- Home

- »

- Medical Devices

- »

-

Aesthetic Threads Market Size, Share, Growth Report, 2030GVR Report cover

![Aesthetic Threads Market Size, Share & Trends Report]()

Aesthetic Threads Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Permanent, Absorbable), By Application (Face Lift, Breast Lift), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-214-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aesthetic Threads Market Summary

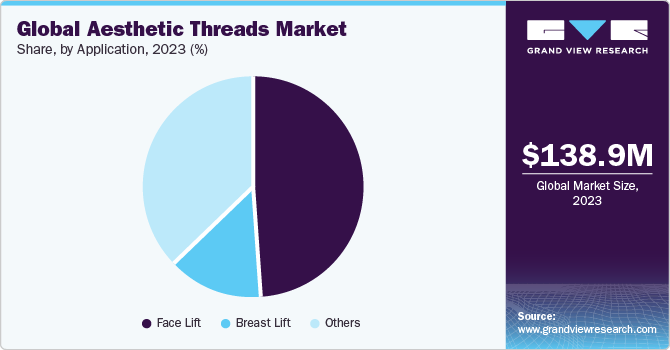

The global aesthetic threads market size was estimated at USD 138.9 million in 2023 and is projected to reach USD 218.1 million by 2030, growing at a CAGR of 6.8% from 2024 to 2030. Growing urban cultivation, vertical farming, and the growing adoption of environment-friendly production of fruits and vegetables are boosting market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Norway is expected to register the highest CAGR from 2024 to 2030.

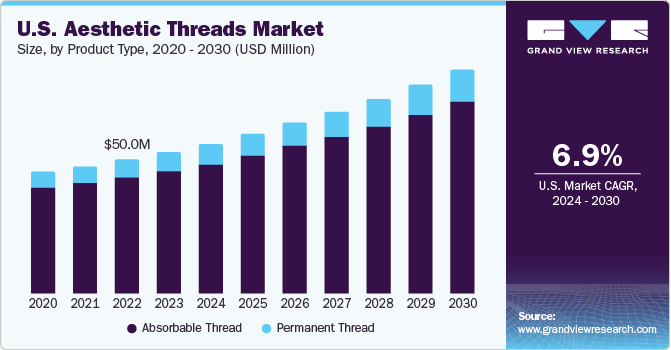

- In terms of segment, absorbable thread accounted for a revenue of USD 119.5 million in 2023.

- Permanent Thread is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 138.9 Million

- 2030 Projected Market Size: USD 218.1 Million

- CAGR (2024-2030): 6.8%

- North America: Largest market in 2023

The concept of cosmetic thread was first offered and tested in Europe, with unsatisfactory results.

The procedure developed and became successful over time with the advanced technologies. It is a less invasive method with better outcomes than traditional surgeries. The rising popularity of minimally invasive procedures for anti-aging, face lifting, and face rejuvenation can be ascribed to the expansion of the cosmetic threads market.

Cosmetic threads can be used to treat a broad variety of conditions, and the patient pool is huge. The thread lift procedure has grown in popularity for brow, midface, jowl, and neck lifts, and it is said to have several benefits. In certain countries, these treatments are less time-consuming and known as 'lunchtime facelifts' since they can be performed during lunchtime for busy office workers. These qualities make such processes incredibly beneficial because they give good outcomes in less time, attracting a huge number of customers globally and propelling the industry.

Facelifts are among the most popular operations for treating a variety of ageing concerns. The growing number of geriatric population is expected to drive the market growth. As the US population ages, there is a growing need for plastic surgery among the elderly. According to the American Society of Plastic Surgeons, individuals over the age of 55 performed 4.2 million cosmetic treatments in 2018 alone, a 2% rise from the previous year. By 2050, the United States is predicted to increase its elderly population of adults 65 and older to 88.5 million from 50 million now.

Market Concentration & Characteristics

The market is currently in a low-growth stage, with the pace of expansion accelerating. This market is marked by a significant level of innovation, driven by the increasing demand for non-invasive surgeries and a rising geriatric population.

Increased product launches and company collaborations have been fuelling the Aesthetic threads market. For instance, in 2023, PDO MAX, Inc., a woman-owned aesthetics medical device firm based in the United States, has launched their latest polydioxanone (PDO) threads.

In developed countries, governments and national agencies are pursuing increased regulation of non-surgical aesthetic procedures. The ultimate goal is to provide a safer environment for members of the public having non-surgical therapies by mandating credentials, premises conditions, insurance, and a variety of other measures. Cosmetic thread procedures are tightly controlled and can only be conducted by a medical team consisting of qualified doctors and trained nurses.

Application Insights

In terms of application, the facelift segment led the market with the largest revenue share of 49.4% in 2023. Thread lift is a good and effective cosmetic surgery that lifts and tightens facial sagging skin tissue.Patients today are constantly looking for the most creative and minimally invasive procedures that are not only safe and effective, but also produce natural-looking outcomes. When it comes to raising the face, the first thing that comes to mind is the classic facelift, an age-old operation that has been around for over 100 years. However, patients today are significantly more demanding of the therapies they choose, with many choosing alternatives that promise good results without the need for incisions.

