AI Governance Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (On-Premises, Cloud), By Organization, By Vertical (BFSI, Government & Defense, Healthcare and Life Sciences), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-081-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

AI Governance Market Size & Trends

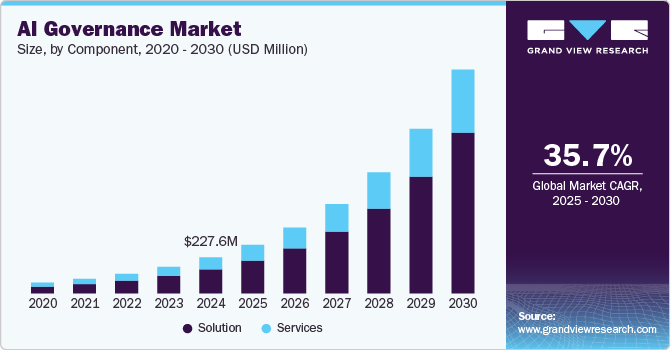

The global AI governance market size was estimated at USD 227.6 million in 2024 and is projected to grow at a CAGR of 35.7% from 2025 to 2030. The market is experiencing significant growth due to the rising awareness of the ethical, legal, and regulatory challenges associated with artificial intelligence. As AI systems become more integrated into industries and public life, the need for frameworks that ensure their responsible use has intensified. Various sectors such as finance, healthcare, and manufacturing are increasingly relying on AI, making it crucial to establish governance models that address transparency, accountability, and fairness. Companies are now focusing on embedding governance mechanisms within their AI development pipelines to mitigate risks like bias, discrimination, and privacy violations. Regulatory bodies around the world are also stepping up efforts to create standards that can guide organizations in managing AI responsibly.

Investments in AI governance technologies and tools are gaining momentum as businesses look to stay ahead of regulatory compliance requirements. Firms are increasingly deploying AI audit tools, explainability frameworks, and fairness monitoring systems to ensure their AI models comply with both local and international laws. This has created opportunities for startups and established firms alike to develop specialized AI governance solutions tailored to different industries. These tools enable organizations to assess and control risks associated with AI deployment, ensuring they align with ethical guidelines and legal frameworks. Moreover, stakeholders are now paying more attention to the social impact of artificial intelligence (AI), urging companies to demonstrate how their technologies promote inclusiveness and prevent harm. This growing concern is pushing the market to evolve rapidly, with new innovations and products emerging to meet the unique needs of diverse sectors.

The market is also seeing increased collaboration between governments, private companies, and academic institutions to develop robust AI governance frameworks. Governments are keen on introducing policies that protect citizens from the potential negative impacts of AI. Meanwhile, academic institutions are contributing to the research and development of ethical AI practices, helping to shape industry standards and best practices. The private sector is following these guidelines and driving advancements by investing in AI governance research and establishing internal ethics committees. This trend is leading to a dynamic ecosystem where public policy, academic research, and corporate responsibility intersect to shape the future of AI governance. As AI continues to advance, these collaborations will be essential in ensuring that governance frameworks evolve to meet new challenges and opportunities.

Component Insights

The solution segment accounted for the dominant share of 66.7% in 2024. The solution segment has dominated the market due to its comprehensive offerings that address key challenges like transparency, accountability, and compliance. These solutions often include tools for AI auditing, bias detection, and explainability, which are essential for businesses to manage risks effectively. Companies are investing heavily in these solutions to ensure their AI systems align with regulatory standards and ethical guidelines. The solution segment's dominance is also driven by the increasing demand for scalable, out-of-the-box governance tools that can be easily integrated into existing AI workflows. As a result, this segment continues to lead the market in terms of both adoption and innovation.

The services segment offers significant benefits, particularly through consulting, implementation support, and ongoing monitoring. Services help businesses navigate complex regulatory landscapes and customize governance frameworks to fit their unique needs. These offerings are crucial for companies that may lack the internal expertise to manage AI governance on their own. Moreover, service providers often offer continuous support, ensuring that AI systems remain compliant as regulations evolve. The service segment complements the solution segment by providing the necessary expertise and guidance, making it an essential part of the market.

Deployment Insights

The on-premises segment dominated the market in 2024 due to its strong appeal for industries that prioritize data security and control. Many companies prefer on-premises solutions because they allow full ownership and customization of governance frameworks. This segment is particularly popular in sectors such as finance and healthcare, where strict regulatory requirements demand tight control over data. Moreover, on-premises solutions reduce reliance on external vendors, offering businesses greater autonomy in managing their AI systems. As a result, the on-premises segment continues to hold a significant share of the market.

The cloud segment is experiencing rapid growth, driven by the scalability, flexibility, and cost-effectiveness it offers. Cloud-based AI governance solutions allow businesses to quickly deploy governance frameworks without the need for extensive infrastructure. This is especially attractive for small and medium-sized enterprises that may lack the resources for on-premises installations. Moreover, cloud solutions often come with built-in updates, ensuring that businesses can stay compliant with evolving regulations. The increasing adoption of cloud technologies across industries is fueling the expansion of this segment in the market.

