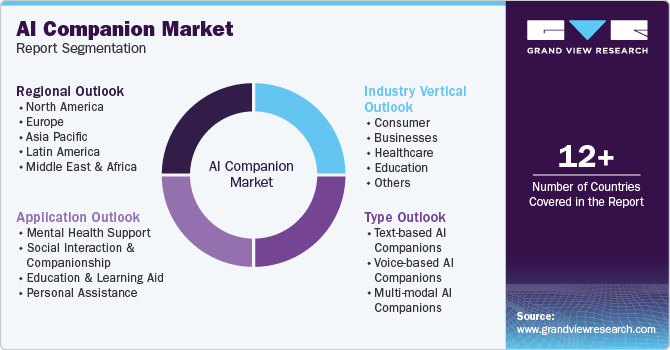

AI Companion Market Size, Share & Trends Analysis Report By Type (Text-based, Voice-based, Multi-modal), By Application (Mental Health Support, Education & Learning Aid), By Industry Vertical (Consumer, Businesses, Healthcare), And By Region Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-517-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

AI Companion Market Size & Trends

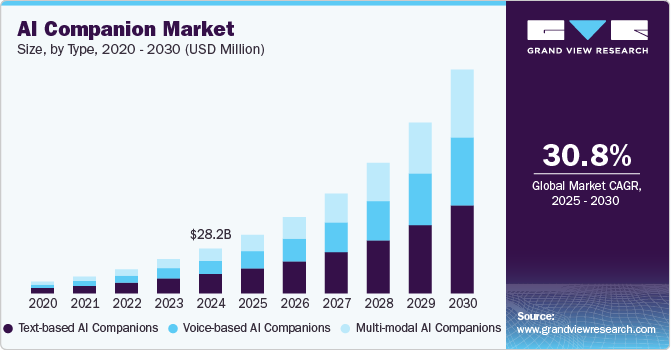

The global AI companion market size was estimated at USD 28.19 billion in 2024 and is expected to witness a CAGR of 30.8% from 2025 to 2030. There is a growing trend of integrating AI companions into workplace communication tools to boost productivity. These AI companions help users manage tasks, simplify communication, and quickly access important information. AI companions improve work efficiency by automating tasks and providing smart summaries. For instance, in January 2025, Zoom Communications, Inc., a U.S.-based video conferencing and collaboration platform, launched a redesigned Team Chat sidebar with enhanced organization features, including customizable tabs, advanced sorting, and AI Companion integration to improve productivity. The AI Companion summarizes conversations, identifies action items, and streamlines communication for eligible paid users at no extra cost.

AI companions designed for mental health and emotional well-being are driving a substantial portion of the market growth. Replika, developed by Luka, Inc., and Woebot, developed by Woebot Health, offer virtual companionship and therapeutic support, helping users manage stress, anxiety, and loneliness. The global rise in mental health awareness has fueled the demand for accessible, affordable, and non-judgmental support systems, which AI companions effectively provide. As more people seek virtual assistance for emotional support, especially during the pandemic, the need for AI companions offering tailored guidance has increased. This sector’s growth has opened up new opportunities for AI companies to innovate and offer solutions aimed at improving mental health.

AI companions are also making a significant impact on the business and customer service industries by automating processes and enhancing customer experiences. Virtual assistants, such as IBM Watson Assistant, is increasingly used for customer support, managing inquiries, and handling routine tasks efficiently. Businesses are adopting AI companions to reduce operational costs, provide 24/7 service, and improve overall customer engagement. With the rise of e-commerce and the demand for quick, personalized customer service, AI companions are becoming a cornerstone in enhancing the user experience. As AI technology becomes more sophisticated, its applications in business and customer support are expected to expand rapidly.

AI companions are increasingly being integrated with Internet of Things (IoT) devices, allowing them to control and manage smart home systems, fitness trackers, and other connected devices. This integration creates a seamless experience where users can interact with their AI companion to adjust home settings, monitor health metrics, and receive personalized recommendations. As AI companions become more connected with various devices, they can respond more intelligently to user needs and preferences. This trend leads to a more cohesive, efficient, and convenient experience across a range of technologies, making everyday tasks easier to manage.

