AI Code Tools Market Size, Share & Trends Analysis Report By Offering (Tools, Services), By Deployment (On-premises, Cloud), By Technology, By Application, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-381-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

AI Code Tools Market Size & Trends

The global AI code tools market size was estimated at USD 4.86 billion in 2023 and is projected to grow at a CAGR of 27.1% from 2024 to 2030. The increasing complexity of software applications is fueling the growth of the artificial intelligence (AI) code tools industry. As software becomes more sophisticated, traditional coding methods fall short. AI code tools, with their advanced algorithms, help developers manage complex tasks, improve accuracy, and speed up the development process. Their capability to handle intricate coding requirements makes them indispensable, driving businesses and developers to adopt these tools and pushing the market forward.

Moreover, the growing investment in AI code tool startups is fueling significant advancements in the industry. These funds enable startups to innovate, create cutting-edge technologies, and improve existing tools.

During the COVID-19 pandemic, the AI code tools market witnessed rapid growth. The widespread move to remote work emphasized the need for efficient software development solutions. Companies pursuing digital transformation adopted AI code tools to boost productivity and streamline their development processes. As demand for digital solutions surged, enterprises invested in these tools to quickly respond to evolving market requirements. This increased adoption highlighted the resilience and adaptability of the AI code tools industry during these challenging times.

The increasing demand for enhanced productivity is driving significant growth in the AI code tools industry. Developers and businesses are looking for efficient solutions to facilitate software development processes. For example, in August 2023, Meta introduced Code Llama, a new AI tool designed to debug human-written work and generate new code. This Large Language Model (LLM) can discuss and create code based on text prompts. Code Llama shows potential as both a productivity and educational tool, helping programmers develop robust and well-documented software. As the need for faster, more reliable software development continues to grow, the market for AI code tools expands, offering innovative solutions that meet the evolving needs of industries and developers.

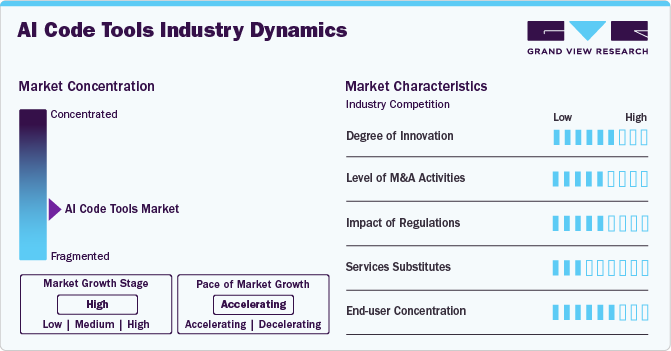

Industry Dynamics

The industry landscape of the market for AI code tools is characterized by rapid growth, innovation, and diverse applications across various sectors worldwide. Key players in this market include established tech giants, innovative startups, and specialized AI software providers, each contributing to a competitive ecosystem. Major tech companies like Google, Microsoft, and IBM lead with comprehensive AI platforms offering a wide range of tools for developers, from machine learning frameworks to natural language processing APIs.

Startups and niche players contribute to the market with specialized AI code tools that address specific industry needs, such as healthcare diagnostics, financial forecasting, or autonomous driving systems. The market also sees significant contributions from open-source communities, which foster collaboration and accelerate innovation in AI development tools.

Government initiatives and regulatory frameworks play a crucial role in shaping the industry landscape by influencing investment priorities, data governance standards, and ethical considerations. Countries such as the U.S., China, and European nations are at the forefront of AI research and development, driving policy agendas that support AI innovation while addressing societal implications.

Substitutes include emerging technologies such as quantum computing for complex AI tasks, blockchain for decentralized AI applications, and neuromorphic computing for mimicking human brain functions. In addition, open-source AI libraries and platforms offer cost-effective alternatives to proprietary AI code tools, fostering community-driven innovation and customization. Furthermore, advancements in low-code and no-code platforms enable non-experts to develop AI applications without extensive programming skills, potentially reshaping accessibility and usability in the AI development landscape.

In the AI code tools industry, the end user landscape spans a wide range of industries and applications. Major sectors include healthcare for diagnostics and personalized treatment, finance for algorithmic trading and risk assessment, retail for customer analytics and supply chain optimization, and automotive for autonomous driving systems and predictive maintenance. Each industry leverages AI code tools to enhance operational efficiency, improve decision-making processes, and innovate customer experiences.

