AI Data Management Market Size, Share & Trends Analysis Report By Deployment, By Offering, By Data Type, By Application, By Technology, By Vertical (BFSI, Retail & E-commerce), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-355-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

AI Data Management Market Size & Trends

The global AI data management market size was estimated at USD 25.53 billion in 2023 and is expected to grow at a CAGR of 22.7% from 2024 to 2030. Factors such as the growth in Big Data and the Internet of Things (IoT), rapid advancements in AI and Machine Learning (ML), and increasing demand for data-driven decision-making are primarily driving the growth of the AI data management market. Moreover, data privacy regulations such as GDPR and CCPA are driving the need for robust data management solutions that ensure data security, governance, and compliance. Furthermore, the widespread adoption of cloud computing provides scalable and cost-effective storage and processing power for managing large datasets used in AI applications.

AI technologies enable companies to sift through extensive datasets, creating personalized experiences that resonate with individual user preferences, past behaviors, and interactions. By applying machine learning, organizations can create evolving systems that adapt by assimilating feedback and new data, thus enhancing and personalizing interactions. This capability is transformative across numerous sectors.

For instance, in the e-commerce sector, AI-driven suggestion engines take into account users' previous browsing and shopping behaviors to recommend products that are more likely to be of interest, thereby increasing engagement and boosting sales. In the realm of healthcare, these intelligent systems can process patient history to tailor treatment options or health advice, leading to better health results. As these technologies continuously refine their operations based on user engagement, they can modify recommendations, content, or services to maintain relevancy and elevate satisfaction.

The widespread implementation of AI-powered chatbots in various sectors to enhance customer service is driving the growth of the AI data management market. The significant uptake of advanced technologies such as artificial intelligence (AI), machine learning (ML), and deep learning in developing nations such as, China, India, South Korea, Japan drive the use of AI data management tools among companies. These tools are used for analyzing customer data, boosting employee efficiency, optimizing inventory, enhancing in-store analytics, and improving the effectiveness of supply chains.

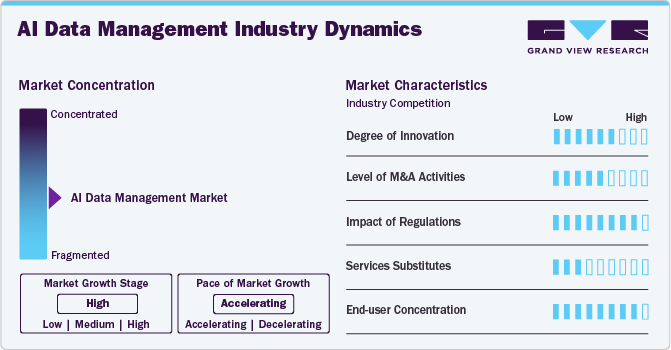

Market Concentration & Characteristics

The AI data management market is characterized by a high degree of innovation. The field of AI is constantly evolving, with new algorithms and techniques emerging regularly. AI data management solutions need to keep pace with these advancements to effectively handle the complex and ever-growing datasets used in AI applications.

The artificial intelligence data management market is a rapidly growing sector with significant merger and acquisition (M&A) activity. Companies are going through mergers and acquisitions to expand capabilities, gain market share, and access new expertise.

Regulatory bodies around the world are actively working on developing more comprehensive frameworks for the AI data management market. For instance, the General Data Protection Regulation (GDPR) applies to any organization processing the personal data of EU residents. It requires transparency about data collection and usage and provides individuals with rights to access, rectify, and erase their data. Moreover, the California Consumer Privacy Act (CCPA) grants California residents similar rights to access, delete, and opt out of the sale of their personal data.

There are low substitutes for AI data management tools. Traditional data management software can be considered a substitute for AI data management tools. However, it doesn’t incorporate advanced AI functionalities such as data cleansing or automated analysis, and it requires significant manual effort.

End user concentration is a significant factor in the AI data management market. Cloud-based deployment is likely to become the norm among end users, offering scalability, affordability, and easier access for end users. Moreover, end use industries such as more industry-specific AI data management tools tailored to the unique needs of different sectors (e.g., healthcare, finance, retail).

