- Home

- »

- Agrochemicals & Fertilizers

- »

-

Agricultural Surfactants Market Size & Share Report, 2030GVR Report cover

![Agricultural Surfactants Market Size, Share & Trends Report]()

Agricultural Surfactants Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Non-ionic, Anionic), By Substrate (Synthetic, Bio-based), By Crop Type, By Application (Herbicides, Pesticides), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-013-1

- Number of Report Pages: 103

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Agricultural Surfactants Market Summary

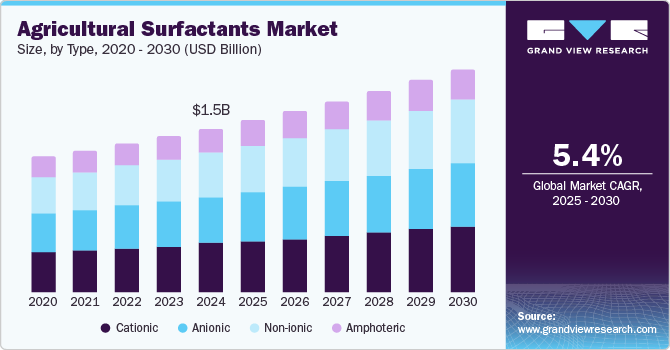

The global agricultural surfactants market size was valued at USD 1.48 billion in 2024 and is expected to reach USD 2.03 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030. The market is primarily driven by the growing demand for crop protection products in agriculture worldwide.

Key Market Trends & Insights

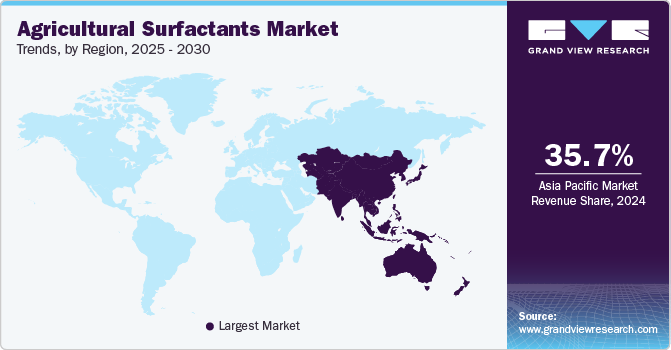

- Asia Pacific dominated the agricultural surfactants market with a revenue share of 35.7% in 2024.

- The agricultural surfactants market in Asia Pacific is expected to show the fastest growth during the forecast period.

- By type, the anionic segment accounted for a significant revenue share of 28.5% in 2024.

- By substrate, synthetic segment led the market in 2024.

- By crop type, cereals and grains segment led the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.48 Billion

- 2030 Projected Market Size: USD 2.03 Billion

- CAGR (2025-2030): 5.4%

- Asia Pacific: Largest market in 2024

Additionally, the increasing adoption of precision farming methods, the reduction of arable land, and the rising global food demand due to the expanding world population are significant factors influencing the industry. The market covers various chemical elements used to boost the performance and efficacy of agrochemicals, including herbicides, fungicides, and pesticides. Specifically, surfactants improve the growth regulators and foliar uptake of defoliants and herbicides. The product market serves agricultural sectors, such as specialty crops, fruits, vegetables, and row crops. Therefore, it fulfills the need for practical solutions to weed infestations and diseases and combating pests.

The agricultural surfactant market is vital to global food security and environmental sustainability. It helps reduce environmental impact while optimizing agricultural inputs. Additionally, the growing adoption of integrated pest management contributes to the market's growth.

Drivers, Opportunities & Restraints

The market is experiencing growth primarily due to the rising demand for effective crop protection solutions. As agricultural practices evolve and the need for higher yields increases, farmers increasingly rely on surfactants to enhance the efficiency of herbicides, pesticides, and fungicides. These surfactants improve the spread and adhesion of chemicals on plant surfaces, leading to better absorption and effectiveness. Furthermore, the global push for sustainable farming practices has amplified the demand for products that optimize resource use while minimizing environmental impact. This trend indicates a robust market for surfactants that cater to the needs of modern agriculture.

