Africa Stationary Electric Compressor Market Size, Share & Trends Analysis Report By Technology (Reciprocating, Centrifugal), By Lubrication (Oil Free, Oil Filled), By End-use (Construction, Mining), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-060-4

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

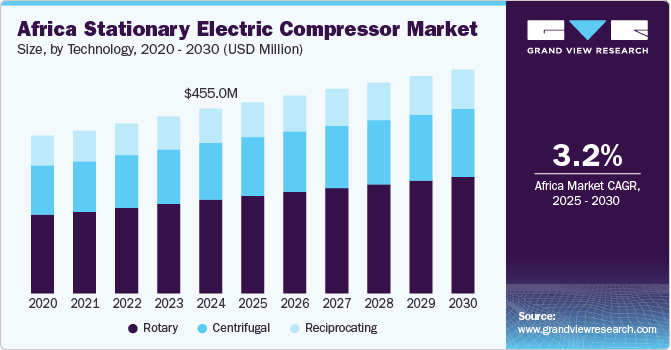

The Africa stationary electric compressor market size was estimated at USD 455.0 million in 2024 and is projected to grow at a CAGR of 3.2% from 2025 to 2030. The growing oil & gas industry in Africa is expected to drive the market growth. Moreover, the increasing demand for stationary electric compressors in the oil & gas industry since they handle all volume capacities and pressures is anticipated to fuel the market expansion over the forecast period. The Africa stationary electric compressors market is anticipated to expand due to the expanding construction industry. This is due to the vast investment potential in energy, transportation, electricity, and housing infrastructure projects.

Another key driving factor is the rising emphasis on energy efficiency and sustainability. Many companies are seeking to reduce their operational costs and environmental impact, leading to a shift towards advanced compressor technologies that offer better fuel economy and lower emissions. Additionally, the growth of renewable energy projects, such as wind and solar farms, is creating new applications for mobile air compressors, which are often required during installation and maintenance phases. As businesses continue to innovate and prioritize sustainable practices, the demand for mobile air compressors in Africa is likely to increase in tandem.

Drivers, Opportunities & Restraints

The Africa stationary electric compressor market is primarily driven by the growing demand across various sectors such as manufacturing, construction, and mining. As industries expand and modernize, the need for reliable and efficient air-powered tools and equipment becomes critical. Additionally, the rise in infrastructural projects across the continent and investments in industrialization are fueling the demand for stationary air compressors, enhancing their adoption in diverse applications ranging from pneumatic tools to automated systems.

There is significant opportunity for growth in the Africa stationary electric compressor market due to the ongoing technological advancements and the shift towards energy-efficient solutions. The increasing focus on sustainability has opened avenues for manufacturers to innovate and offer compressors that minimize energy consumption and reduce emissions. Moreover, the rising trend of automation in industrial processes presents a potential market for advanced air compressor systems that can seamlessly integrate with modern machinery and technologies.

Despite the promising growth, the Africa stationary electric compressor market faces several restraints, including high initial investment costs and maintenance challenges. Many small to medium-sized businesses may find it difficult to afford high-quality compressors or may lack the technical expertise for upkeep, leading to operational inefficiencies. Additionally, inconsistent power supply and infrastructural issues in certain regions can hinder the reliable operation of stationary air compressors, impacting overall market growth.

Technology Insights

“The demand for the rotary technology segment is expected to grow at a significant CAGR of 3.6% from 2025 to 2030 in terms of revenue.”

The rotary technology segment led the market and accounted for 50.8% of the Africa revenue share in 2024. This can be attributed to the high adoption of rotary air compressors in large industrial applications, such as papermaking and printing, metallurgy and mining, electric power, electronic and electrical, and mechanical and electrical machinery. For instance, Ingersoll Rand announced the next generation R-Series rotary screw compressors, which use 13% less energy and have variable speed drives.

Centrifugal air compressors are energy efficient, have fewer rubbing parts, and have higher airflow than other compressors. Furthermore, they are widely used in applications such as gas turbines, oil refineries, petrochemicals, foods & beverages, and chemical plants. All these factors are anticipated to boost segment growth over the forecast period. For instance, Hitachi Industrial Products provides Horizontal Split Process Centrifugal Air Compressor (MCH), these products are highly efficient 3D impellers, reliable, and easy to maintain.