Type Insights

In terms of Type, the text-based AI companions segment dominates the AI Companion market is anticipated to hold 43.4% in 2024. Advances in NLP enable these AI companions to understand and respond to user queries with greater accuracy, making text-based interactions smoother and more intuitive. Text-based AI companions are becoming essential for businesses and individuals aiming to improve efficiency by managing tasks and providing summaries. They also help by answering questions and streamlining workflows. For instance, in October 2024, Zoom Communications, Inc., launched AI Companion 2.0, an advanced text-based AI assistant integrated into Zoom Workplace, designed to enhance productivity by surfacing important information, synthesizing text content, and taking action across Zoom Meetings, Docs, and more.

The multi-modal AI companions segment is expected to experience a significant CAGR over the forecast period. Multi-modal AI companions are driving market growth by offering enhanced user experiences through multiple interaction modes, such as text, voice, and visuals. Their ability to understand and synthesize data from different input types allows them to provide more contextually aware and comprehensive responses. These companions are being adopted across various industries, including healthcare, retail, and customer service, broadening their market reach. Their capacity to personalize interactions based on user inputs increases engagement and satisfaction, making them more effective.

Application Insights

The social interaction and companionship segment is projected to dominate the market revenue share due to the growing demand for AI companions that provide emotional support and companionship. As loneliness and mental health concerns rise, AI companions offer personalized and empathetic interactions, making them increasingly valuable to users. This demand is further fueled by advancements in AI, allowing companions to understand context, recall past conversations, and offer meaningful emotional connections. For instance, Nomi AI, developed by Nomi Technologies, is a company focused on creating advanced AI companions with emotional intelligence and memory capabilities to enhance user experiences in companionship, mentorship, and support.

The mental health support segment is expected to experience a significant CAGR over the forecast period, as more people seek accessible, immediate help for managing stress, anxiety, and other mental health challenges. AI-powered tools, such as chatbots and virtual companions, provide a safe space for individuals to express emotions, offering real-time support and coping strategies. These tools are increasingly integrated into mental health apps and platforms, giving users personalized, ongoing assistance outside traditional therapy hours. With advancements in natural language processing and emotional intelligence, AI companions are becoming more empathetic and capable of understanding user needs. This growth is driven by the increasing demand for accessible mental health resources and the desire for privacy and convenience in managing mental well-being.

Industry Vertical Insights

The consumer segment accounted for the largest market revenue share in 2024. The rise of hybrid and remote work environments demands AI companions that can seamlessly manage interactions across both digital and physical spaces. These companions enhance flexibility and efficiency by streamlining communication and task management in diverse work settings. As businesses seek efficiency, AI companions are becoming more integrated into existing workflows, pulling data from emails, meetings, and documents to deliver personalized support. For instance, in March 2024, Zoom Communications, Inc., launched the AI-powered Zoom Workplace platform, integrating an AI assistant to enhance collaboration and productivity by gathering, synthesizing, and sharing information from meetings, documents, and team chats.

The businesses segment is expected to experience a significant CAGR over the forecast period. The rise of hybrid and remote work environments demands AI companions that can seamlessly manage interactions across both digital and physical spaces. These companions enhance flexibility and efficiency by streamlining communication and task management in diverse work settings. As businesses seek efficiency, AI companions are becoming more integrated into existing workflows, pulling data from emails, meetings, and documents to deliver personalized support. For instance, in March 2024, Zoom Communications, Inc., launched the AI-powered Zoom Workplace platform, integrating an AI assistant to enhance collaboration and productivity by gathering, synthesizing, and sharing information from meetings, documents, and team chats.

Regional Insights

North America leads the global AI Companion market accounting for leading share of 34.0% in 2024. The AI companion market in North America is rapidly growing, driven by increasing demand for automation and productivity tools across various industries. Companies in the region are utilizing AI companions to enhance employee collaboration and improve customer service. This demand is fueled by advancements in AI technology and a robust tech ecosystem. The market is expected to continue expanding as businesses invest in digital transformation and hybrid work solutions.

U.S. AI Companion Market Trends

The U.S. is at the forefront of AI companion development, with major tech companies pioneering innovative AI-driven products for both consumer and enterprise use. The market benefits from substantial investments in AI research and development, supported by a strong startup ecosystem. There is a rising adoption of AI companions in sectors such as healthcare, education, and finance, aiming to improve efficiency and reduce costs.