Offering Insights

The tools segment led the market in 2023, accounting for over 76.0% share of the global revenue. The growing complexity of software projects and the need for rapid deployment of high-quality applications have driven developers to adopt AI-powered tools. These tools offer enhanced capabilities such as intelligent code completion, bug detection, and automated testing, which significantly reduce development time and improve code quality. Furthermore, the integration of machine learning algorithms allows these tools to learn from vast datasets, continuously improving their performance and providing developers with more accurate and context-aware suggestions.

The services segment is predicted to foresee significant growth in the coming years, owing to the increasing reliance on expert support and tailored solutions to maximize the potential of AI technologies. Organizations across various industries recognized the need for specialized services to implement, manage, and optimize AI code tools effectively. This demand was driven by the complexity of AI systems and the necessity for bespoke integration with existing workflows and infrastructure. Service providers offered a range of solutions, including consulting, custom development, training, and ongoing support, which helped businesses overcome the challenges associated with AI adoption.

Deployment Insights

The cloud segment accounted for the largest revenue share in 2023, primarily due to its scalability, accessibility, and cost-efficiency advantages for AI development and deployment. Cloud computing offers a robust infrastructure that allows developers and organizations to harness powerful AI tools without the need for extensive on-premises hardware investments. This flexibility enables businesses of all sizes to access sophisticated AI capabilities that were previously reserved for large enterprises with substantial IT resources. Furthermore, the cloud's ability to support large-scale data processing and storage was pivotal in handling the vast amounts of data required for training AI models. AI code tools hosted on the cloud could leverage distributed computing resources, accelerating model training times and improving overall performance.

The on-premises segment is predicted to witness significant growth in the coming years. Many enterprises, particularly those in regulated industries such as finance and healthcare, opt for on-premises AI solutions to maintain direct control over their data and ensure compliance with stringent security and privacy regulations. By hosting AI code tools locally, organizations mitigate concerns about data sovereignty and maintain confidentiality, which are critical considerations in industries where data sensitivity and regulatory scrutiny are high.

Technology Insights

The machine learning segment accounted for the largest revenue share in 2023. Machine learning algorithms power AI code tools with the ability to learn from data, improving accuracy and performance over time. This capability is particularly attractive to developers and organizations looking to automate complex tasks, optimize processes, and derive actionable insights from large datasets. Machine learning-based tools offer functionalities like automated model training, hyperparameter optimization, and anomaly detection, which significantly enhance productivity and decision-making across various industries.

The generative AI segment is anticipated to witness significant CAGR in the coming years, owing to its transformative capabilities in creating content, designs, and solutions that mimic human creativity and intelligence. Generative AI tools, such as language models and image generators, revolutionized industries by automating tasks that traditionally required human input, such as writing articles, generating artwork, or designing user interfaces. This automation not only accelerated production but also freed up human resources for more strategic and innovative endeavors.

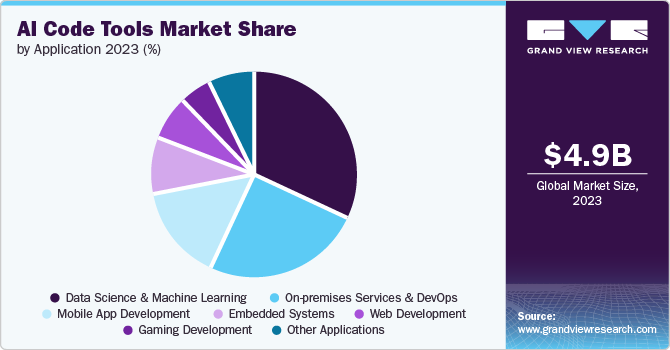

Application Insights

The data science & machine learning segment accounted for the largest market revenue share in 2023, owing to its comprehensive suite of tools and methodologies that enable organizations to extract valuable insights from data. These tools encompass data preprocessing, statistical analysis, machine learning model development, and deployment. They facilitate the creation of predictive models, classification algorithms, and deep learning architectures, empowering businesses to optimize operations, enhance decision-making, and innovate product development.

The on-premises services & DevOps segment is anticipated to exhibit the fastest CAGR over the forecast period, owing to its focus on providing customizable and integrated solutions that cater to stringent regulatory requirements and specialized operational needs. Organizations, particularly in highly regulated sectors such as finance and healthcare, favor on-premises solutions for maintaining data sovereignty, ensuring compliance, and managing sensitive information securely within their infrastructure. In addition, the segment's emphasis on DevOps practices facilitates seamless integration and automation across the AI development lifecycle, enhancing agility, collaboration, and the rapid deployment of AI applications.

Vertical Insights

The BFSI segment accounted for the largest market revenue share in 2023 due to its acute focus on leveraging AI-driven solutions to enhance customer experiences, optimize operational efficiencies, and mitigate risks. In banking, AI-power tools enable personalized customer interactions through chatbots and recommendation engines, improving satisfaction and retention. Financial services utilize AI for fraud detection, risk assessment, and algorithmic trading, thereby bolstering security and maximizing returns.

