- Home

- »

- Next Generation Technologies

- »

-

AI In Chemicals Market Size, Share & Trends Report, 2030GVR Report cover

![AI In Chemicals Market Size, Share & Trends Report]()

AI In Chemicals Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Hardware, Software, Services), By Application (Production Optimization, New Material Innovation), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-444-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Chemicals Market Summary

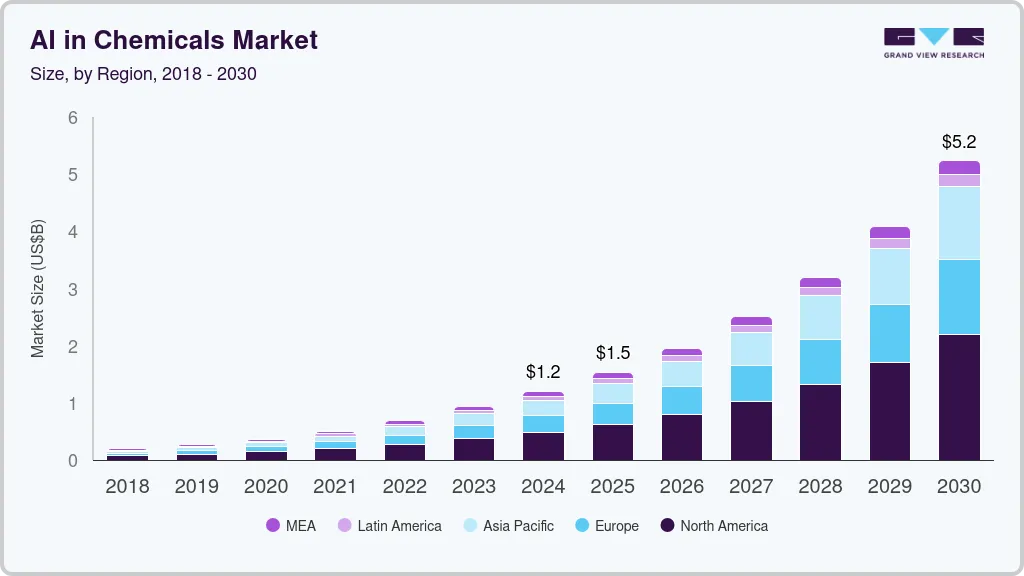

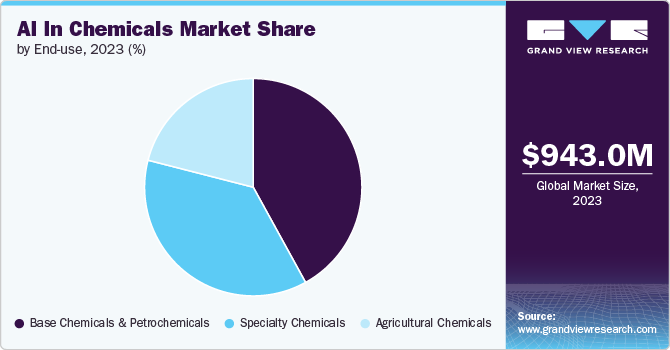

The global ai in chemicals market size was estimated at USD 943.0 million in 2023 and is projected to reach USD 5,235.6 million by 2030, growing at a CAGR of 27.8% from 2024 to 2030. The market is experiencing significant growth as the industry increasingly adopts advanced technologies to enhance efficiency and innovation.

Key Market Trends & Insights

- North America dominated the market and accounted for 39.6% share in 2023.

- In the U.S., AI adoption in the chemicals market is led by a focus on digital transformation and operational efficiency.

- By type, the software segment led the market and accounted for 48.0% of the global revenue in 2023.

- By application, the new material innovation segment is predicted to foresee significant growth over the forecast period.

- By end-use, the base chemicals & petrochemicals segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 943.0 Million

- 2030 Projected Market Size: USD 5,235.6 Million

- CAGR (2024-2030): 27.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

One major driver is the demand for optimization across chemical production processes. AI algorithms are being integrated to streamline operations, reduce waste, and improve energy efficiency. This shift is particularly evident in base chemicals and petrochemicals, where AI enhances production accuracy and cost-effectiveness. The ability of AI to analyze large datasets and predict outcomes is transforming traditional chemical manufacturing into a more agile and responsive process. As companies face rising environmental regulations, AI helps in achieving sustainability goals by optimizing resource use and minimizing emissions. The focus on AI-driven production optimization underscores a broader trend of technological adoption aimed at maintaining competitiveness and operational excellence.

