- Home

- »

- Advanced Interior Materials

- »

-

Africa Mobile Air Compressor Market Size Report, 2030GVR Report cover

![Africa Mobile Air Compressor Market Size, Share & Trends Report]()

Africa Mobile Air Compressor Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Rotary), By Lubrication (Oil Free, Oil Filled), By Power (Diesel), By Application (Construction, Mining, Oil & Gas), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-060-2

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Africa Mobile Air Compressor Market Trends

The Africa mobile air compressor market size was estimated at USD 285.5 million in 2024 and is anticipated to grow at a CAGR of 3.9% from 2025 to 2030. The Africa mobile air compressor market is experiencing significant growth due to the rapid expansion of various industries, particularly construction and mining. As urbanization accelerates and infrastructure projects gain momentum across the continent, there is an increased demand for reliable and efficient equipment. Mobile air compressors are essential in these sectors for powering pneumatic tools, aiding in excavation, and facilitating various construction processes. The need for portability and versatility in equipment further drives businesses to invest in mobile solutions that can easily be transported to different job sites.

Another key driving factor is the rising emphasis on energy efficiency and sustainability. Many companies are seeking to reduce their operational costs and environmental impact, leading to a shift towards advanced compressor technologies that offer better fuel economy and lower emissions. Additionally, the growth of renewable energy projects, such as wind and solar farms, is creating new applications for mobile air compressors, which are often required during installation and maintenance phases. As businesses continue to innovate and prioritize sustainable practices, the demand for mobile air compressors in Africa is likely to increase in tandem.

Drivers, Opportunities & Restraints

The Africa air compressor market is primarily driven by rapid industrialization across various sectors, including construction, mining, and manufacturing. As countries invest in infrastructure development and resource extraction, the demand for efficient and reliable air compressors to power tools and machinery increases. Additionally, technological advancements in efficiency and portability are enhancing the attractiveness of these compressors, leading to wider adoption in both established and emerging industries.

A significant restraint in the African air compressor market is the high initial capital investment required for purchasing and installing compressor systems. This financial barrier can deter small and medium enterprises from upgrading their equipment or adopting new technologies. Furthermore, inadequate infrastructure and maintenance-related challenges in certain regions can complicate deployment and increase operational difficulties, hindering overall market growth.

The market presents substantial opportunities, particularly with the rise of renewable energy projects across the continent. As Africa shifts towards sustainable energy sources, air compressors will play a crucial role in the installation and maintenance of wind and solar systems. Additionally, the integration of smart technologies and IoT solutions into air compressors can enhance efficiency and reliability, paving the way for companies that innovate and meet changing customer demands, thus stimulating growth in the sector.

Technology Insights

The reciprocating technology segment led the market and accounted for 63.8% of the Africa revenue share in 2024. Reciprocating compressors are known as positive displacement compressors. Low maintenance cost, higher-pressure generation, flexibility of use, and high efficiencies are driving the demand for reciprocating technology in the coming years.

The rotary technology segment is expected to witness a CAGR of 3.4% over the forecast period. A positive displacement, a rotary-type compressor is referred to as a rotary air compressor. These compressors provide industrial processes in commercial, trade, and workshop settings with high-quality compressed air or gas. These aforementioned factors will propel the market demand in the coming years.

Lubrication Insights

The oil filled air compressor segment led the market and accounted for 68.3% of the global revenue share in 2024. Oil-filled air compressors are widely used in the energy, manufacturing, and chemical industries. They are more robust and make less noise than oil-free compressors. In the coming years, the aforementioned factors will drive demand for oil-filled air compressors. Atlas Copco, for instance, offers oil-lubricated rotary screw compressors that provide consistent, energy-efficient, and smart AIR solutions. It also has a lower overall lifecycle cost, which drives market demand.

The oil-free lubrication segment is expected to grow due to the implementation of legislation to reduce emissions and increased emphasis on environmental safety. Factors such as rapid industrialization and growth of the food processing, manufacturing, and semiconductor sectors are propelling the demand for air compressors. Oil-free mobile air compressors offer a wide range of advantages such as low risk of contamination, reduced maintenance and replacement cost, low energy cost, and minimal environmental impact, which is expected to drive the segment growth.