The healthcare & life sciences segment is anticipated to exhibit the fastest CAGR over the forecast period. AI-powered tools in healthcare enable advanced image analysis for diagnostics, precision medicine through genomic analysis, and predictive analytics for patient outcomes. These tools not only enhance diagnostic accuracy and treatment planning but also optimize hospital workflows, reducing administrative burdens and healthcare costs. In addition, AI facilitates the development of personalized treatment plans and remote patient monitoring systems, improving accessibility to healthcare services and patient outcomes.

Regional Insights

North America AI code tools market dominated globally with a revenue share of over 38.0% in 2023, primarily due to its robust infrastructure, extensive investments in AI research and development, and a strong ecosystem of technology companies and startups. The region's leading position is bolstered by its concentration of major tech hubs such as Silicon Valley, Seattle, and Boston, which foster innovation and entrepreneurship in AI technologies. In addition, supportive government policies, favorable regulatory environments, and a skilled workforce proficient in AI and data science further propelled North America's dominance in shaping the global AI code tools market landscape.

U.S. AI Code Tools Market Trends

The U.S. AI code tools market is expected to grow at a CAGR of 21.2% from 2024 to 2030. The country maintains a competitive edge with significant investments in AI R&D by leading tech giants, academic institutions, and government agencies. This ecosystem fosters continuous advancements in AI algorithms, infrastructure, and applications, driving adoption across diverse sectors, including healthcare, finance, and entertainment.

The AI code tools market in Canada held a significant share in the North American region, owing to its strategic investments in AI R&D, supportive government policies, and a burgeoning ecosystem of tech innovation. Furthermore, Canada's diverse talent pool, with a strong emphasis on STEM education and immigration policies that attract global talent, has contributed to its competitive advantage in developing and deploying sophisticated AI code tools.

Europe AI Code Tools Market Trends

The AI code tools market in Europe is expected to witness significant growth over the forecast period. The region benefits from robust public and private investments in AI R&D, supported by initiatives such as the European Union's AI strategy and funding programs. Moreover, Europe's diverse industrial base across sectors like automotive, healthcare, and finance provided ample opportunities for integrating AI code tools to enhance operational efficiencies and develop innovative solutions.

The UK AI code tools market held a significant share in the European region. Supportive government policies and initiatives promote AI adoption, while the country's strong academic institutions and collaborations with industry further propelled its leadership in advancing AI code tools.

The AI code tools market in Germany is expected to grow at the fastest CAGR from 2024 to 2030, owing to its renowned engineering prowess, strong industrial base, and strategic investments in AI technologies. The country's emphasis on precision engineering and automation translates seamlessly into AI code tool development, particularly benefiting sectors such as automotive manufacturing, healthcare, and logistics.

Asia Pacific AI Code Tools Market Trends

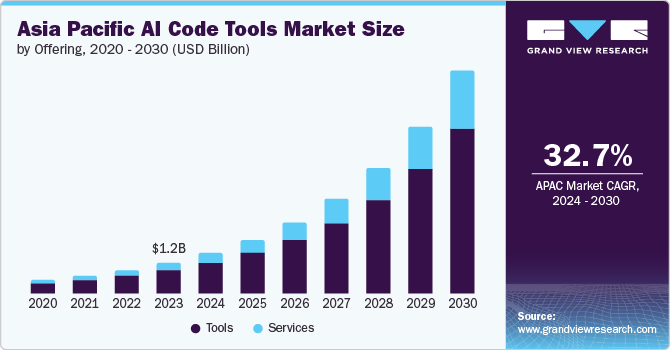

The AI code tools market in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period, owing to its rapid digital transformation, large population of tech-savvy consumers, and burgeoning startup ecosystem. Countries like China, India, and South Korea led the region with substantial investments in AI infrastructure and talent development. Additionally, the region's proactive adoption of AI across sectors such as e-commerce, healthcare, and telecommunications fueled demand for advanced AI code tools.

The India AI code tools market held a significant share in the Asia Pacific region. The country's vibrant startup ecosystem and government initiatives, such as the National AI Strategy, have fueled significant investments in AI R&D.

The AI code tools market in China held a significant share in the Asia Pacific region. The country's government-led initiatives, such as the New Generation Artificial Intelligence Development Plan, have propelled China to the forefront of AI innovation.

Japan AI code tools market held a significant share in the Asia Pacific region. The Japanese government has been actively promoting AI development through initiatives such as the "Society 5.0" vision, which aims to leverage AI and other technologies to address societal challenges.

