- Home

- »

- Agrochemicals & Fertilizers

- »

-

Agricultural Adjuvants Market Size And Share Report, 2030GVR Report cover

![Agricultural Adjuvants Market Size, Share & Trends Report]()

Agricultural Adjuvants Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Activator Adjuvants, Utility Adjuvants), By Application, By Source, By Formulation, By Type By Crop, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-903-5

- Number of Report Pages: 114

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agricultural Adjuvants Market Summary

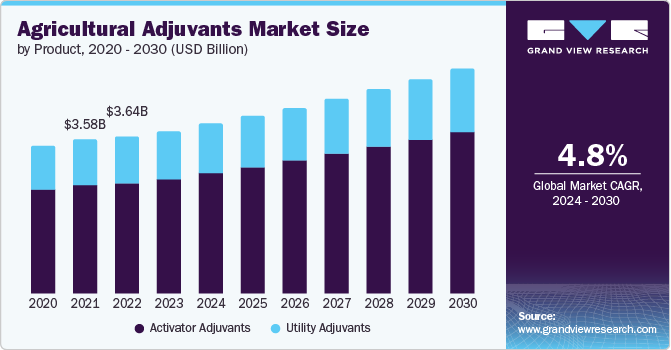

The global agricultural adjuvants market size was estimated at USD 3.80 billion in 2023 and is projected to reach USD 5.25 billion by 2030, growing at a CAGR of 4.8% from 2024 to 2030. The expansion of the product market is being propelled by the increasing global demand for crop protection products in the agricultural sector.

Key Market Trends & Insights

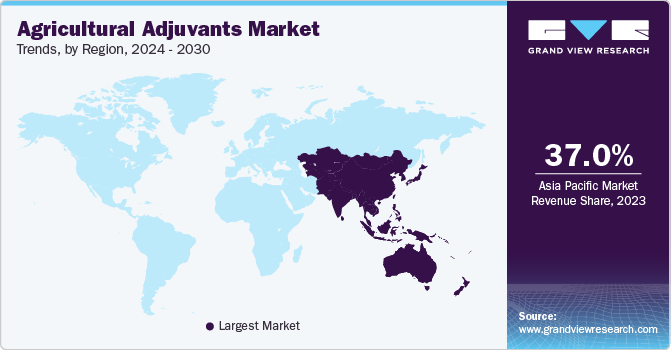

- Asia Pacific emerged as the dominating region with a revenue share of over 37.9% in 2023.

- Europe is expected to experience significant growth over the forecast period.

- Based on formulation, In 2023, the other formulations segment led the market, capturing the largest share of 78.6% of the overall revenue.

- In terms of application, the herbicides application segment is anticipated to dominate the global market with a revenue share of around 48.7% in 2023.

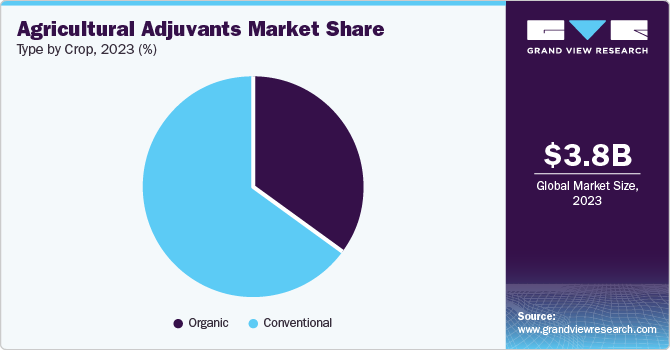

- Based on crop type, the global industry is categorized into conventional crops and organic crops.

Market Size & Forecast

- 2023 Market Size: USD 3.80 Billion

- 2030 Projected Market Size: USD 5.25 Billion

- CAGR (2024-2030): 4.8%

- Asia Pacific: Largest market in 2023

- Asia Pacific: Fastest growing market

An estimated 25% of global crop production is lost annually due to diseases, pests, and weeds. Crop protection chemicals play a critical role in preserving crops, boosting yields, and enhancing overall production. Additionally, the anticipated rise in pesticide consumption is expected to further drive market growth, as a significant share of adjuvants is used in pesticide applications.