Agricultural surfactants, while useful in enhancing pesticide effectiveness and improving crop yield, can have harmful effects on the environment and non-target species. These chemicals may lead to water contamination, affecting aquatic ecosystems and drinking water sources. Additionally, they can harm beneficial insects and soil health, disrupting the natural balance of ecosystems. The potential for bioaccumulation in wildlife poses a significant long-term risk, emphasizing the need for cautious use and regulation of these substances. Overall, careful consideration is necessary to mitigate their negative impacts.

The market is witnessing a significant opportunity due to advancements in cost-effective manufacturing methods. Manufacturers can reduce overall costs by streamlining production processes and utilizing more affordable raw materials while maintaining product quality. Technological innovations, such as bioprocessing and eco-friendly alternatives, further enhance efficiency. These factors allow for competitive pricing and meet the growing demand for sustainable agricultural solutions. As a result, companies can expand their market share while promoting environmentally responsible practices.

Type Insights

The anionic segment accounted for a significant revenue share of 28.5% in 2024 and is expected to continue to dominate the industry over the forecast period. This can be attributed to the increasing demand and use of agricultural surfactants. It is less expensive than other types and contains sulfonates, dispersants, sulfate, and carboxylates.

Non-ionic agricultural surfactants are crucial in improving the efficacy of pesticides and herbicides. Unlike their anionic counterparts, non-ionic surfactants do not carry a charge, making them versatile in various formulations. They enhance agrochemicals' spreading, wetting, and penetration, which can lead to better crop protection. Additionally, non-ionic surfactants are generally less sensitive to water quality, allowing them to perform effectively in varying environmental conditions. Their compatibility with various formulations and lower toxicity profiles also contribute to their growing popularity in agricultural practices.

Substrate Insights

Synthetic agricultural surfactants led the market in 2024 as they are specially formulated compounds designed to enhance the effectiveness of crop protection products like pesticides and herbicides. These surfactants modify the surface properties of liquid formulations, improving their spreading and wetting characteristics on plant surfaces. By facilitating better absorption and penetration into plant tissues, synthetic surfactants help ensure that agrochemicals reach their targets more effectively. Additionally, they can be engineered to be compatible with a wide range of formulations, making them versatile options for various agricultural applications. Their tailored properties also allow for improved performance across different environmental conditions.

Bio-based agricultural surfactants are expected to show the highest CAGR over the forecast period. These are derived from natural sources, such as plant oils, sugars, or other renewable materials. Unlike their synthetic counterparts, these surfactants are more environmentally friendly and biodegradable, reducing the risk of long-term soil and water contamination. They improve the effectiveness of crop protection products by enhancing spreading and wetting on plant surfaces, much like synthetic surfactants. Additionally, bio-based surfactants can offer similar performance in absorption and penetration while being compatible with various formulations. Their use supports sustainable agricultural practices and addresses increasing consumer demand for eco-friendly farming solutions.

Crop Type Insights

Cereals and grains led the market in 2024. In cultivating cereals and grains, the product market plays an important role by enhancing the effectiveness of crop protection products. These surfactants improve spray coverage, ensuring that herbicides, fungicides, and insecticides spread evenly across the plant surfaces. This leads to better absorption and penetration of the active ingredients, promoting healthier crops and more effective pest control. Additionally, bio-based surfactants are particularly beneficial, as they are environmentally friendly, biodegradable, and support sustainable agricultural practices, meeting the growing demand for eco-conscious solutions in farming. Their use can ultimately contribute to higher yields and improved crop quality.

The product market plays a significant role in cultivating fruits and vegetables by enhancing the efficacy of crop protection products. They facilitate better coverage of pesticides and fungicides on plant surfaces, ensuring that these solutions spread uniformly and adhere effectively. This improved application leads to better absorption of active ingredients, resulting in stronger plants and more effective pest and disease management. Additionally, bio-based surfactants in this segment support sustainable farming practices, as they are biodegradable and environmentally friendly. Overall, their application contributes to healthier crops and increased fruit and vegetable farming productivity.

