- Home

- »

- Pharmaceuticals

- »

-

Africa Pharmaceutical Market Size, Industry Report, 2033GVR Report cover

![Africa Pharmaceutical Market Size, Share & Trends Report]()

Africa Pharmaceutical Market (2025 - 2033) Size, Share & Trends Analysis Report By Molecule Type (Biologics & Biosimilars), By Product, By Type, By Disease, By Formulation, By Age Group, By Route Of Administration, By End-user, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-210-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Africa Pharmaceutical Market Size & Trends

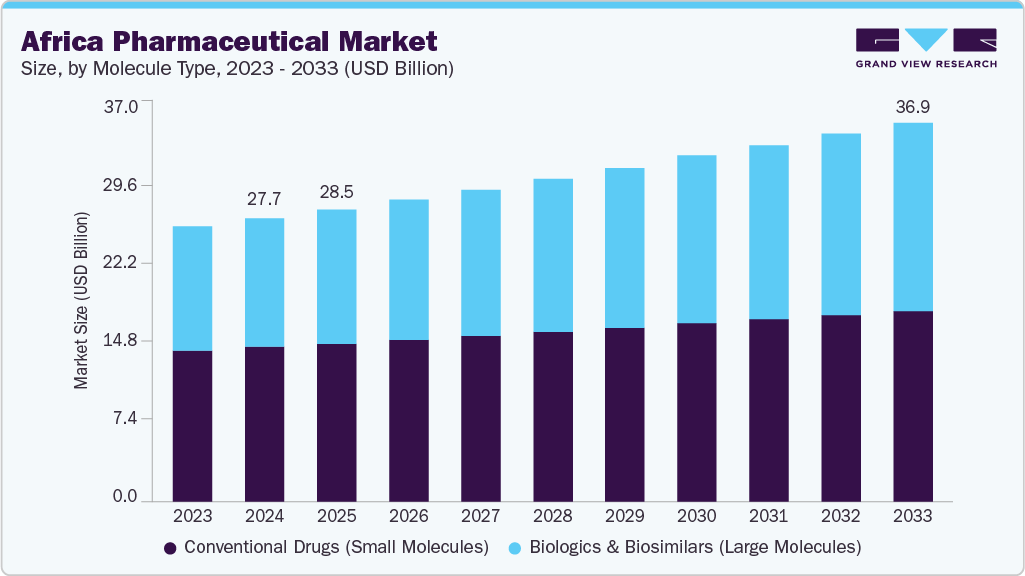

The Africa pharmaceutical market size was estimated at USD 27.65 billion in 2024 and is projected to reach USD 36.96 billion by 2033, growing at a CAGR of 3.3% from 2025 to 2033. Due to the increasing prevalence of both communicable and non-communicable diseases, pharmaceutical demand is expanding rapidly across the continent. Infectious diseases such as malaria, tuberculosis, and HIV/AIDS remain persistent health challenges requiring sustained drug supply. At the same time, lifestyle-related illnesses like diabetes, hypertension, and cardiovascular disorders are on the rise, driven by urbanization and changing dietary habits. This dual disease burden is creating continuous demand for a diverse range of treatments, from affordable generics to advanced biologics. Expanding access to diagnostics and preventive healthcare is also contributing to higher medicine consumption. Collectively, these factors are reinforcing the pharmaceutical sector’s role as a critical pillar of healthcare systems.

The increasing investments in healthcare infrastructure and medical service delivery are accelerating the growth of the pharmaceutical industry. Governments and private sector players are modernizing hospitals, expanding community clinics, and integrating advanced technology into healthcare systems. Public-private partnerships are strengthening medicine distribution channels, improving access in rural and underserved regions. Local manufacturing initiatives in major economies are enhancing self-reliance and reducing dependence on imported drugs.

Donor-funded programs are ensuring the supply of essential medicines for high-burden diseases. For instance, in June 2025, the International Centre for Trade Transparency reported that a leading global logistics firm committed approximately USD 540 billion over five years to enhance healthcare infrastructure across Africa and the Middle East. This included advanced logistics hubs in South Africa, Egypt, Kenya, Dubai, and Saudi Arabia for high-value, time-sensitive shipments such as vaccines, stem cells, and cryogenic materials. Part of a USD 8.64 billion global initiative, this investment strengthens cold-chain networks, warehousing, and supply-chain traceability to meet growing healthcare needs.

