Africa Mining Chemicals Market Size, Share & Trends Analysis Report By Ore Type (Iron Ore, Powder Gold, Phosphate), By Application (Explosives & Drilling, Mineral Processing), By Country, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-370-6

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Bulk Chemicals

Report Overview

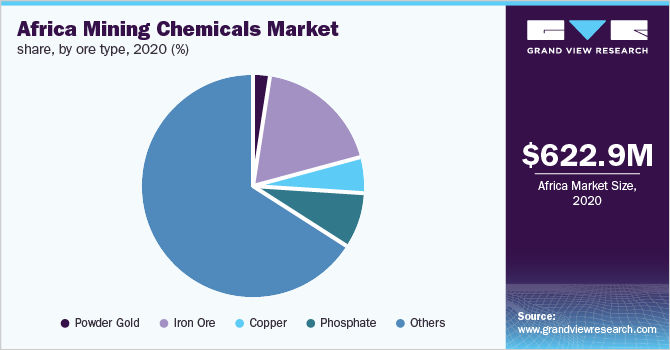

The Africa mining chemicals market size was valued at USD 622.87 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2021 to 2028. Factors such as the increasing mining activities and a surge in water treatment operations are likely to fuel the market growth over the forecast period. The extraction of ore types such as gold, copper, and phosphate is expected to contribute to the product demand over the coming years. In the light of the COVID-19 outbreak, the industry is witnessing a drastic decline in the prices of various commodities. Supply chain disruptions including difficulties in procuring raw materials and ingredients from third-party suppliers created major challenges and affected both operational and financial performances of the market. Many manufacturers were under pressure owing to disruptions in the overall supply chain, which severely impacted the market.

The African market for mining chemicals is characterized by the presence of numerous manufacturing giants and local players who constantly focus on upgrading their overall business portfolio right from product development to marketing. The demand in Africa has increased significantly since the past decade with major shifts in the industry, coupled with the growing wastewater activities in the region. Many end-use application manufacturers have even formed alliances with the manufacturers to maintain consistency in their production processes and eliminate the risk of uncertainty in terms of product availability and sourcing.

Raw materials such as uranium, sulfuric acid, lead, nitric acid, mercury, and cyanide are used in the manufacturing of mining chemicals. Cyanide is used in the industry for the separation of gold and silver from their respective ores using the leaching process. Sulfuric acid is produced by three methods, including the wet process, contact process, and lead chamber process. Countries such as DRC, Zambia, South Africa, and Namibia are the key producers of sulfuric acid in Africa. Furthermore, Tanzania is a potential producer of sulfuric acid in African countries.

China is a major exporter of mercury to Sub-Saharan Africa, followed by Singapore, Switzerland, Turkey, India, Mexico, United Arab Emirates, and Ukraine. In the African continent, Morocco is also involved in producing Mercury. However, due to the adverse effect of mercury on the environment and human health, mineral miners are moving themselves to support mercury-free gold mining.

Application Insights

The explosives and drilling application segment dominated the market with a revenue share of over 35.0% in 2020. This is attributed to the growing utilization of mining chemicals in opencast mining operations. The increasing need for minerals and metals is expected to augment the demand for mineral extraction over the coming years. This is anticipated to boost the growth of the market in Africa over the forecast period.

As per the World Bank report, the growing role of minerals and metals for a low-carbon future and green energy technologies that are necessary for achieving environmental sustainability is likely to boost the demand for metals and minerals, including zinc, steel, silver, aluminum, copper, lead, lithium, manganese, nickel, silver, indium, molybdenum, and neodymium.

The industry has witnessed a rise in the demand for technologies for processing complex minerals. Techniques for grinding hard rocks into ultrafine sizes, reduction in energy and water consumption, and easy disposal of mine waste have significant importance. These factors are anticipated to fuel the utilization of mining chemicals in mineral processing applications.

Ore Type Insights

The others segment dominated the market with a revenue share of over 65.0% in 2020. The iron ore segment accounted for the second-largest revenue share in 2020. This is attributed to the growing utilization of iron ore with fewer impurities in the steel industry. Iron ore helps reduce water usage and improve resource efficiency in mining activities. The growing demand for iron ore in other end-use industries, including wastewater and petroleum, is anticipated to fuel the market growth over the forecast period.

Africa is a major supplier of iron ore and steel to China and the growing construction activities in China are expected to surge the demand for iron ore. According to Trading Economics, in the year 2020, South Africa exported around USD 962.56 million of steel and iron ore to China. Thus, the growing demand for iron ore is likely to surge the demand for mining chemicals in Africa.

Phosphate grinding aids are also used effectively in the cement industry to improve the efficiency of cement. They improve the fineness and help reduce the overall production cost. The demand for phosphate is expected to increase on account of the growing demand from the cement industries across the globe, coupled with the growing phosphate mining activities in South Africa and Morocco.

