- Home

- »

- Homecare & Decor

- »

-

Aging In Bathroom Products Market Size, Share Report 2030GVR Report cover

![Aging In Bathroom Products Market Size, Share & Trends Report]()

Aging In Bathroom Products Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Bath Aids, Bath Lifts, Grab Handles & Bars), By Application, By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-052-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aging In Bathroom Products Market Trends

The global aging in bathroom products market size was valued at USD 5.08 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. The increasing developments in the construction sector of residential buildings, hotels, restaurants, and airports, coupled with the growing need for convenient bathrooms, present lucrative opportunities for players in the aging bathroom products industry. In addition, the rising prominence of multi-functionality bathroom fixtures with aesthetic appeal is boosting the demand for these products. The rising cases of injuries, surgeries, and disabilities among the elderly increase the risk of slips and falls in the bathroom without assistance. Many older persons require help using the restroom but may feel self-conscious while asking for assistance. However, help in the bathroom is essential to prevent an aged adult from slipping, falling, or suffering any other injuries on the slippery and harsh surfaces of a bathroom. A restroom is another dangerous place for the elderly. Wet bathroom flooring creates a dangerous environment where falls are likely to happen. Even worse, senior citizens often suffer from bowel diseases, necessitating a rush to use the restroom, and falls frequently occur due to this.

Most aged individuals decide to stay at home as the overall population ages and delays living in assisted living facilities as long as possible. However, to ensure safety, home improvements are essential for aged individuals. This is particularly true for bathroom designs for older people with chronic diseases or disabilities. 90% of elderly individuals say that they intend to stay in their homes for at least another ten years, according to the recent United States Aging Survey of 2021.

Although retirees might be physically more energetic and live longer, they need to also consider their future requirements. The easiest method to achieve this is to redesign their home tastefully and aesthetically while adding improved functionality and increased convenience for the future. In addition, senior citizens must consider how they now utilize their homes and what modifications will make it simpler for them to age.

The process of using a toilet to relieve oneself varies significantly after a spinal cord injury (SCI), especially for older adults. The majority of SCI survivors no longer have any bladder or bowel control. According to the National Spinal Cord Injury Statistical Center (NSCISC), there are over 17,700 new cases of spinal cord injury survivorship each year.

More than 80% of these people display bladder impairment in some form or another. In a large cohort study, 40% of patients with neurogenic bladder visited a urology clinic during a year, 33% were admitted to a hospital, and 15% were living in a nursing home. More than 20% of all hospital stays lasting one year were brought on by UTIs.

Product Insights

The bath lifts segment dominated the market with a share of around 22% in 2022. Due to an increase in the number of disabled people, their decreased mobility, and their increased ability to pay for healthcare, this market has grown quickly over the past several years and is predicted to continue its growth at a constant rate. For instance, AmeriGlide Distribution, Inc. sells a luxury bath lift that allows the user to be raised up completely in the bathtub without having to move or lift their legs. Such advantages are anticipated to boost product visibility among consumers with limited mobility who are disabled.

The chairs & stools segment is projected to register a CAGR of 7.5% from 2023 to 2030. It is projected that a driving factor would be the rising use of bath chairs and stools among those with long-term disabilities and injuries. These gadgets offer assistance to those who have trouble standing in the shower, such as the elderly or those with injuries. According to a KAISER FAMILY FOUNDATION article from February 2019, almost 25 million Americans who are aging require assistance from others and equipment like shower seats and chairs to complete necessary daily tasks.

Application Insights

The residential segment dominated the market with a share of around 61% in 2022. Toilet products are finding new growth opportunities as more consumers in emerging nations like China and India depend on nursing facilities, as they get older. Nursing homes have become more popular recently because there are fewer young people available to care for the elderly. Over 16% of China's elderly population is over 60 years old, and among these individuals, more than 42 million people are incapacitated seniors, according to a May 2021 report by China Global Television Network (CGTN). Such information points to a favorable market picture for the anticipated period.

The commercial segment is estimated to grow at the fastest CAGR of 7.1% over the forecast period. The increasing development and expansion of commercial infrastructure across developing economies are supporting the demand for aging bathroom products. Apart from this, the significant growth of the healthcare industry, coupled with the rising number of hospitals across the globe, is projected to propel product demand over the forecast period. According to a survey conducted by the American Hospital Association in 2022, there are more than 6,000 hospitals in the U.S.

Distribution Channel Insights

In terms of revenue, the offline segment dominated the market with a share of 68% in 2022. The market's overall sales are expected to increase as a result of the growing trend among businesses selling bathroom products through physical stores to increase customer value by offering customers the physical interaction they need to buy "deep" products, which require extensive inspection before being purchased. In June 2021, 78% of American consumers made more in-store purchases since they could see the products in person before making a decision.

