Agricultural Lubricants Market Size, Share & Trends Analysis Report By Product (Engine Oil, Transmission Oil, Hydraulic Fluid, Grease), By Region (APAC, North America, Europe), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-516-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Agricultural Lubricants Market Size & Trends

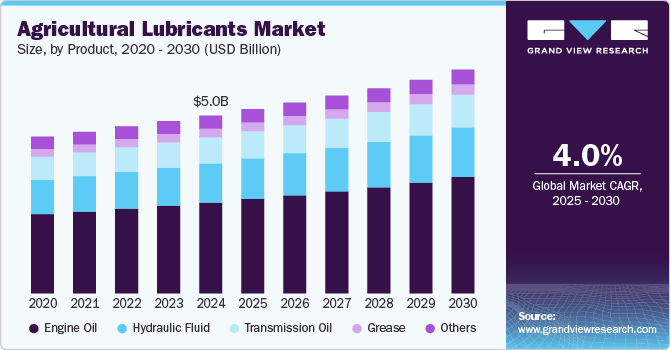

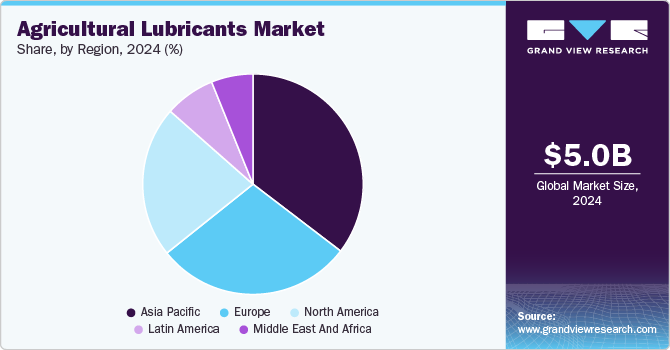

The global agricultural lubricants market size was estimated at USD 5.03 billion in 2024 and is projected to grow at a CAGR of 4.0% from 2025 to 2030. The growing demand for agricultural machinery and equipment, driven by the increasing need to improve farming productivity, proliferates the market. As farms become more mechanized, using high-performance lubricants in tractors, harvesters, and other equipment has become essential for ensuring smooth operation, reducing wear and tear, and enhancing fuel efficiency. This has led to a higher demand for specialized products tailored to the needs of agricultural machinery, fueling market growth.

Farmers and agricultural businesses increasingly adopt lubricants that meet high-performance standards and align with sustainability goals. Biodegradable and eco-friendly oils are gaining popularity as they reduce the environmental impact of farming operations. As concerns about soil and water contamination increase, the demand for such lubricants is expected to grow, contributing to the overall expansion of the agricultural lubricants market.

The advancement of technology in the farming sector also plays a pivotal role in the market's growth. Introducing precision and smart farming technologies has led to the development of more advanced and specialized machinery. These technologies require lubricants that offer superior performance, high resistance to extreme operating conditions, and long-lasting protection against rust and corrosion. As these technologies evolve, the need for high-quality, tailored lubricants designed to optimize equipment efficiency and longevity which is driving the market forward.

Furthermore, the growth of large-scale commercial farming and agribusinesses is accelerating the demand for the market. More extensive operations, with their expansive fleets of tractors, plows, harvesters, and irrigation systems, require consistent and reliable lubrication to maintain optimal performance. These businesses recognize the importance of reducing maintenance costs and downtime, which drives them to invest in premium lubricants that offer long-term reliability. The increasing adoption of automated farming equipment and the shift towards more extensive, complex machinery only heightens the need for specialized lubrication solutions.

Drivers, Opportunities & Restraints

The increasing demand for enhanced efficiency and productivity in agriculture primarily drives the market. As modern farming techniques evolve, there is a growing need for high-performance lubricants that can ensure the smooth operation of machinery, reduce downtime, and improve the longevity of agricultural equipment. Tractors, harvesters, plows, and other farm machinery require specialized lubricants to perform optimally under harsh working conditions. This has led to an increased adoption of advanced lubricants that can withstand extreme temperatures, moisture, and heavy workloads, thus driving the market's growth.