As reported by the Food and Agriculture Organization (FAO), global pesticide consumption reached 4.2 million tons in 2019, marking a 11.6% increase since 2009. Over the past decade, this represents a rise of 436 thousand tons in pesticide usage. The FAO also noted a nearly 30% increase in total traded quantities of pesticides in 2020, with the Americas importing the highest value, amounting to USD 6.9 million. This global uptick in pesticide consumption is consequently driving the demand for agricultural adjuvants. However, the market's growth faces challenges due to diverse regulations imposed by various authorities worldwide regarding the use of agricultural adjuvants.

In Brazil, for instance, adjuvants were regulated under the same framework as agrichemicals until 2017, as per Law 7,802 governed by Decree 4,074. Post-2017, the Ministry of Agriculture, Livestock, and Supply (MAPA) assumed responsibility for regulating agricultural adjuvants. Similarly, in Canada, adjuvants are regulated by the Pest Management Regulatory Agency (PMRA), which mandates thorough testing and verification of each adjuvant's effectiveness and safety in conjunction with every active ingredient it is intended to be used with. These stringent regulations serve as significant restraining factors for market growth. In North America, the U.S. is the largest consumer of these products, holding a revenue share of 69.3% in 2023.

This is largely due to the fact that the U.S. ranks among the top ten food-producing countries in the world, with substantial production of maize, soybean, sorghum, blueberry, and almond. This high level of agricultural output significantly contributes to the expansion of the market within the country. Furthermore, the presence of several key product manufacturers in the U.S. has a considerable impact on market growth, reducing the country’s reliance on imported agrochemicals. As a result, farmers and companies in the U.S. agricultural sector can procure agrochemicals directly from the domestic market, thereby driving demand for these products within the country.

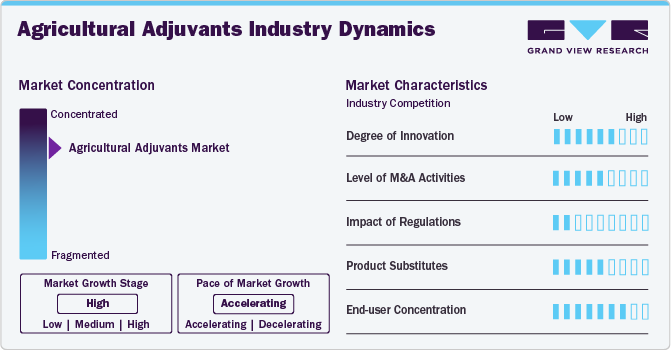

Market Concentration & Characteristics

The agricultural adjuvants market demonstrates moderate concentration, with a few major players holding substantial market shares while smaller and niche players also contribute. Prominent manufacturers in this sector include Solvay SA, BASF SE, and Dow. Despite the trend towards consolidation among major players, there remains room for niche companies and those specializing in sustainable solutions. This dynamic is expected to shape the market's evolution, balancing the influence of major corporations with the innovation and specialization offered by smaller entities.

Due to the rapid population growth, farmers are under increased pressure to produce more food grains within shorter timeframes. Additionally, the available arable land has diminished due to expanding populations, urbanization, and industrialization, further intensifying the demand for higher agricultural output on reduced land areas. This issue is particularly concerning for agriculture-based economies such as India, where agriculture and related activities are crucial to the economy. As a result, farmers are increasingly turning to agricultural adjuvants and fertilizers to boost crop yields within limited time periods.

The agricultural adjuvants market is poised for growth, closely aligned with the rising consumption of pesticides, given that a substantial portion of adjuvants are incorporated into pesticide formulations. According to the Food and Agriculture Organization (FAO), global pesticide consumption reached 4.2 million tons in 2019, marking an 11.6% increase since 2009. Over the past decade, pesticide use has risen by 436 thousand tons. The FAO also indicates that the total traded quantities of pesticides increased by approximately 30% in 2020, with the Americas being the largest importers, totaling USD 6.9 million. This global increase in pesticide usage is, in turn, fueling higher demand for agricultural adjuvants.

