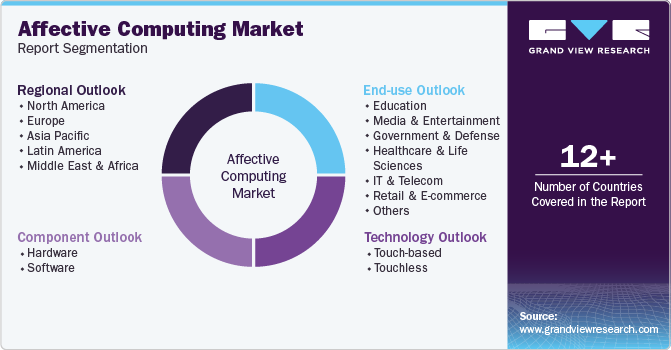

Affective Computing Market Size, Share & Trends Analysis Report By Technology (Touch-based, Touchless), By Component (Hardware, Software), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-908-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Affective Computing Market Size & Trends

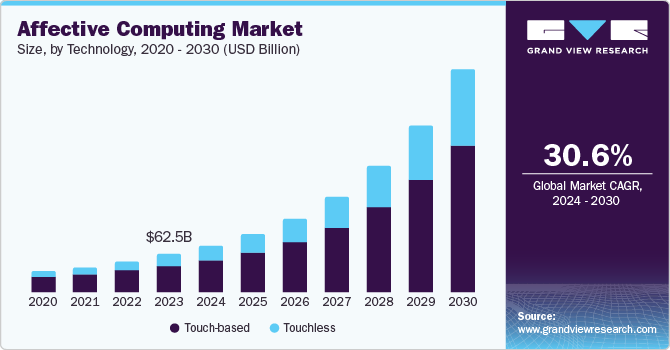

The global affective computing market size was valued at USD 62.53 billion in 2023 and is projected to grow at a CAGR of 30.6% from 2024 to 2030. Rapid advancements in artificial intelligence (AI), machine learning (ML), and sensor technologies, coupled with an increased emphasis on offering an enhanced user experience, have fueled market growth. In addition, the growing need for sentiment analysis and emotional intelligence in customer service and marketing has driven businesses to invest in affective computing solutions.

Various sectors, such as media and entertainment, advertisement services, healthcare and life sciences, and IT & telecom, have started using affective computing solutions to ensure more personalized user experiences. As innovations in this technology continue, various other industries are expected to leverage affective computing techniques over the forecast period.

As per a report published by the International Federation of Robotics, the demand for service robots is expected to rise sharply in the near future, particularly in critical areas such as transportation, logistics, healthcare, and agriculture. Service robots are particularly useful in hospitality, medical operations, and other services where direct human contact is frequent. Enhance service operability and provide a better user experience by equipping these robots with affective computing solutions. Moreover, rapid technological breakthroughs in audio and visual sensor technologies have made it possible to ensure a more personalized user experience in these service areas.

The integration of affective computing and AI has led to the emergence of emotional AI. This concept involves sensing the emotions of humans by using audio-visual sensors and making operational decisions. Emotional AI can be particularly leveraged in the healthcare sector. For instance, a person with autism can be better understood using this technology, which can aid in their mental well-being. Furthermore, the media and entertainment sector can benefit from affective computing by knowing the insights and effectiveness of their advertisement campaigns. For instance, in September 2023, Affectiva announced its new attention metric offering to measure viewer engagement for brands, advertisers, entertainment companies, and market researchers. By analyzing both gaze and head position, this comprehensive solution aims to offer enhanced precision and insights, changing the way that attention is measured and understood. As the sophistication and user base for emotional AI evolves, significant demand growth is expected in the coming years.

Technology Insights

Touch-based technology led the market with a revenue share of 69.8% in 2023. This is attributed to its widespread adoption and versatility across various applications. The interactive interface of touchscreens has helped enhance user experience, and its integration into modern devices has enabled broader accessibility. Furthermore, touch-based inputs provide valuable data for emotion recognition algorithms, allowing for accurate sentiment analysis and emotional state detection. The seamless integration of touch-based technology with various applications, its cost-effectiveness, and continuous innovations have solidified its position as the leading technology in the affective computing industry.

On the other hand, touchless technology is expected to register the fastest CAGR over the forecast period in this market. Frequent developments in computer vision, voice recognition, and sensor technologies have enhanced the accuracy and reliability of touchless devices, enabling more precise emotion detection and analysis. Moreover, the integration of touchless technology with artificial intelligence (AI) and machine learning (ML) algorithms has expanded its applications in areas such as healthcare, automotive, customer service, and market research, thereby fueling its demand in the global market.

Component Insights

Hardware components held the largest market share in 2023. This is owing to the increasing necessity of specialized emotion detection and analysis devices. The widespread adoption of affective computing technologies has increased demand for advanced hardware components, such as facial sensors, cameras, and wearable devices, enabling accurate capturing and transmission of emotional data. Furthermore, the development of sophisticated facial recognition systems, voice recognition modules, and biometric sensors has driven the growth of this segment, as such devices provide the foundation for effective emotion recognition and analysis. Due to these factors, the hardware segment is expected to dominate over the forecast period.

