Agricultural Films And Bonding Market Size, Share & Trends Analysis Report By Raw Material (Agricultural Films (LDPE), Twine (Sisal, Polypropylene), Netting), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-994-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

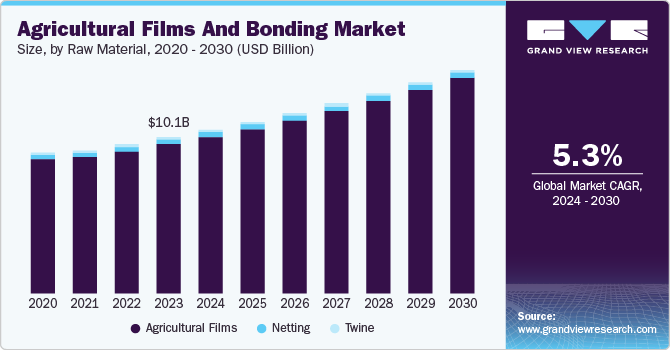

The global agricultural films and bonding market size was valued at USD 10.13 billion in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. The increasing preference for sustainable agricultural methods in various nations has stimulated the demand for agricultural films and bonding. Additionally, the rising need for enhanced crop efficiency and raw materials is anticipated to propel global consumption. Advancements in film materials, particularly in terms of durability and environmental sustainability, are further broadening the market. Moreover, the market is receiving a boost from supportive government policies and growing investments in contemporary agricultural practices, leading to increased adoption of agricultural film and bonding solutions.

The projected increase in global population and subsequent demand for greater agricultural productivity are expected to be key drivers of market growth. With ongoing urbanization and population expansion, there is a heightened need for increased food production, compelling farmers to embrace advanced technologies and solutions such as agricultural films and bonding. These innovations play a crucial role in optimizing crop yields by enabling better control over growth conditions, pest management, and soil health, essential for meeting the escalating food demands of a burgeoning global population.

Moreover, the growing focus on environmental sustainability is poised to fuel market expansion. Both consumers and industries are placing greater emphasis on eco-friendly practices, spurring the development and adoption of sustainable and recyclable agricultural films. This shift towards more environmentally conscious methods not only aids in reducing the agricultural and environmental footprint but also aligns with global trends in environmental stewardship and conservation. Consequently, there is heightened interest in film and bonding solutions that deliver superior performance with minimal environmental impact, further propelling growth in the sector.

Raw Material Insights

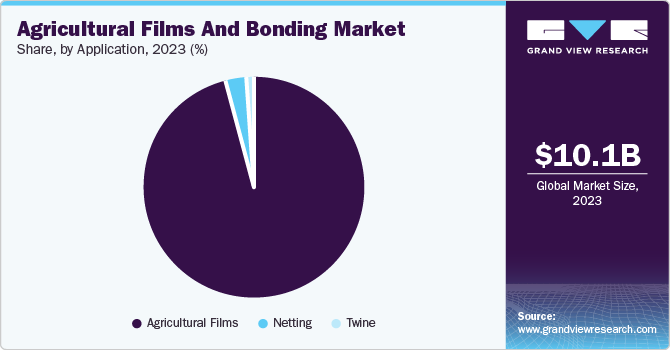

Agricultural films dominated the market with a revenue share of 95.7% in 2023 attributed to their extensive application in various agricultural practices, including mulching, greenhouse covering, and silage. These films are crucial for enhancing crop yield and quality by providing better control over environmental conditions such as temperature, humidity, and light. They also play a significant role in weed control, soil moisture retention, and protection against pests and diseases. The high adoption rate of agricultural films is driven by their proven effectiveness in improving agricultural productivity and efficiency. Additionally, advancements in film technologies, such as the development of biodegradable and UV-resistant films, have further boosted their popularity. These innovations not only enhance the performance of agricultural films but also address environmental concerns, making them a preferred choice among farmers and agricultural businesses.

