- Home

- »

- Next Generation Technologies

- »

-

Agriculture 4.0 Market Size, Share & Trends Report, 2030GVR Report cover

![Agriculture 4.0 Market Size, Share & Trends Report]()

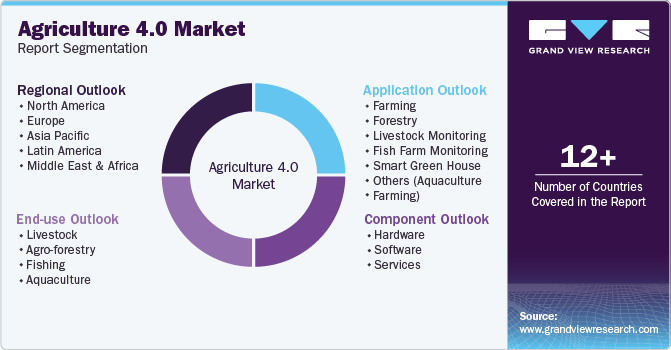

Agriculture 4.0 Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), Application, End-use (Agro-forestry, Livestock, Fishing, Aquaculture), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-436-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agriculture 4.0 Market Summary

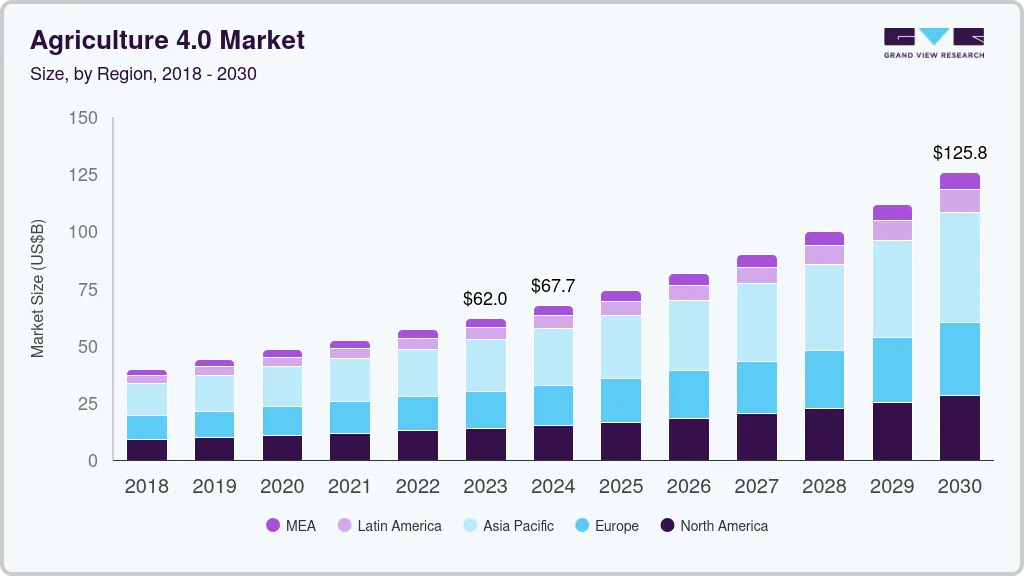

The global agriculture 4.0 market size was estimated at USD 67.73 billion in 2023 and is projected to reach USD 143.44 billion by 2030, growing at a CAGR of 11.6% from 2024 to 2030. The market is a dynamic and rapidly evolving field that leverages technology to transform agricultural practices.

Key Market Trends & Insights

- Asia Pacific dominated the agriculture 4.0 market with the revenue share of 36.8% in 2023.

- The agriculture 4.0 market in India is expected to grow at a significant CAGR from 2024 to 2030.

- Based on component, the hardware segment led the market with the largest revenue share of 56.2% in 2023.

