- Home

- »

- Catalysts & Enzymes

- »

-

Agricultural Enzymes Market Size And Share Report, 2030GVR Report cover

![Agricultural Enzymes Market Size, Share & Trends Report]()

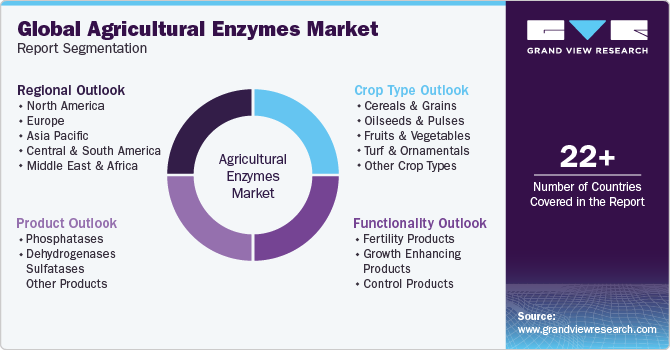

Agricultural Enzymes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Phosphatases, Dehydrogenase, Sulfatases), By Crop Type, By Functionality, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-533-5

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agricultural Enzymes Market Size & Trends

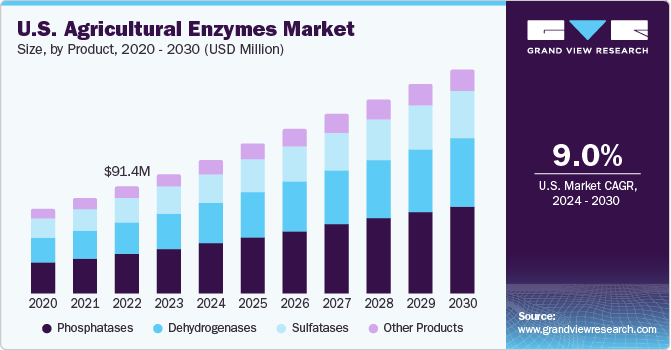

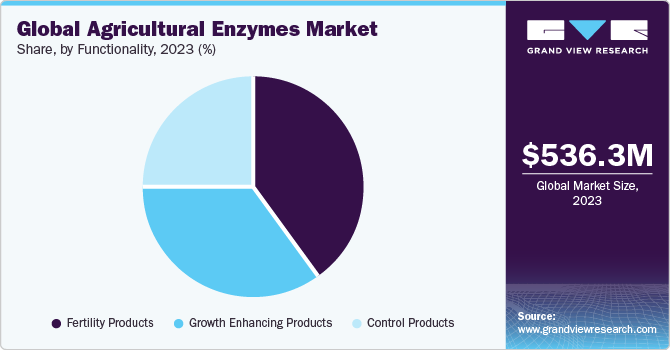

The global agricultural enzymes market size was estimated at USD 536.3 million in 2023 and is projected to grow at a CAGR of 9.0% from 2024 to 2030. This is attributable to rising awareness about the importance of sustainable agricultural practices. Enzymes can play a key role in sustainable agriculture by reducing the need for chemical fertilizers and pesticides, improving soil health, and minimizing environmental impact.

Agricultural enzymes are specialized proteins that play a crucial role in various biological processes related to plant growth, soil health, and animal nutrition in agricultural settings. These products are derived from natural sources such as plants, animals, and microorganisms, or they can be produced through biotechnological methods.

Advances in biotechnology have led to the development of new enzyme formulations tailored for agricultural applications. Rising awareness of these advancements among farmers is growing their emphasis on integrating enzyme-based solutions into farming practices. In addition, agricultural enzymes can improve the efficiency of various agricultural processes, such as soil conditioning, seed treatment, and animal feed digestion. Farmers are increasingly seeking cost-effective solutions that can enhance productivity without significantly increasing operational expenses.

Ongoing research and development efforts in enzyme technology are leading to the discovery of novel products with improved functionality and stability. These advancements are expanding the range of applications for these products and driving their adoption in new markets. Furthermore, environmental issues such as soil degradation, water pollution, and biodiversity loss are prompting farmers to seek alternative solutions that minimize environmental harm. Enzymes offer environment friendly alternatives to traditional chemical-based agricultural practices.

