- Home

- »

- Next Generation Technologies

- »

-

Agricultural Robots Market Size, Share & Trends Report 2030GVR Report cover

![Agricultural Robots Market Size, Share & Trends Report]()

Agricultural Robots Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Milking, Planting & Seeding Management), By Type (Dairy Robots, UAVs), By Offering (Hardware, Software), By Regional Outlook, And Segment Forecasts

- Report ID: 978-1-68038-665-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agricultural Robots Market Summary

The global agricultural robots market size was estimated at USD 14.74 billion in 2024 and is projected to reach USD 48.06 billion by 2030, growing at a CAGR of 23.0% from 2025 to 2030. The persistent need for efficient farm management and the increasing global population driving the market. These factors are poised to witness remarkable growth in the coming years.

Key Market Trends & Insights

- The North America agricultural robots market held a significant share of around 36.4% in 2024.

- Based on application, the milking application segment dominated the market with a revenue share of 29.9% in 2024.

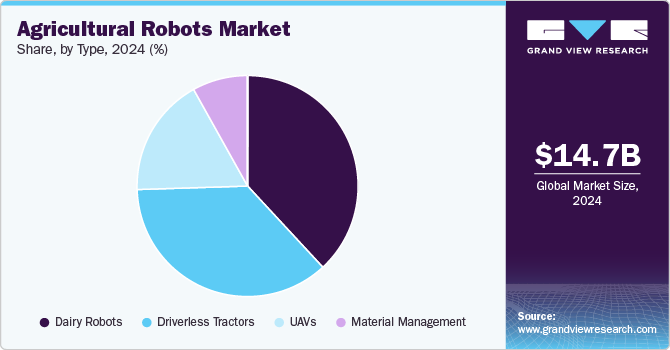

- Based on type, the dairy robots segment dominated the market with a revenue share of 38.1% in 2024.

- Based on offering, the hardware segment dominated the market with a revenue share of 53.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.74 Billion

- 2030 Projected Market Size: USD 48.06 Billion

- CAGR (2025-2030): 23.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These factors are poised to witness remarkable growth in the coming years. As per United Nations projections, the global population is anticipated to grow to 8.6 billion by 2030 and 9.8 billion by 2050. This demographic trend will significantly pressure traditional food production methods to ensure food security.

Agricultural robots and drones are emerging as game-changers, offering precision and optimization capabilities that significantly enhance farming practices. Further, the growing population and migration of young individuals from rural to urban areas has resulted in fewer available farm laborers. To overcome this, agricultural robots are adopted to fill the labor gap by automating tasks and reducing the dependency on manual labor. As the need for cost-effective and efficient labor solutions intensifies, the agricultural robots market is poised to expand significantly.

Agricultural robots, equipped with advanced sensors and AI-driven algorithms, are revolutionizing planting, harvesting, and monitoring crop health. These machines reduce labor costs, minimize resource wastage, and increase yield through precise management. On the other hand, drones provide farmers with real-time aerial views of their fields, allowing for early detection of issues like pests, diseases, or irrigation problems. With the ability to cover vast areas quickly, drones enable farmers to take proactive measures, resulting in higher crop yields. As the global population continues to grow, the demand for efficient and sustainable agriculture will intensify, making agricultural robots and drones indispensable tools for modern farming operations. Their ability to optimize farm management, reduce environmental impact, and boost productivity positions them at the forefront of agricultural innovation, driving substantial growth in this sector.

Furthermore, one notable driver is the increasing adoption of agriculture-based software accessible through smartphones. This digital transformation empowers farmers with real-time data and analytics, enabling them to make data-driven decisions about crop management, resource allocation, and overall farm optimization. The ease of use and accessibility of smartphone-based agricultural apps such as Cropin, Kisan Suvidha, Pusa Krishi, and Panorama are revolutionizing the industry by providing farmers, even in remote areas, with powerful tools to enhance productivity and reduce operational costs.