The increasing emphasis on regulatory harmonization and continental market integration is opening up new opportunities for industry expansion. Initiatives such as the African Medicines Regulatory Harmonization program and the African Medicines Agency are standardizing approval processes across member states. This creates a more predictable regulatory environment, encouraging local and foreign investment in the sector. Smaller markets benefit from faster access to innovative medicines, while pharmaceutical companies can leverage streamlined cross-border trade.

For instance, in July 2025, Reuters reported that eight African countries took part in a joint regulatory assessment, enabling faster access to a new malaria treatment for infants under 4.5 kg. This collaborative approach shortened approval timelines across the participating nations, improving treatment availability in high-burden malaria regions, with the sweet cherry–flavored formulation dissolving easily in liquids such as breast milk to aid caregivers. Pooled procurement strategies are helping lower drug prices and improve affordability, while enhanced compliance with international quality standards is boosting confidence in locally produced medicines, strengthening Africa’s position as a competitive pharmaceutical hub.

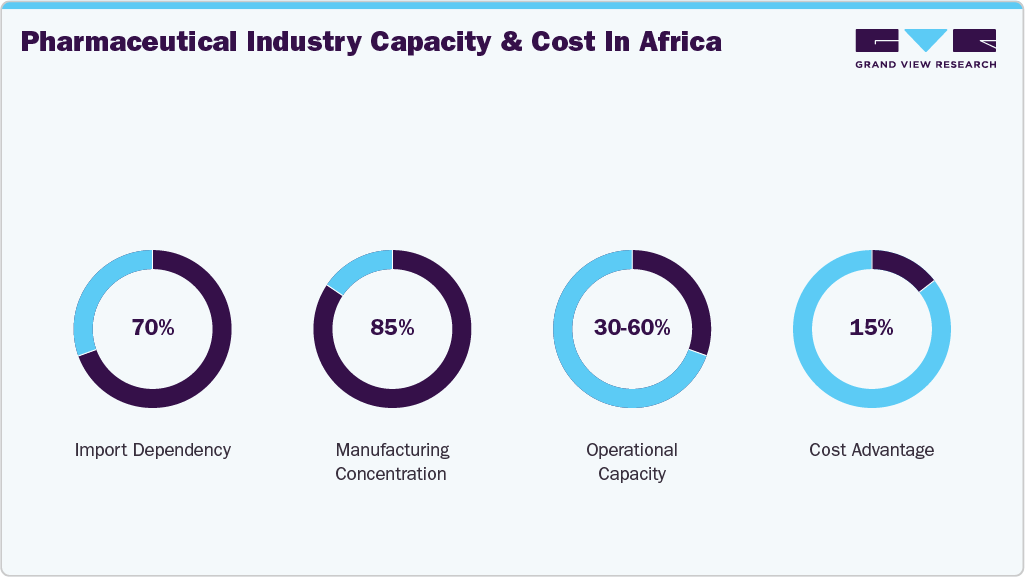

Africa’s pharmaceutical manufacturing landscape is heavily dependent on imports, with over 70% of medicines brought in from abroad, and half of the continent’s countries lacking any local production. Manufacturing is highly concentrated: just eight countries, half of them in North Africa, account for 85% of the continent’s 690 pharmaceutical facilities. Most of these facilities operate at only 30-60% of their capacity, significantly lower than the 70%+ typical in more developed economies.

Despite this, there is a cost advantage for local production: manufacturing tablets, capsules, and creams in countries like Ethiopia and Nigeria can be about 15% cheaper than importing from India. Special Economic Zones (SEZs) are seen as key enablers for growth, offering clustered investment, tailored infrastructure, access to regional markets, and supportive policies. UNCTAD categorizes African countries into four clusters based on readiness for pharmaceutical manufacturing: Leaders, with established industries and strong policies; Followers, with emerging sectors and growth potential; Prospects, showing initial development steps; and Starters, which are at the beginning stage and require substantial investment and support.

