Agriculture Drones Market Size, Share & Trends Analysis Report By Type (Fixed Wing, Rotary Wing), By Component (Hardware, Software), By Farming Environment (Indoor, Outdoor), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-271-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 -2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Agriculture Drones Market Size & Trends

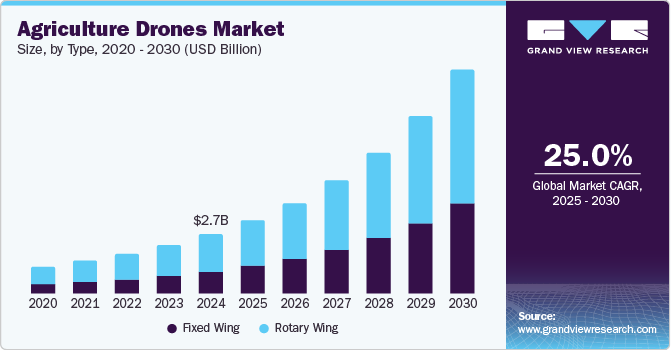

The global agriculture drones market size was valued at USD 2.74 billion in 2024 and is projected to grow at a CAGR of 25.0% from 2025 to 2030. The growing demand for precision farming is driving the adoption of agriculture drones. Precision farming techniques maximize crop yields while minimizing using resources such as water, fertilizers, and pesticides. Drones equipped with high-resolution cameras, multispectral sensors, and GPS technology enable farmers to gather detailed data on crop health, soil conditions, and moisture levels. This real-time information allows farmers to make data-driven decisions about where and when to apply inputs, optimizing crop production and reducing waste. The demand for precision farming solutions, including drones, is rising as the agricultural component faces pressure to increase efficiency and sustainability. According to data from the U.S. Department of Agriculture (USDA), the top five states adopting precision agriculture technologies, namely North Dakota, Nebraska, Iowa, South Dakota, and Illinois, represented nearly half of the 2022 U.S. cash receipts for field crops. This trend reflects a significant opportunity for the compact tractor market, as sales of advanced machinery to support precision farming practices continue to increase in these states.

The increasing adoption of IoT (Internet of Things) and big data analytics in agriculture enhances drones' utility. When integrated with IoT devices and data analytics platforms, drones provide a more comprehensive view of farm operations. They collect data instantly, analyze and transmit it to farmers via cloud-based platforms. This connectivity allows for more accurate and real-time monitoring of crops and soil conditions, helping farmers take immediate action to improve productivity and crop health. The integration of drones with IoT and big data solutions is driving the digital transformation of agriculture, further boosting the adoption of drone technology.

Additionally, the rise of autonomous and AI-powered drones drives further innovation in the market. Autonomous drones with artificial intelligence (AI) perform more complex tasks with minimal human intervention. These drones autonomously navigate fields, identify crop health issues, and even apply fertilizers or pesticides with precision. AI-powered drones also process and analyze vast amounts of data in real-time, allowing farmers to make quick and accurate decisions. This capability is particularly valuable for large-scale farms that require continuous monitoring and fast responses to changing field conditions. The integration of AI makes drones more efficient and effective, enhancing their appeal to farmers.

Furthermore, growing awareness about sustainable and organic farming practices drives the adoption of agricultural drones. As consumers become more concerned about the environmental impact of food production and the use of chemicals in agriculture, there is increasing demand for organically grown produce. Agriculture drones enable farmers to monitor crops more closely, reduce synthetic inputs, and employ targeted spraying methods that minimize chemical usage. This supports organic and eco-friendly farming practices, which are increasingly prioritized in developed and developing markets. According to an article published by the International Federation of Organic Agriculture Movements, in 2022, around 96.4 million hectares (Mha) of land were managed organically, reflecting a 26.6% rise from 2021. Oceania accounted for the largest share, with 53.2 Mha, Europe with 18.5 Mha, and Latin America with 9.5 Mha.