Researchers and chemical companies are utilizing AI to accelerate the development of novel materials with desirable properties. Machine learning models can analyze complex data from experiments and simulations, significantly speeding up the research and development phase. This capability is particularly valuable in specialty chemicals, where customized solutions are in high demand. AI-driven discovery tools are not only reducing the time required to bring new materials to market but also improving the accuracy of material performance predictions. The focus on developing new materials is increasing investment in AI technologies. Companies are using data and computing power to gain a competitive edge. As the chemical industry adapts to changing market needs, artificial intelligence (AI) is becoming essential for creating innovative materials.

The application of AI in pricing and market strategies is another area of notable growth. AI tools are being used to develop dynamic pricing models that respond to real-time market conditions, demand fluctuations, and competitive pressures. This approach enables chemical companies to optimize their pricing strategies, enhancing profitability and market positioning. Moreover, AI contributes to more accurate demand forecasting for raw materials, which is crucial for maintaining supply chain efficiency. The ability to predict market trends and adjust pricing accordingly provides a significant competitive edge. As companies strive to navigate complex and volatile markets, AI’s capabilities in pricing optimization and demand forecasting are proving to be indispensable. This trend shows a wider move towards using data for decision-making in the chemical industry. It highlights the need for agility and accuracy as the global market rapidly changes.

Type Insights

The software segment led the market and accounted for 48.0% of the global revenue in 2023. The software segment leads the AI in the chemical market due to its central role in implementing and utilizing AI technologies. Advanced software solutions, including machine learning algorithms and predictive analytics tools, are essential for data analysis and process optimization. These software applications enable precise control over chemical processes and enhance decision-making capabilities. The continuous development of sophisticated AI platforms drives their adoption, making them indispensable for achieving operational efficiency and innovation. Additionally, software solutions are scalable and adaptable, making them a preferred choice for various chemical industry applications.

The services segment is projected to grow significantly over the forecast period. The services segment is expanding in the AI-driven chemical market as companies increasingly seek expert support for AI integration and optimization. Services such as consulting, system integration, and ongoing maintenance are crucial for the successful deployment of AI technologies. Many chemical companies require tailored solutions and expert guidance to effectively implement AI strategies and ensure they align with their specific needs. The complexity of AI systems and the need for continual updates and support drive demand for specialized services. As AI technologies evolve, the need for professional services to manage and maximize their benefits continues to grow.

Application Insights

Production optimization dominates in the market because it directly impacts efficiency and cost-effectiveness. AI-driven tools improve process control, reduce waste, and enhance energy usage, making production more efficient. These benefits are critical for large-scale chemical manufacturing, where even minor improvements can lead to significant cost savings. The focus on optimization aligns with the industry's push toward maximizing output while minimizing resource consumption. Consequently, production optimization has become a key application area for AI, driving its dominance in the market.

The new material innovation segment is predicted to foresee significant growth over the forecast period. New material innovation is growing in the AI-driven chemical market due to increasing demand for advanced and customized materials. AI accelerates the discovery and development of new materials by analyzing complex data and predicting performance outcomes. This capability is crucial for industries seeking novel materials with enhanced properties or specific functions. As technology advances and market needs evolve, companies are investing in AI to stay competitive by quickly developing innovative materials. The growing focus on material innovation reflects a broader trend of utilizing AI to drive technological progress and meet emerging market demands.

End-use Insights

The base chemicals & petrochemicals segment accounted for the largest revenue share in 2023 due to the scale and complexity of its production processes. AI technologies are used to optimize large-scale manufacturing operations, improve process efficiency, and reduce costs in these sectors. The high volume and significant economic impact of base chemicals and petrochemicals make AI investments particularly valuable for enhancing productivity. Moreover, AI helps in managing supply chains and reducing environmental impact, which are critical concerns for these industries. The widespread adoption of AI in these areas underscores its importance in maintaining competitiveness and operational excellence.

The specialty chemicals segment is projected to grow significantly over the forecast period due to the increasing demand for advanced materials and formulations customized for AI and electronics. These specialty chemicals are crucial in developing high-performance substrates, coatings, and adhesives used in semiconductor manufacturing and AI hardware. The rise of sophisticated AI technologies requires the use of specialized chemicals that enhance the performance and durability of electronic components. Companies are investing in research and development to create innovative chemical solutions that meet the evolving needs of AI applications. As AI technology continues to advance, the demand for specialty chemicals to support these innovations is expected to grow substantially.

Regional Insights

North America dominated the market and accounted for 39.6% share in 2023.In North America, AI in the chemicals market is driven by significant investments in technological advancements and innovation. The region benefits from a strong presence of leading chemical companies and tech giants investing in AI research and development. North American firms are utilizing AI to optimize complex manufacturing processes and improve supply chain efficiencies. The region also emphasizes sustainability, using AI to enhance environmental compliance and reduce waste.