The twine segment is expected to grow at a compound annual growth rate CAGR of 3.9% during the forecast period. Twine is primarily used for binding and securing crops, such as hay, straw, and silage, making it an essential component in agricultural operations. The growth in this segment can be attributed to the increasing mechanization of farming practices, which necessitates the use of durable and reliable binding materials. Furthermore, the rising demand for high-quality forage and the need for efficient storage and transportation solutions are driving the adoption of agricultural twine. Innovations in twine materials, such as the development of stronger and more weather-resistant products, are also contributing to the segment’s growth. As farmers continue to seek ways to optimize their operations and reduce labor costs, the demand for high-performance twine is expected to rise, supporting the overall expansion of the agricultural films and bonding market.

Application Insights

The agricultural films segment dominated the market in 2023. These films are extensively used for various applications such as mulching, greenhouse covering, and silage wrapping. Mulching films help in controlling weeds, retaining soil moisture, and maintaining soil temperature, which collectively enhances crop yield and quality. Greenhouse films provide a controlled environment for plant growth by regulating temperature, light, and humidity, thus extending the growing season and improving productivity. Silage films are essential for preserving forage quality by protecting it from external elements and reducing spoilage. The dominance of this segment is further bolstered by continuous innovations in film technology, including the development of biodegradable and UV-resistant films, which address environmental concerns and improve performance.

The twine segment is projected to grow at a CAGR of 3.9% over the forecast period. The growth in this segment is driven by the increasing mechanization of farming practices, which requires durable and reliable binding materials. The demand for high-quality forage and the need for efficient storage and transportation solutions are also contributing to the rising adoption of agricultural twine. Innovations in twine materials, such as the development of stronger and more weather-resistant products, are enhancing their utility and performance. As farmers continue to seek ways to optimize their operations and reduce labor costs, the demand for high-performance twine is expected to increase, supporting the overall growth of the agricultural films and bonding market.

Regional Insights

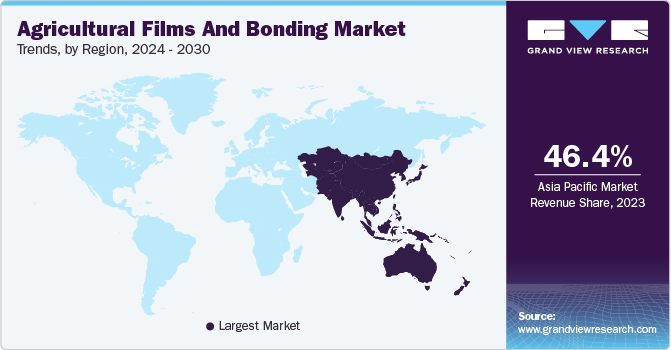

The agricultural films and bonding market in North America is anticipated to witness significant growth due to the region’s emphasis on technological advances and precision agricultural practices aimed at increasing yields. Additionally, investment in sustainable environmental management leads to the adoption of quality agricultural films and binding solutions. Furthermore, supportive government policies to modernize agricultural activities contribute to the expansion of this market.

Asia Pacific Agricultural Films And Bonding Market Trends

Asia Pacific agricultural films and bonding dominated the market with a revenue share of 46.4% in 2023 due to its huge and rapidly growing agricultural industry, which is driving the demand for more advanced agricultural solutions. The region’s focus on increasing yields and improving resource efficiency, coupled with supportive government policies and investments in agricultural technology, has led to the uptake of agricultural films and bonding. Furthermore, increasing emphasis on sustainable and innovative agricultural practices in Asia Pacific is fueling the growth of the market.

The China agricultural films and bonding market dominated in Asia Pacific with a share of 45.5% in 2023 due to its extensive agricultural industry and rapid adoption of advanced agricultural technologies. The country’s focus on increasing agricultural productivity and efficiency, along with major investments in modern agricultural practices, has led to a demand for new agricultural films and bonding solutions.

Europe Agricultural Films And Bonding Market Trends

Europe agricultural films and bonding market grew high in 2023. This is attributable to a strong focus on sustainable farming practices and legal support for environmental protection. Advanced agricultural technologies and the increasing adoption of high-performance films to improve crop yields and resource utilization also expand the market growth. Furthermore, agricultural policies and investments are targeted to provide modernization of agricultural techniques and provision of environmentally friendly solutions contributing to the strong growth of this market segment.

The UK agricultural films and bonding market is expected to grow higher in the coming years due to investments in advanced agricultural technologies aimed at improving crop yields and resource use efficiency. The country’s emphasis on sustainable agricultural practices and stringent environmental regulations is driving the adoption of high-performance agricultural films and bonding solutions. Additionally, government incentives and support for innovative farming methods are further accelerating the growth of the agricultural films and bonding market in the UK.