Lubrication Insights

“The demand for the oil free lubrication segment is expected to grow at a significant CAGR of 3.3% from 2025 to 2030 in terms of revenue.”

The oil filled air compressor segment led the market and accounted for 67.4% of the global revenue share in 2024. Oil-filled air compressors are widely used in the energy, manufacturing, and chemical industries. They are more robust and make less noise than oil-free compressors. In the coming years, the aforementioned factors will drive demand for oil-filled air compressors. Atlas Copco, for instance, offers oil-lubricated rotary screw compressors that provide consistent, energy-efficient, and smart AIR solutions. It also has a lower overall lifecycle cost, which drives market demand.

The oil-free lubrication segment is expected to grow due to the implementation of legislation to reduce emissions and increased emphasis on environmental safety. Factors such as rapid industrialization and growth of the food processing, manufacturing, and semiconductor sectors are propelling the demand for air compressors. Oil-free systems, for example, are likely to gain acceptance in industries, reducing maintenance costs at predetermined intervals. For instance, Atlas Copco offers LFx oil-free piston compressors, which provide reduced noise operation, installation flexibility, and simple maintenance.

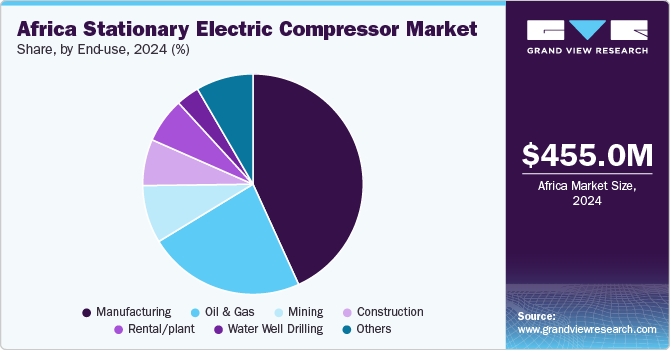

End-use Insights

“The demand for the construction application segment is expected to grow at a significant CAGR of 3.6% from 2025 to 2030 in terms of revenue.”

The manufacturing application segment led the market and accounted for 43.2% of the global revenue share in 2024. Due to an expanding population, manufacturing firms are actively engaged in inventing efficient and fast solutions. Furthermore, the use of robots and automation, IoT, cloud computing, and digital transformation is expected to drive growth. For instance, in June 2022, SIAD MI built and fixed a nitrogen compressor that would be used at the Assiut National Oil Processing Company's new hydrocracking operation in Egypt (ANOPC). The compressor will allow gas to circulate throughout the unit.

In the construction industry, air compressors are vital for powering a wide range of pneumatic tools and equipment, enhancing efficiency and productivity on job sites. They are commonly used to operate tools such as jackhammers, nail guns, and impact wrenches, enabling quick and effective completion of tasks like demolition, framing, and finishing. Additionally, air compressors facilitate the application of materials such as paint and concrete through spray guns, ensuring even and precise coverage. Their portability allows for easy transport between various job sites, making them indispensable for construction projects that require both versatility and reliability in demanding environments.

Country Insights

“Malawi to witness fastest market growth at 6.9% CAGR”

The demand for stationary electric air compressors in Egypt has been steadily increasing, driven by the growth of manufacturing sectors and construction projects. For instance, the expansion of the Suez Canal and various urban development initiatives have led to a heightened need for reliable air compression solutions in industries like construction and automotive repair. Companies are increasingly investing in high-capacity electric compressors to improve productivity and efficiency, demonstrating a shift towards more sustainable practices in industrial applications.

In South Africa, the demand for stationary electric air compressors is being fueled by the mining and agricultural sectors, which heavily rely on compressed air for various applications. For example, in the mining industry, electric air compressors are essential for powering pneumatic tools and equipment, helping to improve safety and operational efficiency. The government's focus on sustainable energy solutions has also encouraged a shift towards more energy-efficient electric compressors, making them an attractive choice for businesses aiming to reduce their environmental impact.