The online segment is estimated to grow at the fastest CAGR of 7.0% over the forecast period. With convenience being a primary facilitator of e-commerce, consumers are looking for hassle-free experiences that save time and provide convenient payment & delivery options. To address consumer concerns regarding the authenticity of aging in bathroom products through online channels, companies have increasingly started adopting a direct-to-consumer approach, which skips the distributors/retailers completely and guarantees product authenticity.For instance, Pottery Barn introduced an accessible home collection in July 2022 that included bath aids for seniors living in their homes as well as people with impairments and accidents.

Regional Insights

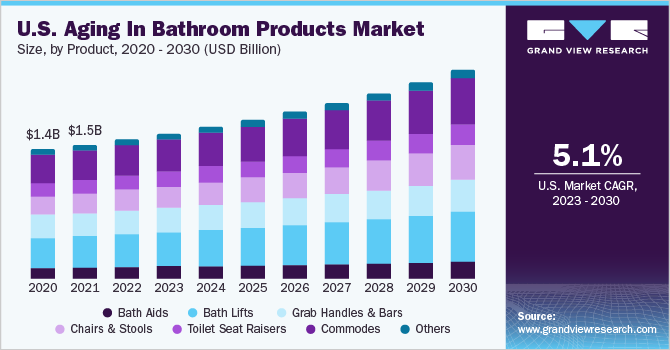

North America dominated the aging in bathroom products industry with a share of around 30% in 2022. The region's market for ageing bathroom products is anticipated to expand in the years to come, largely as a result of an increase in the proportion of Americans who are sixty-five or older. The number of Americans sixty-five and older will nearly double in the upcoming 40 years, expected to reach 80 million in 2040, according to the U.S. Census Bureau. Between 2000 and 2040, the proportion of seniors 85 and older, who frequently require assistance with basic personal care, including bathroom supplies and accessories, will almost quadruple. These numbers point to a favorable outcome for the market during the projected period.

Asia Pacific is expected to witness a CAGR of 22.3% from 2023 to 2030. The increasing geriatric population, caused by substantial declines in fertility and significant improvements in life expectancy, will drive the aging in bathroom products application across the region. Given the rapid growth in the older population, governments have been increasingly concerned with maintaining the quality of life in old age and prioritizing aging-related issues. They have also taken into account the costs entailing an aging population, which will significantly boost the market growth.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus on the growing trend of aging bathroom products. Players in the market are diversifying their product offerings to maintain market share. Some prominent players in the global aging in bathroom products market include:

-

Vermeiren India Rehab Pvt. Ltd.

-

Genteel Homecare Products Co., Ltd.

-

SENIORITY.IN

-

Jianlian Homecare Products Co., Ltd.

-

Jinan Hengsheng New Building Materials Co., Ltd.

-

YUYAO BEILV SANITARY WARE CO., LTD

-

Saamipya

-

Old is Gold Store

-

IgnoxLabs Pvt Ltd. (Emoha Elder Care)

-

Wenzhou Baogeli Sanitary Wares Co.,ltd.

Aging In Bathroom Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.35 billion

Revenue forecast in 2030

USD 8.31 billion

Growth rate

CAGR of 6.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; China; India; Brazil; South Africa

Key companies profiled

Vermeiren India Rehab Pvt. Ltd.; Genteel Homecare Products Co., Ltd.; SENIORITY.IN; Jianlian Homecare Products Co., Ltd.; Jinan Hengsheng New Building Materials Co., Ltd.; YUYAO BEILV SANITARY WARE CO., LTD; Saamipya; Old is Gold Store; IgnoxLabs Pvt Ltd. (Emoha Elder Care); Wenzhou Baogeli Sanitary Wares Co.,ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aging In Bathroom Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global aging in bathroom products market report based on product, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Bath Aids

-

Bath Lifts

-

Grab Handles & Bars

-

Chairs & Stools

-

Toilet Seat Raisers

-

Commodes

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2017 -2030)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aging in bathroom products market was estimated at USD 5.08 billion in 2022 and is expected to reach USD 5.35 billion in 2023

b. The global aging in bathroom products market is expected to grow at a compound annual growth rate of 6.4% from 2022 to 2030 to reach USD 8.31 billion by 2030

b. North America dominated the aging in bathroom products market with a share of around 36% in 2022. Many startup companies as well as major manufacturers of aging in bathroom products are focusing on new product development.

b. Some of the key players operating in the aging in bathroom products market include Vermeiren India Rehab Pvt. Ltd.; Genteel Homecare Products Co., Ltd.; SENIORITY.IN; Jianlian Homecare Products Co.,Ltd.; Jinan Hengsheng New Building Materials Co., Ltd.; YUYAO BEILV SANITARY WARE CO., LTD; Saamipya; Old is Gold Store; IgnoxLabs Pvt Ltd. (Emoha Elder Care); Wenzhou Baogeli Sanitary Wares Co.,ltd.

b. Key factors that are driving the aging in bathroom products market growth include the rising prominence of multi-functionality bathroom fixtures with aesthetic appeal is boosting the demand for these products and The rising cases of injuries, surgeries, and disabilities among the elderly.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.