Africa Nonwoven Fabrics Market Size, Share & Trends Analysis Report By Product (Disposable, Durable), By Material, By Application (Hygiene, Industrial), By Technology (Spunbond, Dry Laid), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-056-4

- Number of Report Pages: 198

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Africa Nonwoven Fabrics Market Trends

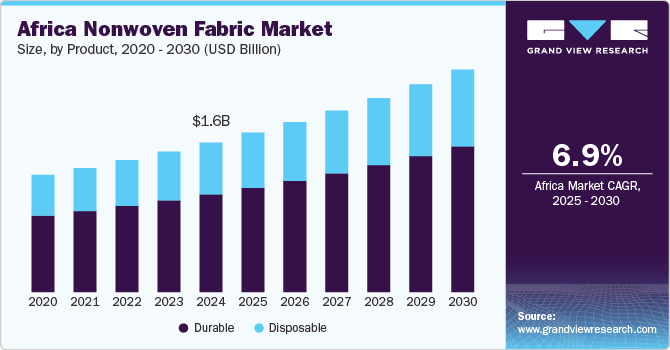

The Africa nonwoven fabric market size was estimated at USD 1.63 billion in 2024 and is expected to grow at a CAGR of 6.9% from 2025 to 2030. As urbanization accelerates and populations grow, there is a heightened need for disposable hygiene products such as diapers and sanitary pads, which utilize nonwoven fabrics. In addition, the automotive industry is expanding in Africa, with nonwoven materials used for interior components, insulation, and soundproofing, further driving market growth.

Technological advancements in nonwoven fabric manufacturing also play a crucial role in the sector’s expansion. Innovations in production processes, such as spunbonding, melt-blowing, and needle punching, are improving efficiency and reducing costs. These technologies enable manufacturers to produce high-quality fabrics that meet the specific requirements of diverse applications. As companies adopt more automated and efficient production techniques, the overall capacity of nonwoven fabric production in Africa is expected to increase, making the region more competitive in the global market.

Environmental considerations are becoming increasingly important, with many companies and consumers seeking sustainable solutions. Nonwoven fabrics made from biodegradable materials and recyclable components are gaining traction. With its rich biodiversity, the African continent also focuses on sustainable practices to minimize environmental impact. As governments and industries prioritize sustainability, the demand for eco-friendly nonwoven fabrics is expected to rise, aligning with global trends and enhancing the market's growth potential.

Furthermore, supportive government policies and investment initiatives bolster the nonwoven fabric industry in Africa. Many African nations recognize the importance of developing their manufacturing sectors to reduce reliance on imports and stimulate local economies. Initiatives aimed at boosting local production, improving infrastructure, and providing incentives for investment are creating a more favorable environment for nonwoven fabric manufacturers. This support attracts foreign direct investment and encourages domestic players to innovate and expand their operations.

Finally, the rise of e-commerce and changing consumer behaviors are contributing to the growth of the nonwoven fabric market in Africa. As online shopping becomes more prevalent, the demand for packaging materials, which often include nonwoven fabrics, is increasing. In addition, the growing awareness of health and hygiene, exacerbated by recent global health crises, drives consumer preferences toward products made from nonwoven fabrics. This shift in consumer behavior creates opportunities for manufacturers to diversify their offerings and cater to evolving market needs, ultimately propelling the growth of the nonwoven fabric sector across the continent.

Product Insights

Durable product segment accounted for 65.3% of the revenue share in 2024. The durable fabrics can be made using different fiber webs that impart properties such as water absorption or repellency, thermal and fire resistance, antimicrobial treatment, and so on. Compared to traditional woven uniform fabrics, the reinforced multi-layer nonwoven composite fabrics are lighter in weight, much more breathable, and superior in tear and breaking strength.

The materials used to make functional clothes must be able to go through numerous washings without losing their functionality (or appearance). Even though they can last a very long period, washable materials are not always possible. Nonwovens that can be washed and are durable belong to a different class. The construction industry uses polyester-based spunbond materials as durable fabrics.

The disposable product segment accounted for a market value of USD 566.2 million in 2024. Disposable nonwoven fabrics are used in single-use products. They go by the name of non-durable fabrics as well. Single-use items include diapers, bandages for injuries, cleaning supplies, and disposable protective garments.

In addition, they are used to produce disposable items like slippers and shoes and bath and face towels. Disposable products made of fabrics are manufactured using spunbond technology. These products also cater to the medical, automotive, filtration, construction, and hospitality industries.

Material Insights

The polypropylene material segment led the Africa nonwoven fabric market, accounting for a 49.7% revenue share in 2024. Nonwoven fabrics made of polypropylene are primarily used in nonwoven bags, interlinings, coveralls for the medical industry, masks, and filters. It is gaining popularity in the healthcare and fashion industries.