Deployment Insights

The cloud deployment segment led the market in 2023, accounting for over 63.0% of the global revenue share. Cloud computing provides a scalable and flexible foundation for storing, processing, and accessing data. This is essential for AI applications, which often require access to large amounts of data. Cloud-based AI data management solutions can help organizations to manage their data more efficiently and cost-effectively. Moreover, cloud-based AI data management solutions can help organizations automate the process of data ingestion, transformation, and curation, which can free up IT resources and improve the efficiency of AI development.

The on-premises segment is expected to register a significant CAGR during the forecast period. Various industries, like finance and healthcare, handle highly sensitive data. Regulations might mandate data residency or strict control over its location. On-premises solutions offer these organizations more control over physical security and data access. Moreover, for real-time AI applications that require very fast data processing, on-premise solutions keep data transfer localized, minimizing latency issues that can occur with cloud-based solutions.

Offering Insights

The platform segment accounted for the largest market revenue share in 2023. Organizations are increasingly reliant on data-driven decision-making. AI data management platforms empower businesses to extract valuable insights from their data through advanced analytical tools, improving strategic decision-making. Moreover, With stricter data privacy regulations being implemented globally, organizations need robust data governance. AI data management platforms can facilitate compliance by ensuring data security and proper access controls.

The services segment is predicted to foresee significant growth in the coming years. While AI data management platforms offer powerful tools, managing them effectively requires specialized skills and expertise. Businesses often lack the in-house resources or knowledge to handle the complexities of AI data pipelines, data governance, and model training data preparation. AI data management services address this gap by providing access to specialists who can plan, implement, and optimize AI data management strategies. Moreover, AI data management services providers can help businesses get started with AI faster by offering pre-built solutions, migration assistance, and expertise in integrating AI with existing data infrastructure. This quicker implementation translates to a faster return on investment (ROI) for AI initiatives.

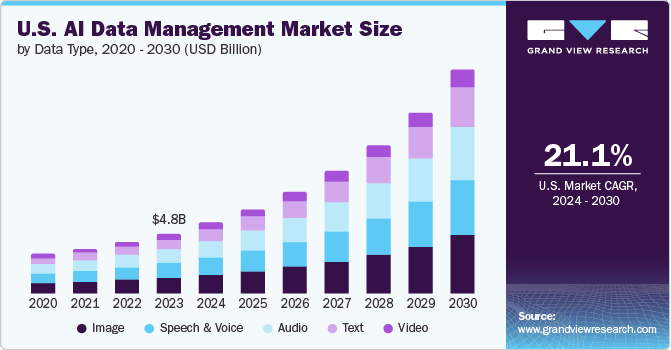

Data Type Insights

The image segment accounted for the largest market revenue share in 2023. AI image data management tools are a type of software that helps organizations store, organize, and access their image data more efficiently. These tools are becoming increasingly important as businesses collect and store ever-increasing amounts of image data, such as photos, and medical scans. AI can be used to automatically tag images with keywords or descriptions. This can make it easier to find specific images when it is required. Moreover, AI can be used to classify images into different categories. This can be helpful for tasks such as organizing product images or medical scans.

The text segment is predicted to foresee significant growth from 2024 to 2030. The surge in AI text data management is driven by a confluence of factors encompassing both the technical capabilities of AI and the growing importance of text data in various industries. The volume of text data being generated is exploding. This includes social media posts, customer reviews, emails, documents, and more. Traditional data management methods struggle to handle this ever-increasing amount of unstructured text data. AI-powered tools offer a more efficient and scalable solution.

Application Insights

The process automation segment accounted for the largest revenue share in 2023. AI-based process automation automates repetitive, rule-based tasks, freeing up human workers to focus on more strategic and creative endeavors. This leads to significant efficiency gains and increased productivity across organizations. Moreover, AI tools can execute tasks with high precision, minimizing errors and ensuring consistent outcomes. Automating tasks reduces reliance on manual labor, leading to lower operational costs. Additionally, AI can streamline workflows, minimize rework due to errors, and optimize resource allocation, further contributing to cost savings.

