- Home

- »

- Agrochemicals

- »

-

Agricultural Microbials Market Size, Industry Report, 2030GVR Report cover

![Agricultural Microbials Market Size, Share & Trends Report]()

Agricultural Microbials Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Bacteria, Fungi), By Formulation (Liquid, Dry), By Application (Foliar, Soil), By Crop Type (Cereals & Grains, Oilseeds & Pulses), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-146-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agricultural Microbials Market Summary

The global agricultural microbials market size was estimated at USD 6.63 billion in 2022 and is projected to reach USD 19.12 billion by 2030, growing at a CAGR of 14.2% from 2023 to 2030. This growth can be attributed to growing consumer preference for organic food products, gradual phase-out of key active ingredients, residue levels of food, pest resistance, and increased need for agricultural sustainability.

Key Market Trends & Insights

- The North America accounted for the largest revenue share of 38.4% in 2022.

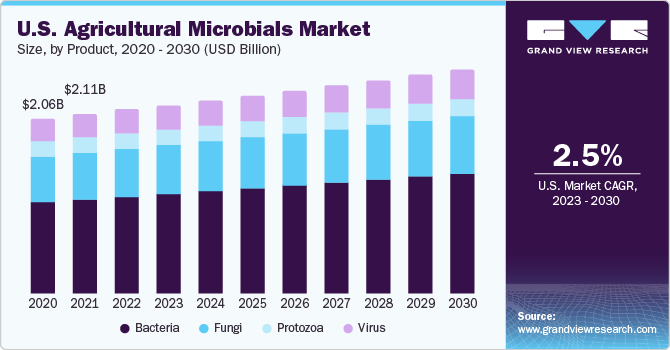

- Based on product, the bacteria segment accounted for the largest revenue share of 52.8% in 2022.

- Based on crop type, the cereals & grains segment accounted for the largest revenue share of 39.9% in 2022.

- Based on application, the foliar segment accounted for a significant market share of 45.8% in 2022.

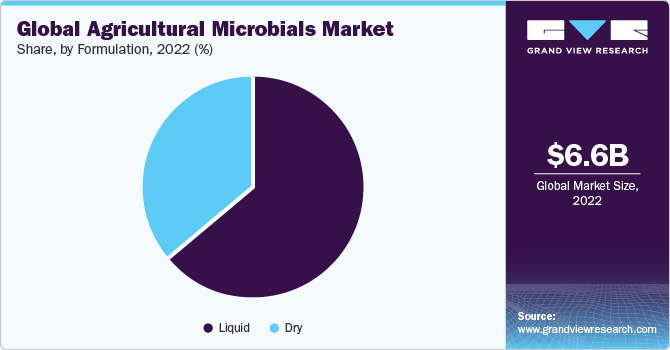

- Based on formulation, the liquid segment of the agricultural microbials market accounted for the largest revenue share of 64.5% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 6.63 Billion

- 2030 Projected Market Size: USD 19.12 billion

- CAGR (2023 to 2030): 14.2%

- North America: Largest market in 2022

Agricultural microbials refer to microorganisms that are used in agriculture to enhance plant growth, improve soil fertility, and protect crops from pests and diseases. These microorganisms can include bacteria, fungi, and other microbes. The use of agricultural microbials is part of a sustainable and environment-friendly approach to farming, often referred to as bio-control or bio-fertilization.

The use of agricultural microbials is seen as an eco-friendly alternative to chemical fertilizers and pesticides. It can contribute to sustainable agriculture by improving soil health, reducing the reliance on synthetic inputs, and minimizing environmental impact. Education and outreach to farmers are crucial for the effective adoption of these microbial-based solutions in agriculture. The use of synthetic chemicals becomes ineffective as they develop pest resistance. Agricultural microbials are practical and quick to decompose even when applied in small quantities, which leads to lower exposure and prevents the environmental problems created by synthetic chemicals.

Product Insights

Based on product, the bacteria segment accounted for the largest revenue share of 52.8% in 2022. This is attributed to its wide utilization in the formulation of bio-pesticides, bio-fertilizers, and bio-stimulants. Bacteria perform several growth-promoting functions such as overcoming root-fungus disease. There are different bacteria strains available in abundance in the environment and also found in the soil. The market is expected to witness increased utilization of fungi due to increasing germination, seedling vigor, yield, and flowering. They can form symbiotic associations with plant roots, enhancing nutrient uptake. Certain fungi act as bio-control agents, suppressing plant pathogens and enhancing soil health. Moreover, fungi contribute to organic matter decomposition, cycling nutrients in the ecosystem.

In precision agriculture, certain viruses are used as bio-pesticides, targeting specific pests and minimizing environmental impact. This approach offers a targeted and environment-friendly method of pest control in crop management systems. Viruses can be engineered or selected for their ability to infect specific pests, leading to reduced pest populations. Furthermore, researchers also continue to explore and develop new virus-based solutions to enhance their practicality in agriculture.

Crop Type Insights

The cereals & grains segment accounted for the largest revenue share of 39.9% in 2022. This can be attributed to improved nutrient availability, enhanced plant growth, disease suppression, and overall sustainable agricultural practices. They can stimulate the growth of cereals & grains by producing growth hormones, enhancing nutrient uptake, and improving root architecture. This can lead to increased crop yields and improved plant resilience. Certain microorganisms act as bio-pesticides, protecting against insect pests that can affect cereals & grains. For example, the bacterium Bacillus thuringiensis (Bt) produces toxins lethal to certain pests, and its incorporation can reduce the need for chemical pesticides.