Type Insights

Based on type, the market is segmented into fixed wing and rotary wing. The rotary wing segment dominated the market with a revenue share of 62.1% in 2024. The expansion of smart farming ecosystems is propelling the growth of the rotary wing segment. As more farms integrate smart technologies, such as the Internet of Things (IoT), cloud computing, and AI-powered analytics, rotary-wing drones are becoming an integral part of these ecosystems. These drones are connected to other smart farming devices, such as soil sensors, weather stations, and irrigation systems, to create a fully automated and interconnected farming environment. The data collected by the drones are fed into centralized farm management platforms, which are analyzed alongside data from other sources to provide a holistic view of farm conditions. Integrating rotary-wing drones into smart farming ecosystems enables farmers to optimize resource use, improve operational efficiency, and enhance crop yields.

The fixed wing segment is anticipated to register significant growth from 2025 to 2030. The expanding applications of fixed-wing drones in crop monitoring and disease detection drive their demand. Fixed-wing drones are equipped with sensors capable of detecting subtle changes in crop health, often before visible disease symptoms appear. By flying over crops regularly, these drones provide early warnings of potential problems, allowing farmers to take preventative measures before diseases spread or yield is significantly impacted. This early detection capability is critical for reducing crop losses and optimizing harvests. Additionally, fixed-wing drones monitor crop growth stages, assess plant density, and estimate harvest timing, providing farmers with valuable information throughout the growing season.

Component Insights

Based on component, the market is segmented into hardware, software, and services. The hardware segment dominated the market with a revenue share of 50.0% in 2024. The growing demand for longer flight times and increased payload capacities drive the segment growth. As farms expand and precision agriculture becomes more widespread, drones need to cover larger areas without the need for frequent recharging or refueling. Innovations in battery technology and energy-efficient motors enable agriculture drones to fly for longer durations, making them more practical for large-scale farming operations. Additionally, advancements in payload capabilities allow drones to carry more sophisticated sensors or even deliver small quantities of inputs like seeds or fertilizers. The demand for drones that can carry heavier payloads and operate for extended periods is pushing manufacturers to develop more robust and durable hardware, which is crucial for meeting the growing needs of modern agriculture.

The services segment is expected to grow significantly, with a CAGR of over 26.6% over the forecast period. The expansion of drone-as-a-service (DaaS) business models is playing a crucial role in driving the services segment of the agriculture drone market. With DaaS, farmers can outsource field mapping, crop scouting, and spraying tasks to expert drone operators. This reduces the need for farmers to become proficient in drone operation and ensures that they receive high-quality, reliable data and services from skilled professionals. The growth of these service models is particularly advantageous for smaller farms or regions with limited access to advanced technology, as it allows them to benefit from drone-based services without significant investments in equipment and training.

Farming Environment Insights

Based on farming environment, the component is divided into indoor farming and outdoor farming. The outdoor farming segment dominated the market in terms of revenue, with a revenue share of 82.5% in 2024. The increasing need for large-scale outdoor agricultural operations is driving the market growth. Managing vast tracts of land becomes more challenging as farms expand, requiring more efficient monitoring and management solutions. Agricultural drones with advanced sensors and imaging technologies allow farmers to gather detailed information about their crops in real-time. This enables them to optimize the use of inputs such as water, fertilizers, and pesticides, which is crucial for maintaining crop health and improving yield in outdoor farming. The ability to make data-driven decisions based on drone-collected information is becoming vital for farmers looking to enhance productivity and reduce waste.

The indoor farming segment is expected to register the highest growth over the forecast period. The rise of urban farming in densely populated areas, where indoor agriculture has become a viable solution to meet the increasing demand for fresh produce. As cities grow and space becomes limited, indoor farms are established in urban areas to reduce food miles and bring production closer to consumers. Drones assist in efficiently managing these compact farming systems, helping automate processes such as crop monitoring, pest detection, and climate control. Urban indoor farms can operate with greater precision and less manual labor by utilizing drones, making them more sustainable and cost-effective. The ability of drones to navigate tight spaces within indoor farms and provide detailed analytics on crop health is a key factor driving their adoption in this segment. According to an article published by the United States Department of Agriculture stated that, urban farming contributes 15 to 20% of the global food supply, a sector that agriculture drones increasingly enhance through improved efficiency and crop management.