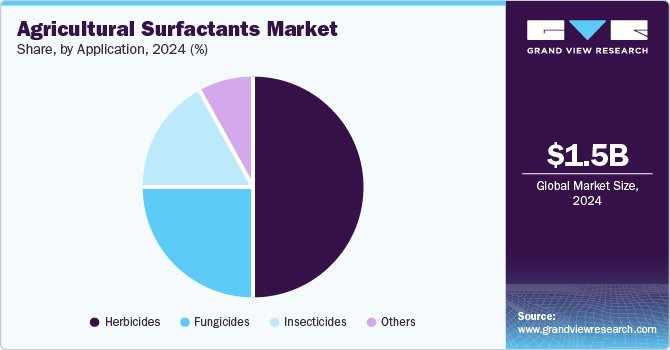

Application Insights

The herbicides segment dominated the market with a share of 49.6% in 2024. Agricultural surfactants play a crucial role in the application of herbicides by enhancing their effectiveness. They improve the spreading and adhesion of herbicides on plant surfaces, ensuring more uniform coverage. This leads to better absorption of active ingredients, resulting in improved weed control. Additionally, surfactants can help reduce the herbicide needed, minimizing environmental impact. Their use supports targeted applications, contributing to more efficient and sustainable farming practices. Overall, they are essential for maximizing the performance of herbicides in crop management.

Agricultural surfactants significantly enhance the effectiveness of insecticides in their application. By improving spreading and adherence on target surfaces, surfactants ensure insecticides distribute more evenly over crops. This results in better coverage and penetration, leading to increased pest absorption of the active ingredients. Moreover, surfactants can help reduce the overall quantity of insecticide required, thus minimizing the potential environmental impact. Their use supports more precise and efficient pest control strategies, ultimately contributing to sustainable agriculture practices.

Regional Insights

North America agricultural surfactants market is growing as the region produces various crops, including specialty crops, vegetables, fruits, oilseeds, and cereals. Agribusinesses and farmers in the region are at the forefront of effective chemical application and employ advanced agricultural techniques.

The agricultural surfactants market in the U.S. is expected to grow. Improving the efficiency of crop safety activities is crucial, especially when dealing with disease challenges and evolving pests. This focus is a key factor driving market growth. Additionally, the United States has a significant trend towards sustainable surfactants and an increasing demand for bio-based products.

Asia Pacific Agricultural Surfactants Market Trends

The agricultural surfactants market in Asia Pacific is expected to show the fastest growth during the forecast period. This is due to several factors, including countries with vast arable lands, rising populations, and a high demand for developed crops. Additionally, rapid industrialization and urbanization are contributing to this growth. Key emerging Asian Pacific countries include India, Japan, China, and Australia.

India agricultural surfactants market is the largest producer of agricultural surfactants, and the pesticide production industry plays a crucial role in ensuring food security and protecting crops. Agricultural surfactants offer a specialized range of products that meet the needs of the Indian pesticide manufacturing sector. These surfactants are produced precisely to ensure compliance with regulations while maintaining high product quality.

Europe Agricultural Surfactants Market Trends

The growing agricultural industry, advancement in farming practices, and increased awareness of healthy eating are some of the major factors driving the demand for agrochemicals in the region. The growing need to improve crop yield and production efficiency drives the market due to the increasing population and diminishing farmlands. This has led to an increase in demand for product markets in the region.

Latin America Agricultural Surfactants Market Trends

The significant growth of the agriculture sector, mainly in Brazil, due to the increasing demand for agrochemicals to enhance the production of Brazilian soybean, is the key driving factor for the growth of the agricultural adjuvants market in Latin America.

Middle East & Africa Agricultural Surfactants Market Trends

The agricultural surfactants market in the Middle East and Africa is expected to grow significantly over the forecast period. The consumption of pesticides is increasing in Saudi Arabia and Oman, and the trend is seen steady for South Africa, Kuwait, and Qatar pesticide consumption. In addition, there is tremendous growth in the consumption of pesticides in Ghana.

Key Agricultural Surfactants Company Insights

Some of the key players operating in the market include Clariant, Dow, and Solvay.