On the other hand, enzyme production and formulation can be expensive, particularly for specialized or genetically engineered products. High production costs may result in expensive enzyme products, limiting their accessibility to small-scale farmers or those operating in low-income regions. In some regions, inadequate infrastructure and distribution networks may pose challenges for delivering agricultural enzyme products to end-users. Limited access to rural areas and insufficient storage facilities can hinder the distribution and availability of these products in agricultural markets.

Market Concentration & Characteristics

The global agricultural enzymes market demonstrates characteristics akin to a moderately consolidated landscape. With the presence of various key players such as Amano Enzymes Inc., Elemental Enzymes, Inc., Infinita Biotech Private Limited, Advanced Enzyme Technologies, AB Enzymes, Novozymes A/S, with some other small and medium regional players from all over the world.

The market growth stage is high, and the pace is accelerating. The product market is characterized by a high degree of innovation. Ongoing research and development activities in the field of enzyme development from natural sources among others, drive innovations in production and application. For example, in October 2023, researchers in the U.S. developed organic nanozymes sustainable for the agriculture industry.

The manufacturing and utilization of agricultural enzymes are subject to a myriad of regulations and standards aimed at safeguarding the safety and quality of these products. These regulations are designed to uphold human safety and environmental safety. While regulatory specifics may diverge depending on country or region, overarching regulatory frameworks govern the industry. Key regulatory bodies and organizations overseeing the market include the U.S. FDA, USDA, Enzyme Technical Association, AMFEP, and Department of Biotechnology (Govt of India), among others.

End-user concentration plays a pivotal role in shaping the dynamics of the global market. With a multitude of product manufacturers increasingly incorporating these products into their formulations, there's a tendency towards larger volume purchases. This trend can engender economies of scale for suppliers of the product, potentially yielding cost efficiencies in both production and distribution processes. Moreover, heightened end-user concentration often fosters enduring relationships between suppliers of the product and major players in the end-use industries. This stability lays the groundwork for collaborative ventures, mutual comprehension, and the establishment of enduring business partnerships.

Product Insights

Phosphatases dominated the market and accounted for a share of approximately 36.09% in 2023. Phosphatase enzymes catalyze the hydrolysis of organic phosphates, releasing phosphate ions that are more readily available for plant uptake. As phosphorus is an essential nutrient for plant growth and development, increasing the availability of phosphorus through these products can enhance plant nutrient uptake and overall crop yield. In addition, phosphorus fertilizers are commonly applied in agriculture to supplement soil phosphorus levels. However, a significant portion of applied phosphorus may become bound to soil particles or immobilized in organic forms, making it unavailable for plant uptake. Phosphatase enzymes can help mobilize and mineralize organic phosphorus, increasing the efficiency of phosphorus fertilizers and reducing the need for excessive phosphorus applications.

Dehydrogenase enzymes are important indicators of soil microbial activity and overall soil health. They catalyze the transfer of hydrogen atoms during metabolic processes in soil microorganisms, and their activity levels reflect the microbial biomass and metabolic activity. As soil health becomes an increasingly important consideration in agriculture, there is growing interest in using these products as biomarkers to assess soil fertility, quality, and resilience. Further, dehydrogenase plays a crucial role in the degradation of organic matter and pollutants in soil. They are involved in the microbial decomposition of organic compounds, including pesticides, herbicides, and hydrocarbons. As agriculture seeks to address issues such as soil contamination and degradation, there is a rising demand for enzyme-based solutions, including dehydrogenases, to facilitate soil remediation and restoration efforts.

Sulfur is an essential nutrient for plant growth and development, playing a vital role in protein synthesis, enzyme activation, and chlorophyll formation. Sulfatase enzymes catalyze the hydrolysis of sulfate ester bonds, releasing sulfate ions that are readily taken up by plants. As soil sulfur levels decline due to factors such as intensive agriculture, soil erosion, and sulfur deposition, there is a growing need to enhance sulfur availability for crops. Sulfatase helps mobilize and mineralize organic sulfur sources, increasing sulfur uptake efficiency and improving plant nutrition. Such factors are responsible for the growth of agricultural enzymes such as sulfatase in the agriculture industry.

Crop Type Insights

Cereals & grains dominated the market and accounted for a share of approximately 33.67% in 2023. Enzymes such as amylases and proteases can enhance the digestibility of cereal grains by breaking down complex carbohydrates and proteins into simpler forms that are more readily absorbed by animals. This leads to improved nutrient utilization, better feed conversion rates, and enhanced animal performance in livestock and poultry production. Cereal grains are susceptible to fungal contamination, leading to the production of mycotoxins such as aflatoxins, ochratoxins, and fumonisins, which pose health risks to humans and animals. Products like glucanases, cellulases, and esterases can degrade fungal cell walls and disrupt mycotoxin production, helping to mitigate mycotoxin contamination in grains and ensure food and feed safety.

