- Home

- »

- Agrochemicals

- »

-

Agricultural Chelates Market Size, Share Report, 2030GVR Report cover

![Agricultural Chelates Market Size, Share & Trends Report]()

Agricultural Chelates Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Synthetic, Organic), By Crop Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-178-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agricultural Chelates Market Summary

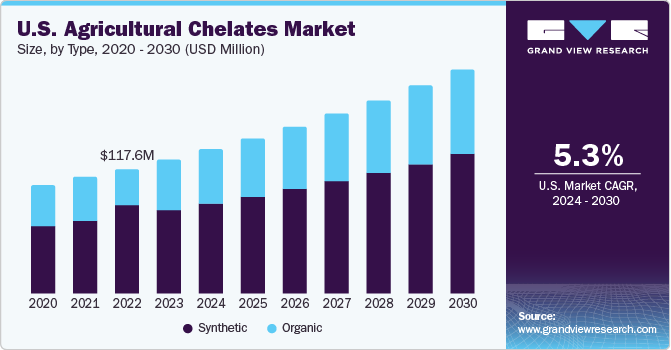

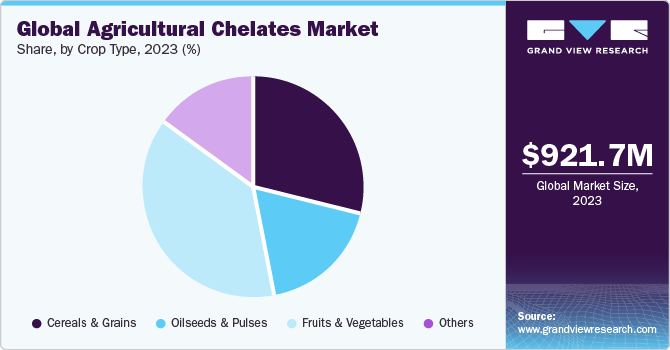

The global agricultural chelates market size was estimated at USD 921.67 million in 2023 and is projected to reach USD 1,321.1 million by 2030, growing at a CAGR of 5.3% from 2024 to 2030. This is attributed to rapidly increasing urbanization, accelerated population, coupled with steady industrialization are projected to positively impact the demand.

Key Market Trends & Insights

- North America dominated the market and accounted for a share of 49.7% in 2022.

- The Europe market is expected to showcase the fastest growth rate of 8.9% during the forecast period.

- By type, the tri-suits segment accounted for 43.7% of the global revenue share in 2022.

- By application, the men segment accounted for 64.0% of the global revenue share in 2022.

- By distribution channel, the online segment accounted for 45.7% of the global revenue share in 2022.

Market Size & Forecast

- 2023 Market Size: USD 921.67 Million

- 2030 Projected Market Size: USD 1,321.1 Million

- CAGR (2024-2030): 5.3%

- North America: Largest market in 2023

- Europe: Fastest growing market

Changing climatic conditions, decreasing availability of arable land, and increasing global population are raising food security concerns. As a result, there has been a significant rise in the use of chelating agents in the agriculture sector to improve crop yield and meet global food demand. Because soil is heterogeneous and complex, the traditional micronutrients in it are readily oxidized or precipitated. Chelation keeps a micronutrient from undesirable reactions in solution and soil. Chelated fertilizers have more potential to increase commercial yield than regular micronutrients when the crop is grown in low-micronutrient stress or soils with a pH greater than 6.5. With the rise of sustainable farming and the increasing awareness of the adverse environmental impact of synthetic chelating agents, there has been a rise in the demand for biodegradable chelating agents. Therefore, companies are capitalizing on customers’ needs to uphold a leading position in the market.

Common chelates include EDTA, DTPA, and EDDHA, which are used to address micronutrient deficiencies in soil. They are effective for micronutrients such as iron, manganese, zinc, and copper. They enhance the solubility and stability of micronutrients, making it easier for plants to absorb them through their root systems. This improves overall nutrient uptake and can positively impact crop yields. The choice of product depends on the pH of the soil. Different products have varying stability at varied pH levels, ensuring that micronutrients remain available within the desired pH range. The product use should be managed to minimize environmental impact. Excessive application can lead to the accumulation of metals in the soil.