Product Insights

The activator adjuvants product segment is expected to dominate the market with a revenue share of around 70.6% in 2023. This growth is attributed to the enhanced performance of agrochemicals when used in conjunction with activator adjuvants, which improve penetration and absorption rates. This leads to more effective control of insects, weeds, or diseases. Activator adjuvants are chemical products designed to enhance the efficacy of crop protection products. For example, while herbicides are effective at penetrating and eliminating unwanted plants and weeds, their performance is significantly improved when activator adjuvants are added, allowing the herbicides to penetrate weeds more effectively.

The utility adjuvants sector is expected to experience substantial growth throughout the projection period, driven by the increasing application of pesticides to address various undesirable elements in agricultural areas. This sector includes a range of utility adjuvants, such as buffering agents, compatibility agents, drift control agents, defoaming agents, water conditioning agents, acidifying agents, and deposition agents. These adjuvants are primarily non-pesticidal substances incorporated into spray mixtures, with compatibility agents playing a key role in the formulation of crop protection products.

Application Insights

The herbicides application segment is anticipated to dominate the global market with a revenue share of around 48.7% in 2023. The growth in this sector is primarily due to the widespread use of herbicides, such as glyphosate and glufosinate, in global crop production. The insecticides segment is expected to grow the fastest during the forecast period. According to the Federation of Indian Chambers of Commerce and Industry (FICCI), insecticides currently represent the largest market share in the Indian agrochemical sector. This growth is fueled by increasing demand for insecticides for various crops, including cotton, paddy (rice), fruits, and vegetables.

They are effective in preventing early germination pest attacks across various crops. Malathion, a well-known organophosphate (OP) insecticide, is widely used in the agricultural sector to control a range of insects, including Japanese beetles, aphids, and leafhoppers. The global emphasis on preventing pest infestations is driving the growth of the insecticide market, which is anticipated to subsequently boost demand for related products.

Source Insights

The global industry is categorized into petroleum-based and bio-based segments based on source. In 2023, the petroleum-based segment dominated the market, capturing the largest share of overall revenue. This segment mainly comprises oil-based adjuvants, including crop oils and crop oil concentrates. Typically, crop oils are composed of 95%–98% naphtha or paraffin-based petroleum oil and 1%–2% surfactants.

Crop oil concentrates consist of 80%–85% petroleum-based oil and 15%–20% nonionic surfactants. The bio-based source segment is anticipated to experience the fastest growth over the forecast period. These adjuvants, derived from renewable and environmentally friendly raw materials, offer greater biodegradability and provide a higher safety level for humans compared to their petroleum-based counterparts.

Formulation Insights

Based on formulation, the global industry is categorized into oil-based and other formulations. In 2023, the other formulations segment led the market, capturing the largest share of 78.6% of the overall revenue. This segment includes surfactants and spray adjuvants, which enhance the performance of herbicides, insecticides, fungicides, and fertilizers by improving surface contact, increasing leaf penetration, and reducing runoff.

The oil-based product segment is expected to experience substantial growth in the future. This segment includes crop oils, vegetable oil concentrates, and crop oil concentrates. These formulations facilitate the slow drying of crop protection products applied to plants, resulting in improved absorption and efficacy. As a result, oil-based formulations are highly effective in enhancing plant yields.

Type By Crop Insights

Based on crop type, the global industry is categorized into conventional crops and organic crops. In 2023, the conventional crops segment led the global market, capturing over 65.4% of the overall revenue. This segment includes additives used with insecticides, pesticides, herbicides, and fungicides to enhance their effectiveness. These additives can be surfactants, polymers, or chemical and petroleum-based substances.

Additives in the conventional crops segment enhance the physical properties of pesticide and herbicide sprays, ensuring even distribution on plants and improved absorption. The organic crops segment is projected to experience the fastest growth rate during the forecast period. In organic agriculture, oils are utilized extensively for various applications. Farmers commonly use vegetable oils, such as soybean, sunflower, and rapeseed oil, as organic adjuvants with pesticides and fertilizers to incorporate hydrophobic materials.