Meanwhile, software components are expected to register the fastest growth from 2024 to 2030. The escalating demand for advanced analytics and artificial intelligence (AI) solutions is expected to drive this. The increasing adoption of cloud-based platforms and the proliferation of Internet of Things (IoT) devices have created a surge in the volume of emotional data generated, requiring sophisticated software solutions for effective analysis and interpretation. Consequently, this segment has witnessed a significant expansion as businesses and developers seek to leverage affective computing capabilities through emotion recognition APIs, sentiment analysis tools, and machine learning frameworks. As data volume grows over time, a continuous advancement in analytics software is required, leading to a high demand for software solutions.

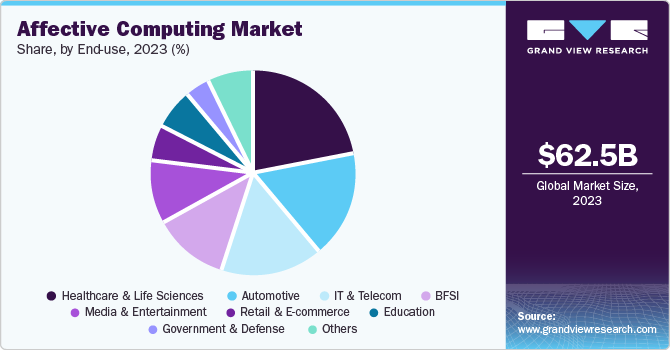

End Use Insights

Healthcare and life sciences accounted for the largest market share in 2023. This is attributed to the growing recognition of the critical role of emotional intelligence in patient care, diagnosis, doctor-patient communication, and treatment outcomes. Affective computing solutions are being increasingly utilized in healthcare to analyze patient emotions, detect early warning signs of mental health conditions, and develop personalized treatment plans. For instance, the health monitoring platform Empatica offers the ‘EmbracePlus’ smartwatch for continuous health monitoring, whose data can later be used to enable effective treatment plans for patients. A variety of deep learning models, including Recurrent Neural Network (RNN), Convolutional Neural Network (CNN), and Transformers, have been developed to identify emotional patterns within single or multiple forms of data. This has led to significant improvements in accurately recognizing and understanding emotions. Additionally, the integration of affective computing with electronic health records and telemedicine platforms has enhanced patient engagement, remote monitoring, and clinical decision-making.

The automotive sector is expected to register the fastest CAGR during the forecast period. This is owing to the increasing integration of higher levels of advanced driver-assistance systems (ADAS) and the development of autonomous vehicles, which rely heavily on emotional intelligence to enhance driver safety and passenger experience. For instance, the National Safety Council has estimated an increasing demand for ADAS-featured vehicles in the U.S. in the near future. Affective computing solutions are being increasingly deployed to detect driver fatigue, stress, and distraction, enabling real-time alerts and interventions to prevent accidents. Furthermore, the incorporation of emotion recognition technologies in infotainment systems and voice assistants is elevating the overall driving experience, ensuring a competitive advantage for automobile manufacturers.

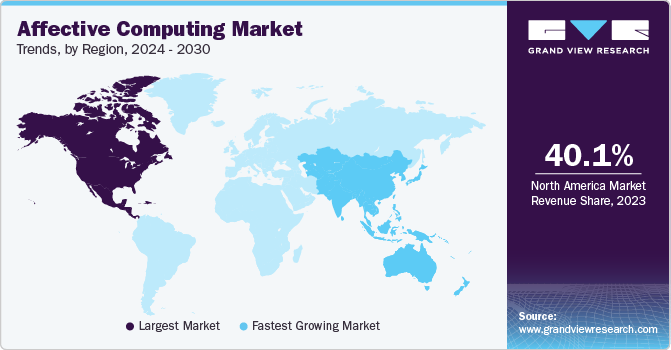

Regional Insights

North America dominated the market with a revenue share of 40.1% in 2023. The region is home to various innovative and technologically advanced companies such as Affectiva, NuraLogix Corporation, and IBM, among others, effectively contributing to the affective computing industry. The well-established healthcare, IT and telecom, advertising and media, and automotive sectors have driven an exponential demand for advanced computing solutions such as affective computing. Moreover, early deployment of high-speed internet connectivity and 5G has enabled a smoother adaptation of these solutions in this region, leading to its high share in the global market.

U.S. Affective Computing Market Trends

The U.S. accounted for the highest share of the regional market in 2023. This is aided by the presence of several companies in the economy that have adopted affective computing solutions to expand their business and retain their competitive position. For instance, Tesla, a prominent manufacturer of electric vehicles based in the U.S., deploys Tesla Autopilot in its cars for advanced-level ADAS and other AI-enabled features, ensuring driver comfort and safety. Furthermore, the increasing adoption of affective computing solutions in the education and BFSI sectors has opened new avenues for growth in this market in the country.

