AI Model Risk Management Market Size, Share & Trends Analysis Report By Offering (Software, Services), By Risk Type, By Application, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-416-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

AI Model Risk Management Market Trends

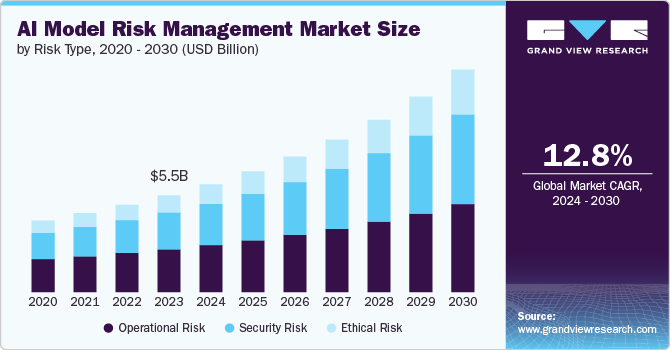

The global AI model risk management market size was estimated at USD 5.48 billion in 2023 and is projected to grow at a CAGR of 12.8% from 2024 to 2030. Businesses across industries are increasingly adopting AI to gain competitive advantages, leading to a corresponding increase in model-related risks. The complexity of AI models is rising, making them harder to understand and manage, necessitating specialized risk management solutions. Thus, governments worldwide are enacting stricter regulations to govern the use of AI, particularly in sectors such as BFSI, healthcare, and automotive. Adherence to data privacy and transparency regulations is driving the demand for the market for AI model risk management.

AI models heavily rely on data, and issues with data quality, such as inaccuracies or biases, can lead to faulty models and reputational damage. Concerns about algorithmic bias and fairness are driving the need for rigorous risk assessment and mitigation strategies. In addition, AI models can be targets for cyberattacks, leading to data breaches, model tampering, and intellectual property theft. Thus, safeguarding sensitive data used to train and operate AI models is a critical concern.

Effective AI model risk management can help organizations avoid costly errors, lawsuits, and reputational damage. By ensuring model reliability and performance, organizations can improve operational efficiency and productivity. Demonstrating a strong commitment to AI model risk management can enhance an organization's reputation and trust among customers and stakeholders. Robust risk management practices can foster a culture of innovation by enabling organizations to deploy AI models confidently.

Offering Insights

The software segment led the market in 2023, accounting for over 63.0% share of the global revenue. Increasing regulatory scrutiny and compliance requirements are pushing organizations to adopt robust risk management solutions. Laws such as GDPR in Europe, CCPA in California, and others worldwide necessitate stringent data protection and risk management practices. With growing public awareness and concern over data privacy, companies are investing more in AI risk management software to ensure they handle data responsibly and mitigate risks. Businesses are increasingly focusing on ensuring operational resilience, which includes the ability to withstand and recover from disruptions. AI risk management software helps in building more resilient systems by proactively managing potential risks.

The services segment is predicted to foresee the highest growth in the coming years. Effective risk management services can help organizations quickly respond to and recover from AI-related incidents, minimizing downtime and reputational damage. Advances in technology are providing advanced tools for AI risk management, making it easier and more efficient for companies to adopt these services. To stay competitive, companies are investing in AI risk management services to ensure their AI solutions are robust and trustworthy, which can be a key differentiator in the market.

Risk Type Insights

The operational risk segment held the largest market revenue share in 2023. As organizations increasingly rely on AI for critical operational processes, the complexity and potential points of failure increase. This necessitates robust risk management frameworks to identify, assess, and mitigate risks associated with these AI models. Regulatory bodies are increasingly focusing on AI and operational risk, requiring organizations to demonstrate that their AI systems are reliable, explainable, and compliant. This drives demand for risk management services that can help ensure compliance.

The ethical risk segment is anticipated to exhibit the fastest CAGR over the forecast period. Governments and regulatory bodies are implementing stricter guidelines and laws to ensure ethical AI usage. Compliance with these regulations necessitates robust ethical risk management practices. Organizations are under growing pressure to demonstrate their commitment to ethical practices, including the ethical use of AI. Investing in ethical risk management helps fulfill these CSR objectives. Consumers are becoming more aware of ethical issues related to AI. Companies aim to build and maintain trust by proactively managing ethical risks in their AI models, which can enhance their reputation.

