- Home

- »

- Plastics, Polymers & Resins

- »

-

Aerospace Foam Market Size, Share, Industry Report, 2033GVR Report cover

![Aerospace Foam Market Size, Share & Trends Report]()

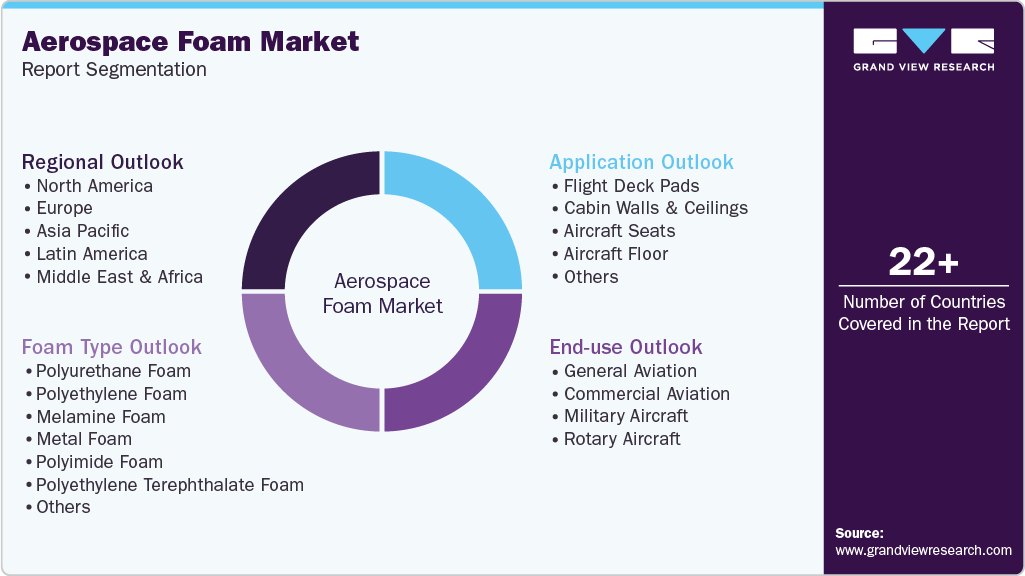

Aerospace Foam Market (2025 - 2033) Size, Share & Trends Analysis Report By Foam Type (Polyurethane Foam, Polyethylene Foam, Melamine Foam, Metal Foam), By Application (Flight Deck Pads, Aircraft Seats, Aircraft Floor), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-735-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerospace Foam Market Summary