In addition to the technological advancements in farming machinery, the rise of precision farming and the growing focus on sustainable agricultural practices present significant opportunities for the market. Precision farming relies heavily on automated and technologically advanced equipment, such as GPS-guided tractors and drones, which require high-quality lubricants for smooth operation. As farmers look to reduce their environmental footprint and improve resource efficiency, demand for eco-friendly, biodegradable, and low-emission lubricants is rising. This trend presents an opportunity for lubricant manufacturers to develop new products that align with the growing emphasis on sustainability within the agricultural sector.

Despite the opportunities, several restraints could hinder the growth of the agricultural lubricants market. One of the primary challenges is the fluctuating prices of raw materials, such as base oils and additives, which can impact production costs. Additionally, the growing preference for synthetic lubricants over traditional mineral oils may require manufacturers to invest heavily in research and development to meet evolving customer demands. Furthermore, in particular developing regions, the lack of awareness about the benefits of specialized lubricants and limited access to high-quality products may slow market adoption. These factors could restrict the growth potential of the agricultural lubricants market in some areas.

Product Insights

Engine oil dominated the market with a market share of 51.1% in 2024. Tractors, harvesters, and other agricultural machinery require lubricants that ensure optimal engine performance, reduce wear and tear, and enhance fuel efficiency. As agricultural machinery becomes more sophisticated with advanced technologies, engine oils are being specifically formulated to meet the needs of these high-performance engines, contributing to the segment's growth.

Hydraulic fluid is anticipated to grow significantly over the forecast period. Hydraulic systems are crucial in modern agricultural equipment such as tractors, combines, plows, and forklifts, as they transmit power to various machine components. With the growing mechanization of agriculture and the need for more efficient, reliable equipment, the demand for high-quality hydraulic fluids has surged. These fluids are essential for maintaining the smooth operation of hydraulic systems, ensuring they work efficiently under heavy loads and harsh environmental conditions.

Regional Insights

North America agricultural lubricants market growth is primarily driven by increasing demand for advanced farming equipment. As farmers in the region adopt larger, more complex machinery for better efficiency and productivity, the need for specialized lubricants to ensure optimal performance is rising. Modern equipment, such as tractors, harvesters, and irrigation systems, requires high-performance oils and greases to function effectively, particularly under the intense conditions they face.

U.S. Agricultural Lubricants Market Trends

With the rising demand for efficiency and higher crop yields, U.S. farmers increasingly rely on advanced machinery such as tractors, harvesters, and irrigation systems. These machines require specialized lubricants to ensure smooth operation, reduce friction, and extend equipment life. As more agricultural equipment is adopted, the need for high-performance lubricants that enhance machinery durability has surged, contributing to market growth.

Asia Pacific Agricultural Lubricants Market Trends

The Asia Pacific region accounted for the largest market revenue share, 35.4%, in 2024. Asia Pacific is home to some of the world's largest agricultural economies, such as China, India, and Indonesia, where the demand for agricultural products is consistently high. As these countries aim to improve food security and increase crop yields, advanced agricultural machinery is essential. This drives the need for specialized lubricants that enhances the performance and longevity of agricultural equipment, ensuring that they operate efficiently under the intense demands of farming.

Europe Agricultural Lubricants Market Trends

Europe has long been a leader in agricultural innovation, and the increasing mechanization of farming practices continues to drive demand for the market. As European farmers adopt more automated machinery, such as tractors, harvesters, and other equipment, the need for high-quality lubricants to enhance performance, reduce wear, and extend equipment lifespan becomes more crucial. This demand is particularly pronounced in countries with large agricultural sectors, such as France, Germany, and Italy, where machinery maintains high productivity levels.