Europe AI Companion Market Trends

In Europe, the AI companion market is experiencing steady growth, driven by regulatory compliance needs and increasing focus on digital transformation. Countries with strong tech hubs, such as the UK, Germany, and France, are adopting AI companions to enhance business operations and improve customer support services. Privacy concerns and the implementation of GDPR regulations also play a significant role in shaping AI companion development in the region.

Asia Pacific AI Companion Market Trends

The AI companion market in the Asia Pacific region is expanding rapidly, fueled by high tech adoption rates and a strong demand for automation in business processes. Countries such as China, Japan, and South Korea are leading the way, with AI companions being integrated into industries such as retail, finance, and healthcare. The region’s fast-paced digital transformation and growing e-commerce sectors are key drivers of the market. As AI technology becomes more accessible, businesses are increasingly adopting AI companions for customer service, sales, and operational efficiency.

Key AI Companion Company Insights

Some of the key companies in the AI Companion market include Google LLC, Amazon.com, Inc., International Business Machines Corporation and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Amazon.com, Inc. has been developing AI companions primarily through its Alexa technology. Alexa has evolved beyond voice control to include conversational features that allow users to interact more naturally with devices. It integrates with various smart home devices, offering a more personalized user experience. Amazon continues to enhance its AI's conversational capabilities and emotional intelligence to improve engagement and user satisfaction.

-

Google LLC has developed several AI tools, including Google Assistant, which serves as a virtual AI companion for managing tasks and providing information. Google’s AI companions are integrated into multiple devices, from smartphones to smart speakers, making them accessible across various platforms. The company focuses on improving natural language processing and context understanding for more efficient interactions.

-

Top of Form

-

Bottom of Form

Key AI Companion Companies:

The following are the leading companies in the AI companion market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc.

- Character.AI, Inc.

- Google LLC

- International Business Machines Corporation

- KNIME

- Nomi AI, Inc.

- OpenAI, LP

- Luka, Inc.

- Soul Machines

- Zoom Video Communications, Inc.

Recent Developments

-

In December 2024, KNIME, a developer of open-source enterprise software in Switzerland, launched its AI companion, K-AI, to help users co-create data workflows, providing answers, recommendations, and workflow enhancements based on user prompts. K-AI speeds up data work, offers transparency with visual workflows, and assists in building, extending, and improving workflows.

-

In November 2024, Google LLC launched an experimental AI learning companion called Learn About, designed to assist with educational research by providing interactive, visually rich content, quizzes, and additional contextual information. It sources data from trusted academic platforms and aims to offer a more comprehensive, personalized learning experience.

-

In August 2024, Amazon launched Rufus, an AI-powered shopping companion designed to improve the online shopping experience by helping users ask questions, compare products, and discover new items easily. Rufus offers personalized recommendations, product comparisons, and up-to-date suggestions based on user's preferences, making shopping more efficient and informed.

AI Companion Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 36,785.2 million |

|

Revenue forecast in 2030 |

USD 1,40,754.2 million |

|

Growth rate |

CAGR of 30.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segment scope |

Type, application, industry vertical, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Amazon.com, Inc.; Character.AI, Inc.; Google LLC; International Business Machines Corporation; KNIME; Nomi AI, Inc.; OpenAI, LP; Luka, Inc.; Soul Machines; Zoom Video Communications, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global AI Companion Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global AI Companion market in terms of type, application, industry vertical and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Text-based AI Companions

-

Voice-based AI Companions

-

Multi-modal AI Companions

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Mental Health Support

-

Social Interaction and Companionship

-

Education and Learning Aid

-

Personal Assistance

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer

-

Businesses

-

Healthcare

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI Companion market size was estimated at USD 28.19 billion in 2024 and is expected to reach USD 36,785.2 million in 2025.

b. The global AI Companion market is expected to grow at a compound annual growth rate of 33.8% from 2025 to 2030 to reach USD 1,40,754.2 million by 2030.

b. North America dominated the AI Companion market with a share of 34.0% in 2024. This is attributable to advanced technological infrastructure, high adoption rates, and significant investments in AI research and development.

b. Some key players operating in the AI Companion market include Amazon.com, Inc., Character.AI, Inc., Google LLC, International Business Machines Corporation, KNIME, Nomi AI, Inc., OpenAI, LP, Luka, Inc., Soul Machines, Zoom Video Communications, Inc.

b. Key factors that are driving the market growth include increasing demand for automation and artificial intelligence, rising consumer preferences for personalized experiences, and the expanding adoption of digital solutions across various industries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."