Europe Affective Computing Market Trends

Europe held a significant share of the global market in 2023. This is attributed to the region's robust technological infrastructure, innovative research initiatives, and favorable regulatory environment. The European Union's emphasis on the secure and efficient deployment of AI and ML technologies through regulations such as the Artificial Intelligence Act has created a thriving ecosystem for affective computing, with numerous startups and established companies specializing in emotional intelligence solutions. Additionally, well-established automotive and healthcare sectors in Germany and the UK have created significant demand for these solutions, particularly in driver monitoring and patient care applications.

The UK affective computing market accounted for a notable share of the European market. The market growth is primarily owing to increasing adoption of affective computing by as-yet untapped sectors such as market research, education, and retail & e-commerce. For instance, in February 2024, Kantar, a prominent market research company based in the UK, partnered with Realeyes to validate its primary market research surveys. By integrating Realeyes' Verify identity recognition software with its QubedAI anti-fraud software, validated and verifiable research data can be generated, thereby mitigating the issue of false data collection.

Asia Pacific Affective Computing Market Trends

Asia Pacific is expected to register the fastest CAGR during the forecast period. This growth is attributed to the region's rapid technological advancements, increasing adoption of AI and ML solutions, and growing demand for emotional intelligence solutions in various industries. Moreover, the increasing presence of multinational organizations, research & innovation in integrating various advanced technologies, and faster penetration of 5G internet connections have created several avenues to integrate effective computing applications in areas such as customer experience, human resources, and healthcare. Moreover, governments in countries such as China, Japan, and South Korea have launched initiatives to support AI development, further fueling market expansion in this region.

China's vast and rapidly growing technology sector and its massive consumer market have created a surge in demand for emotional intelligence solutions across various critical industries such as healthcare, education, and customer service. Furthermore, the country's technological leaders, such as Baidu, Alibaba, SenseTime, and Tencent, have invested significantly in affective computing research and development, driving innovation and increased adoption. As a result, China has become a major target for market expansion.

Key Affective Computing Company Insights

Some key companies involved in the affective computing market include Affectiva, NuraLogix Corporation, and Cognitec Systems GmbH, among others.

-

Affectiva is a computer software and AI solutions company with a vast dataset from over 90 countries that helps it build accurate deep learning-based algorithms. It provides solutions for ad testing, entertainment content testing through Emotion AI, qualitative research via its cloud-based service, Emotion SDK, in-cabin sensing AI for the automotive sector, and behavioral research with solutions from iMotions. In 2021, Affectiva was acquired by Smart Eye, a Swedish AI technology solutions company.

-

NuraLogix Corporation is a Canada-based affective AI solutions company. It is well-known for Anura, a contactless health and wellness monitoring application that can detect vital health signs by analyzing a 30-second facial video of a person. This is possible with its Transdermal Optical Imaging (TOI) solution, which uses a video camera to get facial blood flow information from a person’s face. In addition, the company offers a cloud-based DeepAffex platform that uses machine learning-based computational models for health monitoring. The company is steadily expanding the geographical presence of its Anura platform, showcasing it for the first time at the World IT Show 2024 in South Korea.

Key Affective Computing Companies:

The following are the leading companies in the affective computing market. These companies collectively hold the largest market share and dictate industry trends.

- Affectiva

- Apple Inc.

- Cognitec Systems GmbH

- Google LLC

- IBM

- Microsoft

- NuraLogix Corporation

- Qualcomm Technologies, Inc.

- Realeyes

- Sony Corporation

Recent Developments

-

In February 2024, Veritonic announced the release of its Audio Attention Report, created in partnership with Realeyes. By leveraging the PreView technology of Realeyes to capture a vast amount of facial and audio data of respondents, Veritonic created a comprehensive report that is expected to help media and advertising companies with data-backed insights to launch impactful audio and podcast advertising campaigns.

-

In January 2024, NuraLogix announced the launch of its Anura MagicMirror health data measurement device. This unique tabletop smart mirror uses the company’s cloud-based DeepAffex Affective AI platform. MagicMirror can record and analyze a person's facial blood flow information to precisely calculate the body’s vital signs and carry out disease risk assessments.

Affective Computing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 78.36 billion |

|

Revenue Forecast in 2030 |

USD 388.28 billion |

|

Growth Rate |

CAGR of 30.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Technology, component, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, Australia, South Korea, India, Brazil, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Affectiva; Apple Inc.; Cognitec Systems GmbH; Google LLC; IBM; Microsoft; NuraLogix Corporation; Qualcomm Technologies, Inc.; Realeyes; Sony Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Affective Computing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global affective computing market report based on technology, component, end use, and region:

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Touch-based

-

Touchless

-

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Sensors

-

Cameras

-

Storage Devices and Processors

-

Others

-

-

Software

-

Analytics Software

-

Enterprise Software

-

Facial Recognition

-

Gesture Recognition

-

Speech Recognition

-

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Education

-

Media and Entertainment

-

Government and Defense

-

Healthcare and Life Sciences

-

IT and Telecom

-

Retail and E-commerce

-

Automotive

-

BFSI

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."