Enzymes such as proteases and cellulases can enhance the extraction of oils and proteins from oilseeds and pulses, respectively. By breaking down cell walls and protein bodies, these products facilitate the release of lipids and proteins, increasing extraction yields and improving the efficiency of oilseed and pulse processing operations. Additionally, they can improve the nutritional value of oilseeds and pulses by increasing the bioavailability of nutrients such as proteins, amino acids, and minerals. Enzymatic treatment can reduce anti-nutritional factors present in oilseeds and pulses, such as phytic acid and trypsin inhibitors, which can interfere with nutrient absorption and utilization in humans and animals.

Enzymes play a crucial role in extending the shelf life and maintaining the quality of fresh-cut fruits and vegetables. Enzymatic treatments can inhibit browning, softening, and microbial spoilage, thereby preserving the freshness, color, and nutritional value of processed produce. Products such as polyphenol oxidases (PPO) inhibitors and peroxidases (POD) inhibitors are used to control enzymatic browning, while products like cellulases and hemicellulases can maintain the crispness and texture of cut fruits and vegetables. Additionally, they help reduce food waste in the fruit and vegetable supply chain by improving the utilization of raw materials and byproducts. Enzymatic treatments can extract more juice and pulp from fruits and vegetables, leaving less waste for disposal. Enzymes can also convert fruit and vegetable byproducts into value-added products such as dietary fibers, biofuels, and functional ingredients, maximizing resource efficiency and sustainability.

Functionality Insights

Fertility products dominated the market with a revenue share of 39.78% in 2023. Enzymes contribute to the improvement of soil health by enhancing microbial activity, nutrient cycling, and organic matter decomposition. Healthy soils with balanced microbial populations are better equipped to support plant growth and withstand environmental stressors, leading to sustainable agricultural practices. Agricultural enzymes allow for reduced reliance on chemical fertilizers by improving nutrient utilization efficiency. By enhancing the availability of nutrients already present in the soil or organic amendments, these products can help minimize the need for synthetic fertilizers, reducing input costs and environmental impacts associated with their use.

Enzyme-based growth enhancers can improve plant tolerance to various environmental stresses, including drought, salinity, temperature extremes, and disease. By enhancing plant defense mechanisms and stress response pathways, enzymes help plants withstand adverse conditions and maintain optimal growth and productivity. Agricultural enzymes can stimulate photosynthesis and metabolic processes in plants, leading to increased energy production, nutrient assimilation, and growth rates. Improved metabolic efficiency results in faster plant growth, greater biomass accumulation, and higher yields.

Agricultural enzymes can be used as biopesticides to control pests and pathogens in crops. Enzymes with insecticidal, nematicidal, or fungicidal properties can target specific pests or diseases while minimizing harm to non-target organisms and the environment. This approach offers an eco-friendly alternative to chemical pesticides, reducing pesticide residues in food and minimizing adverse impacts on human health and the environment. Further, agricultural enzymes provide an effective tool for managing pesticide resistance in pest populations. Enzyme-based control products can target pest vulnerabilities that may not be affected by conventional chemical pesticides, thereby diversifying pest management strategies and delaying the development of resistance. This helps preserve the efficacy of chemical pesticides and prolongs their useful lifespan in agricultural systems.

Regional Insights

North America dominated the market and accounting for a 30.14% share in 2023. This high share is attributable to growing emphasis on sustainable agriculture practices in the countries like U.S., Canada, and Mexico, driven by concerns about environmental degradation, soil health, and resource conservation. Enzymes offer eco-friendly solutions for enhancing soil fertility, nutrient management, and pest control, aligning with the goals of sustainable agriculture.

U.S. Agricultural Enzymes Market Trends

The U.S. produces a wide range of specialty crops, including fruits, vegetables, nuts, and herbs, which require specialized management practices. Enzyme-based solutions offer tailored solutions for different crops and production systems, addressing specific challenges related to soil fertility, nutrient management, pest control, and post-harvest quality across a wide range of specialty crops.