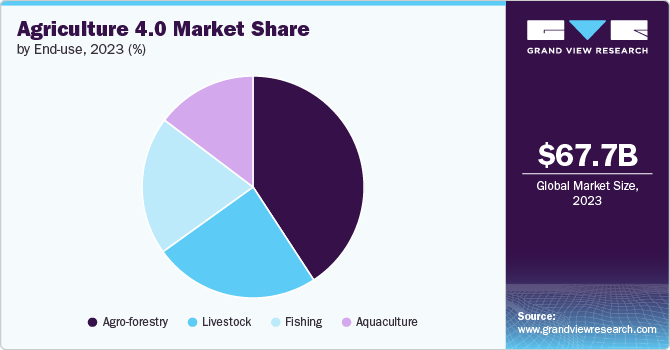

- Based on end use, the agro-forestry segment led the market with the largest revenue share of 40.8% in 2023.

- Based on application, the farming segment led the market with the largest revenue share of 24.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 67.73 Billion

- 2030 Projected Market Size: USD 143.44 Billion

- CAGR (2024-2030): 11.6%

- Asia Pacific: Largest market in 2023

At its core, Agriculture 4.0 encompasses a wide range of tools and solutions that empower farmers to make data-driven decisions and optimize their operations. Key components of the global market include hardware, software, and services. Agriculture 4.0, a subset of the broader Internet of Things (IoT) revolution, represents the convergence of agriculture and advanced technologies. It involves the application of data-driven technologies, such as artificial intelligence (AI), machine learning, robotics, and sensors, to optimize agricultural processes and improve overall efficiency, sustainability, and profitability.Hardware plays a crucial role in collecting and transmitting valuable data. Sensors, drones, robots, and other physical devices are deployed across farms to monitor various aspects of agricultural production, such as soil moisture, crop health, and weather conditions. This data serves as the foundation for informed decision-making. Software platforms and applications are essential for processing, analyzing, and visualizing the data collected by hardware. These tools enable farmers to gain insights into their operations, identify trends, and make predictions. Advanced analytics capabilities, including artificial intelligence and machine learning, can further enhance the value of this data. Services are another critical component of the global market. Consulting firms, system integrators, and technology providers offer expertise in implementing and managing agriculture 4.0 solutions. These services help farmers navigate the complexities of adopting new technologies and ensure that they are maximizing their benefits.

The agricultural industry is undergoing a significant transformation, driven by technological advancements. Precision agriculture, smart farming, robotics, AI, and data analytics are reshaping the way farming is done. Precision agriculture optimizes resource use, reducing waste and improving yields. Smart farms create controlled environments for crop production, enhancing quality and efficiency. Robotics and automation automate labor-intensive tasks, addressing labor shortages and improving safety. AI and machine learning analyze vast amounts of data, providing valuable insights and enabling data-driven decision-making. Data analytics helps farmers optimize operations, manage resources effectively, and increase profitability.

The growth and development of the market are significantly influenced by a complex regulatory landscape. Data privacy, environmental regulations, and government policies all play crucial roles in shaping the industry. Data privacy and security regulations are essential to protect sensitive agricultural data. Ensuring the confidentiality and integrity of this data is crucial for maintaining trust and protecting valuable information. Environmental regulations, such as those related to pesticide use and water conservation, influence the adoption of technologies that prioritize sustainability. Government subsidies and policies can support the economic viability of agriculture 4.0 technologies by offsetting costs and making them more accessible to farmers.

The global market, while facing challenges, offers a wealth of opportunities for growth, innovation, and positive impact. One significant opportunity lies in improved sustainability. Precision agriculture and other technologies can help reduce the environmental footprint of agriculture by optimizing resource use, minimizing waste, and promoting sustainable practices. Another opportunity is enhanced food safety. Blockchain and IoT can improve food traceability, ensuring consumer confidence in the safety and quality of products. Agriculture 4.0 can also improve operational efficiency, reduce costs, and increase yields, leading to increased profitability and improved livelihoods for farmers. In addition, it can create new jobs and economic opportunities in rural areas. The market offers ample opportunities for innovation and entrepreneurship. The development of new products, services, and business models can address the challenges and seize the opportunities presented by agriculture 4.0.

