- Home

- »

- Power Generation & Storage

- »

-

Africa Diesel Generator Market Size, Share Report, 2030GVR Report cover

![Africa Diesel Generator Market Size, Share & Trends Report]()

Africa Diesel Generator Market Size, Share & Trends Analysis Report By Power Rating (Up To 100 kVA, Above 3000 kVA), By End-use (Construction, Manufacturing), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-519-7

- Number of Report Pages: 81

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Market Size & Trends

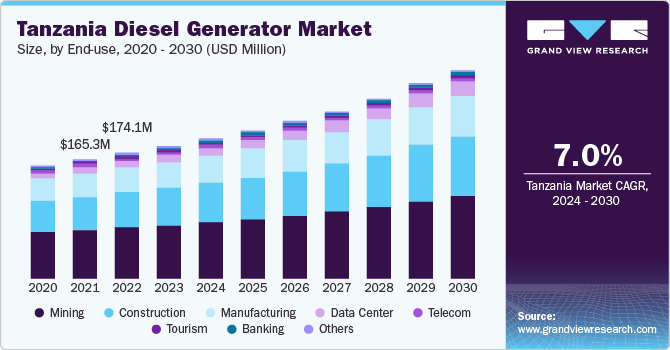

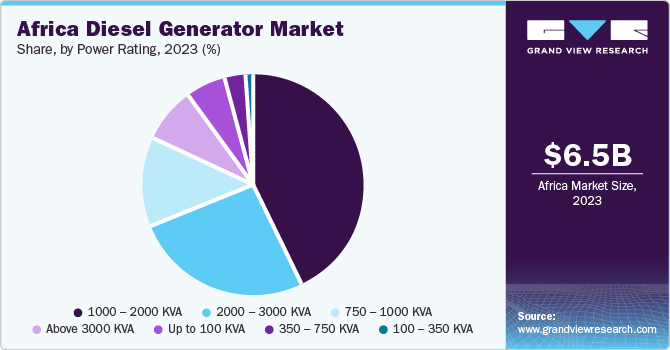

The Africa diesel generator market size was estimated at USD 6.49 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. Datacenter end-use registered a high growth rate owing to an increase in momentum towards digitalization in the African region. Datacenters need to have multiple layers of backup power to ensure continuous operation. Further, even small power failures lasting only for a few minutes can cause major interruptions for the work of entire organizations and result in considerable economic losses.

Industry and construction are major growth contributors to the economy in Tanzania. Growth in the construction sector is due to growing public investments in the construction of railways, airports, roads, port expansions, and bridges. The manufacturing sector in the country mainly includes food processing, textiles, chemicals, beverages, leather products, plastics, and paper & paper industries.

Ethiopia is the second most populated country in the African region after Nigeria; it is one of the highest-growing countries in the African region. Ethiopia’s real GDP was recorded at 9% from 2021-2022. However, owing to the country’s large population it has a low per capita income of USD 850 as per the World Bank. Construction and service industries mainly contributed to the majority of growth in the country. Government has taken steps to support growth for the private sector and enhance competitiveness of small- and medium-sized enterprises in Ethiopia.

The outbreak of COVID-19 pandemic has resulted in a decline in demand for this power range owing to limited mining, industrial, and construction activities in various African countries for non-essential products. With work-from-home models being implemented on a wide scale in the majority of countries in the region, demand for internet services and video & audio-conferencing tools from service sector companies has increased substantially. This factor has increased the demand for diesel generators from data centers within this power range.

Market Dynamics

Current demand of electricity in the African region far outstrips the supply. Factors such as rapid industrialization, and infrastructure development in emerging economies are pacing demand for power. Diesel generators have various advantages such as low operating costs and better fuel efficiency. Thus, they are more popular in developing regions, especially in the African region. Electricity consumption is expected to increase owing to growing demand from the industrial sector as developing and underdeveloped countries of this region rapidly industrialize. Demand for diesel generators is expected to increase in order to keep up with growing demand. Underdeveloped power generation infrastructure is also expected to boost market demand over the forecast period.

The diesel generator emits harmful gasses including nitrogen oxide, hydrocarbons, and carbon monoxide due to combustion of diesel. Due to this, different regulatory bodies have imposed stringent regulations which act as a barrier to usage of diesel generators. This resulted in the growth of eco-friendly alternatives for diesel generators.

Power Rating Insights

Based on power rating, the 1000-2000 kVA segment dominated the market with the largest revenue share of more than 42% in 2023. 1000-2000 kVA diesel generator sets are primarily utilized by data centers and mining, industrial, and construction sectors. Major vendors such as Cummins; Kohler; Mitsubishi Heavy Industries, Ltd.; and Caterpillar provide diesel generators in this power rating range which are capable of providing continuous power supply for a longer duration. Due to periodic outages in African countries such as Ethiopia, Ghana, Uganda, and Mali, end-users opt for diesel generators to maintain seamlessness in operations.

Up to 100 kVA diesel generator sets are mainly utilized in telecom towers and residential and small-scale commercial applications such as shops and clinics. The lack of power distribution infrastructure in most African countries has resulted in demand for up to 100 kVA diesel generators from end-users. 350-750 kVA diesel generator sets are predominantly utilized in high-end hospitals, shopping malls, small-scale industries, and business centers. The market for 350-750 kVA diesel generators is growing due to the requirement for regular power supply due to the critical nature of their operation. African countries such as Ethiopia, Ghana, Uganda, and Mali witnessed around 13.6, 9.8, 6.9, and 6.8 power outages per month respectively in 2018.

