AI Enhanced HPC Market Size, Share & Trends Analysis Report By Component, By Deployment (Cloud, On-premise), By Organization Size, By Computing Type (Parallel Computing, Distributed Computing), By Industry Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-481-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

AI Enhanced HPC Market Size & Trends

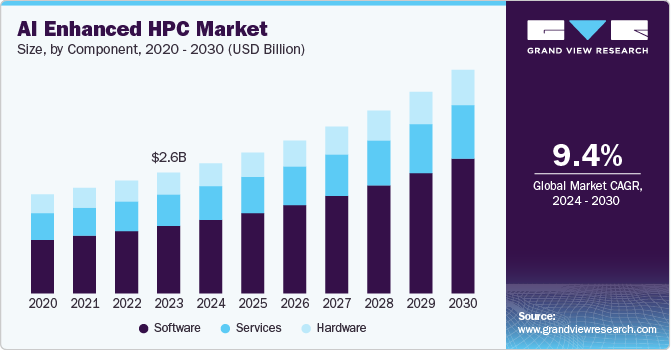

The global AI enhanced HPC market size was valued at USD 2.60 billion in 2023 and is estimated to grow at a CAGR of 9.4% from 2024 to 2030. The growth is driven by the increasing demand for advanced computing capabilities across various sectors. Additionally, the widespread adoption of cloud computing has made high-performance computing resources more accessible and cost-effective for organizations of all sizes. Cloud service providers are integrating AI capabilities with HPC resources, allowing businesses to leverage powerful computing without substantial upfront investments in hardware. This shift from traditional on-premises infrastructure to cloud-based solutions offers scalability and flexibility, enabling organizations to adapt quickly to changing computational demands.

Key sectors are harnessing AI-enhanced HPC for a variety of applications, including drug discovery in pharmaceuticals, predictive analytics in finance, and real-time simulations in energy management. This versatility highlights the transformative potential of HPC in addressing critical challenges. As AI continues to evolve, the integration of AI with HPC is expected to deepen, creating new opportunities for businesses to enhance decision-making, improve efficiency, and unlock insights from vast datasets. Companies that strategically adopt these technologies are likely to lead in their respective markets.

Component Insights

The software segment held the largest revenue share of 53.5% in 2023. The segment is associated with the utilization of optimized software algorithms, that are integrated on a standard CPU-based system, to enhance the performance of AI. Accelerated computing utilizes different application programming interfaces (API), programming models such as Computed Unified Device Architecture (CUDA), and Open Computing Language), networking, and others to interface with software accelerators. Major initiatives by key players, such as the introduction of AI PC Acceleration Program by Intel in October 2023, are aimed at speeding up AI development within the PC industry. The program aims to link independent hardware vendors (IHVs) and independent software vendors (ISVs) with Intel’s resources, which encompass AI toolchains, co-engineering assistance, hardware, design resources, technical expertise, and co-marketing opportunities.

The service segment is estimated to register the highest CAGR of 10.5% over the forecast period. The growing adoption of AI and machine learning technologies across industries is driving the demand for AI-enhanced HPC services. Businesses are recognizing the value of leveraging advanced computing power to process large volumes of data, conduct complex simulations, and gain data-driven insights that inform critical decision-making. As AI and ML become more prevalent, the need for scalable, high-performance computing resources will continue to rise, fueling the growth of AI-enhanced HPC services. Moreover, Governments are increasingly recognizing the strategic importance of AI and HPC integration for scientific research, economic competitiveness, and addressing societal challenges.