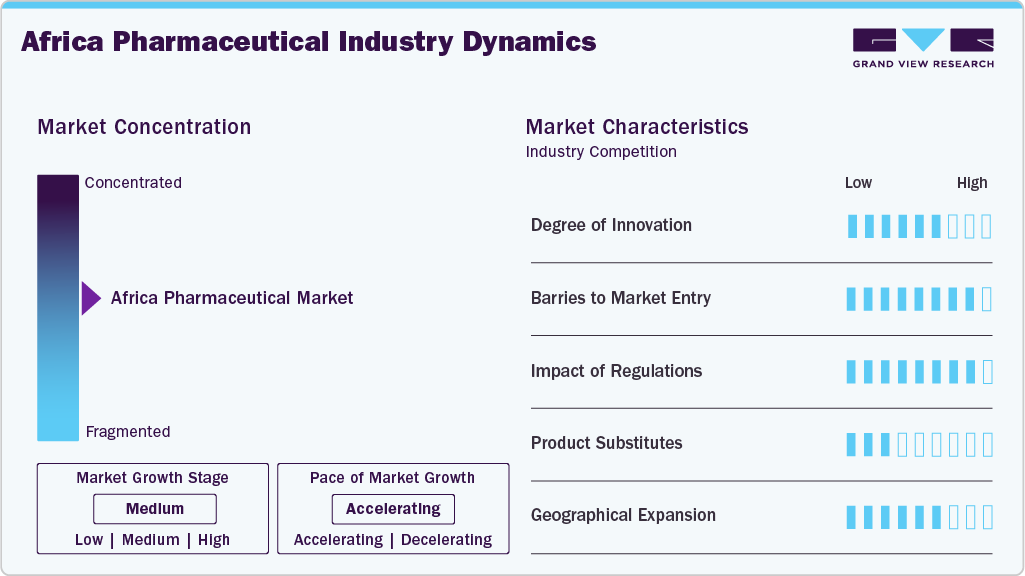

Market Concentration & Characteristics

The Africa pharmaceutical market shows a moderate degree of innovation, driven by the introduction of biologics, biosimilars, and improved formulations of conventional drugs. Key players are investing in treatment advancements for chronic and infectious diseases, with a focus on patient-specific therapies and improved delivery methods such as injectables and inhalers. While innovation is more concentrated in multinational firms, local companies are increasingly developing region-specific treatments to address prevalent conditions. The presence of both branded and generic products ensures a balanced market catering to affordability and innovation. Innovation cycles are influenced by evolving disease patterns and the need for cost-effective therapeutic options.

Market entry in Africa’s pharmaceutical sector faces significant barriers, including stringent regulatory requirements, high production costs, and the need for specialized infrastructure for biologics. New entrants must navigate complex import rules, intellectual property laws, and local manufacturing compliance standards. The dominance of established multinational and regional companies creates strong competitive pressure for newcomers. Limited access to skilled labor and specialized equipment further adds to operational challenges. Additionally, fragmented healthcare systems and uneven purchasing power across countries can make scaling up treatment availability difficult.

Regulations in Africa’s pharmaceutical industry are increasingly harmonized through initiatives like the African Medicines Agency, improving treatment access and safety standards. National regulatory bodies enforce strict quality checks for drug approvals, focusing on efficacy, safety, and therapeutic value. These frameworks encourage a consistent supply of high-quality branded and generic medicines for conditions such as cancer, cardiovascular diseases, and infectious illnesses. Regulatory processes, while improving, can still be lengthy, delaying the introduction of innovative treatments. Overall, robust regulation enhances patient trust but requires significant compliance investments from manufacturers.

Product substitutes in the Africa pharmaceutical market primarily come from generic medicines and alternative formulations of existing treatments. Generics play a critical role in improving affordability and access, especially for chronic diseases like diabetes, hypertension, and respiratory disorders. In some cases, traditional and herbal remedies act as informal substitutes, particularly in rural areas with limited healthcare infrastructure. Biosimilars are also emerging as cost-effective alternatives to expensive biologics, supporting wider patient reach. The competition between branded drugs, generics, and biosimilars drives continuous pricing and accessibility adjustments in the treatment landscape.

Geographical expansion of pharmaceutical treatments in Africa is accelerating, with multinational companies and local manufacturers targeting underserved regions. South Africa, Nigeria, and Egypt remain key production and distribution hubs, while markets like Kenya, Namibia, and Botswana are expanding through improved healthcare infrastructure. Cross-border trade agreements and regional harmonization are enabling broader distribution of life-saving treatments. Rural outreach programs and partnerships with NGOs are extending access to essential medicines for infectious and chronic diseases. This geographical diversification is helping bridge treatment gaps between urban centers and remote communities.

Molecule Type Insights

The conventional drugs (Small Molecules) segment dominated the market with the largest revenue share of 54.63% in 2024, attributed to their established use across a wide range of therapeutic areas. These medicines have proven efficacy and a long track record of safety, making them a first-line treatment in many conditions. They are widely available in both branded and generic forms, ensuring accessibility for a large patient population. Manufacturing and distribution of small molecules are relatively less complex, allowing for competitive pricing. The segment benefits from strong demand in chronic diseases such as hypertension, diabetes, and respiratory disorders. High consumption in both urban and rural settings sustains consistent revenue generation. The versatility of small molecules in oral and other convenient formulations further reinforces their market leadership.