Organization Size Insights

The large enterprise segment dominated the market in 2024 due to its capacity to invest in comprehensive governance frameworks and advanced technologies. These organizations often face more complex regulatory challenges, requiring robust systems to manage risks associated with AI deployment. Large enterprises also have the resources to implement customized solutions and maintain dedicated teams for AI governance. Their scale and need for stringent compliance measures have made them the leading segment in terms of adoption and spending. As a result, large enterprises continue to drive a significant portion of the market's overall growth.

The SME segment is growing rapidly as smaller businesses increasingly recognize the importance of AI governance. While SMEs may have fewer resources, cloud-based and scalable solutions are making governance tools more accessible and affordable. These companies are adopting AI technologies to remain competitive, which in turn drives the need for appropriate governance to manage risks and ensure compliance. The growth of SMEs in the AI governance market is fueled by their desire to implement governance frameworks without the heavy investment required by larger enterprises.

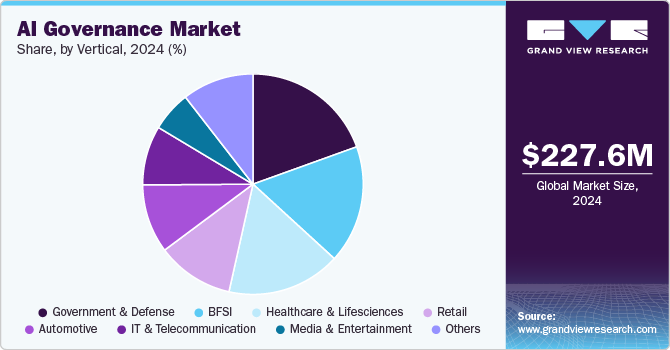

Vertical Insights

The government and defense segment has dominated the market in 2024 due to its focus on national security, data privacy, and strict regulatory compliance. These sectors require highly secure and controlled AI governance frameworks to manage sensitive information and mitigate risks associated with AI use. Government agencies often prioritize transparency, accountability, and the ethical use of AI, making governance a critical factor in their AI strategy. Moreover, defense organizations utilize advanced AI systems for mission-critical operations, requiring robust governance solutions to ensure responsible deployment.

The healthcare and life sciences segment is experiencing significant growth as the sector increasingly integrates AI into medical research, diagnostics, and patient care. With the rise of AI-driven technologies in areas like drug discovery and personalized medicine, the need for strong governance to manage data privacy, bias, and ethical concerns is paramount. Healthcare organizations are adopting AI governance frameworks to ensure compliance with strict regulations such as HIPAA, while also safeguarding patient data. This growth is further driven by the sector’s focus on improving AI explainability and fairness, especially in sensitive clinical settings.

Regional Insights

North America leads the global AI Governance market accounting for leading share of 32.6% in 2024. In North America, the market is seeing rapid growth, driven by strong regulatory frameworks and high levels of AI adoption across industries. Companies are focusing on implementing governance solutions to address ethical concerns, data privacy, and transparency. Canada, in particular, has been proactive in developing AI guidelines and collaborating with industry leaders to promote responsible AI use. The presence of major technology firms and research institutions in North America has further accelerated the demand for robust governance frameworks.

U.S. AI Governance Market Trends

In the U.S., the AI governance market is driven by a combination of corporate initiatives and emerging regulatory efforts aimed at addressing ethical concerns surrounding AI. Large tech companies in the U.S. are investing heavily in governance tools, emphasizing transparency, bias mitigation, and responsible AI use to avoid reputational and legal risks. Moreover, there’s growing pressure from consumers and advocacy groups for more stringent AI regulations, particularly in areas like privacy and discrimination.

Europe AI Governance Market Trends

Europe AI governance market is expanding due to strict regulations such as the General Data Protection Regulation (GDPR) and upcoming AI-specific laws. European countries are heavily invested in ensuring that AI systems are ethical, transparent, and free from bias, which has spurred demand for governance solutions. Governments are also collaborating with industry and academic institutions to develop policies that balance innovation with ethical AI use. The European Union is pushing for comprehensive AI governance frameworks that will influence companies operating both within and outside the region.

Asia Pacific AI Governance Market Trends

Asia Pacific is experiencing rapid growth in the AI governance market, fueled by increasing AI adoption in countries like China, Japan, and South Korea. Governments and businesses in the region are recognizing the need for governance frameworks to manage the risks associated with AI deployment, particularly in sectors like finance and healthcare. While some countries are still in the early stages of developing formal AI governance policies, there is growing momentum toward establishing regulatory frameworks. Companies in Asia Pacific are also investing in AI auditing, bias detection, and compliance tools to ensure responsible use of AI technologies.