Application Insights

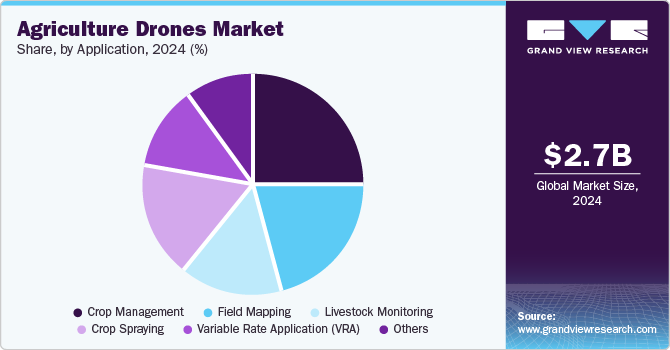

Based on application, the market is segmented into crop management, field mapping, crop spraying, livestock monitoring, variable rate application (VRA), and others. The crop management segment dominated the market with a revenue share of 24.9% in 2024. The growing awareness of the need for crop monitoring in the face of climate change is shaping the demand for drones in crop management. As extreme weather events become more frequent, farmers must adapt their practices to mitigate risks and ensure stable yields. Drones assist in monitoring crop conditions during adverse weather events, allowing farmers to assess damage and take corrective actions swiftly. The ability to respond quickly to changing environmental conditions enhances resilience in crop production and contributes to food security in a changing climate.

The field mapping segment is expected to grow significantly, with a CAGR of over 26% over the forecast period. The rising availability of drone-related software and analytics platforms drives growth in the field mapping segment. These platforms allow farmers to analyze drones' data and derive actionable insights easily. With user-friendly interfaces and advanced analytical tools, farmers can interpret their field maps and make data-informed decisions regarding crop management, irrigation, and resource allocation. This accessibility to technology enhances the appeal of drone-based field mapping solutions.

Regional Insights

North America agriculture drones market held a significant share of around 33.7% in 2024. The growing popularity of remote sensing technologies is a key factor influencing the agriculture drone market. Drones with various sensors, such as multispectral and thermal imaging, enable farmers to gather detailed information about their crops from above. These remote sensing technologies allow for the monitoring of plant health, moisture levels, and nutrient deficiencies, providing insights that were previously difficult to obtain. As farmers increasingly adopt these technologies to enhance their monitoring capabilities, the demand for drones will continue to grow.

U.S. Agriculture Drones Market Trends

The U.S. agriculture drones market is growing due to the growing movement toward sustainable agriculture. Farmers increasingly seek ways to minimize their ecological impact as consumers demand more environmentally friendly products. Drones facilitate sustainable practices by enabling precise applications of fertilizers and pesticides, reducing chemical runoff and environmental harm. Furthermore, drones assist in soil health assessments and crop rotation planning, contributing to sustainable land management practices. As sustainability becomes a core focus for the agricultural sector, the use of drones will likely expand.

Asia Pacific Agriculture Drones Market Trends

The Asia Pacific agriculture drones market is expected to achieve the fastest CAGR of 68.2% during the forecast period. Government support and favorable policies promoting the use of technology in agriculture drive market growth. Many governments in the Asia Pacific region recognize drones' potential to revolutionize farming practices. They are implementing policies and initiatives to encourage the adoption of drone technology, including subsidies, training programs, and regulatory frameworks that facilitate drone usage. For instance, countries such as China and India actively promote the integration of drones in agriculture to improve efficiency and sustainability, creating a conducive environment for market growth.

In September 2024, the government of India approved the Digital Agriculture Mission with a budget of INR 2,817 crore (USD 335.5 million), including INR 1,940 crore (USD 231.1 million) from the central government. This mission aims to support digital agriculture initiatives, including developing Digital Public Infrastructure, implementing the Digital General Crop Estimation Survey (DGCES), and other IT projects by various government and research institutions. The 2023-24 Union Budget also emphasized building Digital Public Infrastructure for agriculture, with further enhancements announced in the 2024-25 Budget. The DPI will provide detailed data on farmers, including land holdings, demographic information, and crops. It will integrate with relevant state and central government data to offer innovative, farmer-centric agricultural digital services.

Key Agriculture Drones Company Insights

Some of the key players operating in the market include DJI, Sentera, and Trimble Inc., among others.