The biologics & biosimilars (Large Molecules) segment is projected to grow at a fastest CAGR of 4.4% over the forecast period, due to their expanding role in treating complex and life-threatening diseases. Advanced therapies in oncology, autoimmune disorders, and rare genetic conditions are increasingly based on biologics. Growing clinical adoption is supported by their high specificity and ability to target disease pathways more effectively. Biosimilars are enabling broader patient access to biologic treatments at reduced costs.

The segment is benefiting from rising incidence rates of cancers and immune-related conditions in Africa’s urban centers. In July 2025, Aspen Pharmacare initiated registrations to manufacture GLP-1 drugs for diabetes and obesity, aiming to tap into a booming global weight-loss drug market projected to reach USD 100 billion by the end of the decade. Increased private investment in cold-chain infrastructure supports safe distribution of these products, while ongoing innovation in monoclonal antibodies and recombinant proteins will further accelerate growth.

Product Insights

The branded segment dominated the market with the largest revenue share of 66.86% in 2024, due to strong physician preference and established brand trust. These products are often supported by robust clinical evidence and post-marketing surveillance. They dominate treatment regimens for serious conditions such as cancer, cardiovascular diseases, and advanced infections. Higher patient confidence in branded medicines ensures sustained demand in both retail and hospital settings. For instance, in September 2023, Novo Nordisk announced a partnership with Aspen Pharmacare to escalate insulin supplies in Africa, reinforcing the availability of critical branded therapies for chronic conditions. The segment benefits from extensive marketing and distribution networks maintained by multinational companies. Premium pricing and exclusivity in patented drugs contribute to revenue leadership, while consistent supply and product quality reinforce brand loyalty across the region.

The generic segment is projected to grow at the fastest CAGR of 4.4% over the forecast period due to patent expirations of key branded drugs creating new opportunities for generic manufacturers. Local production capabilities in major African economies are improving supply stability. For instance, in September 2024, Eli Lilly licensed production of its rheumatoid arthritis drug, Olumiant, to Egypt’s Eva Pharma, with plans to supply 49 African countries starting by 2026, marking a notable move toward regional generics manufacturing under license.

The increasing prevalence of chronic conditions is driving demand for long-term medication use, where generics offer significant cost savings. Expansion of pharmacy chains in urban centers is boosting retail distribution of generics. Wider therapeutic coverage across cardiovascular, respiratory, and metabolic disorders enhances market penetration. Competitive pricing strategies are ensuring strong acceptance among both prescribers and patients.

Type Insights

The prescription segment dominated the market with the largest revenue share of 86.76% in 2024, driven by its role in managing complex and high-risk medical conditions. Many critical treatments for oncology, cardiovascular, and infectious diseases require physician oversight. For instance, in January 2024, LifeArc, along with the Bill and Melinda Gates Foundation, announced investments in the Grand Challenges African Drug Discovery Accelerator (GC ADDA) program to support five African drug discovery projects over three to five years, underscoring the importance of specialized prescription-based therapies in addressing critical health needs. These medicines are often tied to hospital-based administration or specialist monitoring. Strong clinical protocols in hospitals and specialty clinics support prescription demand. The segment benefits from advanced diagnostic capabilities that guide targeted treatment plans. Physician preference for evidence-based therapies drives consistent usage. The complexity and potential risks of these drugs maintain their dominance over non-prescription alternatives.

The OTC segment is projected to grow at the fastest CAGR of 5.0% over the forecast period due to self-care practices becoming more common in urban Africa. Expanding consumer awareness of preventive health is increasing demand for analgesics, vitamins, and cold medications. Retail pharmacy growth is making OTC products more accessible to a broader population. The segment benefits from ease of purchase without the need for medical consultations. Increasing disposable incomes in middle-class households are fueling demand for wellness-oriented products. Seasonal surges in respiratory and gastrointestinal conditions further boost OTC sales. Product innovation in packaging and formulations is enhancing consumer appeal.

Disease Insights

The cancer segment dominated the market with the largest revenue share of 18.06% in 2024, driven by the rising incidence of oncology cases across Africa. Advancements in diagnostic imaging and screening programs are boosting early detection rates, while targeted therapies and immuno-oncology drugs are gaining adoption in major urban centers. Branded biologics dominate treatment, supported by specialist protocols and multi-drug regimens, sustaining high treatment volumes. Hospital oncology units remain key drivers of prescription demand.