Deployment Insights

The on-premises segment accounted for a significant revenue share in 2023. On-premises high-performance computing solution performs complex computational tasks by running or deploying advanced applications and large data sets with advanced network management tools in compact servers or clusters. In the on-premises deployment of AI-enabled HPC, large-scale and medium-scale business organizations and research institutions build an HPC cluster full of servers, storage solutions, and other infrastructure, that were managed and upgraded over time. The Hewlett Packard Enterprise Development LPE utilizes a hybrid deployment platform; it uses on-premises, and as well as cloud solutions for deployment for AI-enhanced HPC. Key launches by major players are augmenting the market growth. For instance, in July 2024, Parallel Works unveiled ACTIVATE, a unified control plane for artificial intelligence (AI) and high-performance computing (HPC) that streamlines the configuration, access, and management of computing resources both on-premises and in major cloud environments. This solution facilitates multi-site and hybrid computing capabilities, driving exceptional innovation across various industries.

The cloud segment is estimated to grow significantly over the forecast period. The deployment of AI-enhanced high-performance computing on a cloud platform assists companies in upgrading their computing capabilities, as AI workloads are deployed in the cloud platform. The high-performance computing built on a cloud platform allows companies to innovate by incorporating AI-enhanced HPC operations. Acquisition by major players is significantly improving market growth. For instance, in July 2024, The AI cloud platform Nscale announced its acquisition of Kontena, a company specializing in high-density modular data centers and AI data center solutions. This acquisition marks a significant step in Nscale’s mission to enhance the infrastructure backbone for the growing generative AI and AI enhanced HPE industry. By incorporating Kontena’s innovative solutions, Nscale intends to provide cost-effective, high-performance infrastructure that maximizes AI’s potential.

Organizational Size Insights

The large enterprises segment led the market and accounted for 62.9% of the global revenue in 2023. Large enterprises are utilizing high-performance computing architecture to streamline their business processes and execute tasks more efficiently. In the manufacturing sector, these organizations employ AI-enhanced HPC to optimize supply chain performance, develop demand forecasting models, and leverage deep learning techniques to improve product development. Additionally, large enterprises in the semiconductor and IT sectors are using HPCs like IBM cloud HPC to effectively manage their operations. Moreover, the exponential growth of data generated across industries in AI enhanced HPC necessitates powerful computing solutions to analyze and extract valuable insights, driving the demand for AI-enhanced HPC.

The SME segment is estimated to grow significantly over the forecast period. High-performance computing (HPC) addresses complex calculations and provides opportunities for small and medium-sized enterprises (SMEs) to innovate products, enhance services, and optimize resource allocation. SMEs leverage AI-enhanced HPC as they require support and training to effectively use both commercial and open-source software for simulation, modeling, and visualization on larger servers, such as those offered by HPC cloud services. Utilizing HPC cloud solutions helps SMEs reduce costs and time involved in developing and validating new products and production lines. Additionally, the adoption of AI-driven computing improves efficiency in managing vast amounts of data on large servers, facilitating better oversight of production lines, machinery, raw materials, logistics, and customer relationship management.

Computing Type Insights

The parallel computing segment led the market and accounted for significant global revenue in 2023. The integration of advanced accelerator technologies, particularly GPUs and AI-specific processors, is driving significant growth in parallel computing for AI-enhanced HPC. These accelerators provide the massive computational power required for training large neural networks and processing vast amounts of data in parallel. Companies like NVIDIA, Cerebras, and SambaNova are leading the development of AI-centric servers and processors optimized for HPC workloads. As AI models become increasingly complex, with billions of parameters, the need for scalable parallel computing becomes critical. HPC systems with thousands of interconnected nodes can distribute the training of these large models across multiple GPUs, significantly reducing training times. Techniques like data parallelism and model parallelism enable efficient scaling of AI training on HPC infrastructure.

The exascale computing segment is estimated to grow at a CAGR of 9.2% over the forecast period. Exascale computing represents a transformative leap in computational capabilities, enabling systems to perform a billion calculations per second (10^18 operations). This unprecedented processing power is crucial for tackling complex problems across various fields, including scientific research, climate modeling, drug discovery, and advanced AI applications. The ability to handle massive datasets facilitates more accurate simulations and predictions, driving innovation and breakthroughs in critical areas such as genomics and material science.The integration of AI with exascale computing is becoming increasingly prevalent, enhancing data processing and analysis capabilities. AI algorithms can optimize workflows, improve resource allocation, and automate system management tasks within HPC environments. This synergy allows organizations to leverage the vast computational resources of exascale systems to train complex AI models more efficiently, leading to advancements in natural language processing, image recognition, and predictive analytics.