Type Insights

The synthetic segment accounted for the largest revenue share of 51.8% in 2023. This is attributed to various benefits offered by them such as preventing micronutrient deficiencies, enhancing nutrient uptake, and promoting optimal plant growth. They are chemical compounds created to mimic the chelating properties of naturally occurring substances. Some of the key types include EDTA, DTPA, HEDTA, and EDDHA. Their application is tailored to the needs of different crops and soil types to ensure efficient nutrient utilization.

DTPA is effective in soil with slightly acidic to neutral pH and helps in preventing micronutrient deficiencies. HEDTA is a synthetic chelate used for micronutrient delivery, particularly in alkaline soils. It forms stable complexes with metals like iron, improving their availability to plants. Further, EDDHA is a synthetic chelate designed for iron delivery in alkaline soils, where other chelates might be less effective.

Humic acids and fulvic acids derived from decomposed organic matter like compost or decomposed plant material can act as natural chelating agents. They enhance nutrient availability in the soil and improve nutrient uptake by plants. Some organic chelates are based on amino acids, which are the building blocks of proteins. Amino acids can form complexes with metal ions, aiding the transportation of nutrients to plants.

Application Insights

The foliar segment accounted for a significant market share in 2023. This is attributed to the fact that this method ensures uniform application of nutrients and reduces agricultural input costs. This technique includes product application through tractor-mounted sprays, spray pumps, airplanes, and drones. This provides an opportunity to maximize the yield, minimize nutrient losses, and reduce environmental pollution. The application of agricultural chelates in soil is a strategic practice aimed at improving nutrient availability for plants. They can be incorporated into the soil during land preparation or planting. This method ensures that the products are distributed throughout the root zone, promoting a more even availability of micronutrients to plants as they grow.

Furthermore, agricultural chelates are sometimes applied through irrigation systems using the fertigation method. This allows for the controlled release of chelates directly into the soil along with water, ensuring efficient nutrient distribution and uptake by plant roots. In cases where specific areas of a field exhibit micronutrient deficiencies, spot treatments with chelates can be applied. This targeted approach addresses localized nutrient needs and minimizes unnecessary application in areas with sufficient nutrient levels.

Crop Type Insights

The fruits and vegetables segment accounted for the largest revenue share in 2023. This is attributed to the increase in export demands for fruits and vegetables from emerging countries, especially in the Asia Pacific region, and high return values that have led to the expansion of cultivation areas for these crops. Hence, the agricultural chelates market for fruits and vegetables is expected to witness significant growth over the forecast period.

Cereal crops such as wheat, barley, and oats may face iron deficiencies, especially in alkaline soils. Iron chelates, including synthetic ones like EDDHA or natural ones from organic sources, are applied to the soil to improve the availability of iron for cereals. This is crucial for processes like chlorophyll formation and photosynthesis. Cereals often require sufficient amounts of zinc and manganese for proper growth and development. In addition to soil application, chelates can be applied directly to the leaves of cereal crops through foliar sprays. This method allows for quick nutrient absorption, particularly during critical growth stages.

Agricultural practices often involve tailored chelate formulations to meet specific nutrient requirements of different pulse varieties. This customization ensures that pulses receive the necessary micronutrients in proportions suitable for their growth and development. Soil pH can impact the availability of micronutrients. Chelates are selected based on the pH conditions of the soil to ensure that the micronutrients remain in a form that oilseed crops can absorb. This is particularly important for crops such as canola, which can be sensitive to micronutrient deficiencies.