Power Insights

The electric power segment led the market and accounted for 63.5% of the global revenue share in 2024. Portable electric air compressors are useful for mining and construction areas where electricity is readily available. These portable compressors have the advantage of being quiet and emitting no emissions. These factors will fuel demand for electric-powered mobile air compressors in the coming years. For instance, ELGi offers diesel and electric-driven compressors that provide dependable compressed air support in difficult environments. The portable line of ELGi has grown to meet the evolving needs of the construction, mining, oil & gas, and water well industries. Moreover, ELGi portable air compressor is engineered to be highly efficient, productive, and simple to use.

Diesel-powered air compressors are known for their dependability and toughness. They are employed in a variety of applications, including jackhammers, rock drills, impact wrenches, and chipping tools, as well as sandblasting. These reasons will increase the need for diesel-powered mobile air compressors over the coming years. Additionally, portable diesel air compressors deliver compressed air wherever it is required, including plant, road, and refinery sites, among others. In the coming years, the aforementioned factors will drive demand for diesel-powered mobile air compressors. Furthermore, ELGi is one of the few firms in the world that offers a complete line of single and two-stage compressors in this range. ELGi portable compressors are widely utilized by drill rig OEMs around the world owing to their efficiency, compactness, and maneuverability.

Application Insights

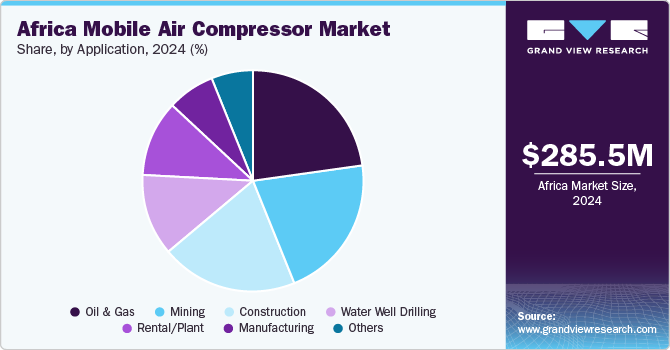

The oil & gas application segment led the market and accounted for 23.1% of the global revenue share in 2024. In the oil and gas industry, air compressors play a critical role in various applications throughout the exploration, extraction, and processing phases. They are essential for powering pneumatic tools used in drilling and maintenance operations, facilitating tasks such as drilling rig operations and well servicing. Additionally, air compressors are utilized for driving separation and processing equipment, as well as providing breathing air in hazardous environments and during maintenance activities. Their reliability and efficiency are crucial for ensuring safety and productivity in demanding oil and gas operations, making them an integral component of the industry’s infrastructure.

In the construction industry, air compressors are vital for powering a wide range of pneumatic tools and equipment, enhancing efficiency and productivity on job sites. They are commonly used to operate tools such as jackhammers, nail guns, and impact wrenches, enabling quick and effective completion of tasks like demolition, framing, and finishing. Additionally, air compressors facilitate the application of materials such as paint and concrete through spray guns, ensuring even and precise coverage. Their portability allows for easy transport between various job sites, making them indispensable for construction projects that require both versatility and reliability in demanding environments.

Country Insights

In Egypt, the demand for mobile air compressors is significantly driven by the robust construction and infrastructure development activities, particularly in projects like the New Administrative Capital and the expansion of the Suez Canal. These large-scale initiatives require versatile and portable equipment to support various tasks such as excavation, road construction, and maintenance of pneumatic tools. The ability to easily transport mobile air compressors to different job sites enhances operational flexibility, making them a preferred choice among contractors and construction firms looking to meet tight deadlines and ensure efficient project execution.

In South Africa, the demand for mobile air compressors is largely fueled by ongoing mining operations and infrastructure projects. The mining sector, particularly in regions like the Witwatersrand, relies heavily on mobile air compressors to power drilling and excavation equipment in challenging terrain. Furthermore, the South African government’s investment in infrastructure, such as roads and bridges, enhances the need for portable air compressors that can be relocated quickly to various sites. This flexibility not only improves productivity but also supports the country's efforts to modernize and expand its industrial capabilities.

Key Africa Mobile Air Compressor Company Insights

Some of the key players operating in the market are Atlas Copco, Ingersoll Rand, Doosan, and ELGI EQUIPMENTS LIMITED.