The imputation predictive modeling segment is predicted to foresee significant growth in the coming years. AI-based data collection methods generate massive datasets, often containing missing values. Traditional methods for handling missing data can be time-consuming and lead to information loss. AI-powered imputation techniques can efficiently address missing data in complex datasets while preserving valuable information. Data cleaning, including handling missing values, is a crucial but tedious step in the data science pipeline. AI-powered imputation tools can automate this process, freeing up data scientists to focus on more strategic tasks such as model building and analysis.

Technology Insights

The machine learning segment accounted for the largest revenue share in 2023. Enterprises are generating huge amounts of data from various sources like sensors, social media, and customer interactions. This data is often complex and unstructured, making traditional data management methods inadequate. Machine learning algorithms can automate tasks such as data classification, anomaly detection, and data cleansing, enabling efficient handling of massive and intricate data sets. Additionally, ML techniques can extract valuable insights from complex data sets that might be missed by traditional methods. This empowers businesses to make data-driven decisions with greater accuracy.

The computer vision segment is predicted to foresee significant growth in the coming years. Businesses across various sectors are increasingly using computer vision for tasks such as object detection, image classification, and anomaly detection. This reliance on visual data necessitates robust management solutions. Computer vision-based data management tools automate tasks like data ingestion, pre-processing, annotation, and version control. This streamlines workflows and allows for faster development and deployment of computer vision models.

End Use Insights

The BFSI segment represented a significant market revenue share in 2023. Financial institutions are subject to stringent regulations regarding data privacy and security. AI-based data management tools can automate tasks like data access control, audit trails, and anonymization, ensuring compliance and mitigating security risks associated with vast amounts of customer data. Moreover, financial institutions constantly battle fraud and financial crime. AI-based data management tools can analyze vast datasets of transactions and customer behavior to identify anomalies and suspicious patterns in real time, enabling proactive fraud detection and risk mitigation.

The healthcare & life sciences segment is anticipated to exhibit a substantial growth rate over the forecast period. Healthcare and life sciences generate enormous amounts of data from electronic health records (EHRs), clinical trials, genomics, and medical imaging. Traditional data management methods struggle to handle this data volume and complexity. AI tools can analyze vast datasets to uncover hidden patterns and generate valuable insights for research, diagnostics, and treatment planning. Furthermore, early and accurate diagnosis is crucial for better patient outcomes. AI-based data management tools can analyze medical images and patient data to assist in early disease detection, personalized treatment plans, and improved diagnostic accuracy.

Regional Insights

North America AI Data Management Market Trends

North America dominated with a revenue share of over 32.0% in 2023. North American businesses are constantly seeking ways to streamline processes and automate tasks. AI data management tools can automate data collection, organization, and analysis, freeing up human resources to focus on more strategic endeavors.

The U.S. AI data management market is expected to grow at a CAGR of 21.1% from 2024 to 2030. The U.S. is the most prominent country in cloud computing adoption. Various AI data management solutions are cloud-based, offering U.S. businesses scalability, flexibility, and cost-effectiveness for data storage and processing. Thus, driving the growth of the market in the country.

The Canada AI data management market held a significant share in the North America region in 2023. The Canadian government, through initiatives like the Pan-Canadian Artificial Intelligence Strategy, actively invests in AI research and development. This fosters a supportive environment for AI-related technologies, including AI data management solutions.

The AI data management market in Mexico held a significant share in the North America region in 2023. Mexico is experiencing a surge in AI adoption for numerous applications, such as project management, and customer service. AI data management tools become crucial as businesses handle the influx of data generated by these AI applications.

Europe AI Data Management Market Trends

The Europe AI data management market held a significant share in the global region. Europe has stringent data privacy regulations such as, General Data Protection Regulation (GDPR). AI data management tools can automate tasks related to data access control, data anonymization, and audit trails, ensuring compliance with these regulations and mitigating risks associated with vast amounts of data.