Regional Insights

North America presents a promising growth opportunity for the agricultural adjuvants market. This is driven by the rising demand for various agricultural products, including cereals, fruits, vegetables, and oilseeds in the United States, Canada, and Mexico. The expansion of agricultural land and increased production of cereals and food crops in the region are contributing to a heightened demand for agricultural adjuvants. This trend is likely to continue as the region seeks to enhance crop yields and meet the growing food needs of its population.

U.S Agricultural Adjuvants Market Trends

The U.S. agricultural adjuvants market is a leading force in the development of innovative agricultural technologies, including advanced adjuvants that enhance functionality such as improved targeting or compatibility with specific pesticides. Precision farming techniques, widely adopted in American agriculture, involve the targeted application of crop protection chemicals. Adjuvants are essential in these methods, ensuring uniform distribution and maximizing efficacy on target areas, thereby driving advancements in crop management and productivity.

Asia Pacific Agricultural Adjuvants Market Trends

Asia Pacific emerged as the dominating region with a revenue share of over 37.9% in 2023. This growth is attributed to Asia Pacific's position as the largest producer of agricultural commodities, projected to account for 53% of global agricultural product and fish output by 2030, according to the Organization for Economic Cooperation and Development (OECD) and the FAO. Within this region, China is a major consumer due to its prominent role as an exporter, consumer, and producer of pesticides—a key application in the product market. Furthermore, research from the University of Melbourne and Zhejiang-based researcher Baojing Gu underscores that China is the world’s largest consumer of agricultural pesticides, using approximately 30% of global pesticides and fertilizers and meeting around 90% of global technical raw material requirements.

The China agricultural adjuvants market is experiencing growth due to the increasing emphasis among growers on enhancing the effectiveness of crop protection products. This shift is driven by a rising preference for organic goods, which has spurred demand for green adjuvants. Additionally, growing awareness of the nutritional benefits of organic food is generating further demand for these products.

The market for agricultural adjuvants in India is expanding due to the increased deployment of crop protection chemicals in developing regions. The demand for tools that enhance crop efficiency is contributing to the growth of the agricultural activator adjuvants market. Rising income levels in both rural and urban areas, coupled with a heightened demand for agricultural products, are further fueling this trend. Farmers in India are increasingly adopting advanced techniques and technologies to improve crop yields and productivity, which is also driving the demand for agricultural adjuvants.

Europe Agricultural Adjuvants Market Trends

Europe is expected to experience significant growth over the forecast period. Although crop production has been declining in some European countries in recent years, several nations have shown growth in specific crop sectors. For instance, a USDA report from November 2021 noted that Russia's total wheat production reached 74.5 million metric tons, reflecting an increase in the country's wheat output. The market's growth is largely driven by the need to enhance crop yields and production efficiency due to a rising population and decreasing farmland. Consequently, the region's increasing agricultural production and diminishing arable land are driving demand for crop protection chemicals, which in turn fuels the demand for related products.

The agricultural adjuvants market in Germany is expected to grow significantly due to the increasing need to enhance crop yield and production efficiency amidst a rising population and diminishing farmland. The region’s expanding agricultural output combined with reduced farming areas is driving demand for crop protection chemicals, which in turn stimulates the demand for agricultural adjuvants.

The UK agricultural adjuvants market is evolving with a focus on high-value crops such as fruits, vegetables, and specialty crops. These crops require enhanced protection from pests and diseases, leading to a demand for adjuvants that improve the effectiveness of crop protection chemicals. Additionally, the UK’s emphasis on sustainable agricultural practices is boosting the popularity of adjuvants derived from natural sources or those with a lower environmental impact. This trend reflects a broader movement towards environmentally conscious farming methods.

