmented into upstream, midstream, and downstream. In 2022, the market was primarily commanded by the upstream segment, and this dominance is projected to persist in the years to come. The upstream sector entails tasks like drilling test wells and exploring for potential subterranean natural gas and crude oil deposits, and as a result, running the wells in charge of drawing crude oil or unprocessed natural gas from under the Earth's surface.

Function Insights

Based on the function, the market is segmented into predictive maintenance and machinery inspection, quality control, material movement, field services, production planning, and reclamation. The predictive maintenance and machinery inspection segment dominated the market in 2022 due to its ability to reduce downtime through the analysis of equipment data and the foresight of probable breakdowns, predictive maintenance, and machinery inspection. Additionally, these functions are essential in spotting degradation indicators and other sorts of damage that, if ignored, might pose serious safety risks. Companies can improve overall operating safety by replacing or repairing components as soon as they are damaged by proactively anticipating these future difficulties. The market also gains from advancements in sensor technology and the Internet of Things (IoT), which have increased the robustness and accuracy of data collecting, making predictive maintenance and machinery inspection more dependable and effective.

Regional Insights

North America dominated the market in 2022. The infrastructure in North America is well-established and supports both oil and gas production and AI technology, making it easier for businesses operating in the region to adopt and integrate AI solutions. A key factor in assuring the ongoing development and use of AI within the oil and gas sector and, consequently, supporting market growth is the increasing commitment to research and innovation by regional governments as well as commercial organizations. Additionally, North American businesses have a sophisticated understanding of the utility of data analytics, fostering an atmosphere that is favorable for the adoption and optimization of AI capabilities across a variety of industries, including oil and gas.

Competitive Insights

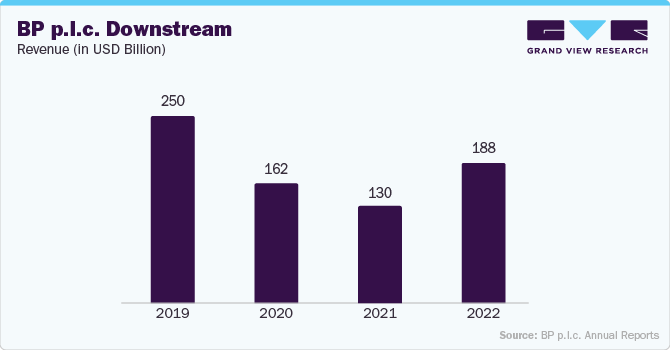

Key players operating in the market are Accenture plc, BP p.l.c., Cisco Systems Inc., Fugenx Technologies, Cloudera Inc., Huawei Technologies Co. Ltd, Intel Corporation, Infosys Limited, International Business Machines Corporation, Microsoft Corporation, Nvidia Corporation, Oracle Corporation, Shell plc. Vendors active in the market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including mergers & acquisitions, partnerships, collaborations, and new product/ technology development. The following are some instances of such initiatives.

-

In May 2023, it was announced that the big-data analytics solution offered by SparkCognition, an AI firm, will be used by Shell Plc. In the area of deep-sea exploration and production, this partnership aims to increase offshore oil production. SparkCognition's AI algorithms will handle the essential duty of processing and analyzing copious seismic data as part of this agreement, assisting Shell in its search for new oil sources.

-

In January 2023, the C3 Generative AI product suite was unveiled by C3.AI Inc. as part of a complete offering intended to speed up transformation activities in a variety of industries, including the oil and gas sector.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."