Component Insights

Based on component, the hardware segment led the market with the largest revenue share of 56.2% in 2023. The proliferation of advanced technologies like drones, IoT sensors, autonomous tractors, and GPS-enabled devices has revolutionized modern farming. These tools enable precise monitoring and control over agricultural activities, leading to improved efficiency, higher yields, and better resource management. The essential role that hardware plays in gathering real-time data, automating tasks, and ensuring accuracy in farming processes cannot be overstated. Although the initial costs of adopting these advanced hardware solutions are high, the long-term benefits, including enhanced productivity and reduced operational costs, make them a necessary investment for large-scale and technologically progressive farms. In addition, continuous innovations in hardware technology, such as more affordable and user-friendly devices, are making these solutions more accessible to smaller farms.

The services segment is projected to expand at the fastest CAGR during the forecast period, driven by the increasing need for expertise in deploying and managing advanced agricultural technologies. As farms adopt complex hardware and software systems, the demand for specialized services, including installation, maintenance, consulting, and training, has surged. These services are crucial for maximizing the efficiency and effectiveness of agriculture 4.0 solutions, ensuring that farms can fully leverage the technology to optimize their operations. In addition, the growth of data-driven farming practices has led to a rising need for data analysis services, where experts help interpret the vast amounts of data generated by sensors and other devices. This insight enables farmers to make informed decisions about crop management, pest control, and resource allocation.

End-use Insights

Based on end use, the agro-forestry segment led the market with the largest revenue share of 40.8% in 2023, as it integrates the principles of both agriculture and forestry, creating a sustainable and productive land-use system. The adoption of smart technologies in agro-forestry has led to more efficient management of land, enhanced biodiversity, and improved ecosystem services. Technologies such as remote sensing, geographic information systems (GIS), and precision forestry tools allow for better monitoring of forest health, soil quality, and crop performance, leading to optimized resource use and increased productivity. The integration of these technologies has also facilitated the implementation of sustainable practices, such as agro-ecology and regenerative agriculture, which focus on maintaining soil health, conserving water, and reducing carbon emissions. Agro-forestry systems benefit from the use of smart irrigation, automated planting, and harvesting equipment, which further enhance the efficiency and sustainability of these practices. The dominance of agro-forestry in the global market is also driven by the global push towards sustainable land management and the need to balance agricultural production with environmental conservation.

The fishing segment is projected to grow at a significant CAGR during the forecast period, driven by the increasing adoption of smart technologies in aquaculture and commercial fishing operations. The use of IoT devices, sensors, and data analytics in fishing has revolutionized the way fish populations are monitored, managed, and harvested. These technologies provide real-time data on water quality, temperature, oxygen levels, and fish behavior, enabling more precise management of fish farms and reducing the environmental impact of aquaculture. In addition, the use of automated feeding systems and drones for monitoring fish stocks has improved the efficiency and sustainability of fishing operations. The growth of the fishing segment is also fueled by the rising demand for seafood and the need to ensure the sustainability of fish stocks in the face of overfishing and climate change. Smart fishing technologies help in tracking and reducing bycatch, optimizing fishing routes, and ensuring compliance with environmental regulations, all of which contribute to the sustainability and profitability of the industry.

Application Insights

Based on application, the farming segment led the market with the largest revenue share of 24.2% in 2023. The integration of smart technologies into traditional farming practices has led to significant improvements in crop management, soil health, and resource efficiency. Precision farming, which involves the use of IoT sensors, GPS, and data analytics, is at the forefront of this transformation. These technologies enable farmers to monitor field conditions in real time, apply inputs like water, fertilizers, and pesticides more accurately, and manage crops with greater precision. This not only boosts crop yields but also reduces waste and environmental impact. Furthermore, automation and robotics are becoming increasingly common in farming, with autonomous tractors and harvesting machines helping to address labor shortages and improve efficiency. The farming segment’s dominance is reinforced by the global need to increase food production to meet the demands of a growing population while managing the challenges posed by climate change and limited natural resources.