The UK AI data management market held a significant share in the European region. Numerous initiatives such as, the "AI Sector Deal" and the Alan Turing Institute demonstrate the UK government's commitment to fostering a strong AI ecosystem. This creates a supportive environment for the growth of AI data management solutions.

The AI data management market in Germany is expected to grow at a significant CAGR from 2024 to 2030. Germany is a prominent country in manufacturing and a strong proponent of Industry 4.0, which emphasizes data-driven automation and interconnected systems. AI data management tools are crucial for handling the vast amount of sensor data generated in these intelligent factories, enabling real-time process monitoring, predictive maintenance, and data-driven optimization of production lines.

The France AI data management market is expected to grow at a significant CAGR from 2024 to 2030. The government in the country emphasizes data sovereignty, keeping data within the region. Various AI data management solutions are now compliant with these regulations and offer on-premises or France cloud deployment options. This fosters a secure and localized data storage environment.

Asia Pacific AI Data Management Market Trends

The AI data management market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. APAC economies are experiencing rapid digitization across sectors, leading to a massive generation of data from various sources. AI data management tools is essential for handling this data volume effectively and efficiently.

India AI data management market held a significant share in the Asia Pacific region. India is undergoing rapid digitization across sectors such as, government services, finance, and retail. This digital transformation generates massive amounts of data from various sources, making data management a critical challenge. AI data management tools facilitate efficient data handling, storage, and analysis.

The AI data management market in China held a significant share in the Asia Pacific region. China prioritizes domestic innovation and reducing reliance on foreign technologies. This can lead to increased investment in AI data management solutions developed by Chinese companies, catering to the specific needs of the Chinese market and data security regulations.

Japan AI data management market held a significant share in the Asia Pacific region. Japan is a prominent country in robotics and advanced manufacturing. AI data management plays a crucial role in handling the vast amount of sensor data generated by robots and intelligent factories. This data is essential for real-time monitoring, predictive maintenance, and data-driven optimization of production lines within Industry 4.0 environments.

The AI data management market in South Korea held a significant share in the Asia Pacific region. The government of South Korea is actively investing in AI research and development through initiatives such as, the "AI Korea 2.0" strategy and the "AI for All" vision. This fosters a supportive environment for the growth of AI-related technologies, including AI data management solutions.

Australia AI data management market held a significant share in the Asia Pacific region. Australian businesses across sectors such as, healthcare, finance, and manufacturing are increasingly adopting AI for various business operations such as, fraud detection, personalized medicine, and optimizing operational efficiency. This drives the need for robust AI data management solutions to handle the data used to train and power these AI models.

Middle East & Africa AI Data Management Market Trends

The Middle East & Africa (MEA) region is anticipated to thrive over the forecast period. Governments across the region are actively supporting AI research, development, and digitalization initiatives. This fosters a supportive environment for the growth of AI-related technologies, including AI data management solutions tailored to the region's needs.

UAE AI data management market held a significant share in the MEA region. The UAE is undergoing rapid digitization across various sectors such as, finance, tourism, and logistics. This digital transformation generates massive amounts of data from various sources, making data management a critical challenge. AI data management tools become crucial for handling this data volume effectively.

The AI data management market in KSA held a significant share in the MEA region. KSA’s ambitious Vision 2030 heavily emphasizes AI as a key driver of economic diversification and technological advancement. This fosters significant government investment in AI research, development, and infrastructure, creating a strong market for AI data management solutions.

South Africa AI data management market held a significant share in the MEA region. Data security and privacy are major concerns in South Africa, with various regulations such as, the Protection of Personal Information Act (POPIA). AI data management solutions with features such as, access control, data encryption, and audit trails can help businesses comply with these regulations and ensure responsible data handling practices.

Key AI Data Management Company Insights

Key AI data management companies, including SAS Institute, Accenture plc, and Amazon Web Services, active in the AI data management market, are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development.