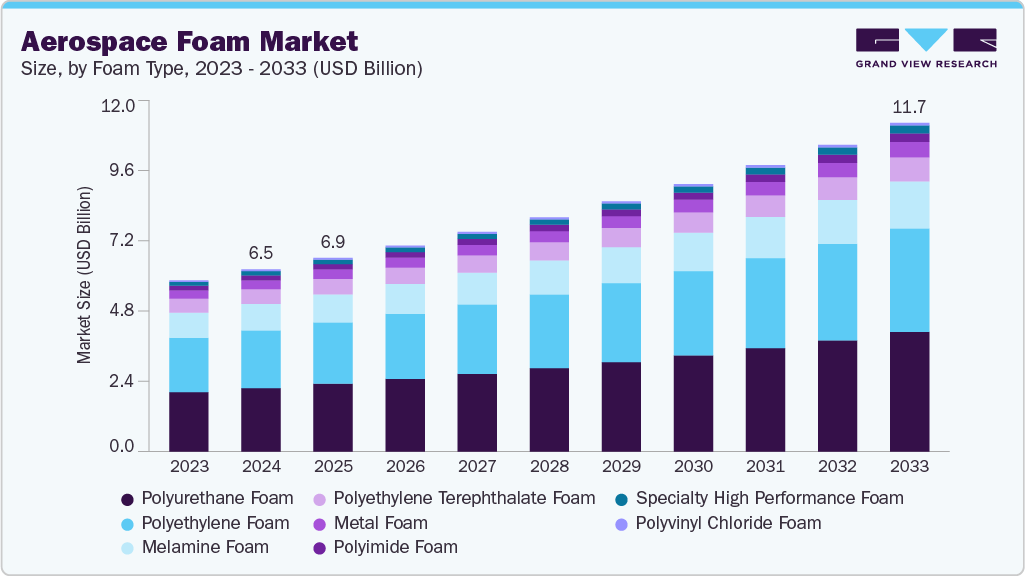

The global aerospace foam market size was estimated at USD 6.48 billion in 2024 and is projected to reach USD 11.71 billion by 2033, growing at a CAGR of 6.8% from 2025 to 2033. Increasing fuel prices have propelled aircraft manufacturers to minimize the aircraft weight and to carry more load in a go.

Key Market Trends & Insights

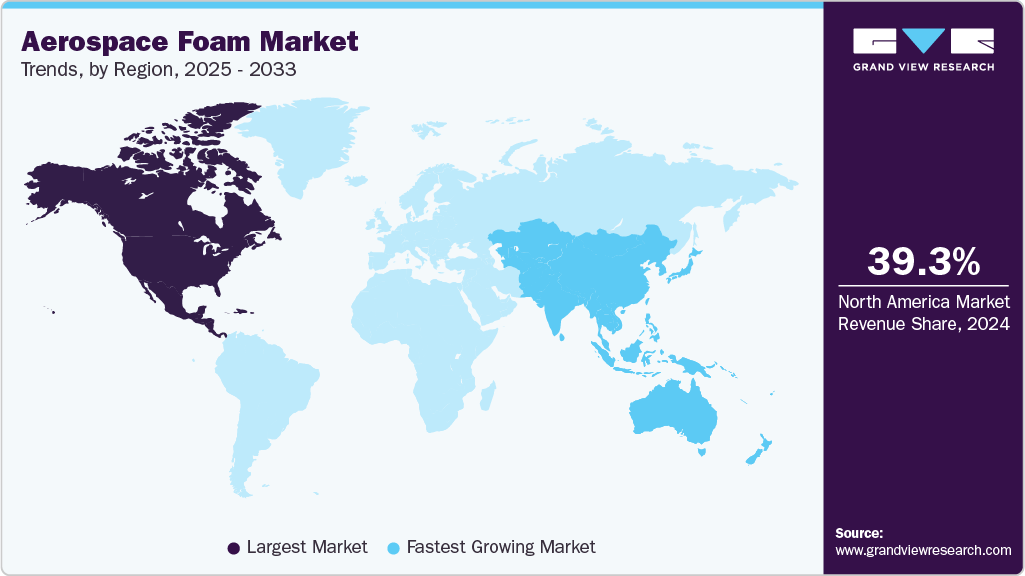

- North America dominated the aerospace foam market with the largest revenue share of 39.31% in 2024.

- The aerospace foam market in the U.S. is expected to grow at the fastest CAGR of 8.0% from 2025 to 2033.

- By foam type, the polyurethane segment is expected to grow at the fastest CAGR of 7.4% from 2025 to 2033 in terms of revenue.