For instance, in May 2024, the European Journal of Cancer Prevention published an analysis of mortality patterns in selected Northern and Southern African countries, revealing lung cancer as the leading cause of death among men in nearly all countries, reaching 24 per 100,000 in Réunion, while prostate cancer topped in South Africa at 23 per 100,000. Among women, breast cancer ranked highest except in South Africa, where uterine cancer led at 17 per 100,000. Rising colorectal and pancreatic cancer mortality highlights the need for improved prevention, detection, and treatment strategies.

The neurological disorders segment is projected to grow at the second-highest CAGR of 5.7% over the forecast period due to the rising prevalence of conditions such as epilepsy, Alzheimer’s disease, Parkinson’s disease, and multiple sclerosis across Africa. Increasing life expectancy and the region’s growing aging population have led to a higher incidence of neurodegenerative disorders, further fueling demand for effective treatment options. Limited access to specialized neurological care in rural areas has also created opportunities for innovative pharmaceutical solutions and affordable generic drugs. In addition, the expansion of healthcare infrastructure, supportive government initiatives, and increasing investments by international pharmaceutical companies in neurological research and drug availability are expected to drive strong growth in this segment.

Route Of Administration Insights

The oral segment dominated the market with the largest revenue share of 57.81% in 2024, driven by the most convenient and widely accepted route of administration. They are favored for chronic disease management due to ease of use and high patient compliance. The segment covers a broad range of therapeutic categories, from cardiovascular to metabolic disorders. Manufacturing scalability of oral drugs ensures consistent availability. The stability of solid dosage forms supports longer shelf life and simpler distribution. Retail and hospital pharmacies maintain a strong inventory of oral medicines. Cost efficiency in production and packaging further reinforces market share.

The parenteral segment is projected to grow at the fastest CAGR of 5.8% over the forecast period due to its critical role in hospital-based treatments. They enable rapid onset of action, essential for emergency care and severe infections. Complex biologics, chemotherapy agents, and advanced antibiotics are often administered parenterally. Growing use in oncology, autoimmune diseases, and critical care is driving demand. Investment in cold-chain systems is supporting the safe delivery of temperature-sensitive injectables. Expansion of specialty infusion centers is improving patient access. Higher therapeutic effectiveness in acute settings is fueling clinical adoption.

Formulation Insights

The tablets segment dominated the market with the largest revenue share of 26.09% in 2024, driven by their convenience, stability, and cost-effectiveness. They are widely used in managing chronic illnesses requiring long-term medication adherence, with broad applicability across therapeutic categories, ensuring consistent demand. Tablets are easy to store, transport, and dispense, supporting supply chain efficiency. For instance, in November 2023, Universal Corporation Limited received WHO approval to manufacture malaria drugs, becoming the first African company to achieve this milestone, which will aid in preventing malarial outbreaks worldwide. High production capacity from regional manufacturers strengthens availability, while patient preference for familiar dosage forms sustains their popularity. The format’s compatibility with both branded and generic products further enhances market reach.

The sprays segment is projected to grow at the fastest CAGR of 5.3% over the forecast period due to their ease of administration, improved patient compliance, and rapid onset of action. Sprays are particularly favored in treatments for respiratory disorders, allergies, and nasal congestion, which are prevalent in parts of Africa due to rising pollution levels and increasing incidence of asthma and other chronic respiratory conditions. Moreover, pharmaceutical companies are expanding their portfolio of nasal and oral spray formulations as they offer a non-invasive alternative to injections, making them more acceptable to patients. Growing urbanization, lifestyle changes, and higher awareness of self-administered therapies are expected to further fuel demand for pharmaceutical sprays across the African market.

Age Group Insights

The adult segment dominated the market with the largest revenue share of 65.40% in 2024, due to higher disease prevalence in this age group. Chronic conditions such as diabetes, hypertension, and respiratory disorders are more common among adults. Increased health awareness and regular health checks are driving treatment uptake. Urban populations have greater access to diagnostics and medicines. Adults often require multiple medications for comorbidities, increasing per-patient spending. Lifestyle changes and sedentary habits are contributing to higher pharmaceutical consumption. The segment benefits from high demand in both preventive and therapeutic treatments.

The children & adolescents segment is projected to grow at the significant CAGR of 3.4% over the forecast period due to improved access to child-specific formulations. Higher focus on vaccination programs and infectious disease management in younger populations is driving demand. Development of flavored syrups, dispersible tablets, and low-dose injectable is improving adherence. Rising awareness among parents about early treatment intervention is boosting uptake. School health initiatives are increasing detection and treatment rates for common conditions. Expanding availability of pediatric antibiotics and antivirals is strengthening market presence. Nutritional supplements for growth and immunity are adding to segment growth.