Application Insights

The fraud detection and risk reduction segment held the largest market revenue share in 2023. The continuous improvement of AI and machine learning algorithms enhances the capability to identify complex fraud patterns. Companies are investing in these advanced risk management solutions to stay ahead of fraud schemes. Stricter regulations around financial crimes, such as anti-money laundering (AML) and Know Your Customer (KYC) requirements, drive the need for robust AI-based fraud detection and risk management systems to ensure compliance.

The sentiment analysis segment is anticipated to witness the fastest CAGR over the forecast period. The exponential growth in unstructured data, particularly from social media, news, and other online platforms, provides ample input for sentiment analysis. This data can be crucial for risk assessment and management. Advancements in artificial intelligence (AI) and natural language processing (NLP) technologies have significantly improved the accuracy and efficiency of sentiment analysis, making it more reliable for risk management purposes. Financial and other regulated industries face increasing pressure to manage risks more effectively. Sentiment analysis can help organizations meet compliance requirements by providing insights into potential risks early on.

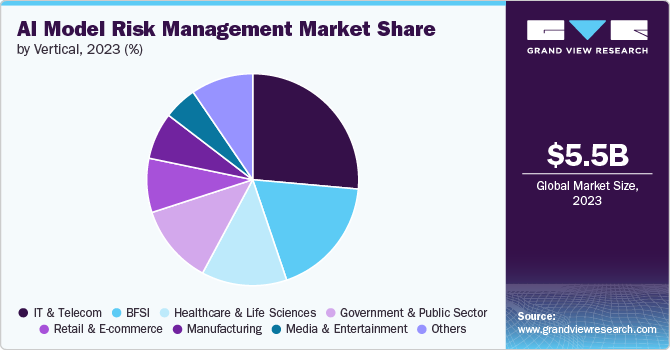

Vertical Insights

The IT & telecommunications segment held the largest market revenue share in 2023. The ongoing digital transformation in IT and telecommunications drives the adoption of AI and machine learning for risk management, aiming to enhance efficiency, reduce costs, and improve decision-making. The massive amount of data generated by IT and telecommunications systems provides advanced AI models. This data is essential for training and refining risk management algorithms. With the increasing complexity of networks, AI-based risk management helps in identifying and mitigating security threats, ensuring the integrity and reliability of telecommunications infrastructure.

The healthcare and life sciences segment is anticipated to exhibit the fastest CAGR over the forecast period. The vast amounts of patient data generated from electronic health records (EHRs), wearable devices, and other digital sources provide a foundation for AI models to analyze and manage risks. In addition, stringent regulatory requirements in healthcare necessitate robust risk management solutions. AI helps organizations comply with regulations such as HIPAA by identifying and mitigating compliance risks. Moreover, AI models enable the analysis of genetic, clinical, and lifestyle data to identify risks and personalize treatments, improving patient outcomes and reducing adverse events.

Regional Insights

North America AI model risk management market dominated globally with a revenue share of over 39.0% in 2023. North American companies have been at the forefront of AI implementation across industries such as finance, healthcare, and retail. This early adoption has led to a greater awareness of associated risks. The region's strong focus on research and development has fostered advancements in AI technologies, necessitating advanced risk management solutions.

U.S. AI Model Risk Management Market Trends

The U.S. AI model risk management market is anticipated to exhibit a significant CAGR over the forecast period. Various regulations such as GDPR and CCPA have prompted organizations to prioritize data protection and privacy, which are integral components of AI model risk management. Moreover, the country's robust financial sector faces stringent regulatory oversight, driving the demand for robust model risk management frameworks.

Europe AI Model Risk Management Market Trends

The AI model risk management market in the Europe region is expected to witness significant growth over the forecast period. The General Data Protection Regulation (GDPR) data privacy laws have fostered a strong data protection culture. This has led to a heightened awareness of the risks associated with AI models and a demand for robust risk management solutions. Moreover, the European Union is increasingly focusing on AI regulation with initiatives like the AI Act, which will further drive the need for comprehensive risk management frameworks.

Asia Pacific AI Model Risk Management Market Trends

The AI model risk management market in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period. Various countries such as China, India, and Singapore are at the forefront of AI adoption across various industries. The region's focus on digital transformation is accelerating AI implementation, leading to a corresponding increase in model-related risks.