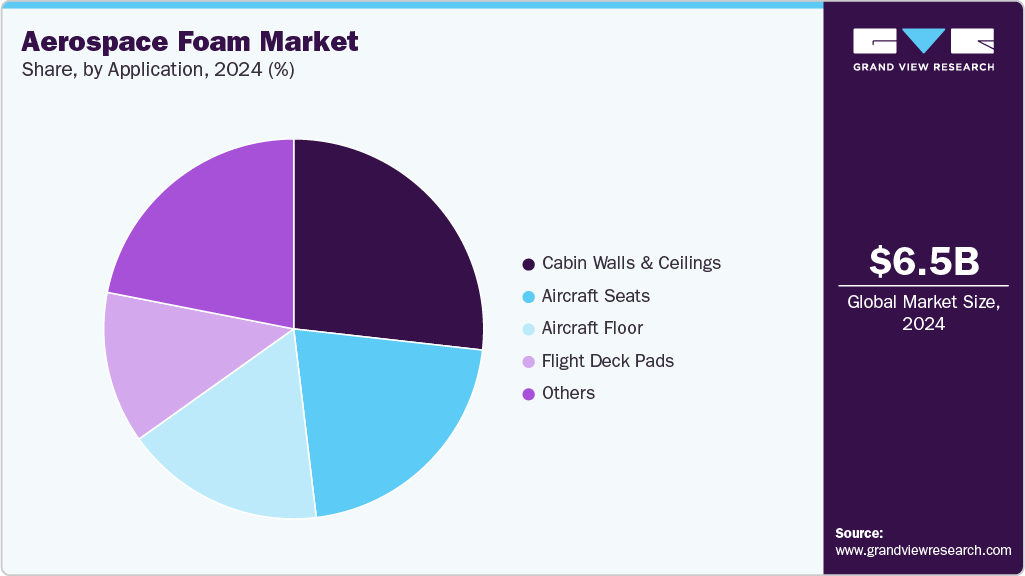

- By application, the cabin walls & ceilings segment is expected to grow at the fastest CAGR of 7.3% from 2025 to 2033 in terms of revenue.

- By end use, commercial aviation segment is expected to grow at the fastest CAGR of 7.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 6.48 billion

- 2033 Projected Market Size: USD 11.71 billion

- CAGR (2025-2033): 6.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Hence, these manufacturers have adopted the installation of aerospace foam across various aircraft applications such as flight deck pads, Cabin Walls & Ceilings, aircraft seats, and aircraft floors. Furthermore, the increasing commotion across air travel in recent years has propelled the demand for aircraft across all end uses, including general aviation, commercial aviation, military aircraft, and rotary aircraft. Hence, this has positively impacted the utility for aerospace foam across the aircraft manufacturing industry and is expected to grow prominently during the forecast period.

Drivers, Opportunities & Restraints

Major drivers include the aerospace industry’s aggressive push toward lightweight materials to improve fuel efficiency and reduce emissions, supported by initiatives from NASA and aircraft OEMs. Continued expansion in global air travel and aircraft deliveries, particularly for models like Boeing 737 MAX and Airbus A320neo, is stimulating demand for foam-based interior components-from seats to insulation panels, thereby leading to market growth.

Furthermore, stringent safety and regulatory standards necessitate advanced fire-retardant, acoustic, and vibration-dampening foams, presenting an opportunity for specialized materials that meet FAA and EASA specifications. Furthermore, the expanding space exploration market, along with MRO growth in aging fleets, creates demand for high-performance foams in spacecraft and airframe refurbishment.

However, high production costs tied to specialty raw materials and advanced manufacturing processes act as major restraints, limiting accessibility for budget-conscious airlines and newer players. Additionally, the limited range of qualified foam materials capable of meeting extreme aerospace requirements in flame, toxicity, and environmental toughness further hampers innovation and market expansion.