Latin America Agricultural Lubricants Market Trends

Latin America is anticipated to grow significantly over the forecast period. As agricultural operations in Latin America grow larger and more technologically advanced, the need for specialized lubricants to handle the rigorous demands of modern farming machinery becomes more critical. Mechanized farming has become crucial to meet the region's growing production demands, and farmers rely on equipment to work effectively across large tracts of land. Lubricants prevent wear and tear on machinery components, reduce fuel consumption, and minimize maintenance costs.

Middle East & Africa Agricultural Lubricants Market Trends

The Middle East and African market is expected to grow significantly over the forecast period. With rapid population growth and a growing middle class, particularly in countries such as Saudi Arabia and South Africa, there is a greater emphasis on boosting agricultural productivity. Governments and farmers are investing in modern farming equipment and technologies to meet food demand. This increased mechanization of agriculture necessitates using high-performance lubricants to ensure the smooth operation and longevity of farming machinery, thereby driving the demand for agricultural lubricants in the region.

Key Agricultural Lubricants Company Insights

Some of the key players operating in the market include BP p.l.c., Chevron Corporation, and others.

-

BP p.l.c. is a British multinational oil and gas company and is one of the world’s largest companies, operating in all areas of the industry, including exploration, production, refining, distribution, and marketing. BP offers a range of products and services across various sectors. BP’s agricultural lubricants include high-performance oils that meet the specific requirements of modern farming equipment, ensuring optimal efficiency while contributing to environmental sustainability through reduced emissions.

-

Chevron Corporation is a leading global integrated energy company recognized as the second-largest integrated energy company in the United States. It operates across various segments of the energy sector, including exploration, production, refining, and marketing of oil and natural gas. Chevron produces various finished and base oils for multiple industries. This includes premium products marketed under well-known brands such as Havoline and Delo. These products are designed to improve or maintain fuel economy across different applications.

Key Agricultural Lubricants Companies:

The following are the leading companies in the agricultural lubricants market. These companies collectively hold the largest market share and dictate industry trends.

- BP p.l.c.

- Chevron Corporation

- CLASS KGaA mbH

- CONDAT

- Cougar Lubricants International Ltd.

- Exol Lubricants Limited

- Exxon Mobil Corporation

- FRONTIER PERFORMANCE LUBRICANTS, INC.

- Fuchs

- Gulf Oil International Ltd.

Agricultural Lubricants Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.22 billion |

|

Revenue forecast in 2030 |

USD 6.33 billion |

|

Growth rate |

CAGR of 4.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative Units |

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; Argentina; Saudi Arabia; and South Africa. |

|

Key companies profiled |

BP p.l.c.; Chevron Corporation; CLASS KGaA mbH; CONDAT; Cougar Lubricants International Ltd.; Exol Lubricants Limited; Exxon Mobil Corporation; FRONTIER PERFORMANCE LUBRICANTS, INC.; Fuchs; Gulf Oil International Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Agricultural Lubricants Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global agricultural lubricants market report by product, and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Engine Oil

-

Transmission Oil

-

Hydraulic Fluid

-

Grease

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global agricultural lubricants market size was estimated at USD 5.03 billion in 2024 and is expected to reach USD 5.22 million in 2025.

b. The global agricultural lubricants market is expected to grow at a compound annual growth rate of 4.0% from 2025 to 2030, reaching USD 6.33 million by 2030.

b. Engine Oil accounted for the largest revenue share, 51.1%, in the agricultural lubricants market in 2024 due to its importance in maintaining the performance and longevity of farming machinery, such as tractors and harvesters.

b. Some of the key players operating in the agricultural lubricants market include BP p.l.c.; Chevron Corporation; CLASS KGaA mbH; CONDAT; Cougar Lubricants International Ltd.; Exol Lubricants Limited; Exxon Mobil Corporation, among others.

b. The key factors driving the agricultural lubricants market include the increasing mechanization of farming, which leads to higher demand for machinery and, consequently, lubricants to maintain optimal performance, and the rising focus on sustainability and efficiency in agriculture.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."