The smart greenhouses segment is projected to expand at the fastest growth rate during the forecast period 2024 to 2030. Smart greenhouses utilize advanced technologies such as climate control systems, automated irrigation, and LED lighting to create optimal growing conditions for crops. These technologies allow for precise control over factors such as temperature, humidity, light, and CO2 levels, leading to higher yields and more consistent crop quality compared to traditional open-field farming. The ability to monitor and adjust these conditions in real time also helps to reduce resource consumption and increase energy efficiency, making smart greenhouses an attractive option for sustainable farming. In addition, the growing interest in urban agriculture and the increasing demand for locally grown, fresh produce have further fueled the adoption of smart greenhouses. These facilities are often located near urban centers, reducing transportation costs and carbon emissions associated with food distribution. As consumers become more conscious of the environmental impact of food production, the demand for produce grown in smart greenhouses is expected to rise. The scalability and year-round production capabilities of smart greenhouses also make them a viable solution for addressing food security challenges in regions with harsh climates.

Regional Insights

The agriculture 4.0 market in North America is expected to witness at a steady CAGR from 2024 to 2030. The region, particularly the U.S., is a global leader in the adoption of precision agriculture, automated machinery, and data analytics to enhance farming efficiency and productivity. The vast agricultural landscapes in the U.S. and Canada provide ample opportunities for the deployment of advanced technologies such as GPS-guided equipment, drone monitoring, and IoT-based systems. In addition, the strong presence of leading agri-tech companies and startups in North America fosters innovation and drives market growth. Government support in the form of subsidies, grants, and research initiatives further encourages the adoption of smart farming practices. The growing demand for sustainable and organic farming practices, coupled with the need to address labor shortages, is also fueling the market's expansion.

U.S. Agriculture 4.0 Market Trends

The agriculture 4.0 market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. With its vast agricultural land, diverse crops, and technologically advanced farming practices, the U.S. is a prime market for Agriculture 4.0 solutions. American farmers are increasingly adopting precision agriculture tools, including satellite imagery, drones, and AI-powered analytics, to optimize crop management and resource use. The country's strong agricultural research and development infrastructure, coupled with its entrepreneurial spirit, is fostering innovation and adoption of new technologies. The U.S. government's support for agricultural technology development and its focus on precision agriculture are further driving the market's growth. The U.S. market is also driven by the growing demand for sustainable farming practices, as consumers and policy makers’ alike push for reduced environmental impact and more efficient use of resources.

Asia Pacific Agriculture 4.0 Market Trends

Asia Pacific dominated the agriculture 4.0 market with the revenue share of 36.8% in 2023. The region is anticipated to grow at the fastest CAGR of 12.4% during the forecast period. The region's dominance is primarily due to its large population and the corresponding demand for increased food production. In Addition, a vast agricultural sector, coupled with rapidly growing population and increasing urbanization, are driving the demand for advanced agricultural technologies. Countries like China and India, with their large agricultural land areas and diverse farming practices, are at the forefront of adopting agriculture 4.0 solutions. Countries like Japan and South Korea are leading in innovation, particularly in robotics and smart greenhouse technologies. Adoption of precision farming, smart irrigation, and automated equipment is growing rapidly as farmers seek to optimize yields and manage resources efficiently. Moreover, the region's diverse climatic conditions and large-scale agricultural practices provide fertile ground for deploying agriculture 4.0 solutions.

The agriculture 4.0 market in India is expected to grow at a significant CAGR from 2024 to 2030. With its vast agricultural land, diverse crops, and a large rural population, India presents immense potential for Agriculture 4.0 adoption. The Indian government’s initiatives, such as the Digital Agriculture Mission and various subsidy programs, are playing a crucial role in encouraging the adoption of advanced technologies among farmers. The country is witnessing a surge in the use of drones, IoT-based monitoring systems, and data analytics to improve crop management and productivity. In addition, the growing focus on sustainable farming practices and climate resilience is driving the adoption of smart technologies in agriculture. Indian farmers are increasingly embracing solutions like precision agriculture, IoT-enabled devices, and AI-powered analytics to improve their productivity and sustainability.