Key Africa Stationary Electric Compressor Company Insights

Some of the key players operating in the Africa stationary electric compressor market Atlas Copco, Ingersoll Rand, Doosan, and ELGI EQUIPMENTS LIMITED.

-

Atlas Copco specializes in the innovation, development, and manufacturing of oil-free compressor technologies. The company's air compressors are ISO-certified. It also rents, services, manufactures, and develops assembly systems, construction systems, and industrial tools. The company majorly operates through four segments, namely, industrial technology, power technology, vacuum technology, and compressor technology.

-

Ingersoll Rand is a multinational corporation that provides solutions and services to increase industrial efficiency and productivity through a diverse range of mission-critical and innovative medical, energy, fluid, and air technologies. The company's products are sold under more than 40 brands, including Gardner Denver and Ingersoll Rand, which are globally recognized in their respective end markets and are known for superior customer service, product efficiency, reliability, and quality.

Trade Air and CompAir are some of the emerging players in the Africa stationary electric compressor market.

-

Trade Air is a prominent manufacturer and supplier of compressed air solutions, specializing in high-quality air compressors and related equipment. Founded in Italy, the company has built a strong reputation for its innovative technology and commitment to sustainability. Trade Air offers a wide range of products, including industrial air compressors, portable compressors, and accessories, designed to meet the diverse needs of various industries such as construction, manufacturing, and automotive.

-

Airstream is a renowned American manufacturer of travel trailers and mobile homes, celebrated for its iconic aluminum-bodied designs that combine vintage charm with modern amenities. Founded in the 1930s by Wally Byam, the company has built a legacy of quality craftsmanship and innovation, creating products that cater to a diverse range of outdoor enthusiasts. Airstream trailers are known for their distinctive rounded shape, durability, and efficient functionality, often equipped with luxurious interiors that enhance the travel experience.

Key Africa Stationary Electric Compressor Companies:

- Atlas Copco

- Doosan

- ELGI EQUIPMENTS LIMITED

- Kirloskar

- Sandvik

- Ingersoll Rand

- Sullair (Hitachi, Ltd)

- Kaeser

- Airstream

- CompAir

Recent Developments

-

In April 2023, Atlas Copco announced the acquisition of the compressed air business division of Asven S.R.L., a specialist in the service, installation, and sales of compressed air systems.

Africa Stationary Electric Compressor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 470.8 million |

|

Revenue forecast in 2030 |

USD 551.1 million |

|

Growth rate |

CAGR of 3.2% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, lubrication, end use, country |

|

Country scope |

Zambia; Malawi; Congo DRC; South Africa; Egypt |

|

Key companies profiled |

Atlas Copco; Doosan; ELGI EQUIPMENTS LIMITED; Kirloskar; Sandvik; Ingersoll Rand |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Africa Stationary Electric Compressor Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Africa stationary electric compressor market report based on technology, lubrication, end use, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Rotary

-

Centrifugal

-

Reciprocating

-

-

Lubrication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil Free

-

Oil Filled

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Mining

-

Water Well Drilling

-

Oil & Gas

-

Rental/Plant

-

Manufacturing

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Africa

-

Zambia

-

Malawi

-

Congo DRC

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The Africa stationary electric compressor market size was estimated at USD 455.0 billion in 2024 and is expected to reach USD 470.8 billion in 2025.

b. The Africa stationary electric compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.2% from 2025 to 2030 to reach USD 555.1 billion by 2030.

b. The oil filled air compressor segment led the market and accounted for 67.4% of the global revenue share in 2024. Oil-filled air compressors are widely used in the energy, manufacturing, and chemical industries. They are more robust and make less noise than oil-free compressors.

b. Some of the key players operating in the Africa stationary electric compressor market include Atlas Copco; Doosan; ELGI EQUIPMENTS LIMITED; Kirloskar; Sandvik; Ingersoll Rand, among others.

b. The growing oil & gas industry in Africa is expected to drive the growth. Moreover, the increasing demand for stationary electric compressors in the oil & gas industry since they handle all volume capacities and pressures is anticipated to fuel the market expansion over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."