The Canada agricultural enzymes market is expected to grow over the forecast period. There is a growing consumer demand for organic food products in Canada, driving an expansion in organic farming practices. Organic farmers rely on natural inputs and biological methods for pest management, soil fertility, and crop production, creating opportunities for the use of agricultural enzymes as organic-approved inputs in organic farming systems.

The agricultural enzymes market in Mexico is expected to witness growth from 2024 to 2030. Mexico has a diverse agriculture sector that produces a wide range of crops, including fruits, vegetables, grains, and specialty crops. As the agriculture sector expands and modernizes to meet domestic demand and export markets, there is a growing need for innovative solutions to enhance crop productivity, quality, and sustainability, driving the demand for agricultural enzymes.

Europe Agricultural Enzymes Market Trends

European countries have a strong emphasis on sustainable agriculture practices to minimize environmental impact, conserve natural resources, and ensure food security. Agricultural enzymes offer environment friendly solutions that reduce reliance on synthetic chemicals, promote soil health, and support biodiversity conservation, aligning with European sustainability goals and regulations.

Agricultural enzymes market in Germany is increasing on the account of growing emphasis of organic farming. Germany has one of the largest organic farming sectors in Europe, driven by consumer demand for organic products and government support for sustainable agriculture. Enzyme-based products are well-suited for organic farming systems as they are natural, biodegradable, and non-toxic, supporting organic certification requirements and meeting consumer preferences for organic and eco-friendly agriculture.

Asia Pacific Agricultural Enzymes Market Trends

Many countries in the Asia Pacific are experiencing rapid agricultural expansion to meet the food demands of growing populations. Agricultural enzymes offer solutions to improve crop productivity, soil health, and resource use efficiency, making them increasingly attractive to farmers seeking to optimize yields and profitability. In addition, the Asia Pacific region is characterized by a diverse range of crops, climates, and growing conditions. Enzyme-based solutions can be tailored to specific crop needs and production systems, addressing challenges related to soil fertility, nutrient management, pest control, and post-harvest quality across a wide range of crops, including rice, wheat, maize, fruits, vegetables, and cash crops.

The agricultural enzymes market in China is intensively increasing on account of rapid development in the agriculture sector. In addition, the Chinese government has introduced policies and incentives to promote sustainable agriculture, reduce chemical fertilizer and pesticide use, and improve food safety and quality. Enzyme-based solutions align with these government priorities by offering natural, eco-friendly alternatives to synthetic chemicals, supporting soil health, and enhancing crop resilience, driving their adoption and market growth in China.

Central & South America Agricultural Enzymes Market Trends

Ongoing research and development in enzyme technology have led to the discovery of new enzymes with improved functionalities, stability, and efficacy for agricultural applications in this region. Advanced formulations and delivery systems enhance the effectiveness and convenience of enzyme-based products, driving their adoption and market growth in Central and South America.

Brazil agricultural enzymes market is experiencing rapid demand in the country on account of the increasing utilization of enzymes as biological pest control products. Enzymes can be used as biopesticides to control pests and diseases in crops, offering safer alternatives to chemical pesticides. Brazil's rich biodiversity and tropical climate create favorable conditions for pests and pathogens, making enzyme-based pest control solutions particularly relevant for Brazilian farmers seeking effective and environmentally friendly pest management strategies.

Middle East & Africa Agricultural Enzymes Market Trends

Many countries in the Middle East and Africa face water scarcity, which poses significant challenges to agriculture. Agricultural enzymes can help improve water and nutrient use efficiency in crops, allowing farmers to achieve higher yields with limited water resources. Enzyme-based solutions promote soil health, enhance moisture retention, and optimize nutrient uptake, making them valuable tools for sustainable agriculture in water-stressed regions.

Key Agricultural Enzymes Company Insights

The global agricultural enzymes market is moderately consolidated in nature with the presence of several key players, such as Amano Enzymes Inc., Elemental Enzymes, Inc., Infinita Biotech Private Limited, Advanced Enzyme Technologies, AB Enzymes, and Novozymes A/S, among others. The players witnessing intense competition from each other as well as from regional players, who have strong distribution networks and good knowledge about suppliers and regulations.

-

Novozymes A/S is one of the leading companies engaged in manufacturing and sales of enzymes for an array of application areas such as agriculture, animal nutrition, food & beverages, household care, pulp & paper, carbon capture, biotechnology, among others. The company has operational bases in Australia, New Zealand, India, U.S., Japan, China, Southeast Asia. South America, and Middle east & Africa. The company operates through more than 49 subsidiaries throughout the world.