Country Insights

South Africa dominated the market with a revenue share of over 24.0% in 2020. This is attributed to the extensive mining activities in the country, coupled with the larger reserve base of minerals including gold, diamonds, platinum, iron ore, coal, titanium, vanadium, chrome, and some other lesser minerals. About 61% of the mining industry generated income, from outside the country in the year 2019. According to Trading Economics, in the year 2020, South Africa exported around USD 962.56 million of steel and iron ore to China. The growing demand for iron ore is likely to surge the demand for mining chemicals in South Africa.

Countries such as Sudan, South Africa, Morocco, Zimbabwe, Mali, and Ghana are some prominent producers of a variety of minerals. The economic and social growth of these countries is based on mineral mining. The industry is also a key provider of employment and a source of revenue for the governments. The government's initiative to develop the industry in Africa by introducing Foreign Direct Investment in the industry is expected to boost the mining activities in Africa, which, in turn, surge the demand for mining chemicals in Africa.

The demand for the product in Morocco is propelled by the rising demand for phosphate. Morocco is a major producer of phosphate in the world. Apart from phosphate, the country is also rich in minerals like cobalt, copper, iron ore, manganese, silver, gold, uranium, and some other rare elements, which are still underexplored.

The government is focusing on diversifying its mining sectors by trapping unexplored minerals and has also introduced the National Strategy for Mining Sector Development, under this plan, the government is aiming to triple the sector revenue by 2025 through providing exploration and exploitation permits to foreign companies. Thus, the surging mining activities in the country are anticipated to boost the product demand.

Key Companies & Market Share Insights

The African market for mining chemicals is highly competitive due to the presence of a large number of multinationals that are engaged in constant research & development activities and local players. Companies such as BASF SE, Ashland, Sasol, and Dow dominate the market due to their global brand presence and extensive product portfolio catering to the respective applications.

Some of the local players are involved in enhancing their market presence in Africa through signing an agreement with distributors and the majority of companies such as BASF SE, Ashland, Sasol, and Dow have integrated their business operations across the value chain to incur maximum profit at low investment. Some prominent players in the Africa mining chemicals market include:

-

Akzo Nobel N.V.

-

BASF SE

-

DOW

-

Sasol

-

Cytec Solvay

-

Clariant

-

Shell Chemicals

-

AECI Mining Chemical

Africa Mining Chemicals Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2021 |

USD 641.52 million |

|

Revenue forecast in 2028 |

USD 960.97 million |

|

Growth Rate |

CAGR of 5.6% from 2021 to 2028 |

|

Base year for estimation |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2021 to 2028 |

|

Report coverage |

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Ore type, application, country |

|

Regional scope |

Africa |

|

Country scope |

South Africa; Ghana; Morocco; DRC; Zambia; Mali; Zimbabwe; Tanzania; Ivory Coast; Sudan |

|

Key companies profiled |

Akzo Nobel N.V; BASF SE; DOW; Sasol; Cytec Solvay; Clariant; Shell Chemicals; AECI Mining Chemical |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts volume and revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the Africa mining chemicals market report on the basis of ore type, application, and country:

-

Ore Type Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Powder Gold

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Iron Ore

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Copper

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Phosphate

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Others

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

-

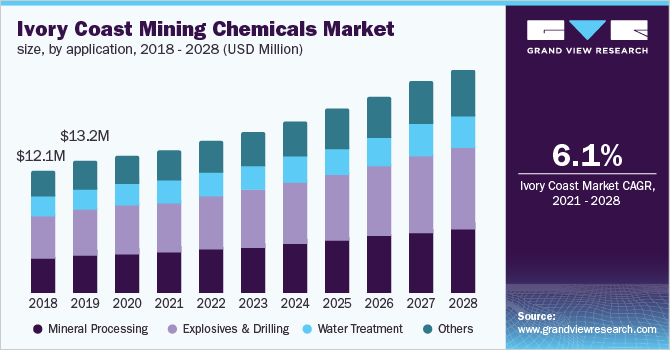

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Mineral Processing

-

Explosives & Drilling

-

Water Treatment

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

South Africa

-

Ghana

-

Morocco

-

DRC

-

Zambia

-

Zimbabwe

-

Tanzania

-

Mali

-

Ivory Coast

-

Sudan

-

Frequently Asked Questions About This Report

b. The Africa mining chemicals market size was estimated at USD 622.87 million in 2020 and is expected to reach USD 641.52 million in 2021.

b. The Africa mining chemicals market size is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2021 to 2028 and reach USD 960.97 million by 2028.

b. The explosives & drilling application dominated the Africa mining chemicals market with a revenue share of over 35% in 2020. This is attributed to the growing utilization of mining chemicals in opencast mining operations.

b. Some of the prominent players in the Africa mining chemicals market include Akzo Nobel N.V, BASF SE, DOW, Sasol, Cytec Solvay, Clariant, Shell Chemicals, AECI Mining Chemical.

b. Factors such as increasing mining activities, and a surge in water treatment operations are likely to drive Africa mining chemicals market growth over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."