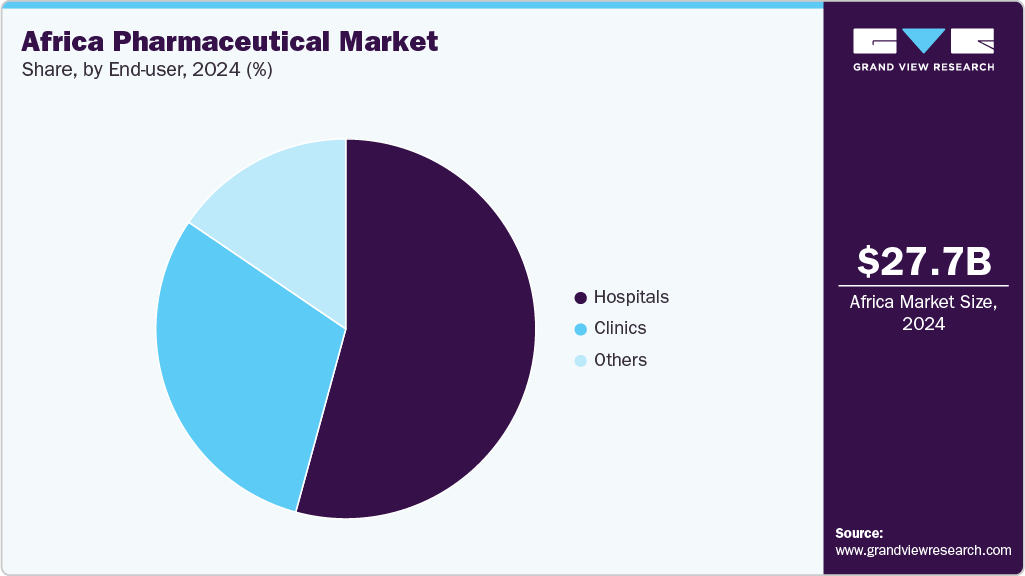

End-user Insights

The hospitals segment dominated the market with the largest revenue share of 54.25% in 2024, owing to their role in managing complex and acute conditions. They serve as the primary distribution point for prescription medicines in critical care and surgical settings. Specialized departments such as oncology, cardiology, and intensive care generate high drug consumption. Hospitals maintain steady procurement for both branded and generic products, and centralized purchasing supports a consistent supply of essential medicines.

Inpatient treatment regimens often involve multi-drug therapies, increasing volume demand, while strong diagnostic capabilities enable targeted and advanced treatment approaches. For instance, in October 2023, the well-known Tygerberg Hospital in Parow, South Africa, revealed a major redevelopment program aimed at transforming healthcare infrastructure by replacing inefficient traditional facilities with modern, fully equipped ones. This mega-project included a new 596-bed facility at Belhar offering Level 1 and Level 2 services, as well as an 893-bed tertiary facility on the Tygerberg campus, designed to bridge the gap between higher education institutes and healthcare trainers and technologists.

The clinics segment is projected to grow at the fastest CAGR of 3.6% over the forecast period due to primary access points for outpatient care. They provide convenient and cost-efficient treatment for common and chronic conditions. The rise of private and specialized clinics in urban areas is boosting pharmaceutical sales. Clinics are increasingly offering preventive health services, expanding product uptake. Improved diagnostic equipment in clinics supports accurate prescribing. The shorter patient waiting times encourage higher visit frequency.

Country Insights

South Africa Pharmaceutical Market Trends

The South Africa pharmaceutical market dominated the market with a revenue share of 22.56% in 2024, due to its advanced healthcare infrastructure, strong manufacturing base, and established distribution networks. The presence of multinational pharmaceutical companies ensures a steady supply of innovative medicines across multiple therapeutic areas. High demand for treatments addressing both communicable and non-communicable diseases is supported by well-equipped hospitals and clinics. Urbanization and a growing middle-income population are contributing to increased spending on quality healthcare products. The market benefits from a skilled workforce and access to cutting-edge research facilities, enabling rapid adoption of new therapies. Expansion in specialty medicines, including oncology and biologics, is strengthening the market’s premium segment. Rising health awareness among consumers continues to drive the adoption of both preventive and chronic disease treatments.

Nigeria Pharmaceutical Market Trends

Nigeria pharmaceutical market held a substantial revenue share in 2024, driven by large population base and rapidly expanding urban centers. Growing incidences of chronic diseases such as diabetes, hypertension, and cardiovascular disorders are fueling consistent medicine demand. A vibrant local manufacturing sector supports production of cost-effective generics, meeting a wide range of treatment needs. Retail pharmacies and private healthcare providers are expanding across urban and semi-urban areas, enhancing access to essential medicines. Increased consumer preference for branded generics is improving market penetration for both domestic and international players. Strong demand for pediatric and maternal health products reflects the country’s demographic profile. The continuous diversification of therapeutic offerings is strengthening Nigeria’s position as a key hub in West Africa’s pharmaceutical supply chain.