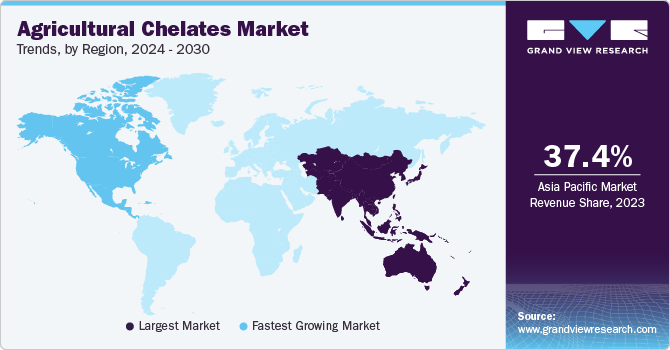

Regional Insights

Asia Pacific accounted for the largest revenue share of 37.4% in 2023. This is attributed to the growing regional population along with a continuous need to increase agricultural productivity to meet the rising demand for food. They play a key role in enhancing nutrient availability for crops, which can contribute to improved yields. Farmers in the region are increasingly adopting modern agricultural practices to optimize crop production, including using chelates to address micronutrient deficiencies and promote better plant growth.

The North American region has seen an increasing adoption of precision agricultural practices aimed at optimizing resource use and improving crop yields. They are used as part of precision farming strategies to enhance nutrient availability for plants. Moreover, changes in weather patterns and increased climate variability can impact soil conditions and nutrient availability. Farmers may turn to chelates as a tool to mitigate the effects of such variability on crop protection.

Europe places a strong emphasis on sustainable and environment-friendly agricultural practices. Chelates, by improving nutrient use efficiency and reducing the risk of nutrient runoff, fit into the broader goals of sustainable agriculture. The regional product demand may be influenced by the growth of organic farming. Organic chelates, derived from natural sources, can be used in organic agriculture to enhance nutrient availability without compromising organic certification standards.

Key Companies & Market Share Insights

The market for agricultural chelates is moderately fragmented with the presence of small and large players. Key market participants include BASF SE; Nouryon; The Andersons Inc.; ICL; Yara International; and Haifa Chemicals Ltd., among others. Market players invest in innovation, product launches, mergers, and acquisitions to improve their market share and gain a competitive edge. For instance, in January 2023, Nouryon acquired a Poland-based supplier of chelated fertilizers and other agriculture solutions named ADOB. This strategy would help Nouryon enhance its crop nutrition product portfolio and broaden its geographical reach.

Key Agricultural Chelates Companies:

- BASF SE

- Nouryon

- Dow

- Yara International

- ICL

- Haifa Chemicals Ltd.

- Syngenta

- Nufarm Ltd.

- Aries Agro Ltd.

- The Andersons, Inc.

Agricultural Chelates Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 966.6 million

Revenue forecast in 2030

USD 1,321.1 million

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, crop type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Nouryon; Dow; Yara International; ICL; Haifa Chemicals Ltd.; Syngenta; Nufarm Ltd.; Aries Agro Ltd.; The Andersons, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

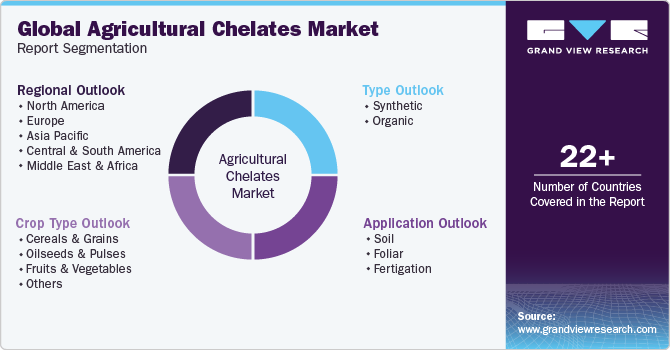

Global Agricultural Chelates Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agricultural chelates market report based on type, crop type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Organic

-

-

Crop Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Soil

-

Foliar

-

Fertigation

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the agricultural chelates market with a share of 37.4% in 2023. This is attributable to the growing population along with a continuous need to increase agricultural productivity to meet the rising demand for food

b. Some key players operating in the agricultural chelates market include BASF SE, Nouryon, The Andersons Inc, ICL, Yara International, and Haifa Chemicals Ltd, among others

b. Key factors that are driving the market growth include attributed to rapidly increasing urbanization, accelerated population, coupled with steady industrialization

b. The global agricultural chelates market size was estimated at USD 921.67 million in 2023 and is expected to reach USD 966.6 million in 2024.

b. The global agricultural chelates market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 1321.1 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.