Europe Agriculture 4.0 Market Trends

The agriculture 4.0 market in Europe is expected to grow at a significant CAGR from 2024 to 2030. The region's emphasis on sustainable agriculture, coupled with its advanced technological capabilities, is fostering the adoption of innovative solutions. Countries like Germany, France, and the Netherlands are leading the way in implementing precision agriculture, smart farming, and robotics in their agricultural sectors. The region's strong research and development infrastructure, along with supportive government policies, are creating a favorable environment for the growth of Agriculture 4.0 technologies. The European Union's policies, such as the Common Agricultural Policy (CAP) and the European Green Deal, emphasize the adoption of digital and sustainable farming practices. These policies incentivize farmers to integrate smart technologies into their operations, thus driving market growth. The region's commitment to reducing carbon emissions and promoting organic farming further supports the growth of Agriculture 4.0 technologies.

The Germany agriculture 4.0 market is expected to grow at the fastest CAGR from 2024 to 2030, due to its strong technological infrastructure and commitment to innovation. The country is known for its advanced manufacturing sector, which translates into significant expertise in developing and deploying agricultural machinery and precision farming technologies. German farmers are increasingly adopting IoT devices, autonomous tractors, and data analytics to enhance farm productivity and sustainability. The government's support through various funding programs and initiatives aimed at digitizing agriculture also plays a crucial role in this growth. Furthermore, Germany’s focus on sustainable farming practices aligns with the broader European agenda of reducing environmental impact, driving the adoption of smart technologies. The rise of smart greenhouses and vertical farming in urban areas reflects the country’s innovative approach to agriculture.

Key Agriculture 4.0 Company Insights

Key players operating in the global market include AGCO Corporation, Bayer AG, CNH Industrial, Corteva Agriscience, CropX Inc., Deere & Company, IBM, Kubota Corporation, Saga Robotics AS, Syngenta Crop Protection AG, Trimble Inc., and Yara International.

The competitive landscape of the global market is characterized by a mix of established technology companies, specialized agricultural equipment manufacturers, and emerging AgTech startups. Key players such as Deere & Company, AGCO Corporation, and Bayer AG dominate the market with extensive portfolios that combine traditional agricultural machinery with cutting-edge technologies like precision farming, automation, and data analytics. These companies leverage their established market presence and significant R&D investments to maintain competitive advantages and expand their offerings.

At the same time, the market is experiencing a surge in competition from agri-tech startups specializing in niche areas like AI-driven decision-making, drone-based crop monitoring, and smart irrigation systems. These startups are agile, often offering more tailored and cost-effective solutions that appeal to smaller farms and emerging markets. The competitive landscape is further shaped by strategic partnerships and collaborations, with technology giants like IBM and Trimble Inc. entering the agriculture sector through alliances that integrate advanced computing and AI capabilities with agricultural practices. Mergers and acquisitions are also prevalent, as larger companies seek to acquire innovative startups to quickly expand their technological capabilities and market reach. This dynamic environment fosters continuous innovation, as companies race to develop and deploy the most effective and efficient agriculture 4.0 solutions.

Key Agriculture 4.0 Companies:

The following are the leading companies in the agriculture 4.0 market. These companies collectively hold the largest market share and dictate industry trends.

- AGCO Corporation

- Bayer AG

- CNH Industrial

- Corteva Agriscience

- CropX inc.

- Deere & Company

- IBM

- Kubota Corporation

- Saga Robotics AS

- Syngenta Crop Protection AG

- Trimble Inc.

- Yara International

Recent Developments

-

In May 2024, John Deere introduced a new business unit to help farmers upgrade their existing machinery to precision agriculture standards. The new unit, Precision Upgrade Business, will offer a range of hardware and software solutions to equip older machinery with the latest technologies, including autonomy, sensors, and intelligent application systems. This initiative aims to bring thousands of growers into the era of Agriculture 4.0

-

In July 2023, FarmERP, a prominent ERP-based farm management platform provider, expanded its Smart Agritech Platform to include Spanish and French. This strategic move aimed to increase the platform's accessibility to farmers in European and West African countries. By offering multi-language support, FarmERP sought to eliminate language barriers and foster seamless collaboration and knowledge sharing among farmers globally. With the addition of Spanish and French, FarmERP's platform supports eight languages, including English, Russian, Vietnamese, Turkish, Thai, and Arabic. This linguistic diversity empowers the platform to serve a broader spectrum of farmers and agricultural businesses worldwide