Key Agricultural Films And Bonding Company Insights

Some key companies in the global agricultural films and bonding market include Dow, BASF, Exxon Mobil Corporation, Berry Global Inc., KURARAY CO., LTD, and others. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Dow, a materials science company, offers a range of high-performance agricultural films designed to enhance crop yields and resource efficiency, alongside advanced bonding solutions that support sustainable farming practices and improve overall agricultural productivity.

-

BASF is a chemical company that provides advanced agricultural films that enhance crop protection and efficiency, as well as innovative bonding solutions designed to support sustainable farming practices and improve overall agricultural productivity.

Key Agricultural Films And Bonding Companies:

The following are the leading companies in the agricultural films and bonding market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- BASF

- Exxon Mobil Corporation

- Berry Global Inc.

- KURARAY CO., LTD

- Novamont S.p.A.

- RKW Group

- Ginegar Plastic Products Ltd.

- Essen Multipack Limited

- MONO INDUSTRIES

- BAGHBAAN VINIMAY PVT. LTD

- Shivam Polymers

- AEP Company.

- Al-Pack

Recent Developments

-

In July 2024, Revolution Sustainable Solutions announced the acquisition of Norflex, a manufacturer of agricultural and industrial films. This strategic move reinforces the company's commitment to expanding its sustainable stretch and shrinking its film portfolio while significantly enhancing its offerings within the sustainable agriculture sector.

-

In July 2024, BASF introduced Tinuvin NOR 211 AR to address the challenges faced by global film producers and converters in the plasticulture sector. This innovative, high-performance heat and light stabilizer is designed to extend the service life of agricultural plastics exposed to harsh conditions, including elevated levels of inorganic chemicals such as sulfur and chlorine.

Agricultural Films And Bonding Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 10.63 billion |

|

Revenue forecast in 2030 |

USD 14.52 billion |

|

Growth rate |

CAGR of 5.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Raw Material, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, India, Japan, Australia, South Korea, Indonesia, Vietnam, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Dow, BASF, Exxon Mobil Corporation, Berry Global Inc., KURARAY CO., LTD, Novamont S.p.A., RKW Group, Ginegar Plastic Products Ltd., Essen Multipack Limited, MONO INDUSTRIES, BAGHBAAN VINIMAY PVT. LTD, Shivam Polymers, AEP Company., Al-Pack |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Agricultural Films And Bonding Market Report Segmentation

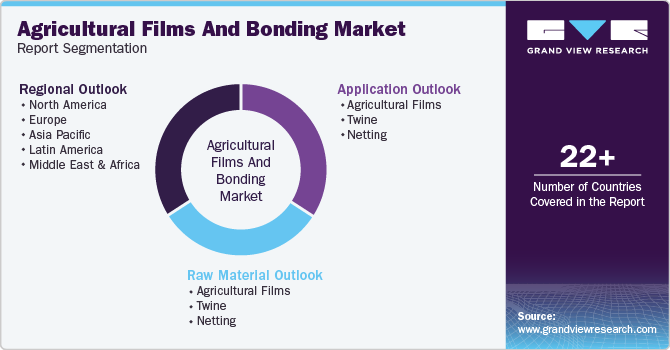

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agricultural films and bonding market report based on raw material, application, and region:

-

Raw Material Outlook (Revenue, USD Million, Volume In Kilotons, 2018 - 2030)

-

Agricultural Films

-

LDPE

-

Others

-

-

Twine

-

Sisal

-

Polypropylene

-

LDPE

-

Others

-

-

Netting

-

HDPE

-

LDPE

-

Polypropylene

-

Others

-

-

-

Application Outlook (Revenue, USD Million, Volume In Kilotons, 2018 - 2030)

-

Agricultural Films

-

Greenhouse

-

Mulching

-

Silage

-

Stretch Wrap

-

Bags

-

Sheets

-

-

-

Twine

-

Vegetable Packing

-

Fruit Packing

-

Bale

-

Others

-

-

Netting

-

Shade

-

Anti-hail

-

Anti-insect

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, Volume In Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."