Central & South America Agricultural Adjuvants Market Trends

In Central and South America, Brazil, Argentina, and Colombia are pivotal to the growth of the agricultural adjuvants market. In Brazil, the expansion of the agriculture sector, particularly driven by the rising demand for agrochemicals to boost soybean production, is a key factor propelling market growth. The U.S.-China trade war has intensified this trend, with China imposing high tariffs on U.S. soybeans and other agricultural products in retaliation for U.S. tariffs on Chinese goods. This situation has led to a surge in demand for Brazilian soybeans, further stimulating the need for agricultural adjuvants in the region.

The agricultural adjuvants market in Brazil has a growing focus among growers on enhancing the effectiveness of crop protection products, driving an increased demand for agricultural adjuvants. These adjuvants, which are added to spray mixtures to improve the performance of chemicals, are becoming more critical as farmers seek to optimize crop protection.

Additionally, rising incomes in Brazil have led to a higher demand for meat and eggs, which has, in turn, expanded the mixed-feed industry. This growth has increased the need for feed crops like corn, used in the rapidly expanding poultry and hog industries. Consequently, there is a greater demand for agricultural adjuvants to support the production and efficiency of these essential crops.

Middle East & Africa Agricultural Adjuvants Market Trends

The agricultural adjuvants market in the Middle East and Africa is anticipated to experience substantial growth over the forecast period. This expansion is driven by rising pesticide consumption in countries such as Saudi Arabia and Oman, and is expected to continue in South Africa, Kuwait, and Qatar. The growing need for food crops, along with increased use of pesticides and insecticides, is contributing to the heightened demand for agricultural adjuvants in the region. These adjuvants play a crucial role in optimizing the effectiveness of crop protection products and supporting agricultural productivity.

The Saudi Arabia agricultural adjuvants market increasing adoption of advanced farming practices, including precision agriculture, hydroponics, and vertical farming, is increasing. These high-tech methods are designed to maximize crop yields within controlled environments and necessitate the use of specialized agrochemicals, including agricultural adjuvants. Additionally, there is a significant shift towards greenhouse production in the country. Greenhouses offer a controlled environment that facilitates year-round crop production and shields plants from harsh climatic conditions, further driving the demand for agricultural adjuvants to optimize these innovative farming systems.

Key Agricultural Adjuvants Company Insights

The market is highly competitive, characterized by the presence of numerous independent small-scale and large-scale manufacturers and suppliers. Large-scale companies focus on innovation and product development, while smaller players often compete primarily on price. Many market participants are engaging in mergers and partnerships to strengthen their market position. For example, BASF has acquired various businesses and assets from Bayer, a prominent manufacturer of crop protection and agricultural products.

This acquisition has significantly enhanced BASF’s existing crop protection product line and allowed the company to enter new markets, including seeds, nematicide seed treatments, and non-selective herbicides. In addition, in 2022, Evonik Industries AG inaugurated its Applied Technology Center (ATC) in Brazil. This facility is dedicated to developing additives for biopesticides and bioinoculants for customers in the region. The ATC is expected to bolster Evonik's business and performance in the agricultural sector.

Some key players operating in the market include Solvay S.A., Dow, BASF SE, and Croda International among others.

-

Solvay S.A. is a leading advanced materials and specialty chemicals company dedicated to developing solutions that address major societal challenges. Operating across a range of sectors—such as agriculture, automotive, construction, consumer goods, healthcare, electronics, resources, environment, energy, and industrial applications—Solvay focuses on science and process innovation. The company aligns its efforts with global megatrends, driving advancements and sustainability in its various industries.

-

BASF SE, headquartered in Ludwigshafen, Germany, is a prominent chemical company with diverse operations spanning Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care, and Agricultural Solutions. BASF is renowned for its comprehensive portfolio that includes chemicals, plastics, crop protection products, and performance products. The company serves numerous industries, including construction, furniture and wood, agriculture, electronics, paints and coatings, automotive, home care, and nutrition, among others.

Nufarm Limited, Ingevity, etc. are some emerging participants in the market.