Namibia Pharmaceutical Market Trends

Namibia pharmaceutical market registered the substantial revenue share in 2024. The expansion of retail pharmacy chains is improving medicine accessibility in both cities and remote areas. Demand for specialized treatments, including oncology and cardiovascular drugs, is increasing as diagnostic capabilities improve. Rising health awareness and a preference for preventive care are boosting the sales of vitamins, supplements, and wellness products. The country’s strategic location in Southern Africa supports its role as a distribution point for surrounding markets.

Botswana Pharmaceutical Market Trends

The Botswana pharmaceutical market held a substantial revenue share in 2024, driven by a growing demand for chronic disease management and preventive healthcare. An expanding middle-income group is fueling interest in higher-quality medicines and wellness products. Private hospitals and pharmacies are expanding their reach, offering a wider selection of both branded and generic drugs. Rising incidences of cancer, cardiovascular disorders, and respiratory illnesses are prompting demand for advanced treatments. Improvements in diagnostic services are enabling early detection and boosting prescription volumes. The market is experiencing growth in therapeutic categories such as antibiotics, antivirals, and biologics. Botswana’s position as a stable and economically strong market supports consistent demand for pharmaceutical imports and domestic distribution.

Senegal Pharmaceutical Market Trends

The Senegal pharmaceutical market is projected to grow at the fastest CAGR of 6.1% over the forecast period, driven by rising demand for treatments addressing chronic diseases such as diabetes, hypertension, and cancer. Government initiatives to improve healthcare infrastructure and expand universal health coverage are further enhancing access to essential medicines. Increasing urbanization, coupled with rising disposable incomes, is fueling demand for both prescription drugs and over-the-counter (OTC) products. Generic medicines remain a key growth driver due to their affordability, while herbal and traditional remedies are gaining popularity among consumers. Additionally, the expansion of pharmacy networks and online distribution channels is boosting availability. Despite challenges such as counterfeit drugs, the market is poised for steady and robust growth.

Ivory Coast Pharmaceutical Market Trends

The Ivory Coast pharmaceutical market held a substantial revenue share in 2024, driven by government initiatives to strengthen local manufacturing capacity and reduce reliance on imports. Policies supporting the expansion of pharmaceutical facilities and the promotion of generic medicines have played a central role in increasing access to affordable treatments. The introduction of universal health coverage has further boosted demand by improving healthcare accessibility across a broader population. Growing urbanization and rising consumer awareness of health and wellness are also contributing to market growth, with over-the-counter products such as vitamins, minerals, and herbal remedies gaining popularity. Together, these factors have created a favorable environment for the sustained development of the pharmaceutical sector in the Ivory Coast.

Mozambique Pharmaceutical Market Trends

The Mozambique pharmaceutical market held a notable revenue share in 2024, driven by efforts to expand domestic manufacturing and reduce reliance on imports. Local production facilities have strengthened the output of essential medicines, vaccines, and medical supplies, supporting the country’s broader goal of achieving greater healthcare self-sufficiency. Government initiatives promoting investment in pharmaceutical infrastructure, along with the implementation of stricter regulatory frameworks, have enhanced quality standards and encouraged innovation. The introduction of systems to improve medicine traceability and combat counterfeiting has further boosted market confidence. Rising demand for affordable treatments, coupled with increasing attention to public health programs, has created favorable conditions for growth and positioned Mozambique’s pharmaceutical sector as an important contributor to the regional market.

Key Africa Pharmaceutical Company Insights

The Africa pharmaceutical market is highly competitive, led by Abbott Laboratories and AbbVie, which maintain strong portfolios in chronic disease treatments and specialty care segments. AstraZeneca and Bristol Myers Squibb focus on innovative therapies for oncology, cardiovascular, and respiratory conditions, supported by extensive clinical research and physician engagement.

Aspen and Cipla leverage their strong regional manufacturing bases to supply both branded and generic medicines across therapeutic areas, enhancing accessibility. Aurobindo Pharma, Sun Pharma, and BAYER drive competitive pricing and diverse treatment offerings, especially in infectious and lifestyle-related diseases. Alfasigma and BGM maintain niche expertise in gastrointestinal and metabolic treatments, targeting specialized patient needs. Competition in the market revolves around treatment innovation, manufacturing capacity, cost efficiency, and expansion into underserved African regions.