Middle East & Africa (MEA) AI Code Tools Market Trends

The MEA region is anticipated to thrive over the forecast period. The region is undergoing swift digital transformation, marked by heightened investments by governments and businesses in AI technologies to foster innovation and enhance competitiveness. Moreover, the region benefits from a youthful, technology-savvy population, which offers substantial potential for integrating AI-powered solutions across diverse sectors such as healthcare, finance, energy, and transportation.

The KSA AI code tools market held a significant share in the MEA region. The KSA government's Vision 2030 initiative, aimed at diversifying the economy and fostering innovation, includes significant investments in AI technologies and digital transformation across various sectors. Moreover, partnerships between the public and private sectors, as well as collaborations with global technology firms, are facilitating the development and deployment of AI solutions tailored to the region's specific needs.

Key AI Code Tools Company Insights

Key AI code tools companies include Microsoft, International Business Machines Corporation, Google LLC, and Amazon Web Services, Inc. Companies active in the AI code tools industry are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in March 2024, Cognition, a technology company, launched Devin, the first AI software engineer globally capable of coding and developing websites and software in response to a single prompt, intended to collaborate with human engineers.

Key AI Code Tools Companies:

The following are the leading companies in the AI code tools market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- International Business Machines Corporation

- Google LLC

- Amazon Web Services, Inc.

- Salesforce, Inc.

- Meta

- OpenAI

- Replit, Inc.

- Sourcegraph, Inc.

- AdaCore

Recent Developments

-

In April 2024, Oracle developed an AI-driven coding tool aimed at enhancing software development speed and ensuring code uniformity. Named Oracle Code Assist, this tool is specifically optimized for Java, SQL, and application development on Oracle Cloud Infrastructure. It allows businesses to customize the assistant to align with internal code bases, libraries, and policies, thereby promoting best practices.

-

In February 2024, GitHub, Inc. unveiled its premium version of a coding assistant under Copilot Enterprise, priced higher than its standard offerings. This tool incorporates a feature enabling it to provide answers based on a company’s proprietary code, facilitating accelerated learning and faster coding for novice developers. Copilot Enterprise is priced at USD 39 per user per month and includes AI chat capabilities to assist engineers in resolving issues promptly.

-

In February 2024, Apple Inc. is reportedly gearing up to release a new software development tool utilizing generative artificial intelligence to automate coding tasks. This AI-powered tool aims to simplify coding by automatically generating code blocks, drawing parallels to Microsoft’s GitHub Copilot.

AI Code Tools Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.11 billion |

|

Revenue forecast in 2030 |

USD 26.03 billion |

|

Growth Rate |

CAGR of 27.1% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, deployment, technology, application, vertical, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Australia, South Korea, Brazil, UAE, South Africa, KSA |

|

Key companies profiled

|

Microsoft, International Business Machines Corporation, Google LLC, Amazon Web Services, Inc., Salesforce, Inc., Meta, OpenAI, Replit, Inc., Sourcegraph, Inc., AdaCore |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global AI Code Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global AI code tools market report based on offering, deployment, technology, application, vertical, and region.

-

Offering Outlook (Revenue, USD Billion, 2017 - 2030)

-

Tools

-

Code Generation Tools

-

Code Review & Analysis Tools

-

Bug Detection Tools

-

Code Optimization Tools

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Machine Learning

-

Natural Language Processing

-

Generative AI

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Data Science & Machine Learning

-

On-premises Services & DevOps

-

Web Development

-

Mobile App Development

-

Gaming Development

-

Embedded Systems

-

Other Applications

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Banking, Financial, and Insurance (BFSI)

-

Healthcare and Life Sciences

-

Retail

-

IT & Telecommunication

-

Government and Defense

-

Manufacturing

-

Energy & Utility

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global AI code tools market size was estimated at USD 4.86 billion in 2023 and is expected to reach USD 6.11 billion in 2024.

b. The global AI code tools market is expected to grow at a compound annual growth rate of 27.1% from 2024 to 2030 to reach USD 26.03 billion by 2030.

b. North America dominated the AI code tools market with a share of 39.5% in 2023, primarily due to its robust infrastructure, extensive investments in AI research and development, and a strong ecosystem of technology companies and startups.

b. Some key players operating in the AI code tools market include Microsoft, International Business Machines Corporation, Google LLC, Amazon Web Services, Inc., Salesforce, Inc., Meta, OpenAI, Replit, Inc., Sourcegraph, Inc., AdaCore.

b. Key factors that are driving the AI code tools market growth include continuous advancements in AI algorithms, machine learning models, and computing infrastructure, and increasing demand across industries for automation of repetitive tasks, enhanced productivity, and operational efficiency.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."