Key AI Model Risk Management Company Insights

Key AI model risk management companies include Adobe, Autodesk Inc., and echo3D, Inc. Companies active in the AI model risk management industry are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/technology development. For instance, in July 2023, KPMG partnered with Microsoft to deliver professional services in several essential business areas, such as modernizing the workforce, ensuring development is safe and secure, and leveraging Artificial Intelligence (AI) solutions for the benefit of clients.

Key AI Model Risk Management Companies:

The following are the leading companies in the ai model risk management market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Amazon Web Services

- DataRobot, Inc.

- Deloitte

- International Business Machines Corporation

- LogicGate

- McKinsey & Company

- Microsoft

- SAS Institute

Recent Developments

-

In May 2024, Union Bank of India, a public sector bank in India, enhanced its risk management frameworks by adopting SAS Institute’s solutions. With the help of advanced model risk management solutions, it aimed to improve and make its risk operations and reporting more efficient.

-

In May 2024, International Business Machines Corporation partnered with Palo Alto Networks, a cybersecurity solutions provider, to provide customers with AI-driven security results. The aim of the partnership is to simplify security operations, effectively halt threats on a large scale, and expedite the resolution of incidents for their clients through the comprehensive AI-enabled strategy.

-

In May 2024, Amazon Web Services expanded its strategic partnership with CrowdStrike, a cybersecurity solutions provider, to modernize cybersecurity integration and facilitate cloud transformation. As a key component of the partnership, Amazon Web Services has consolidated its cybersecurity defenses under the CrowdStrike Falcon platform. This move ensures comprehensive protection from the level of individual code segments to entire cloud infrastructures and from devices to data.

AI Model Risk Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.10 billion |

|

Revenue forecast in 2030 |

USD 12.57 billion |

|

Growth Rate |

CAGR of 12.8% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, risk type, application, vertical, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Australia, South Korea, Brazil, UAE, South Africa, KSA |

|

Key companies profiled

|

Accenture; Amazon Web Services; DataRobot, Inc.; Deloitte; Google; International Business Machines Corporation; LogicGate; McKinsey & Company; Microsoft; and SAS Institute |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

AI Model Risk Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global AI model risk management market report based on offering, risk type, application, vertical, and region.

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

- Software By Type

- Software By Deployment Mode

-

Services

-

Professional Services

-

Consulting & Advisory

-

Integration & Deployment

-

Support & Maintenance

-

Training & Education

- Managed Services

-

-

-

Risk Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Security Risk

-

Ethical Risk

-

Operational Risk

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Fraud Detection and Risk Reduction

-

Data Classification and Labelling

-

Sentiment Analysis

-

Model Inventory Management

-

Customer Segmentation and Targeting

-

Regulatory Compliance Monitoring

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Retail & E-commerce

-

IT & Telecom

-

Manufacturing

-

Healthcare & Life Sciences

-

Media & Entertainment

-

Government and Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global AI model risk management market size was estimated at USD 5.48 billion in 2023 and is expected to reach USD 6.10 billion in 2024.

b. The global AI model risk management market is expected to grow at a compound annual growth rate of 12.8% from 2024 to 2030 to reach USD 12.57 billion by 2030.

b. North America dominated the AI model risk management market with a share of 39.9% in 2023. North American companies have been at the forefront of AI implementation across industries such as finance, healthcare, and retail. This early adoption has led to a greater awareness of associated risks. The region's strong focus on research and development has fostered advancements in AI technologies, necessitating advanced risk management solutions.

b. Some key players operating in the AI model risk management market include Accenture, Amazon Web Services, DataRobot, Inc., Deloitte, Google, International Business Machines Corporation, LogicGate, McKinsey & Company, Microsoft, and SAS Institute.

b. Businesses across industries are increasingly adopting AI to gain competitive advantages, leading to a corresponding increase in model-related risks. The complexity of AI models is rising, making them harder to understand and manage, necessitating specialized risk management solutions. Thus, governments worldwide are enacting stricter regulations to govern the use of AI, particularly in sectors such as BFSI, healthcare, and automotive. Adherence to data privacy, and transparency regulations is driving the demand for AI model risk management market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."