The demand for high-value crops such as fruits and vegetables is rising globally due to the high remuneration factors associated with such crops. Agricultural microbials help in providing essential nutrients to these crops. The surging demand for organic fruits and vegetables is likely to promote the utilization of microbials for their cultivation. Microbials play a key role in breaking down organic matter and releasing nutrients. This decomposition process contributes to improving nutrient availability in the soil, benefiting the growth of the plants. Some microbial inoculants can enhance the stress tolerance of oilseeds and pulses, helping them withstand environmental challenges such as drought or salinity. This is particularly important for crops grown in regions with varying climatic conditions. They can be applied as seed coatings or soil amendments during planting. This ensures that the beneficial microorganisms are near the emerging roots, maximizing their impact on early plant growth and development.

Application Insights

Based on application, the foliar segment accounted for a significant market share of 45.8% in 2022. The nutrient uptake is faster in the foliar spray technique as the foliage rapidly absorbs the nutrients, providing essential nutrients to the crops. This technique is easy to apply and acts as a prompt correction treatment for deficiencies and diseases in plants. The microbials are used in soil for enhancement of plant growth, improved nutrient availability, and promote overall soil health. Microbes can solubilize minerals and convert organic matter into forms that are more readily available to plants. This process increases the availability of nutrients like potassium, iron, and calcium. Certain microorganisms have the ability to degrade pollutants and contaminants in the soil, a process known as bio-remediation.

The use of agricultural microbials can contribute to sustainable agriculture by reducing the need for synthetic fertilizers and pesticides. This, in turn, can have positive effects on the environment and human health. Incorporating agricultural microbials into soil management practices can contribute to sustainable and environment-friendly agricultural systems by promoting soil health, improving crop yields, and reducing the reliance on chemical inputs.

Formulation Insights

Based on formulation, the liquid segment of the agricultural microbials market accounted for the largest revenue share of 64.5% in 2022. This can be attributed to the ease of their application as compared to the dry forms. This is because they are directly used by drenches, sprays, and root dips. Furthermore, they do not require any additional procedures, such as mixing, which helps avoid spoilage and wastage of the product.

Liquid formulation often enhances soil fertility, promotes plant growth, and may act as bio-pesticides. It allows for its application through irrigation systems or foliar spraying, ensuring efficient distribution in the field. It enables even distribution of microbial agents across the field, ensuring uniform coverage and consistent benefits to crops. Liquids are absorbed more rapidly by plants and soil, leading to quicker activation of microbial activity and faster response in terms of plant growth or disease control.

Dry formulations on the other hand, often have a longer shelf life compared to liquid counterparts. The absence of water helps to preserve the viability of the microorganisms for extended periods. They are generally more compact and lightweight, making them easier to store, handle, and transport. This can reduce logistical challenges and costs. Additionally, dry form can be more cost-effective in terms of production, packaging, and transportation, contributing to overall economic benefits for both manufacturers and farmers.

Regional Insights

North America accounted for the largest revenue share of 38.4% in 2022. This is attributed to the increasing awareness about the benefits of using microbial in agriculture over synthetic chemicals. Moreover, the rising environment-friendly and organic farming practices drive market growth across the region. Whereas, Central & South America is expected to emerge as one of the fastest-growing regions as farmers have started to replace chemical fertilizers with microbials. The high profitability of organic farming and the increasing support from government and non-government organizations are expected to fuel market growth in the coming years.

Asia Pacific region is expected to witness significant growth in the agricultural microbial sector because it is the largest producer of organic products, with China and India being the key organic crop-producing countries in the region. In Europe, the expanding organic crop areas and the rising demand for organic products and biological fertilizers lower the overall chemical fertilizer usage and crop production costs. The governments' efforts to encourage organic farming are expected to drive the global agricultural biologicals market over the forecast period.

Key Companies & Market Share Insights

The agricultural microbials industry is moderately fragmented with the presence of small and large players in the market. Market players invest in innovation, product launches, mergers, and acquisitions to improve their market share and gain a competitive edge. For instance, in September 2022, Corteva Agriscience acquired Symborg Inc., with an aim to strengthen Symborg's global presence with a strong distribution network.

Key Agricultural Microbials Companies:

- Certis

- Marrone Bio Innovations, Inc.

- BASF SE

- Novozymes

- Sumitomo Chemical Co. Ltd.

- Koppert Biological Systems

- Andermatt Biocontrol AG

- Corteva Agriscience

- FMC Corporation

Agricultural Microbials Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.54 billion

Revenue forecast in 2030

USD 19.12 billion

Growth rate

CAGR of 14.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, formulation, crop type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Certis; Marrone Bio Innovations, Inc.; BASF SE; Novozymes; Sumitomo Chemical Co. Ltd.; Koppert Biological Systems; Andermatt Biocontrol AG; Corteva Agriscience; FMC Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agricultural Microbials Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agricultural microbials market report based on product, formulation, crop type, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bacteria

-

Fungi

-

Protozoa

-

Virus

-

-

Formulation Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Dry

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Foliar

-

Soil

-

Seed

-

Others

-

-

Crop Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global agricultural microbials market size was estimated at USD 6.63 billion in 2022 and is expected to reach USD 7.54 billion in 2023

b. The global agricultural microbials market is expected to grow at a compound annual growth rate of 14.2% from 2023 to 2030 to reach USD 19.12 billion by 2030.

b. North America dominated the agricultural microbials market with a share of 38.4% in 2022. This is attributable to increasing awareness about the benefits of using microbial in agriculture over synthetic chemicals

b. Some key players operating in the agricultural microbials market include Certis, Marrone Bio Innovations, Inc., BASF SE, Novozymes, Sumitomo Chemical Co. Ltd., Koppert Biological Systems, Andermatt Biocontrol AG, Corteva Agriscience, FMC Corporation

b. Key factors that are driving the market growth include sustainable agriculture by improving soil health, reducing the reliance on synthetic inputs, and minimizing environmental impact.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.