For instance, in February 2024, Carahsoft Technology Corp., the government IT solutions provider, partnered with SAS Institute, an AI data management platform provider, to distribute analytics, AI, and data management solutions of SAS Institute to the public sector. This collaboration enables Carahsoft Technology Corp to offer SAS Institute’s advanced solutions to U.S. Government agencies by utilizing its network of reseller partners and leveraging different contract vehicles and government schedules.

Key AI Data Management Companies:

The following are the leading companies in the AI data management market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture plc

- Amazon Web Services

- Databricks Inc.

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- SAS Institute

Recent Developments

-

In May 2024, International Business Machines Corporation collaborated with SAP SE, to enhance client productivity and innovation by offering cutting-edge generative AI capabilities and industry-tailored cloud solutions. The companies are working together to develop new generative AI features for RISE with SAP and integrate AI throughout SAP's business processes, encompassing both industry-specific cloud solutions and core business applications.

-

In February 2024, Wipro Limited, an AI solutions provider, extended its partnership with International Business Machines Corporation, to utilize the International Business Machines Corporation’s data platform, including watsonx.data, watsonx.ai, and watsonx.governance and AI assistants, to facilitate clients with a service for rapid adoption of AI, this new offering enhances operational efficiency through a comprehensive array of features that include large language models (LLMs), tools, efficient workflows, and strong governance measures. It also establishes a base for the development of future industry analytics solutions that will be built on watsonx.data and AI.

-

In November 2023, Informatica Inc., an enterprise cloud data management software provider, partnered with MongoDB, Inc., a software company, to empower clients to effectively develop cloud-native, data-centric applications that are custom-fit for various industries, utilizing MongoDB Atlas, with foundation of Informatica's AI-powered Master Data Management (MDM) solution.

AI Data Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 30.50 billion |

|

Revenue forecast in 2030 |

USD 104.32 billion |

|

Growth rate |

CAGR of 22.7% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Base Year |

2023 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, offering, data type, application, technology, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa |

|

Key companies profiled |

Accenture plc; Amazon Web Services; Databricks Inc.; Google LLC; International Business Machines Corporation; Microsoft Corporation; Oracle Corporation; Salesforce, Inc.; SAP SE; SAS Institute |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global AI Data Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global AI data management market report based on deployment, offering, data type, application, technology, vertical, and region:

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Offering Outlook (Revenue, USD Billion, 2017 - 2030)

-

Platform

-

Software Tools

-

Services

-

-

Data Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Audio

-

Speech & Voice

-

Image

-

Text

-

Video

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Data Augmentation

-

Data Anonymization & Compression

-

Exploratory Data Analysis

-

Imputation Predictive Modeling

-

Data validation & Noise Reduction

-

Process Automation

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Machine Learning

-

Natural Language Processing

-

Computer Vision

-

Context Awareness

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Retail & e-commerce

-

Government & Defense

-

Healthcare & Life Sciences

-

Manufacturing

-

Energy & Utilities

-

Media & Entertainment

-

IT & Telecommunications

-

Others

-

-

Regional Outlook (Revenue, USD Billion,2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI data management market size was estimated at USD 25.53 billion in 2023 and is expected to reach USD 30.50 billion in 2024.

b. The global AI data management market is expected to grow at a compound annual growth rate of 22.7% from 2024 to 2030 to reach USD 104.32 billion by 2030.

b. North America dominated the AI data management market with a share of 32.0% in 2023. North American businesses are constantly opting ways to streamline their business processes and automate tasks. AI data management tools can automate data collection, organization, and analysis, freeing up human resources to focus on more strategic tasks.

b. Some key players operating in the AI data management market include Accenture plc; Amazon Web Services; Databricks Inc.; Google LLC; International Business Machines Corporation; Microsoft Corporation; Oracle Corporation; Salesforce, Inc.; SAP SE; and SAS Institute.

b. Various factors, such as growth in Big Data and the Internet of Things (IoT), rapid advancements in AI and Machine Learning (ML), and increasing demand for data-driven decision-making, are primarily driving the growth of the AI data management market. Moreover, data privacy regulations such as GDPR and CCPA are driving the need for robust data management solutions that ensure data security, governance, and compliance.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."