-

AB Enzymes is one of the leading manufacturer and supplier of industrial enzymes in the world. The company provides its vast range of products to numerous end-use industries like food & beverages, pulp & paper, detergents, textiles, animal feed, among others. The company operates in numerous geographical locations including Brazil, U.S., Germany, Poland, China, and Malaysia.

Field International UK Limited, Infinita Biotech Private Limited, Antozyme Biotech Pvt Ltd., Biolaxi Enzymes Pvt Ltd., Grotech Production Ltd., are some of the emerging participants in the agricultural enzymes market.

-

Infinita Biotech Private Limited is a leading biotechnology company specializing in the development, production, and distribution of agricultural enzymes. With a commitment to sustainability and innovation, Infinita Biotech aims to revolutionize agricultural practices by providing cutting-edge enzyme solutions that enhance crop yield, improve soil health, and mitigate environmental impact.

-

Antozyme Biotech Pvt. Ltd. is a leading biotechnology company specializing in the development, production, and distribution of agricultural enzymes. With a strong focus on innovation and sustainability, the company aims to revolutionize agricultural practices by providing cutting-edge enzyme solutions that enhance crop yield, improve soil health, and mitigate environmental impact.

Key Agricultural Enzymes Companies:

The following are the leading companies in the agricultural enzymes market. These companies collectively hold the largest market share and dictate industry trends.

- AB Enzymes

- Advanced Enzyme Technologies

- Amano Enzymes Inc.

- Antozyme Biotech Pvt Ltd.

- Biolaxi Enzymes Pvt Ltd.

- Biorizon Biotech

- Creative Enzymes

- Elemental Enzymes, Inc.

- Field International UK Limited

- Grotech Production Ltd.

- Infinita Biotech Private Limited

- Kemin Industries, Inc.

- Novozymes A/S

Recent Developments

-

In February 2024, Elemental Enzymes and Nutrien AG announced partnership to deliver noval solutions to combat citrus greening across North American market.

-

In February 2023, Ginkgo Bioworks and Zymtronix announced partnership to manufacturer various enzymes for various end-use industries like food, cosmetics, agriculture, and pharmaceutical industries.

-

In January 2023, BASF SE and Cargill, Incorporated further expanded their partnership and collaborations to offer high-performance enzyme solutions to various end-use industries like animal health & wellness, agriculture, and Industrial solutions.

Agricultural Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 600.3 million

Revenue forecast in 2030

USD 1.0 billion

Growth rate

CAGR of 9.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, crop type, functionality, region

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

AB Enzymes; Advanced Enzyme Technologies; Amano Enzymes Inc.; Antozyme Biotech Pvt Ltd.; Biolaxi Enzymes Pvt Ltd.; Biorizon Biotech; Creative Enzymes; Elemental Enzymes, Inc.; Field International UK Limited; Grotech Production Ltd; Infinita Biotech Private Limited; Kemin Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agricultural Enzymes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agricultural enzymes market report based on product, crop type, functionality, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Phosphatases

-

Dehydrogenases

-

Sulfatases

-

Other Products

-

-

Crop Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Turf & Ornamentals

-

Other Crop Types

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Fertility Products

-

Growth Enhancing Products

-

Control Products

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global agricultural enzymes market was estimated at USD 536.3 million and is expected to reach USD 600.3 million in 2024.

b. The global agricultural enzymes market is expected to grow at compound annual growth rate (CAGR) of 9.0% from 2024 to 2030 to reach USD1.0 billion.

b. Phosphatases dominated the market and accounted for a share of approximately 36.09% in 2023. Phosphatase enzymes catalyze the hydrolysis of organic phosphates, releasing phosphate ions that are more readily available for plant uptake. As phosphorus is an essential nutrient for plant growth and development, increasing the availability of phosphorus through these products can enhance plant nutrient uptake and overall crop yield.

b. The global agricultural enzymes market is moderately consolidated in nature with the presence of several key players, such as Amano Enzymes Inc., Elemental Enzymes, Inc., Infinita Biotech Private Limited, Advanced Enzyme Technologies, AB Enzymes, and Novozymes A/S, among others

b. The high growth of the global agricultural enzymes market is attributable to rising awareness about the importance of sustainable agricultural practices. Enzymes can play a key role in sustainable agriculture by reducing the need for chemical fertilizers and pesticides, improving soil health, and minimizing environmental impact.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.