Bio-polymers are anticipated to register the fastest CAGR of 8.5% over the forecast period. With global concerns surrounding plastic pollution and environmental degradation, there is a marked shift towards biodegradable and eco-friendly products. African consumers, increasingly aware of ecological issues, seek alternatives to conventional petroleum-based nonwoven fabrics. This shift creates a ripe bio-polymer market, which can provide the same functionalities while minimizing environmental impact.

The polyester product segment is expected to experience substantial growth during the forecast period with a CAGR of 6.8%. Polyester is preferred in many manufacturing technologies, such as wet-laid web formation, spunlaid, and melt-blown. Fabrics made of polyester are durable and robust. Polyester blends or 100% polyester filaments can make polyester fabric.

The polyethylene fabric was valued at USD 40.6 million in 2024 owing to the rising demand in building & construction, industrial, filtration, and furniture industries. Polyethylene fabric is made with melt-blown technology, employing polyethylene and polyethylene wax resin composition.

The wood pulp segment of the African nonwoven fabric market was valued at USD 152.6 million in 2024. This growth is attributed to the sustainability offered by wood pulp. Wood pulp is regarded as an optimum fit for air-laid manufacturing technology. The laid process uses wood pulp and assures sustainability.

Rayon, a natural fiber, is a derivative of wood pulp. Pure rayon filament, or a rayon blend, makes nonwoven fabrics. The fiber made of rayon offers a smooth finish, a high degree of softness, and significantly high absorbency. Nonwoven fabrics made of rayon are more accessible to dye and, hence, offer a wide array of options for coloring.

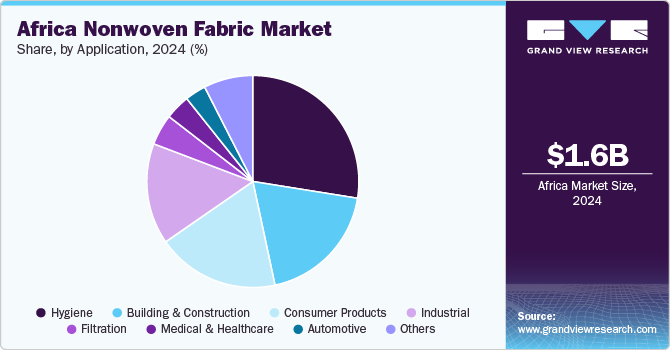

Application Insights

The hygiene segment accounted for the largest market revenue share of 29.7% in 2024. As more people move to urban areas, the demand for hygiene products such as diapers, sanitary pads, and adult incontinence products has surged. This demographic shift creates a pressing need for affordable and effective hygiene solutions, positioning nonwoven fabrics as preferred due to their lightweight, absorbent, and disposable characteristics.

The medical & healthcare segment is anticipated to register the fastest CAGR of 8.5% over the forecast period. The rising prevalence of chronic diseases and an aging population contribute to the growth of the medical and healthcare segment. As the incidence of conditions such as diabetes, cardiovascular diseases, and respiratory issues rises, there is an increasing need for specialized medical products that can provide effective treatment and care. Due to their absorbency, softness, and breathability, nonwoven fabrics are commonly used in wound care products, surgical dressings, and other medical applications. This growing demand for high-quality medical supplies is driving the expansion of the nonwoven fabric market in the healthcare sector.

Technology Insights

The spunbond segment accounted for the largest market revenue share of 43.7% in 2024. Spunbond technology allows for producing nonwoven fabrics with excellent strength and flexibility, making them suitable for various uses, from hygiene products to agricultural covers. As industries seek more efficient materials to meet performance and budgetary requirements, spunbond nonwovens are becoming a go-to solution.

The spunlace (Hydroentaglement) segment is anticipated to register the fastest CAGR over the forecast period. The expanding applications of spunlace fabrics across multiple sectors further bolster their market growth. In addition to hygiene and medical uses, spunlace nonwovens are increasingly utilized in personal care products, household wipes, and industrial applications. Their ability to combine textile materials' softness with nonwovens' functional characteristics makes them suitable for a wide range of products. As industries continue to explore and innovate with spunlace fabrics, the demand for these materials is expected to rise, enhancing their market presence.

Regional Insights

Central Africa led the market and accounted for a market value of USD 835.4 million in 2024. The Central African nonwoven fabrics market has a vast potential for growth over the forecast period. The increase is because they have replaced woven and knitted textiles in the textile industry.

North Africa Nonwoven Fabrics Market Trends

The market for North Africa nonwoven fabric is expected to experience the fastest growth during the forecast period, with a CAGR of 7.8%. Algeria has considerably rich natural resources, mainly oil & natural gas. Egypt and Morocco contain huge industrial bases. The economy of North Africa is based on textile and consumer goods, amongst others. The Egyptian economy was a major driving factor for the African market.