Key AI Governance Company Insights

Some of the key companies in the market include ABB Ltd, DXC Technology Company, IBM Corporation, Infosys Ltd, Microsoft and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

IBM Corporation has been at the forefront of AI governance development by introducing frameworks and tools designed to promote responsible AI usage. The company emphasizes ethical AI practices through its IBM Watson platform, which incorporates transparency, fairness, and accountability in AI models. Moreover, IBM collaborates with various organizations to create guidelines and standards for AI governance, addressing issues such as bias and data privacy.

-

Microsoft develops comprehensive frameworks that prioritize responsible AI practices. The company emphasizes transparency, fairness, and accountability in its AI solutions, particularly through the Azure OpenAI Service, which aims to ensure ethical usage of generative AI technologies. Microsoft actively engages with policymakers, industry leaders, and academic institutions to shape global standards and regulations around AI governance, addressing concerns such as bias and data privacy.

Key AI Governance Companies:

The following are the leading companies in the AI governance market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd

- DXC Technology Company

- IBM Corporation

- Infosys Ltd

- Microsoft Corporation

- NTT Data

- Oracle Inc

- SAP SE

- Siemens SA

- Tata Consultancy Services (TCS) Ltd

- TIBCO

View a comprehensive list of companies in the AI Governance Market

Recent Developments

-

In October 2024, Microsoft introduced new AI capabilities for healthcare organizations, including a service that enables companies to create custom AI agents for tasks like appointment scheduling and clinical trial matching. These advancements, along with foundation models for medical imaging and a healthcare data analysis platform, aim to enhance patient care while addressing clinician burnout through improved workflow management.

-

In May 2024, IBM Corporation partnered with Amazon Web Services (AWS) to integrate its watsonx governance platform with Amazon SageMaker, enabling enterprises to scale AI solutions with enhanced governance and compliance in light of evolving regulatory requirements. This partnership aims to provide customizable risk assessment and model approval processes, ultimately helping businesses utilize generative AI securely and effectively across hybrid environments.

-

In February 2024, Infosys launched its Responsible AI Suite as part of its AI-first offering, Infosys Topaz, to address the ethical challenges posed by generative AI, focusing on data privacy, ethics, security, and bias. The suite employs a Scan, Shield, and Steer framework to help enterprises monitor AI risks, establish technical safeguards, and implement effective governance while collaborating with the Responsible AI Coalition to set industry standards for responsible AI practices.

-

In July 2023, ABB Ltd collaborated with Microsoft to integrate generative AI capabilities into its ABB Ability Genix Industrial Analytics and AI Suite, enhancing user interaction and enabling significant gains in efficiency, sustainability, and operational safety. This collaboration aims to utilize Microsoft Azure OpenAI Service to unlock insights from operational data, improve decision-making, and help customers achieve their sustainability goals while optimizing asset performance.

AI Governance Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 308.3 million |

|

Revenue forecast in 2030 |

USD 1,418.3 million |

|

Growth rate |

CAGR of 35.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD Million/Billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segment scope |

Component, deployment, organization size, vertical, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Brazil |

|

Key companies profiled |

ABB Ltd, DXC Technology Company, IBM Corporation, Infosys Ltd, Microsoft, NTT Data, Oracle Inc, SAP SE, Siemens SA, Tata Consultancy Services (TCS) Ltd, TIBCO |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global AI Governance Market Report Segmentation

This report offers revenue growth forecasts at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global AI governance market report based on component, deployment, organization size, vertical and region:

-

Component Outlook (Revenue, USD Million; 2018 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million; 2018 - 2030)

-

On-Premises

-

Cloud

-

-

Organization Size (Revenue, USD Million; 2018 - 2030)

-

Large Enterprise

-

SMEs

-

-

Vertical (Revenue, USD Million; 2018 - 2030)

-

BFSI

-

Government and Defense

-

Healthcare and life sciences

-

Media and Entertainment

-

Retail

-

IT and Telecommunication

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI governance market size was estimated at USD 227.6 million in 2024 and is expected to reach USD 308.3 million in 2025.

b. The global AI governance market is expected to grow at a compound annual growth rate of 35.7% from 2025 to 2030 to reach USD 1,418.3 million by 2030.

b. North America dominated the AI governance market with a share of 32.6% in 2024. This is attributable to its strong regulatory frameworks, significant investment in AI technologies, and the presence of leading tech companies prioritizing ethical AI practices.

b. Some key players operating in the AI governance market include ABB Ltd., DXC Technology Company, Infosys Ltd., Microsoft, NTT Data, Oracle Corporation, SAP SE, Siemens AG, Tata Consultancy Services (TCS) Ltd., and TIBCO.

b. Key factors driving the AI governance market growth include increasing regulatory requirements for ethical AI use, the need for transparency and accountability in AI systems, rising concerns about data privacy and security, and the demand for bias mitigation in AI algorithms.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."