AI Agents Market Size, Share & Trends Analysis Report By Technology (ML, NLP), By Agent System (Single Agent Systems, Multiple Agent Systems), By Type, By Application, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-471-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

AI Agents Market Size & Trends

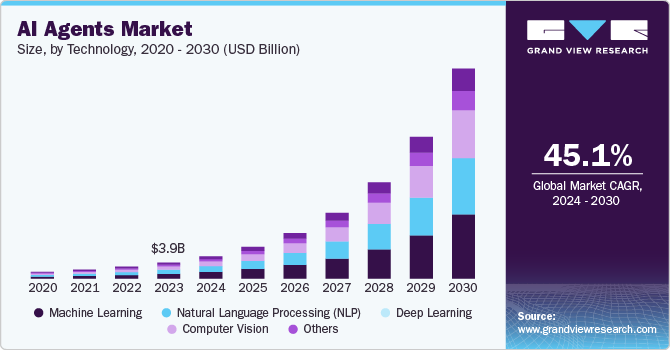

The global AI agents market size was estimated at USD 5.40 billion in 2024 and is expected to grow at a CAGR of 45.8% from 2025 to 2030. Increased demand for automation, advancements in Natural Language Processing (NLP), and rising demand for personalized customer experience are primarily driving the AI agents industry’s growth. Moreover, the widespread adoption of cloud computing has made it easier and cost-effective for businesses to deploy AI agents. Cloud-based platforms enable companies to scale AI agent applications with lower infrastructure investments, driving wider adoption across industries.

Consumers expect more personalized interactions, and AI agents enable businesses to deliver customized solutions by leveraging data to provide targeted recommendations, customer support, and marketing outreach, increasing customer satisfaction and loyalty. AI agents enhance customer engagement in e-commerce by offering real-time product recommendations, assisting with transactions, and improving the online shopping experience.

Moreover, the rise of online retail has been a significant growth driver, especially post-pandemic. AI agents are used in telemedicine, patient management, and diagnostics, which are crucial in streamlining healthcare operations. Their ability to handle patient queries, assist in appointment scheduling, and offer health guidance contribute significantly to the AI agents industry’s growth in healthcare.

AI agents are integrated with security systems to monitor, analyze, and respond to security threats in real time. Their capabilities in detecting anomalies, predictive analysis, and automating security procedures drive market demand in both public and private sectors. Moreover, ongoing research and development in AI technologies, particularly machine learning, deep learning, and NLP, improve AI agents' functionality and performance. As AI agents become more advanced, industries adopt them for increasingly complex tasks.

Technology Insights

The machine learning segment led the market in 2024, accounting for over 30.5% of the global revenue. Machine learning algorithms enable AI agents to analyze vast amounts of data and make informed decisions quickly. This capability enhances automation and improves overall operational efficiency across various industries. Machine learning models can scale efficiently as data increases, allowing AI agents to adapt to new patterns and trends. This adaptability is essential for industries facing rapidly changing environments, such as finance and healthcare.

The deep learning segment is anticipated to exhibit the highest CAGR over the forecast period. Enhanced performance and accuracy, big data availability, and advancements in computational power & real-time processing are factors primarily driving segment growth. For instance, AI-specific NVIDIA GPUs have become central to machine learning and deep learning initiatives. With Compute Unified Device Architecture (CUDA) accelerating computation, AI researchers can train and refine their models more efficiently. Moreover, deep learning models, particularly neural networks, perform superior tasks such as NLP, image recognition, and speech recognition. This improved accuracy enhances the effectiveness of AI agents in various applications.

Agent System Insights

The single agent systems segment accounted for the largest market revenue share in 2024. Single agent systems are easier and faster to implement compared to multi-agent systems. Businesses can deploy these solutions quickly without extensive customization, making them suitable for companies looking to enhance efficiency rapidly. Moreover, single agent systems' development and deployment costs are generally lower. Organizations can achieve automation and AI capabilities without the significant investment required for multi-agent systems.

The multi agent systems segment is anticipated to exhibit the highest CAGR over the forecast period. Complex problem-solving, real-time decision-making, enhanced collaboration and communication, and diverse applications across industries primarily contribute to segment growth. Multi-agent systems enable better communication and collaboration among agents, improving coordination and teamwork. This aspect is crucial in numerous applications, such as emergency response, where multiple agents must work together effectively. For instance, in November 2023, researchers at Tsinghua University developed a simulation model where each evacuee is assigned unique attributes, such as age, health status, and a dynamic stress level, influencing their movement velocity. This enables planners to observe the potential effects of factors such as mob mentality or panic during evacuation and bottlenecks.

Type Insights

The ready-to-deploy agents segment accounted for the largest market revenue share in 2024. Businesses can implement ready-to-deploy agents with minimal setup time, allowing them to start benefiting from AI technologies immediately. Various solutions come with intuitive interfaces that do not require extensive technical knowledge, making them accessible to a wider range of users. These agents typically require less upfront investment compared to developing custom solutions, making them suitable for small to medium-sized enterprises. Businesses can significantly reduce labor costs and improve operational efficiency by automating tasks such as customer service.