-

Nufarm Limited is an Australian agricultural chemical company established in 1956 by Max Fremder, with its headquarters in Melbourne, Australia. Nufarm specializes in manufacturing and marketing crop protection solutions and seed technologies. The company operates on a global scale, holding over 2,100 product registrations and marketing its products in more than 100 countries. Nufarm focuses on providing farmers and growers with timely, effective products, partnering with distributors to address needs throughout the crop life cycle.

-

Ingevity is a global specialty chemicals and materials company founded in 2016 and headquartered in North Charleston, South Carolina, United States. The company operates primarily in two segments: Performance Materials and Performance Chemicals. Ingevity is dedicated to delivering high-performance products and solutions across a diverse range of industries.

Key Agricultural Adjuvants Companies:

The following are the leading companies in the agricultural adjuvants market. These companies collectively hold the largest market share and dictate industry trends.

- Clariant AG

- Solvay SA

- The Dow Chemical Company

- Huntsman International LLC

- Evonik Industries AG

- Ingevity

- Nufarm Limited

- Corteva Agriscience

- Croda International PLC

- BASF SE

- Miller Chemical & Fertilizer, LLC.

- Helena Chemical Company

- Winfield United

- Wilbur-Ellis Holdings, Inc.

- Stepan Company

Recent Developments

-

In April 2023, Evonik introduced two innovative adjuvants: BREAK-THRU® MSO MAX 522 and TEGO XP 11134. These adjuvants are designed to enhance efficacy and reduce drift for drone applications in agriculture. They feature advanced blends of polyether-trisiloxanes and other components, reflecting Evonik's commitment to improving agricultural input efficiency and application precision.

-

In September 2023, Croda launched Atlo BS-50, a new delivery system tailored to the expanding biopesticide market. This product addresses the specific needs of biopesticides, aiming to optimize their effectiveness and application.

Agricultural Adjuvants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.97 billion

Revenue forecast in 2030

USD 5.25 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million/billion, Volume in Tons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, source, formulation, type by crops, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Australia; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

Clariant AG; Solvay SA; The Dow Chemical Company; Huntsman International LLC; Evonik Industries AG; Ingevity; Nufarm Ltd.; Corteva Agriscience; Croda International PLC; BASF SE; Miller Chemical & Fertilizer, LLC; Helena Chemical Company; Winfield United; Wilbur-Ellis Holdings, Inc.; Stepan Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agricultural Adjuvants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the agricultural adjuvants market report on basis of product, application, source, formulation, type by crops, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Activator Adjuvants

-

Surfactants

-

Oil-based Adjuvants

-

-

Utility Adjuvants

-

Compatibility Agents

-

Drift Control Agents

-

Buffering Agents

-

Water Conditioning Agents

-

Others

-

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Herbicides

-

Insecticides

-

Fungicides

-

Others

-

-

Source Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Petroleum-based

-

Bio-based

-

-

Formulation Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Oil-based

-

Others

-

-

Type by Crop Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Organic

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Conventional

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global agricultural adjuvants market size was valued at USD 3.80 billion in 2023 and is expected to reach USD 3.97 billion in 2024.

b. The global agricultural adjuvants market is anticipated to grow at a compounded annual growth rate (CAGR) of 4.8% from 2024 to 2030 to reach USD 5.25 billion by 2030.

b. Asia Pacific dominated the agricultural adjuvants market and accounted for a 37.6% share of global revenue in 2023, This growth is attributed to the fact that Asia Pacific is the largest producer of agricultural commodities, accounting for 53% of global agricultural product and fish output by 2030 according to the Organization for Economic Cooperation and Development and FAO.

b. Some prominent players in the agricultural adjuvants market include Clariant AG, Solvay, The Dow Chemical Company, Huntsman International LLC., Evonik Industries AG, Ingevity, Nufarm Limited, Croda International PLC, BASF SE, Miller Chemical & Fertilizer, LLC., Helena Chemical Company, WinField United, Wilbur-Ellis Company LLC, Stepan Company.

b. The agricultural adjuvants market growth is expected to be driven by the growing demand for effective insecticides across the globe. Moreover, increasing pesticides utilization in agriculture to increase crop production and yield is also driving the demand for agricultural adjuvants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.