-

Clariant has five business units, including oil and mining services, industrial & consumer specialties, functional minerals, catalysts, and additives. These units are reported in three businesses, namely areas of catalysis, care chemicals, and natural resources. The company offers agricultural adjuvants under the industrial & consumer specialties segment.

-

Dow manufactures agrochemicals, rubber, specialty chemicals, and plastic materials. The company serves its products to several industries, including agricultural, infrastructure, packaging, and consumer care industries, globally. It has a presence in all regions, including North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Its major markets include North America and Asia Pacific. The company had 106 manufacturing sites, 19 manufacturing sites in 10 Asia Pacific countries, 37 sites in 15 Europe, Middle East, Africa, and India (EMEAI) countries, 15 sites in 4 Latin American countries, and 35 manufacturing sites in the U.S. and Canada.

-

The company has expertise in chemicals, materials, and solutions and offers its products and solutions to various industries such as automotive, healthcare, and water treatment, among others. It focuses on developing safer, cleaner, and sustainable solutions. The company has a presence in 64 countries, and its major markets include Asia Pacific, Europe, and North America. As of 2023, it had 45 production sites in 41 countries and 20 major research & innovation centers.

Key Agricultural Surfactants Companies:

The following are the leading companies in the agricultural surfactants market. These companies collectively hold the largest market share and dictate industry trends.

- Clariant

- Evonik Industries AG

- Dow

- DuPont

- Solvay

- Bayer AG

- Nufarm

- Huntsman International LLC

- Croda International Plc

- Helena Agri-Enterprises, LLC

- Stepan Company

- Wilbur-Ellis Holding, Inc.

Recent Developments

-

In July 2024, Bionema Group, specializing in agricultural agrochemicals and biologicals, launched biodegradable surfactants like Soil Jet BSP 100. Bionema focuses on plant health management and crop protection. Soil Jet BSP100 utilizes Polyether-Modified Polysiloxane technology.

-

In October 2023, Nouryon announced the launch of two innovative products at the annual SEPAWA Congress and Exhibition in Germany. The new offerings include Berol Nexxt, which is a next-generation surfactant and multifunctional hydrotrope, and Dissolvine GL Premium, recognized as the industry’s most concentrated GLDA-based chelating agent.

Agricultural Surfactants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.56 billion

Revenue forecast in 2030

USD 2.03 billion

Growth Rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative Units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, substrate, crop type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Australia, Brazil, Argentina, Saudi Arabia, South Africa.

Key companies profiled

Clariant, Evonik Industries AG, Dow, DuPont, Solvay, Bayer AG, Nufarm, Huntsman International LLC, Croda International Plc, Helena Agri-Enterprises, LLC, Stepan Company, Wilbur-Ellis Holding, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agricultural Surfactants Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agricultural surfactants market report on the basis of type, substrate, crop type, application and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Non-ionic

-

Anionic

-

Cationic

-

Amphoteric

-

-

Substrate Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Bio-based

-

-

Crop Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Other Crop Types

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Herbicides

-

Insecticides

-

Fungicides

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global agricultural surfactants market size accounted at USD 1.48 billion in 2024 and is expected to reach USD 1.56 billion in 2025.

b. The global agricultural surfactants market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 2.0 3 billion by 2030.

b. Asia Pacific dominated the agricultural surfactants market with a revenue share of 35.7% in 2024. This is attributed to increasing demand for improved varieties of crops, increasing population, and presence of countries with vast arable lands. The countries such as India, China, and Japan are major contributors.

b. Some of the key players operating in the agricultural surfactants market include Clariant, Evonik Industries, BASF SE, Dow DuPont, Solvay, Bayer AG, Nufarm, Huntsman International LLC, Croda International Plc, Helena Agri-Enterprises, LLC, Stepan Company, Wilbur-Ellis Holdings, Inc, among others.

b. The key factors that are driving the global agricultural surfactants market include increasing demand for crop protection products in the agricultural field across the globe. In addition, increasing adoption of precision farming methods, shrinking arable land and growing food demand globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.