The adoption of agricultural robots can also contribute to the sustainability of farming practices. These robots are adaptable and can be used in both small-scale and large-scale farming operations, which allows farmers to expand their production capabilities to keep up with the demands of a larger population. For instance, Thorvald, a multi-functional, modular, & autonomous robot developed by Saga Robotics AS, can perform various operations such as precision spraying, livestock handling, UV-C light treatment, phenotyping, picking fruits & vegetables, in-field transportation, and cutting grass for forage, among others. This flexibility allows for cost-effective scalability for farmers of all sizes with diverse needs for their farms.

Application Insights

The milking application segment dominated the market with a revenue share of 29.9% in 2024. This automatic milking machine helps increase the milk yield and reduces workforce costs. Milking robots are designed to provide a comfortable and stress-free milking experience for cows. They use sensors and cameras to detect the presence of milking animals, clean their udders, attach the equipment, and monitor the milking process. This reduces the need for physical contact with the cows and helps minimize stress and discomfort during milking. In addition, agricultural robots can detect and address any health issues or abnormalities in the milk, promoting better cow welfare. This automatic milking machine would help increase the milk yield and reduce workforce costs.

The planting and seeding management application segment is anticipated to portray the highest CAGR of 26.0% over the forecast period. The segmental growth can be attributed to several key factors, such as technological advancements, which have played a crucial role in driving this growth. Agricultural robots have become more capable and efficient with the continuous development of robotics, artificial intelligence, and automation technologies. These advancements have increased the adoption and demand for such robots in farming operations.

Environmental concerns are another factor contributing to the growth of the agricultural robot market. There is a growing awareness of the need for sustainable farming practices and reducing the environmental impact of agriculture. Agricultural robots can help achieve these goals by enabling precise application of inputs, reducing chemical usage, and minimizing soil compaction. By adopting robotic planting and seeding systems, farmers can reduce their environmental footprint and contribute to more sustainable agricultural practices.

Type Insights

The dairy robots segment dominated the market with a revenue share of 38.1% in 2024, driven by the increasing number of dairy farmers worldwide. As the demand for dairy products continues to rise globally, more farmers are entering the dairy industry to meet this growing consumer need. However, this surge in dairy farming has also brought challenges, such as the need for efficient and labor-saving solutions. For instance, in 2021, as per the data published by the International Dairy Federation (IDF), the global dairy sector comprises approximately 133 million dairy farms. Furthermore, the international dairy industry witnesses the annual trade of approximately 9% of global milk production.

The UAV segment is expected to emerge as the fastest segment with a CAGR of over 24.4% over the forecast period. The increasing demand for UAVs in the market is driven by the need for precision agriculture, efficient pest management, and optimized crop spraying. These aerial robots equipped with advanced sensors and imaging capabilities enable farmers to monitor crop health, detect diseases, and assess yield potential, leading to timely action and resource optimization. Additionally, UAVs offer precise pest and weed management, reducing the use of harmful chemicals and promoting sustainable practices.

For instance, as per an industry expert, revealed that roughly 385 million individuals, with a notable concentration within the farming and agricultural labor force, encounter pesticide-related poisoning on an annual basis, resulting in 11,000 fatalities per year. It's noteworthy that among these tragic incidents, India bears the brunt, accounting for nearly 60% of the annual death toll, which amounts to approximately 6,600 deaths each year. The ability to navigate challenging terrains and operate in adverse conditions makes UAVs an ideal solution for crop spraying, especially during resource constraints. Overall, the adoption of UAVs in agriculture is revolutionizing the industry, providing farmers with greater efficiency, improved yields, and a sustainable approach to farming.