There has been a rising adoption of thread for breast, neck, and other body parts and hence is augmenting the market growth of the others segment. For instance, neck thread lifting is becoming increasingly popular as the demand for non-invasive or minimal surgeries grows. As a result, there is an increasing number of therapy providers. Neck threading minimises symptoms of ageing such as acne scars in the neck and removes wrinkles and creases to give you a youthful look within an hour.

Product Type Insights

Based on product type, the absorbable thread segment led the market with a largest revenue share of 86% in 2023, owing to the wide adoption of PDO and PCL threads for the facelift procedures. PDO threads offer a significant improvement in cosmetic operations, providing a non-surgical solution for aesthetic rejuvenation. The substance of PDO threads is polydioxanone, a polymer that naturally degrades in the body over time, improving safety and lowering the chance of long-term issues. A PDO thread surgery has a far faster recovery time than standard facelifts, allowing for a quick return to everyday activities.

The permanent thread segment is anticipated to grow at a significant CAGR during the forecast period. Permanent suspension thread lifts are a medical aesthetics treatment that efficiently and permanently repositions sagging tissues by lifting them to the higher region of the face. Only permanent (non-resorbable) threads may achieve a stable, long-lasting outcome with no scarring.

End-use Insights

Based on end-use, the cosmetic surgery centers led the market with a largest revenue share of 47% in 2023. These centers offer a wide range of specialized procedures or focus on specific areas such as facial rejuvenation, body contouring, or breast augmentation and may see increased demand from clients seeking expertise in those areas. Centers with board-certified plastic surgeons who have extensive experience and a track record of successful outcomes tend to instill confidence in potential clients and attract more business.

The Medspas segment is anticipated to register the significant CAGR during the forecast period, due to the increasing demand for non-invasive cosmetic treatments and wellness services. Med spas are often more accessible than traditional medical practices or plastic surgery centers. They typically offer extended hours, walk-in appointments, and a spa-like atmosphere, making them convenient for busy individuals.

Regional Insights

North America dominated the market with the revenue a share of 44.5% in 2023. This is due to the rising demand for aesthetic treatments, a growing senior population, and an increasing number of non-invasive cosmetic operations in the region. According to the American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS), the demand for facelifts in 2022 is much higher than in prior years (2021), with 83% of doctors seeing a rise in bookings over the last year (up 70% from 2020). This, in turn, fuels the expansion of the aesthetic thread market in this region.

U.S. Aesthetic Threads Market Trends

The aesthetic threads market in the U.S. is expected to witness lucrative CAGR during the forecast period, due to key factors, such as high disposable income and growing awareness about availability of a variety of aesthetic procedures. According to an article published by American Society of Plastic Surgeons, the number of minimally invasive & surgical cosmetic procedures increased by nearly 1%, in 2020. In addition, adoption among millennials tripled in the last 4 years in the U.S., accounting for over 1 million individuals undergoing aesthetic procedures in 2018.

Europe Aesthetic Threads Market Trends

The aesthetic threads market in Europe is growing owing to the advanced technologies and well-established infrastructure, resulting in better healthcare facilities & patient care. The presence of skilled healthcare professionals and high disposable income are key factors responsible for the market growth in Europe.

The UK aesthetic threads market is expected to grow at the fastest CAGR over the forecast period, due to an increase in advancements in nonsurgical procedures. Minimally invasive procedures are quick, simple, and affordable, with lower risk and minimal or no scarring. Such procedures are also attracting patients who would never have considered cosmetic surgeries earlier but are happy with a quick and easy short-term solution. These factors are driving non-invasive aesthetic treatment market in the UK, hence boosting the market growth. The British Association of Aesthetic Plastic Surgeons states that market in the country is growing owing to affordability, patient satisfaction, and improving accessibility.

The aesthetic threads market in France is expected to grow at the fastest CAGR over the forecast period, due to high aesthetic & fashion consciousness in the country. According to export.gov, France is currently the global leader in cosmetic market. It is among the top 10 countries responsible for a large number of cosmetic procedures, accounting for around 2.2% of all procedures performed worldwide. Increased awareness among customers about potential benefits of aesthetic procedures coupled with growing adoption of minimally invasive procedures is boosting non-invasive aesthetic treatment market in France. In addition, non-invasive or minimally invasive techniques have gained popularity in the country.

The Germany aesthetic threads market is expected to grow at the fastest CAGR over the forecast period, owing to various factors such as increase in popularity of cosmetic procedures, technological advancements, and rise in beauty consciousness. Germany is one of the major countries spearheading aesthetic treatment market. Furthermore, rising urban population, novel product approvals, advancements in noninvasive procedures, and availability of skilled professionals are some of the other factors leading to market growth. However, high cost of aesthetic procedures is likely to impede growth.