-

DJI is a Chinese technology company specializing in civilian drones and aerial imaging technology. The company's primary products include drones for photography, filmmaking, agriculture, and drone hardware and software systems for other industries. DJI's product line has expanded beyond drones to include handheld gimbals, action cameras, and camera stabilizers, all of which integrate advanced imaging and stabilization technology. Due to their versatility and precision, DJI's products are widely used in industries like film production, agriculture, mapping, and law enforcement.

Parrot Drone SAS Lab and DroneDeployare some of the emerging market participants in the target market.

-

Parrot Drone SAS is a French drone manufacturer focused on wireless products before pivoting to drones. Parrot's product lineup includes a variety of consumer drones, such as the Parrot Anafi and Parrot Mambo; these drones often feature high-quality cameras and advanced features like automated flight modes, making them popular among hobbyists and photography enthusiasts. In the professional sector, Parrot offers robust solutions like Parrot Bluegrass and Parrot Disco, designed for agricultural and surveying applications. These drones are equipped with specialized sensors and software to assist in crop analysis, mapping, and aerial inspections.

Key Agriculture Drones Companies:

The following are the leading companies in the agriculture drones market. These companies collectively hold the largest market share and dictate industry trends.

- DJI

- Parrot Drone SAS

- AgEagle Aerial Systems Inc.

- AeroVironment, Inc.

- PrecisionHawk

- Trimble Inc.

- DroneDeploy

- Autel Robotics

- Draganfly Inc.

- Pix4D SA

- Sky-Drones Technologies Ltd

- Sentera

Recent Developments

-

In April 2024, DJI, the manufacturer of civilian drones, announced the global release of the Agras T50 and T25 drones. The T50 delivers exceptional efficiency for large-scale farming operations, while the T25 drones are designed for greater portability and are suitable for smaller fields. Both drones integrate seamlessly with the enhanced SmartFarm app, providing robust and comprehensive aerial application management capabilities.

-

In July 2023, Pix4D SA launched PIX4Dfields 2.4, an enhanced workflow to facilitate precision application scenarios. With the introduction of Targeted Operations, users could have a more streamlined process for creating personalized prescription maps.

Agriculture Drones Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.36 billion |

|

Revenue forecast in 2030 |

USD 10.26 billion |

|

Growth rate |

CAGR of 25.0% from 2025 to 2030 |

|

Actual Data |

2017 - 2024 |

|

Forecast Period |

2025 - 2030 |

|

Quantitative Units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Type, component, farming environment, application, region |

|

Regional Scope |

North America; Europe; Asia Pacific; South America; MEA |

|

Country Scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Kingdom of Saudi Arabia (KSA) (KSA); UAE; South Africa |

|

Key Companies Profiled |

DJI, Parrot Drone SAS, AgEagle Aerial Systems Inc, AeroVironment, Inc., PrecisionHawk, Trimble Inc., DroneDeploy, Autel Robotics, Draganfly Inc, Pix4D SA, Sky-Drones Technologies Ltd, and Sentera |

|

Customization Scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Agriculture Drones Market Report Segmentation

This report forecasts revenue growth at global, regional, as well as country level and offers qualitative and quantitative analysis of the market trends for each of the segments and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global agriculture drones market report based on type, component, farming environment, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Fixed Wing

-

Rotary Wing

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Farming Environment Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor Farming

-

Outdoor Farming

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Crop Management

-

Field Mapping

-

Crop Spraying

-

Livestock Monitoring

-

Variable Rate Application (VRA)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global agriculture drones market size was estimated at USD 2.74 billion in 2024 and is expected to reach USD 3.37 billion in 2025.

b. The global agriculture drones market is expected to grow at a compound annual growth rate of 25.0% from 2025 to 2030 to reach USD 10.26 billion by 2030.

b. North America dominated the agriculture drones market with a share of 33.7% in 2024. This is attributable to the increasing trend of using UAVs for practices such as mowing and plowing to ensure optimum productivity.

b. Some key players operating in the agriculture drones market include AeroVironment, Inc., DJI Technology, 3D Robotics, Trimble Navigation Ltd., and DroneDeploy, and Trimble Navigation Ltd.

b. Key factors that are driving the market growth include the increasing need to ensure better productivity and efficiency in using water, land, and fertilizers.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."