- Home

- »

- Consumer F&B

- »

-

Agave Nectar Market Size, Share & Trends Report, 2030GVR Report cover

![Agave Nectar Market Size, Share & Trends Report]()

Agave Nectar Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Light, Amber, Dark, Raw), By Application (F&B Sweetener, Baking & Desserts, Sauces & Dressing), By Distribution, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-476-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agave Nectar Market Summary

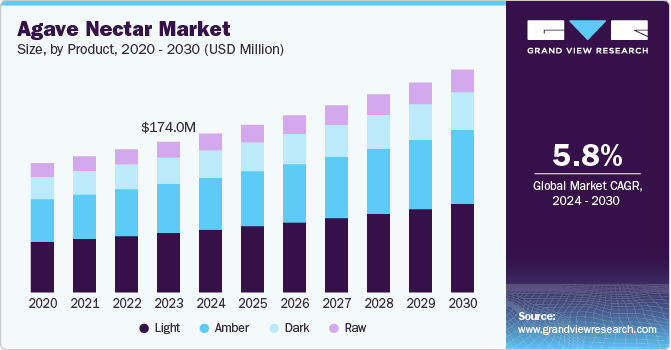

The global agave nectar market size was estimated at USD 174.0 million in 2023 and is projected to reach USD 257.3 million by 2030, growing at a CAGR of 5.8% from 2024 to 2030. The key factor driving the demand for agave nectar is its use as a healthier sweetener option.

Key Market Trends & Insights

- The North America agave nectar market exceeded USD 80 million in 2023.

- The U.S. is expected to grow at a CAGR of 5% from 2024 to 2030.

- Based on product, light segment accounted for a revenue share of over 40% in 2023.

- Based on application, the food and beverage segment was the most extensive application, with revenue exceeding USD 75 million in 2023.

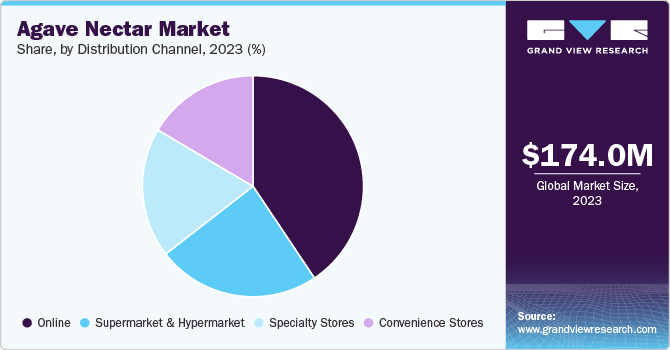

- Based on distribution channel, the online segment accounted for over 45% of the global market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 174.0 million

- 2030 Projected Market Size: USD 257.3 million

- CAGR (2024-2030): 5.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Consumers seek natural sweeteners as alternatives to refined sugars and artificial sweeteners. Due to its lower glycemic index, agave nectar is seen as a healthier option that does not spike blood sugar levels as much as traditional sugars do. This shift towards natural products drives the demand across various food and beverage applications.

Consumer awareness about the health hazards of sugar consumption, particularly about obesity and diabetes, is a significant driver of the agave nectar market growth. The increase in diabetes cases has led many individuals to seek healthier sweetening options like agave nectar, which is perceived as a safer alternative due to its natural ingredients and potential health benefits. The growing prevalence of health issues associated with poor diets further reinforces this trend, with consumers increasingly favoring products with natural and simple ingredients.

The increasing preference for vegan and organic food is expected to positively impact growth of the agave nectar market. Increasing demand for plant-based products is expected to increase agave nectar usage in the coming years. Agave nectar is increasingly used in food recipes and formulations, particularly in the U.S., and it is expected to boost product demand over the forecast period. Organic product movement is also expected to be an essential contributor to the market growth. Many agave nectar brands provide organic certified varieties which appeals to the consumers seeking products free from pesticide, GMO and herbicides. The certification ensures the plant used has been responsibly farmed and is eco-friendly.

Agave nectar, being a natural alternative to artificial processed sugar, is increasingly being used in a variety of applications. Consumer preference towards products with low GI index is a key promoter for the growth of the market for agave nectar. Health-conscious consumers around the world constantly seek alternative products to sugar. Sugar is associated with a host of diseases, such as diabetes and obesity, and consumers are increasingly aware of this, resulting in greater than ever demand for natural sweetener products.