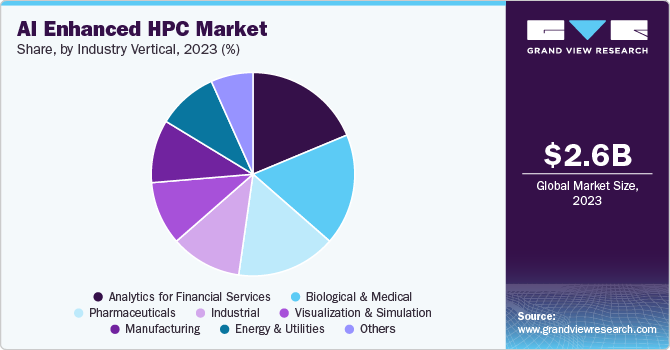

Industry Vertical Insights

The biological and medical segments accounted for a 17.7% share of the global revenue in 2023. The growth is attributed to revolutionizing industries in AI enhanced HPC, such as automotive and aerospace, by enabling intelligent simulation processes. In the automotive sector, for instance, manufacturers are leveraging AI-guided HPC to streamline the simulation of vehicle designs, optimizing factors like aerodynamics and noise reduction. This capability allows for faster product development cycles, helping companies respond swiftly to market demands and maintain competitive advantages. Major initiatives by key players are augmenting the market growth. For instance, in March 2023, Cleveland Clinic and IBM officially announced the first deployment of an onsite, privately managed IBM quantum computer in the United States. The IBM Quantum System One, installed at Cleveland Clinic, is the quantum computer specifically dedicated to healthcare research, aiming to accelerate biomedical discoveries for the clinic.

The analytics for the financial services segment are estimated to grow significantly over the forecast period. Financial institutions generate vast amounts of data from various sources, including transactions, market data, and customer interactions. AI-enhanced HPC systems are increasingly being adopted to process and analyze this data efficiently. This capability allows financial firms to gain insights faster, enabling them to make more informed decisions and maintain a competitive edge in a rapidly evolving market. The ability to handle large datasets with speed and accuracy is becoming crucial for operational success in financial services. Moreover, AI algorithms, when combined with the computational power of HPC, are revolutionizing fraud detection and risk management practices in the financial services industry. By analyzing vast datasets in real-time, these systems can identify fraudulent transactions and detect patterns that may indicate potential risks. This enhanced fraud detection capability not only reduces false positives but also improves customer satisfaction by ensuring safer transactions. Financial institutions are increasingly leveraging these technologies to comply with regulatory requirements while minimizing financial crime risks.

Regional Insights

North America AI enhanced HPC market held a significant share and accounted for a 32.7% share in 2023. North American organizations are increasingly adopting AI-enhanced HPC to process and analyze large datasets more efficiently. The ability to leverage AI algorithms and HPC's computational power enables businesses to gain insights faster, make data-driven decisions, and maintain a competitive edge in rapidly evolving markets. This demand is particularly strong in industries such as finance, healthcare, and manufacturing. Moreover, the rise of cloud computing is making AI-enhanced HPC resources more accessible to organizations of all sizes in North America.

U.S. AI Enhanced HPC Market Trends

The AI enhanced HPC market in the U.S. is accounted to hold the highest market share over the forecast period. The U.S. government is prioritizing the incorporation of AI innovations in HPC, realizing the significant impact on scientific research, national security, and economic competitiveness. Moreover, the Department of Energy's National Nuclear Security Administration uses HPC for nuclear weapons simulation and modeling expanding the market growth.