Offering Insights

The hardware segment dominated the market with a revenue share of 53.9% in 2024. The hardware segment plays a pivotal role in the agricultural robots market, serving as the backbone of these advanced farming solutions. It encompasses the physical components and machinery such as motors, and batteries that enable robots to perform various tasks in agricultural settings. Another factor contributing to the dominance of the hardware segment is the capital-intensive nature of agriculture robots components. Developing and manufacturing high-quality hardware requires substantial investments in research, development, and production. The hardware components are often complex and require advanced engineering expertise, precision manufacturing processes, and rigorous quality control measures. Consequently, established players such as CLAAS KGaA mbH, GEA Group with the financial resources and technical capabilities to invest in hardware development have a competitive advantage, leading to the dominance of the hardware segment.

The software segment is expected to grow at the fastest CAGR of 28.9% over the forecast period. One of the primary drivers behind the rapid growth of the software segment is the advancements in artificial intelligence (AI) and machine learning (ML) technologies. These technologies have revolutionized the capabilities of agriculture robots, allowing them to analyze vast amounts of data, make real-time decisions, and adapt to changing conditions. Software algorithms enable robots to identify and classify crops, detect diseases and pests, optimize irrigation and fertilization, and even predict crop yields. The integration of AI and ML in agriculture robots has led to increased productivity, resource efficiency, and cost savings, driving the rapid growth of the software segment.

Regional Insights

The North America agricultural robots market held a significant share of around 36.4% in 2024 and has become one of the most influential markets. One significant factor is the vast expanse of farmland in the region. For instance, as per the data published by the United States Agriculture Department in February 2022, the typical farm size for 2021 measured at 445 acres, marking a slight increase from the previous year's figure of 444 acres. North America boasts some of the world’s largest average farmland sizes, which can make manual management and monitoring a highly challenging and resource-intensive task. To address this challenge, North American farmers have been quick to embrace agricultural robots and automation technologies, seeking efficiency gains and improved crop yields.

Moreover, the region benefits from a high level of access to advanced agricultural technologies. North America has a robust ecosystem of tech companies, research institutions, and innovation hubs focused on agriculture. This favorable environment fosters the development and adoption of cutting-edge agricultural robotics solutions. In addition, a strong commitment to sustainable and precision farming practices in North America has driven the demand for precision agriculture tools like autonomous tractors, drones, and robotic harvesters. As a result, North America continues to lead the agricultural robots market in terms of revenue, with its blend of extensive farmland and access to advanced technology driving substantial growth in the sector.

U.S. Agricultural Robots Market Trends

The demand for agricultural robots in the U.S. is experiencing significant growth due to a combination of economic, technological, and environmental factors. One of the primary drivers is the persistent labor shortage faced by the agricultural sector. With fewer individuals willing to take on seasonal farm labor, farmers are increasingly turning to automation solutions to ensure that essential tasks, such as planting, harvesting, and crop monitoring, can be completed efficiently. Additionally, government support for agricultural innovation plays a significant role in fostering the growth of the agricultural robotics market. Various initiatives and funding programs encourage technology adoption in farming, providing financial assistance to farmers seeking to integrate robotics into their operations.

Asia Pacific Agricultural Robots Market Trends

Asia Pacific agricultural robots market is expected to achieve the fastest CAGR of 23.6% during the forecast period in the market. Technological advancements and innovation in countries like Japan, India, and China have led to the development of advanced robotics solutions for the agriculture sector. With a growing population and increasing food security concerns, the need for efficient farming practices is paramount. Agriculture robots offer a solution by automating labor-intensive tasks and improving crop yields. In addition, labor shortages and rising wages in the region make robotics an attractive investment for farmers. Strong government support and a diverse agricultural landscape further contribute to the region's potential for agriculture robot growth.

Bottom of FormKey Agricultural Robots Company Insights

Some key players operating in the market include CNH Industrial N.V., and AGCO Corporation, among others.