Companies have been capitalizing on the heightened demand for agave nectar and have been innovating in order to gain a competitive advantage. Brands have been launching flavored nectar such as cinnamon and vanilla to provide consumers with increased choices and wider applications in the F&B industry. Furthermore, companies have also been investing in R&D to reduce the fructose content of agave nectar to make it further marketable to the health-conscious consumer. Companies that can capitalize on these trends are expected to gain a competitive advantage in the industry.

Product Insights

Light agave nectar accounted for a revenue share of over 40% in 2023 and is expected to grow at a CAGR of 6.0% over the forecast period. Light agave nectar has a milder flavor profile than its darker counterparts. The extra processing of agave sap is the reason for the light color and subtle flavor, making this product highly versatile in its applications. Light nectar is used in various applications, such as beverages, baking, yogurts, and dressings, without overpowering the other flavors. Like other nectars, light agave nectar is also rich in fructose, making it sweeter than sugar, resulting in lesser quantities being needed to achieve the same level of sweetness.

Amber agave nectar has a medium-intensity caramel flavor that can improve the taste of various dishes. This decadent flavor makes it suitable for sweet and savory applications, allowing it to be used in multiple recipes, from desserts to sauces and marinades. Its distinct taste can elevate the flavors of many foods without overpowering them. The primary applications of amber agave nectar include baking and marinades.

Raw agave nectar is the least processed form of nectar resulting in a sweet and mild flavor profile. These characteristics make it ideal for use in the beverage industry. The low processing appeals to consumers seeking organic products with some amounts of essential nutrients. Raw agave has been gaining popularity in recent times, but its market size is still much smaller compared to its processed counterparts such as light, dark, and amber.

Application Insights

Agave nectar usage as a sweetener in the food and beverage industry was the most extensive application, with revenue exceeding USD 75 million in 2023. Its low glycemic index, coupled with natural fructose, makes agave nectar an ideal substitute for sugar in numerous applications. Increasing health-conscious consumers have promoted the demand for natural ingredients in F&B applications, and agave nectars are a perfect choice. It is a natural product, and brands sell organic variants, which are the preferred choice among the majority of consumers.

Distribution Channel Insights

The sale of agave nectar online accounted for over 45% of the global market in 2023. Agave nectar sales online have been gaining traction in recent times as online retailers are better able to cater to consumers' evolving preferences. Online retailers have made agave nectar more accessible to a broader audience, allowing health-conscious shoppers and those with specialized dietary requirements to locate and purchase the product quickly. This accessibility is particularly beneficial for consumers who may not find a wide variety of agave nectar options in local stores, thus expanding the market reach of these products.

The surge in e-commerce, particularly during and after the COVID-19 pandemic, has facilitated direct-to-consumer sales of agave nectar. Many manufacturers and retailers have enhanced their online presence, capitalizing on the shift towards online shopping. This trend has allowed consumers to access detailed product information, nutritional benefits, and usage suggestions, which can influence purchasing decisions. Furthermore, online platforms offer consumers education on the advantages of agave nectar. For example, the low GI index of agave nectar makes it an ideal choice for consumers managing their blood glucose levels. This information encourages consumers to incorporate agave nectar into their regular diet, resulting in increased market demand.

The sale of agave nectars in the supermarket is expected to grow at a CAGR of 6% over the forecast period. Supermarkets usually stock various agave nectar products, including light, dark, and amber options and organic and flavored versions, allowing shoppers to choose the one that fits their dietary needs or cooking preferences. Many supermarkets promote agave nectar by emphasizing its health benefits and versatility. It’s often placed in noticeable spots within the baking or sweetener aisles, sometimes alongside recipe ideas or tips on how to use it. This encourages people to try it out and helps boost sales.

Regional Insights

The North America agave nectar market exceeded USD 80 million in 2023, with the U.S. leading the demand. The increasing awareness of agave nectar's low glycemic index has led to its adoption among consumers managing blood sugar levels or seeking healthier options. Furthermore, the availability of agave nectar in supermarkets and online platforms in the U.S. has made it easily accessible, further boosting its popularity.

U.S. Agave Nectar Market Trends

The agave nectar market in the U.S. is expected to grow at a CAGR of 5% from 2024 to 2030 predominantly due to increasing consumer preference for natural sweetening products. The other key reason for extensive usage of the product is the U.S. is the country's proximity to Mexico, the largest producer of agave nectar globally. Mexico accounts for over 80% of the agave nectar production globally due to the abundance of the blue agave plant in the region. Easy accessibility coupled with lower logistics cost is a key reason for use of agave nectar in the U.S. as compared to others forms of alternate sweeteners such as stevia or aspartame.