Europe AI Enhanced HPC Market Trends

The AI enhanced HPC market in Europe is particularly strong and is driven by a combination of factors. In July 2024, an amendment to the EuroHPC JU regulation entered into force, expanding its objectives to include the development and operation of "AI Factories". The EuroHPC JU deploys AI-dedicated supercomputing and service infrastructures to support the growth of a highly competitive and innovative AI ecosystem in the EU.

Asia Pacific AI Enhanced HPC Market Trends

The AI enhanced HPC market in Asia Pacific is experiencing rapid growth. The Asia Pacific region is experiencing high growth in the cluster computing market due to the rapid digitization and growing adoption of cloud computing technologies. Countries like India, China, and South Korea are witnessing increased demand for cluster computing solutions in areas such as e-commerce, telecom, and manufacturing. These countries are focusing on building advanced IT infrastructure to support their growing economies, further propelling the cluster computing market.

Key AI Enhanced HPC Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, partnerships, and collaborations contracts, agreements, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in September 2024,Lenovo has unveiled an expansion of its Neptune liquid-cooling technology, introducing new ThinkSystem V4 server designs designed to enhance efficiency and performance for businesses utilizing high-performance computing (HPC) and artificial intelligence (AI).

Key AI Enhanced HPC Companies:

The following are the leading companies in the ai enhanced hpc market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services

- AMD

- DELL INC.

- Fujitsu

- HP Enterprise

- Intel

- Lenovo

- NVIDIA Corporation

- Penguin Computing

- YOTTA

Recent Developments

-

In August 2024, Amazon Web Services, Inc. (AWS) revealed the availability of the AWS Parallel Computing Service, a new managed solution that simplifies the setup and management of high-performance computing (HPC) clusters. This service enables customers to efficiently run scientific and engineering capabilities at virtually any ratio on AWS. It allows system administrators to easily build clusters using Amazon Elastic Compute Cloud (Amazon EC2) instances, along with low-latency networking and storage tailored for HPC workloads.

-

In June 2024, At Computex 2024, AMD announced significant advancements in its AI and high-performance computing (HPC) offerings, introducing the new AMD Instinct MI325X accelerator, which features industry-leading memory capacity set to launch in Q4 2024. The company also previewed the upcoming 5th Gen AMD EPYC processors, aimed at enhancing data center performance and efficiency, expected to be available in the second half of 2024.

AI Enhanced HPC Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.80 billion |

|

Revenue forecast in 2030 |

USD 4.80 billion |

|

Growth rate |

CAGR of 9.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, organization size, computing type, industry vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S., Canada, U.K., Germany, France, China, Japan, India, South Korea, Australia, Brazil, Mexico, Kingdom of Saudi Arabia (KSA), UAE, South Africa |

|

Key companies profiled |

Amazon Web Services; AMD; DELL INC.; Fujitsu; HP Enterprise; Intel; Lenovo; NVIDIA Corporation; Penguin Computing; YOTTA |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global AI Enhanced HPC Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global AI enhanced HPC market report based on component, deployment, organization size, computing type, industry vertical and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Computing Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Parallel Computing

-

Distributed Computing

-

Exascale Computing

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy and Utilities

-

Industrial

-

Manufacturing

-

Pharmaceuticals

-

Analytics for Financial Services

-

Visualization and Simulation

-

Biological and Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI enhanced HPC market size was estimated at USD 2.60 billion in 2023 and is expected to reach USD 2.80 billion in 2024.

b. The global AI enhanced HPC market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 4.80 billion by 2030.

b. North America dominated the AI enhanced HPC market with a share of 32.7% in 2023. This is attributable to North American organizations that are increasingly adopting AI-enhanced HPC to process and analyze large datasets more efficiently.

b. Some key players operating in the AI enhanced HPC market include Amazon Web Services, AMD, DELL INC., Fujitsu, HP Enterprise, Intel, Lenovo, NVIDIA Corporation, Penguin Computing,YOTTA

b. Key factors that are driving the market growth include key sectors harnessing AI-enhanced HPC for a variety of applications, including drug discovery in pharmaceuticals, predictive analytics in finance, and real-time simulations in energy management.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."