U.S. AI In Chemicals Market Trends

In the U.S., AI adoption in the chemicals market is led by a focus on digital transformation and operational efficiency. American chemical companies are using AI for predictive maintenance, advanced analytics, and automation to stay competitive. The U.S. also sees substantial investment in AI-driven innovation for new material development, driven by its strong R&D capabilities and funding availability. Regulatory frameworks in the U.S. support the integration of AI for safety and environmental compliance.

Europe AI In Chemicals Market Trends

Europe is witnessing growth in AI applications in the chemical market due to its emphasis on sustainability and green chemistry. European companies are using AI to optimize resource use and reduce emissions, aligning with stringent environmental regulations. The region’s strong focus on collaborative research fosters AI innovations in chemical processes and product development. European governments and institutions are also providing funding and incentives for AI-driven projects.

Asia Pacific AI In Chemicals Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. In the Asia Pacific region, AI adoption in the chemicals market is expanding rapidly due to robust industrial growth and increasing investments in technology. Countries such as China and India are utilizing AI to scale up production capabilities and enhance manufacturing efficiency. The region is also focusing on AI to improve supply chain management and product quality in response to growing domestic and international demand. Moreover, Asia Pacific countries are exploring AI for new material development to support their burgeoning technology sectors. Government initiatives and private investments are driving AI integration in the region’s chemical industry.

Key AI In Chemicals Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, In April 2024, NVIDIA Corporation, a U.S.-based software company, extended its partnership with SandboxAQ to advance chemistry simulations using quantum and AI technologies. This partnership has resulted in the development of highly accurate AI simulations utilizing Nvidia’s H100 GPUs and quantum technology to enhance computational chemistry capabilities significantly.

Key AI In Chemicals Companies:

The following are the leading companies in the AI in chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- BASF

- Google LLC

- Honeywell International Inc.

- IBM Corporation

- Insilico Medicine

- Microsoft

- NVIDIA Corporation

- Siemens

- SLB

Recent Developments

-

In June 2024, Microsoft introduced two new features, Accelerated DFT and Generative Chemistry, to its Azure Quantum Elements platform to enhance research productivity in chemistry and materials science. These updates utilize AI and quantum computing to accelerate the discovery and analysis of molecular compounds, significantly reducing the time needed for complex simulations and advancing scientific research.

-

In May 2024,Menten AI, Inc., a U.S.-based drug discovery company, announced the completion of a research collaboration and licensing agreement with Bristol Myers Squibb, utilizing Menten AI's generative AI platform to optimize peptide macrocycles. This collaboration highlights the platform's ability to accelerate drug discovery by efficiently exploring chemical space and optimizing biochemical properties.

-

In April 2024, Insilico Medicine, a Hong Kong-based biotechnology company, launched a Generative AI for Sustainability initiative. The company uses its AI platform to develop sustainable chemicals, fuels, and materials while also advancing AI-driven drug discovery.

-

In November 2023, Google DeepMind researchers created the AI tool Graph Networks for Materials Exploration, leading to the identification of 2.2 million stable inorganic structures, greatly enhancing the Materials Project database. This AI was also integrated with an automated chemistry platform to test and synthesize new materials to accelerate the discovery of novel compounds, such as recyclable plastics and transparent conductors.

AI In Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1202.3 million

Revenue forecast in 2030

USD 5,235.6 million

Growth rate

CAGR of 27.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Accenture; BASF; Google LLC; Honeywell International Inc.; IBM Corporation; Insilico Medicine; Microsoft; NVIDIA Corporation; Siemens; SLB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global AI in chemicals market report based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Optimization

-

New Material Innovation

-

Operational Process Management

-

Pricing Optimization

-

Raw Material Demand Forecasting

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Base Chemicals & Petrochemicals

-

Agricultural Chemicals

-

Specialty Chemicals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI in chemicals market size was estimated at USD 943.0 million in 2023 and is expected to reach USD 1.20 billion in 2024.

b. The global AI in chemicals market is expected to grow at a compound annual growth rate of 27.8% from 2024 to 2030 to reach USD 5.23 billion by 2030.

b. North America dominated the AI in chemicals market with a share of 39.6% in 2023. This is attributable to its leading-edge technology adoption, substantial R&D investments, and the presence of major industry players.

b. Some key players operating in the AI in Chemicals market include Accenture, BASF, Google LLC, Honeywell International Inc., IBM Corporation, Insilico Medicine, Microsoft, NVIDIA Corporation, Siemens, and SLB.

b. Key factors that are driving the market growth include increasing advancements in AI technologies, the need for improved operational efficiency, increasing data availability, and the demand for enhanced process optimization and predictive analytics in chemical production.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.