Asia Pacific Agave Nectar Market Trends

Asia Pacific is expected to witness the fastest growth over the forecast period, owing to the increasing awareness of health benefits associated with agave nectar coupled with increasing cases of diabetes. The market is expected to grow at a CAGR of 8% over the forecast period. The area is home to some of the fastest-growing economies globally, and with consumers looking for healthier food options, agave nectar demand is expected to rise in the coming years.

Europe Agave Nectar Market Trends

Europe is expected to remain a vital market for agave nectar growth with countries such as Germany and the UK and France leading regional demand. These countries are witnessing an increase in consumers looking for clean labels, making agave nectar an ideal replacement for processed sugar. In addition, Western Europe has seen many consumers opting for foods that provide health benefits, augmenting the demand for agave nectar-infused products.

Key Agave Nectar Company Insights

Numerous well-established and emerging players characterize the global agave nectar market. The market is fragmented, and product innovation is the key to achieving market share. Most production happens in Mexico, and companies try to differentiate their products through quality and branding. Many companies are expanding their product lines to include various types of agave nectar (light, dark, flavored) and related products. This diversification caters to a broader range of consumer preferences and dietary needs, particularly among health-conscious individuals seeking natural sweeteners.

Many market players are focused on sustainability. Companies are increasingly focusing on responsible sourcing of agave and ethical farming practices. Certifications such as organic and fair trade are becoming essential for brands looking to align with consumer values and enhance brand loyalty. Companies are also trying to educate consumers on the health benefits of agave nectar to have a wider reach and gain market share.

Key Agave Nectar Companies:

The following are the leading companies in the agave nectar market. These companies collectively hold the largest market share and dictate industry trends.

- Wholesome Sweeteners Inc.

- Now Foods

- Ciranda Inc.

- Global Goods Inc. (Agave In The Raw)

- Malt Products Corporation

- Sisana Sweeteners

- The Groovy Food Company

- Domino Foods, Inc.

- Tierra Group

- Arizona Beverages USA LLC

- Madhava Natural Sweeteners

Recent Developments

-

To offer its consumers a fresh taste, the producers of organic Agave in the Raw unveiled Organic Hot Agave in the Raw in July 2023. The sweetness of agave nectar is combined with the heat of jalapenos and chilis in Hot Agave.

-

Natural food maker Ciranda added new reduced sugar syrups to its lineup in May 2023. This series of tastes includes tapioca and agave. These syrups can be used in confections, gummy vitamins, frozen treats, and other products.

-

In March 2023, Monin Americas launched its first flavored agave nectar. It is a organic agave infused with blend of Hatch and Guajillo chile peppers.

Agave Nectar Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 183.4 million

Revenue forecast in 2030

USD 257.3 million

Growth rate

CAGR of 5.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil

Key companies profiled

Wholesome Sweeteners Inc.; Now Foods; Ciranda Inc.; Global Goods Inc. (Agave In The Raw); Malt Products Corporation; Sisana Sweeteners; The Groovy Food Company; Domino Foods, Inc.; Tierra Group; Arizona Beverages USA LLC; Madhava Natural Sweeteners

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agave Nectar Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global agave nectar market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Light

-

Amber

-

Dark

-

Raw

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

F&B Sweetener

-

Baking & Desserts

-

Sauces & Dressing

-

Others

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket & Hypermarket

-

Convenience Stores

-

Specialty Stores

-

Online Sales

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global agave nectar market size was estimated at USD 174.0 million in 2023 and is expected to reach USD 183.4 million in 2024.

b. The global agave nectar market is expected to grow at a compounded growth rate of 5.8% from 2024 to 2030 to reach USD 257.3 million by 2030.

b. Light agave nectar accounted for a revenue share of over 40% in 2023 and is expected to grow at a CAGR of 6.0% over the forecast period. Light agave nectar has a milder flavor profile than its darker counterparts.

b. Some key players operating in agave nectar market include Wholesome Sweeteners Inc.; Now Foods;Ciranda Inc.;Global Goods Inc. (Agave In The Raw);Malt Products Corporation;Sisana Sweeteners;The Groovy Food Company;Domino Foods, Inc.;Tierra Group;Arizona Beverages USA LLC;Madhava Natural Sweeteners

b. The key factor driving the demand for agave nectar is its use as a healthier sweetener option. Consumers seek natural sweeteners as alternatives to refined sugars and artificial sweeteners. Due to its lower glycemic index, agave nectar is seen as a healthier option that does not spike blood sugar levels as much as traditional sugars do.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.