Asia Pacific Aesthetic Threads Market Trends

The aesthetic threads market in Asia Pacific is anticipate to grow at a fastest CAGR during the forecast period. This results from large numbers of surgical procedures performed in South Korea, Japan, and China each year, the availability of skilled and trained professionals, and comparatively lower procedural costs in the region. Furthermore, an increase in the number of working professionals and high disposable income are factors leading to increased demand for aesthetic procedures in the Asia Pacific region

The China Aesthetic threads market is expected to grow at the fastest CAGR over the forecast period due to the the increasing demand for aesthetic treatment by men. For instance, men accounted for nearly 15% of the customers in Chinese aesthetic treatment market. Chinese contemporary culture greatly values the importance of physical appearance of women and has strong emphasis on ideal beauty standards. Therefore, the country has become a hub for aesthetic procedures. Moreover, the country also ranks third globally for the highest number of aesthetic professionals, after the U.S. and Brazil.

The Japan is the second largest market for aesthetic products and procedures in APAC countries and largest market in the world. Facial features are extremely important to the Japanese population; according to the Japan Society of Aesthetic Plastic Surgery, in 2018, approximately 90% of nearly 237,000 cosmetic surgeries performed in the country were related to the face. One of the key market drivers of the cosmetic industry in Japan is medical tourism (mainly from China).

MEA Aesthetic Threads Market Trends

The aesthetic threads market in the Middle East & Africa is growing due to the high demand for aesthetic procedures in the region. However, factors such as limited availability of skilled professionals is leading to a lower revenue share of the market

The Saudi Arabia Aesthetic threads market is expected to grow at a lucrative CAGR over the forecast period, as there is wide acceptance of aesthetic procedures and need to keep up with the beauty standards of the West. Saudi Arabia is a country with very high living standards and is greatly influenced by Western culture. Key drivers of Saudi Arabia aesthetic market include presence of young & aspirational population with growing health consciousness and rising geriatric population.

Key Aesthetic Threads Company Insights

Companies are focusing on strategic initiatives, such as the introduction of novel products through customization according to consumers’ needs, partnerships, collaborations, and mergers & acquisitions, to expand their product portfolio and extend leadership positions in the field of aesthetic industry. Moreover, the competition between key players will turn intense in the coming years as they are focusing more on geographical expansion, strategic collaborations, and partnerships through mergers & acquisitions.

Key Aesthetic Threads Companies:

The following are the leading companies in the aesthetic threads market. These companies collectively hold the largest market share and dictate industry trends.

- Aptos International Ltd

- Intraline

- Healux Corporation

- Croma Pharma GambH

- Les Encres Cosmetic Threads

- W & O Medical Esthetics Gambh

- Hyundae Meditechh Co. Ltd.

- N-Finders Co., Ltd.

- Nova Threads

- Savia medical

Recent Developments

-

Croma Pharma announced the availability of new Anchor Plus PDO threads in 2021, with increased thread integrity and more cogs, resulting in a stronger, more lasting thread capable of lifting heavy skin in places such as the submental, cheekbone, lower face, and neck

-

In 2021, Menarini Group, an Italian pharmaceutical company, launched Definisse double needle threads in India through its dermatology and aesthetic medicine arm RELIFE

Aesthetic Threads Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 147.2 million

Revenue forecast in 2030

USD 218.1 million

Growth rate

CAGR of 6.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Segments covered

Product type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark, Sweden; Norway; Japan; China; India; South Korea; Thailand; Australia; Brazil; Mexico; South Africa; Saudi Arabia; UAE; Kuwait; Argentina

Key companies profiled

Aptos International Ltd; Intraline; Healux Corporation; Croma Pharma GambH; Les Encres Cosmetic Threads; W & O Medical Esthetics Gambh; Hyundae Meditechh Co. Ltd.; N-Finders Co., Ltd.; Nova Threads; Savia Medical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aesthetic Threads Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aesthetic threads market report based on product type, application, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Permanent Thread

-

Absorbable Thread

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Face Lift

-

Breast Lift

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Cosmetic Surgery Centers

-

Medspas

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global aesthetic threads market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 218.1 million by 2030.

b. In 2023, North America held the largest aesthetic threads market, with a revenue share of 44.5%. This is due to the rising demand for aesthetic treatments, a growing senior population, and an increasing number of non-invasive cosmetic operations in the region.

b. Some of the key market players are Aptos International Ltd, Intraline, Healux Corporation, Croma Pharma GambH, Les Encres Cosmetic Threads, W & O Medical Esthetics Gambh, Hyundae Meditechh Co. Ltd., N-Finders Co., Ltd., Nova Threads, Savia medical

b. The rising popularity of minimally invasive procedures for anti-aging, face lifting, and face rejuvenation can be ascribed to the expansion of the cosmetic threads market.

b. The global aesthetic threads market size was estimated at USD 138.9 million in 2023 and is expected to reach USD 147.2 million in 2024

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.