The build-your-own agents segment is expected to exhibit the highest CAGR over the forecast period. Businesses often have legacy systems and applications that need to be connected to new AI solutions. Build-your-own agents can be designed to integrate with various enterprise systems, facilitating smoother workflows seamlessly. Moreover, companies prefer to maintain control over their data and security protocols, especially in healthcare and BFSI industries. Building their own agents allows organizations to implement stringent data handling and privacy measures.

Application Insights

The customer service and virtual assistants segment accounted for the largest market revenue share in 2024. Businesses are increasingly adopting AI agents to automate customer service tasks, leading to improved efficiency and reduced operational costs. In addition, AI agents can handle a large volume of customer interactions simultaneously, making it easier for companies to scale their customer service operations without significant increases in staff. Furthermore, advanced AI algorithms allow virtual assistants to analyze customer data and interactions, providing personalized responses and recommendations that enhance the customer experience.

The healthcare segment is anticipated to exhibit the highest CAGR over the forecast period. Various factors, such as improved patient engagement, efficiency in operations, enhanced diagnosis and decision support, and integration with wearable devices, are primarily driving segment growth. Moreover, AI agents help reduce healthcare costs by automating repetitive tasks, minimizing administrative burdens, and enhancing operational efficiencies, which is crucial in a sector facing rising expenses.

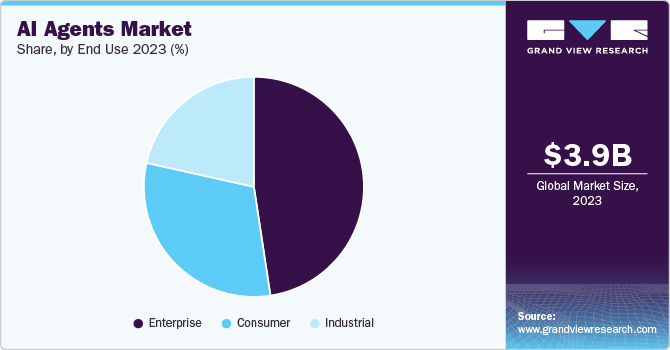

End-use Insights

The enterprise segment accounted for the largest market revenue share in 2024. AI agents provide 24/7 customer support, personalized interactions, and quick responses, improving overall customer satisfaction and loyalty, which is crucial for businesses in competitive markets. For instance, Salesforce's Einstein AI platform helps businesses automate customer service processes, personalize customer interactions, and provide AI-driven recommendations to support agents, enhancing customer experience. Moreover, AI agents can analyze vast amounts of data quickly, providing valuable insights for decision-making, trend analysis, and customer behavior prediction, thus enabling enterprises to make informed strategic choices. Furthermore, AI agents help enterprises manage compliance with regulations by automating documentation, monitoring transactions, and ensuring adherence to standards, thereby reducing legal risks.

The industrial segment is expected to exhibit the highest CAGR over the forecast period. Industries are increasingly adopting automation to enhance operational efficiency and reduce labor costs. AI agents can automate repetitive tasks, monitor processes, and make real-time decisions. Moreover, AI agents optimize workflows, reduce downtime, and streamline operations, significantly improving productivity and resource management. Furthermore, the ability of AI agents to analyze vast amounts of data and provide actionable insights supports better decision-making and enhances strategic planning within industrial operations.

Regional Insights

North America AI agents market dominated with a revenue share of over 40.1% in 2024. This share is attributed to advanced technological infrastructure, a high concentration of leading technological companies, and substantial investments in regional research and development. Furthermore, the early adoption of AI technologies across various sectors, including defense, healthcare, finance, and retail, contributes significantly to the AI agent industry’s growth. For instance, in April 2024, the U.S. Army is channeling investments into AI and machine learning solutions through its Army Applied Small Business Innovation Research (SBIR) Program, which included USD 50 million in phase II funding.

U.S. AI Agents Market Trends

The AI agents market in the U.S. is anticipated to exhibit a significant CAGR over the forecast period due to the presence of tech giants such as Google, Microsoft, and IBM, which are pioneering advancements in AI agent technology. A thriving startup ecosystem focused on AI innovation and automation further accelerates development across diverse sectors, including finance, education, and customer service. Government initiatives, such as the U.S. National AI Initiative, are also pivotal in fostering AI research, development, and deployment, solidifying the U.S. market position.

Europe AI Agents Market Trends

The AI agents market in Europe is expected to witness significant growth over the forecast period, driven by proactive government support through regulations and initiatives such as the European Union's AI strategy. This strategic framework encourages research, innovation, and the responsible deployment of AI agents across diverse industries such as manufacturing, healthcare, and energy. Furthermore, increasing investments in AI research and development, coupled with a growing awareness of the benefits of AI agents in improving efficiency and productivity, are fueling market expansion in Europe.