End-use Insights

Based on end-use, the telecom segment dominated the market with a largest revenue share of more than 18% in 2023. Increasing demand for uninterrupted and reliable power supply from end-use segments, such as manufacturing and construction, telecom, mining, data center, tourism, banking, and others, is anticipated to propel market growth over the forecast period.

Provide emergency or continuous power supply to telecom towers. Furthermore, in areas with access to the grid, a diesel-powered generator acts as a backup power supply option whereas, in areas with no power supply, a diesel generator acts as a continuous power supply option. Diesel generators are conventionally used to power telecom towers owing to low capital cost and easy fuel availability in remote as well as developed areas.

Emergency power generators are an essential item for banking institutions. Since backup power source activates automatically in a few seconds which aids in keeping systems connected and running. Further, in case of longer-duration outages diesel generators aid to provide baseload power to banks. Critical nature of the operation of banks requires them to compulsorily install backup power solutions which predominantly remain diesel generators owing to their lower capital cost and easy availability of diesel.

Diesel generators in range of up to 45 kVA are utilized in the telecom sector for other applications, which include residential, and educational institutes such as schools, colleges, and commercial & government institutions such as hospitals, shops, shopping malls, government offices, and sports complexes. All these end-users require a backup power supply in case of power outages. Diesel generators have been conventionally used by these end-users owing to their economic cost and easy storage and availability of diesel fuel.

Country Insights

South Africa dominated Africa’s diesel generator industry and accounted for the largest revenue share of over 16% in 2023. South Africa has emerged as a highly developed economy in the African region due to the presence of advanced economic infrastructure. South Africa is also home to most of the large companies operating in African region. For instance, global manufacturing companies such as BMW, Nissan, Ford, Toyota, Volkswagen, Daimler-Chrysler, and General Motors have manufacturing facilities in the country. South Africa is one of the major producers and exporters of natural resources such as gold, manganese, platinum, palladium, diamonds, and coal.

The industrial sector is significant in the country and consists of consumer goods production, food processing, construction, gold, and phosphate mining. The impact of COVID-19 on Mali’s economy has been limited. Being a net importer of oil, Mali has benefitted from a sharp decline in crude oil prices. Major export item for the country is gold whose demand was less impacted during pandemic as compared to oil & gas demand.

Key Companies & Market Share Insights

Africa’s diesel generator industry is highly characterized by expansion and joint venture strategies opted for by diesel generator companies across the region. Established players such as Cummins are investing in product development to gain a competitive edge in the market. For instance, Cummins in 2019 recorded total sales of USD 23,571 million globally, whereas, Power Systems business segment (including diesel generator set) of the company recorded sales of USD 4,460 million globally.

Key Africa Diesel Generator Companies:

- Caterpillar

- Cummins Inc.

- Atlas Copco AB

- AKSA power generation

- Kohler Co.

- HIMOINSA

- Wartsila

- Kirloskar Oil Engines Ltd.

- MITSUBISHI HEAVY INDUSTRY LTD.

Africa Diesel Generator Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.82 billion

Revenue forecast in 2030

USD 9.56 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in units, revenue in USD million, CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Power rating, end-use, country

Country scope

Kenya; Algeria; South Africa; Ethiopia; Ghana; Tanzania; Morocco; Mali; Uganda; Zambia; Malawi; Congo DRC

Key companies profiled

Caterpillar; Cummins Inc; Atlas Copco AB; AKSA power generation; Kohler Co; HIMOINSA; Wartsila; Kirloskar Oil Engines Ltd.; MITSUBISHI HEAVY INDUSTRY LTD.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Africa Diesel Generator Market Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Africa diesel generator market report based on power rating, end-use, and country:

-

Power Rating Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Up to 100 KVA

-

100 - 350 KVA

-

350 - 750 KVA

-

750 - 1000 KVA

-

1000 - 2000 KVA

-

2000 - 3000 KVA

-

Above 3000 KVA

-

-

End-use Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Construction

-

Telecom

-

Mining

-

Data Center

-

Tourism

-

Banking

-

Others

-

-

Country Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Kenya

-

Algeria

-

South Africa

-

Ethiopia

-

Ghana

-

Tanzania

-

Morocco

-

Mali

-

Uganda

-

Frequently Asked Questions About This Report

b. The Africa diesel generator market size was estimated at USD 6.49 billion in 2023 and is expected to reach USD 6.82 billion in 2024.

b. The Africa diesel generator market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 9.56 billion by 2030.

b. South Africa dominated the Africa diesel generator market with a share of about 16.0% in 2023. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance and constant research and development initiatives.

b. Some key players operating in the Africa diesel generator market include Teladoc; Doctor on Demand; iCliniq; IBM; Intel Corporation; Philips Healthcare; McKesson Corporation; AMD Telemedicine; GE Healthcare; CardioNet Inc.; 3m Health Information Systems; Medic4all; CirrusMD Inc.; Cisco; and American Telecare Inc.

b. Key factors that are driving the Africa diesel generator market growth include increasing medicare reimbursement for telehealth services, reducing emergency room visits and hospitalization rates, and technological innovation in communication technology across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."