Key Africa Pharmaceutical Companies:

- Abbott Laboratories

- AbbVie

- Alfasigma

- Aspen

- Aurobindo Pharma

- AstraZeneca

- Bristol Myers Squibb

- BGM

- Cipla

- Sun Pharma

- BAYER

Recent Developments

-

In October 2024, Aurobindo Pharma's subsidiary, Aurogen South Africa, sold its entire 24.5% shareholding in Novagen BBBEE Invest Co, ending its joint venture partnership.

-

In September 2023, Cipla, South Africa announced the agreement to acquire Actor Pharma. This acquisition will support Cipla’s strategy for OTC and wellness portfolio growth.

-

In June 2023, Fosum Pharma partnered with IFC to improve the pharmaceutical company facility and distribution hub. This project will improve access to quality, affordable life life-saving medicines across West Africa.

Africa Pharmaceutical Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.54 billion

Revenue forecast in 2033

USD 36.96 billion

Growth rate

CAGR of 3.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Molecule type, product, type, disease, route of administration, formulation, age group, end-user, country

Country scope

Botswana; Namibia; Zimbabwe; Zambia; Tanzania; Rwanda; Ghana; Nigeria; South Africa; Angola; Mozambique; Cameroon; Senegal; Ivory Coast

Key company profiled

Abbott Laboratories; AbbVie; Alfasigma; Aspen; Aurobindo Pharma; AstraZeneca; Bristol Myers Squibb; BGM; Cipla; Sun Pharma; BAYER.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Africa Pharmaceutical Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Africa pharmaceutical market report based on molecule type, product, type, disease, route of administration, formulation, age group, end-user, and country:

-

Molecule Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Biologics & Biosimilars (Large Molecules)

-

Conventional Drugs (Small Molecules)

-

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Branded

-

Generic

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Prescription

-

OTC

-

-

Disease Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cardiovascular Diseases

-

Cancer

-

Diabetes

-

Infectious Diseases

-

Neurological Disorders

-

Respiratory Diseases

-

Autoimmune Diseases

-

Mental Health Disorders

-

Gastrointestinal Disorders

-

Women’s Health Diseases

-

Genetic And Rare Genetic Diseases

-

Dermatological Conditions

-

Obesity

-

Renal Diseases

-

Liver Conditions

-

Hematological Disorders

-

Eye Conditions

-

Infertility Conditions

-

Endocrine Disorders

-

Allergies

-

Others

-

-

Route Of Administration Outlook (Revenue, USD Billion, 2021 - 2033)

-

Oral

-

Topical

-

Parenteral

-

Intravenous

-

Intramuscular

-

-

Inhalations

-

Others

-

-

Formulation Outlook (Revenue, USD Billion, 2021 - 2033)

-

Tablets

-

Capsules

-

Injectable

-

Sprays

-

Suspensions

-

Powders

-

Other Formulations

-

-

Age Group Outlook (Revenue, USD Billion, 2021 - 2033)

-

Children & Adolescents

-

Adults

-

Geriatric

-

-

End-user Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hospitals

-

Clinics

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2021 - 2033)

-

Botswana

-

Namibia

-

Zimbabwe

-

Zambia

-

Tanzania

- Rwanda

-

Ghana

-

Nigeria

-

South Africa

-

Angola

-

Mozambique

-

Cameroon

-

Senegal

-

Ivory Coast

-

Frequently Asked Questions About This Report

b. The Africa pharmaceutical market size was estimated at USD 27.65 billion in 2024 and is projected to reach USD 36.96 billion by 2033, growing at a CAGR of 3.3% from 2025 to 2033.

b. The Africa pharmaceutical market is projected to grow at a CAGR of 3.3% from 2025 to 2033 to reach USD 36.96 billion by 2033.

b. Based on molecule type, conventional drugs (small molecules) segment dominated the market with the largest revenue share of 54.63% in 2024, attributed to their established use across a wide range of therapeutic areas.

b. Some key players operating in the Africa pharmaceutical market include Abbott Laboratories, AbbVie, Alfasigma, Aspen, Aurobindo Pharma, AstraZeneca, Bristol Myers Squibb, BGM, Cipla, Sun Pharma, and Bayer.

b. Key factors that are driving the market growth include increasing prevalence of both communicable and non-communicable diseases, pharmaceutical demand is expanding rapidly across the continent. Infectious diseases such as malaria, tuberculosis, and HIV/AIDS remain persistent health challenges requiring sustained drug supply.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.