Asia Pacific AI Agents Market Trends

The AI agents market in Asia Pacific is anticipated to register the highest CAGR over the forecast period, fueled by rapid digital transformation across industries, leading to increased adoption of AI technologies. Businesses are increasingly leveraging AI to optimize operations, enhance customer engagement, and drive innovation. Factors such as expanding internet penetration, rising disposable income, and supportive government policies further contribute to this region's growth potential. In addition, the growing adoption of AI solutions by Small and Medium-Sized Enterprises (SMEs) is accelerating regional market expansion.

Key AI Agents Company Insights

Key AI agents companies include Salesforce, Inc., IBM Corporation, and Microsoft. Companies active in the AI agents industry focus aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/technology development. For instance, in September 2024, Salesforce, inc. launched Agentforce, which offers a collection of independent AI agents designed to enhance employees' work and manage duties across service, sales, marketing, and commerce sectors, leading to efficiency and customer contentment. It allows any organization to create, tailor, and implement their personalized agents rapidly by utilizing user-friendly, low-code solutions.

Key AI Agents Companies:

The following are the leading companies in the AI agents market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Apple Inc.

- Baidu

- IBM Corporation

- Meta

- Microsoft

- NVIDIA Corporation

- Salesforce, inc.

Recent Developments

-

In February 2025, GitHub introduced Agent Mode for GitHub Copilot, enhancing the AI-powered coding assistant's ability to independently iterate on code, identify errors, and implement fixes. This upgrade allows Copilot to interpret high-level requests, generate code across multiple files, and debug its output with minimal human intervention.

-

In September 2024, Microsoft launched Microsoft 365 Copilot innovations, including new Copilot agents that automate and streamline processes. The AI agent offers users the capability to develop a range of AI assistants capable of performing tasks within Microsoft's proprietary software and software from third-party vendors.

-

In September 2024, IBM Corporation partnered with Salesforce, inc., to offer AI agents and tools that organizations can implement in their own IT infrastructures, utilizing their specific data while maintaining rigorous oversight of their systems. Through the integration of Agentforce, Salesforce, Inc.’s collection of autonomous agents, with the functionalities from IBM Corporation’s WatsonX, businesses aim to empower customers by leveraging agents' strength in their daily applications.

-

In July 2024, BRYTER, an AI workflow automation provider, launched AI Agents, a new product suite, and major updates to its no-code platform. Utilizing specialized trained AI, BRYTER's AI Agents assist law firms and legal departments in handling their tasks' repetitive and laborious aspects. This includes accelerating the contract review process with the Review Agent and providing draft email responses to frequent requests from commercial teams directly within MS Outlook or Gmail via the Email Agent.

AI Agents Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.63 billion |

|

Revenue forecast in 2030 |

USD 50.31 billion |

|

Growth rate |

CAGR of 45.8% from 2025 to 2030 |

|

Actual data |

2017 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, agent system, type, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

Alibaba Group Holding Limited; Amazon Web Services, Inc.; Apple Inc.; Baidu; Google; IBM Corporation; Meta; Microsoft; NVIDIA Corporation; Salesforce, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global AI Agents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global AI agents market report based on technology, agent system, type, application, end-use, and region.

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Machine Learning

-

Natural Language Processing (NLP)

-

Deep Learning

-

Computer Vision

-

Others

-

-

Agent System Outlook (Revenue, USD Million, 2017 - 2030)

-

Single Agent Systems

-

Multi Agent Systems

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Ready-to-Deploy Agents

-

Build-Your-Own Agents

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Customer Service and Virtual Assistants

-

Robotics and Automation

-

Healthcare

-

Financial Services

-

Security and Surveillance

-

Gaming and Entertainment

-

Marketing and Sales

-

Human Resources

-

Legal and Compliance

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Consumer

-

Enterprise

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global AI agents market size was estimated at USD 5.40 billion in 2024 and is expected to reach USD 7.60 billion in 2025.

b. The global AI agents market is expected to grow at a compound annual growth rate of 45.8% from 2025 to 2030 to reach USD 50.31 billion by 2030.

b. North America dominated the AI agents market with a share of 40% in 2024. The customer service sector in North America has widely adopted AI agents to handle routine inquiries, resolve issues, and offer personalized support. With large volumes of customer interactions across various industries, AI agents help businesses scale and optimize customer service operations.

b. Some key players operating in the AI agents market include Alibaba Group Holding Limited; Amazon Web Services, Inc.; Apple Inc.; Baidu; Google; IBM Corporation; Meta; Microsoft; NVIDIA Corporation; and Salesforce, inc.

b. Increased demand for automation, advancements in Natural Language Processing (NLP), and rising demand for personalized customer experiences are primarily driving the growth of the AI agents market. Moreover, the widespread adoption of cloud computing has made it easier and cost-effective for businesses to deploy AI agents.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."