-

CNH Industrial N.V. is a multinational corporation engaged in the production and distribution of capital goods, primarily focusing on agriculture and construction equipment. The company operates through several key segments, including agriculture, construction, commercial vehicles, and powertrain. The agriculture segment encompasses the design and manufacturing of various agricultural machinery, such as tractors and combines, marketed under well-known brands like Case IH and New Holland Agriculture. The company's manufacturing footprint is extensive, with facilities located in North America, Europe, South America, and Asia.

DeLaval and Lely are some emerging market participants in the target market.

-

DeLaval is an emerging player specializing in dairy farming equipment and solutions. DeLaval offers a comprehensive range of dairy farming solutions, including milking equipment, farm management systems, cow comfort products, and feeding solutions. Key product categories include milking machines, cooling and storage systems, and herd management technologies like the DeLaval DelPro. The company focuses on enhancing milk production, animal welfare, and operational efficiency for dairy farmers.

Key Agricultural Robots Companies:

The following are the leading companies in the agricultural robots market. These companies collectively hold the largest market share and dictate industry trends.

- AGCO Corporation

- Autonomous Solutions, Inc.

- BouMatic

- CNH Industrial N.V.

- CLAAS KGaA mbH

- GEA Group Aktiengesellschaft

- Harvest Automation, Inc.

- Trimble, Inc.

- Agrobot

- Lely

- DeLaval

Recent Developments

-

In February 2024, CNH Industrial N.V. announced that it had invested in Bem Agro, a Brazilian startup specializing in AI-driven agronomic mapping solutions. This investment aims to enhance the company's agricultural technology offerings, specifically in precision farming, by utilizing Bem Agro's aerial imaging capabilities to improve crop management, reduce herbicide use, and optimize resource allocation.

-

In April 2023, GEA Group Aktiengesellschaft strengthened its collaboration with Kerbl, a supplier of livestock farming products. This partnership aims to enhance the company’s market presence through the GEA Exclusive Program, which facilitates entry into new countries. By leveraging Kerbl's expertise and distribution network, GEA Group Aktiengesellschaft seeks to expand its agricultural solutions and support livestock farmers with innovative technologies.

Agricultural Robots Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 17.09 billion

Revenue Forecast in 2030

USD 48.06 billion

Growth rate

CAGR of 23.0% from 2025 to 2030

Actual data

2017 - 2024

Forecast Period

2025 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Application, type, offering, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key Companies Profiled

AGCO Corporation; Autonomous Solutions, Inc.; BouMatic; CNH Industrial N.V.; CLAAS KGaA mbH; GEA Group Aktiengesellschaft; Harvest Automation, Inc.; Trimble, Inc.; Agrobot, Lely; DeLaval

Customization Scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agricultural Robots Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segments and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global agricultural robots market based on application, type, offering, and region.

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Planting & Seeding Management

-

Spraying Management

-

Milking

-

Monitoring & Surveillance

-

Harvest Management

-

Livestock Monitoring

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Driverless Tractors

-

UAVs

-

Dairy Robots

-

Material Management

-

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Service

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global agricultural robots market size was estimated at USD 14.74 billion in 2024 and is expected to reach USD 17.09 billion in 2025.

b. The global agricultural robots market is expected to grow at a compound annual growth rate of 23.0% from 2025 to 2030 to reach USD 48.06 billion by 2030.

b. In the application segment, the milking sub-segment accounted for the largest market share of 29.9% in 2023. Robotic milking systems reduce labor costs, improve milk yield, and enhance animal welfare by automating repetitive tasks. Additionally, the increasing adoption of precision agriculture technologies, coupled with the labor shortage in agriculture, has driven the demand for milking robots

b. Some key players operating in the agricultural robot market include AGCO Corporation, Autonomous Solutions, Inc., BouMatic, CNH Industrial N.V., CLAAS KGaA mbH, GEA Group Aktiengesellschaft, Harvest Automation, Inc., Trimble, Inc., Agrobot, Lely, and DeLaval.

b. Key factors that are driving the market growth include increasing use of precision agriculture practices among farmers to make better decisions on fertilizing, planting, and harvesting crops.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.