Agriculture 4.0 Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 74.20 billion

Revenue forecast in 2030

USD 143.44 billion

Growth rate

CAGR of 11.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Japan; India; South Korea; Australia; Brazil; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

AGCO Corporation; Bayer AG; CNH Industrial; Corteva Agriscience; CropX inc.; Deere & Company; IBM; Kubota Corporation; Saga Robotics AS; Syngenta Crop Protection AG; Trimble Inc.; Yara International

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agriculture 4.0 Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the agriculture 4.0 market based on component, application, end-use, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Livestock Monitoring Hardware

-

RFID Tags and Readers

-

Sensors

-

Control Systems

-

GPS

-

Others (Drones)

-

-

Agriculture Hardware

-

Automation and Control Systems

-

Sensing and Monitoring Devices

-

-

Forestry Hardware

-

Harvesters & Forwarders

-

UAVs/ Drones

-

GPS

-

Cameras

-

RFID and Sensors

-

Variable Rate Controllers

-

Others

-

-

Fish Farm Hardware

-

GPS/ GNSS

-

Sensors

-

Others

-

-

Greenhouse Farming Hardware

-

Combined Heat and Power Systems (CHPs)

-

Cooling Systems

-

Automated Irrigation Systems

-

pH Sensors

-

-

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Farming

-

Crop Health Assessment

-

Crop Monitoring and Spraying

-

Planting

-

Soil and Field Analysis

-

Field Mapping

-

Weather Tracking and Forecasting

-

Irrigation Management

-

Inventory Management

-

Farm Labor Management

-

Financial Management

-

-

Forestry

-

Genetics and Nurseries

-

Silviculture and Fire Management

-

Harvesting Management

-

Inventory and Logistics Management

-

-

Livestock Monitoring

-

Heat Stress & Fertility Management

-

Milk Harvesting Management

-

Feeding Management

-

Animal Health & Comfort Management

-

Behavior Monitoring Management

-

Others

-

-

Fish Farm Monitoring

-

Tracking and Fleet Navigation

-

Feeding Management

-

Water Quality Management

-

Others

-

-

Smart Green House

-

HVAC Management

-

Yield Monitoring

-

Water and Fertilizer Management

-

Lighting Management

-

-

Others (Aquaculture Farming)

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Livestock

-

Agro-forestry

-

Fishing

-

Aquaculture

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The agriculture 4.0 market is experiencing a rapid evolution, driven by several key trends. The agricultural industry is undergoing a significant transformation, driven by technological advancements. Precision agriculture, smart farming, robotics, AI, and data analytics are reshaping the way farming is done. Precision agriculture optimizes resource use, reducing waste and improving yields. Smart farms create controlled environments for crop production, enhancing quality and efficiency. Robotics and automation automate labor-intensive tasks, addressing labor shortages and improving safety.

b. The global agriculture 4.0 market was estimated at USD 67.73 billion in 2023 and is expected to reach USD 74.20 billion in 2024.

b. The global agriculture 4.0 market is expected to grow at a compound annual growth rate of 11.6% from 2024 to 2030, reaching USD 143.44 billion by 2030.

b. The Asia Pacific region dominated the agriculture 4.0 market in 2023, accounting for a 36.8% share of global revenue. The region is anticipated to grow at the fastest CAGR of 12.4% during the forecast period from 2024 to 2030. The region's dominance is primarily due to its large population and the corresponding demand for increased food production. Additionally, a vast agricultural sector, coupled with rapidly growing population and increasing urbanization, are driving the demand for advanced agricultural technologies.

b. Some key players operating in the agriculture 4.0 market include AGCO Corporation, Bayer AG, CNH Industrial, Corteva Agriscience, CropX inc., Deere & Company, IBM, Kubota Corporation, Saga Robotics AS, Syngenta Crop Protection AG, Trimble Inc., and Yara International.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.