-

Atlas Copco specializes in the innovation, development, and manufacturing of oil-free compressor technologies. The company's air compressors are ISO-certified. It also rents, services, manufactures, and develops assembly systems, construction systems, and industrial tools. The company majorly operates through four segments, namely, industrial technology, power technology, vacuum technology, and compressor technology.

-

Ingersoll Rand is a multinational corporation that provides solutions and services to increase industrial efficiency and productivity through a diverse range of mission-critical and innovative medical, energy, fluid, and air technologies. The company's products are sold under more than 40 brands, including Gardner Denver and Ingersoll Rand, which are globally recognized in their respective end markets and are known for superior customer service, product efficiency, reliability, and quality.

Trade Air and CompAir are some of the emerging players in the Africa mobile air compressor market.

-

Trade Air is a prominent manufacturer and supplier of compressed air solutions, specializing in high-quality air compressors and related equipment. Founded in Italy, the company has built a strong reputation for its innovative technology and commitment to sustainability. Trade Air offers a wide range of products, including industrial air compressors, portable compressors, and accessories, designed to meet the diverse needs of various industries such as construction, manufacturing, and automotive.

-

CompAir is a leading global manufacturer of compressed air and gas solutions, known for its extensive range of innovative air compressor products and systems. Established in the UK, CompAir has a rich history of providing efficient and reliable solutions for various industries, including manufacturing, automotive, and construction. The company focuses on reducing energy consumption and improving productivity through advanced technology, offering products such as rotary screw compressors, reciprocating compressors, and vacuum pumps.

Key Africa Mobile Air Compressor Companies:

- Atlas Copco

- Doosan

- ELGI EQUIPMENTS LIMITED

- Kirloskar

- Sandvik

- Ingersoll Rand

- Sullair (Hitachi, Ltd)

- Kaeser

- Airstream

- Trade Air

- CompAir

Recent Developments

-

In April 2023, Atlas Copco announced the acquisition of the compressed air business division of Asven S.R.L., a specialist in the service, installation, and sales of compressed air systems.

-

Doosan Portable Power introduced a wide range of accessories for its portable air compressors in April 2022. The new blast pot, double hose reel, and tool holder are lightweight, practical, and strong accessories that are simple for equipment owners to install. These add-ons work with the C185 and P185 portable air compressors from Doosan Portable Power as well as the XP185-VHP165, P185-HP150, and P250-MHP185 models.

Africa Mobile Air Compressor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 298.8 million

Revenue forecast in 2030

USD 362.2 million

Growth Rate

CAGR of 3.9% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, lubrication, power, end use, country

Country scope

Zambia; Malawi; Congo DRC; South Africa; Egypt

Key companies profiled

Atlas Copco; Doosan; ELGI EQUIPMENTS LIMITED; Kirloskar; Sandvik; Ingersoll Rand; Sullair (Hitachi, Ltd); Kaeser; Airstream; Trade Air; CompAir

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Africa Mobile Air Compressor Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Africa mobile air compressor market on the basis of technology, lubrication, power, end use, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Rotary

-

Reciprocating

-

-

Lubrication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil Free

-

Oil Filled

-

-

Power Outlook (Revenue, USD Million, 2018 - 2030)

-

Diesel

-

Electric

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Mining

-

Water Well Drilling

-

Oil & Gas

-

Rental/Plant

-

Manufacturing

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Africa

-

Zambia

-

Malawi

-

Congo DRC

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The Africa mobile air compressor market size was estimated at USD 285.5 million in 2024 and is expected to reach USD 298.8 million in 2025.

b. The Africa mobile air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.9% from 2025 to 2030 to reach USD 362.2 million by 2030.

b. The electric power segment led the market and accounted for 63.5% of the global revenue share in 2024. Portable electric air compressors are useful for mining and construction areas where electricity is readily available. These portable compressors have the advantage of being quiet and emitting no emissions.

b. Some of the key players operating in the Africa mobile air compressor market include Atlas Copco; Doosan; ELGI EQUIPMENTS LIMITED; Kirloskar; Sandvik; Ingersoll Rand; Sullair (Hitachi, Ltd); Kaeser; Airstream; Trade Air; CompAir, among others.

b. Clean air technology and new-age devices such as noise-free are predicted to stimulate demand for mobile air compressors. Furthermore, eco-friendly features, cost-effective operations, and retrofitting of existing systems are likely to increase demand over the projection period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.