South Africa Nonwoven Fabrics Market Trends

The South Africa nonwoven fabric market was valued at USD 279.7 million in 2024, owing to the deposits of plentiful minerals in this region. The primary region's main industries are mining, transport, energy, manufacturing, tourism, and agriculture. South Africa currently has over 420 state hospitals and 200 private hospitals. Because of the expanding healthcare sector, the South African market is expected to grow significantly over the forecast period.

The African nonwoven fabrics market has a vast potential for growth over the forecast period. The increase is because these products have replaced woven and knitted textiles in the textile industry. Approximately 30,000 and 100,000 people are employed directly and indirectly by the nonwoven industry in Africa.

Key Africa Nonwoven Fabrics Company Insights

Some of the key players operating in the market include Fibertex Nonwovens A/S, PFNonwovens Group, Berry Global Group Inc., and others:

-

Fibertex Nonwovens A/S manufactures nonwoven fabrics, specializing in innovative solutions for various industries, including automotive, hygiene, construction, and geotextiles. In Africa, the company offers diverse products, including absorbent materials for hygiene applications, durable fabrics for construction and filtration, and geotextiles designed for soil stabilization and erosion control. Their commitment to sustainability and technological advancement drives their product development, aiming to meet local and global demands.

-

PFNonwovens Group is a manufacturer of nonwoven fabrics, recognized for its high-quality production and innovative technologies. The company has expanded its footprint across Europe and into Africa, focusing on diverse applications such as hygiene products, medical supplies, and industrial textiles. The company offers a range of nonwoven solutions, including materials for personal care products, such as diapers and feminine hygiene items, as well as durable fabrics for automotive and construction applications.

Key Africa Nonwoven Fabrics Companies:

- Fibertex Nonwovens A/S

- PFNonwovens Group

- Spunchem

- Kimberly-Clark

- Wemy industries

- Brits Nonwoven

- Freudenberg Group

- Ahlstorm-Munksjo

- Berry Global Group Inc.

- Fitesa S.A. and Affiliates

- Indorama Ventures Public Company Limited

- Asahi Kasei Corporation

- Mitsui Chemicals, Inc.

- Glatfelter Corporation

- Dupont

Africa Nonwoven Fabrics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.74 billion |

|

Revenue forecast in 2030 |

USD 2.43 billion |

|

Growth rate |

CAGR of 6.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million, volume in kilotons and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, material, application, technology, region |

|

Regional Scope |

Africa |

|

Country scope |

Central Africa; South Africa; North Africa |

|

Key companies profiled |

Fibertex Nonwovens A/S; PFNonwovens Group, Spunchem; Kimberly-Clark; Wemy industries; Brits Nonwoven; Freudenberg Group; Ahlstorm-Munksjo; Berry Global Group Inc.; Fitesa S.A. and Affiliates; Indorama Ventures Public Company Limited; Asahi Kasei Corporation; Mitsui Chemicals, Inc.; Glatfelter Corporation; Dupont |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Africa Nonwoven Fabrics Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Africa nonwoven fabrics market on the basis of product, material, application, technology and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Durable

-

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene

-

Polyester

-

Polyethylene

-

Wood Pulp

-

Rayon/Lyocell

-

Biopolymers

-

PLA

-

PHA

-

Other Types

-

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Hygiene

-

Building & Construction

-

Industrial

-

Consumer Products

-

Filtration

-

Automotive

-

Medical & Healthcare

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Spunbond

-

Dry Laid

-

Wet Laid

-

Spunlace

-

Meltblown

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Africa

-

South Africa

-

North Africa

-

Central Africa

-

-

Frequently Asked Questions About This Report

b. The Africa nonwoven fabric market size was estimated at USD 1.63 billion in 2024 and is expected to reach USD 1.70 billion in 2025.

b. The Africa Nonwoven fabric market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 2.43 billion by 2030.

b. Durable product segment dominated the market and accounted for 60.4% share of the revenue in 2024. The durable nonwoven fabric market demand is driven as in comparison to traditional woven uniform fabrics, the reinforced multi-layer nonwoven composite fabrics have been created to be lighter in weight, much more breathable, and superior in tear and breaking strength.

b. Some of the key players operating in the Africa nonwoven fabric market include Fibertex Nonwovens A/S, PFNonwovens Group, Spunchem, Kimberly-Clark, Wemy industries, Brits Nonwoven, Freudenberg Group, Ahlstorm-Munksjo, Berry Global Group Inc., Fitesa S.A. and Affiliates, Indorama Ventures Public Company Limited, Asahi Kasei Corporation, Mitsui Chemicals, Inc., Glatfelter Corporation, Dupont.

b. The key factors driving the Africa nonwoven fabric market include a rise in Hospital-acquired Infections (HAIs).

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."