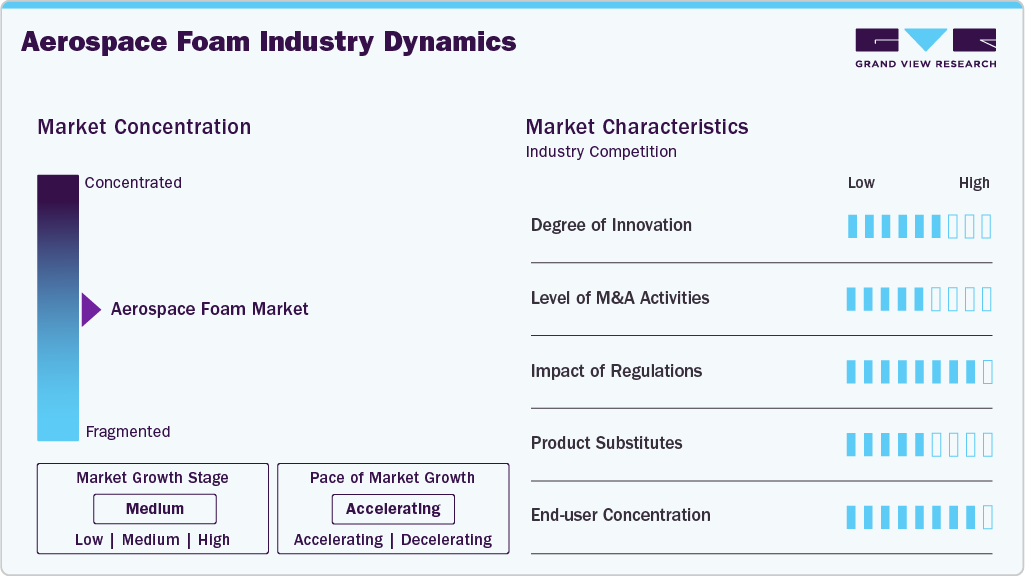

Market Concentration & Characteristics

The aerospace foam market is in a medium growth stage, and the pace is accelerating. Innovation is robust, driven by advanced manufacturing technologies, such as enhanced foam formulations with superior flame retardancy, vibration control, and thermal insulation, alongside emerging 3D printing for custom foam parts and nano-reinforced syntactic foams for next-gen aerospace composites.

M&A activity is moderate and targeted, with strategic acquisitions focused on expanding material portfolios and capabilities. For instance, 3A Composites’ acquisition of Solvay’s foam business and Trelleborg's acquisition of 4M indicate consolidation around high-performance foam technologies.

Strict regulatory standards from aviation authorities like the FAA/EASA regarding fire, smoke, and toxicity shape product development and certification, demanding continuous investment in new foam chemistries. Similarly, environmental mandates are fostering eco-friendly bio-based and recyclable foam solutions.

Product substitutes include advanced composites, honeycomb core materials, and foam-metal hybrids offering similar lightweight and structural properties. However, high certification costs and longer qualification timelines often delay their adoption, preserving aerospace foams’ role in thermal, acoustic, and impact applications.

The market shows high end user concentration, with major commercial OEMs like Boeing and Airbus and MRO service providers exerting significant buying influence. Their bulk orders and stringent technical specifications set the tone for suppliers, reinforcing a competitive environment that demands continuous innovation and compliance.

Foam Type Insights

Polyurethane (PU) dominated the aerospace foam market, accounting for a revenue share of 34.90% in 2024, owing to its wide application usage. PU foams are used for the insulation of aircraft, baggage sections, ceilings and walls, and separators between the class segments and lavatories.

Followed by specialty high-performance foam, including special polyethylene (PE) and expanded polyethylene (EPE) foam. The EPE foam provides unparalleled dimensional stability and recovery characteristics, making it an ideal alternative to traditional foams used across the aerospace industry. These foams are used across the ceilings of the aircraft to decrease the repeated impacts across the aircraft by providing optimal cushioning.

Polyethylene foam is anticipated to grow at a significant CAGR of 6.8% through the forecast period. PE foam is used across the aisle and walls & ceiling of the aircraft owing to its high insulation and dampening properties. PE foam has recently gained traction across the aerospace market. It is anticipated to grow noticeably during the forecast period due to its properties of maintaining cabin temperature in contrast to colder atmospheric temperature conditions during the flight duration, preventing temperature exchange.

End-use Insights

Commercial aviation dominated the market in terms of revenue, accounting for a share of 29.64% in 2024. The push toward fleet modernization and fuel efficiency has intensified the use of lightweight, high-performance foams to reduce overall aircraft weight. Increasing passenger traffic, coupled with rising demand for aircraft retrofitting and cabin upgrades, continues to propel the market in this segment.

The general aviation segment is expected to grow at a substantial CAGR of 6.6% during the forecast period. In general aviation, aerospace foams are widely used for seating, cabin insulation, and cockpit padding in smaller aircraft such as private jets, light aircraft, and charter planes. With increasing interest in personal and corporate aviation, there is growing adoption of advanced polyurethane and polyethylene foams that offer excellent acoustic dampening and fire-retardant properties.

Aerospace foams are essential for structural insulation, impact absorption, noise reduction, and specialized seating in military aircraft. These applications require foams with enhanced durability, thermal stability, and resistance to extreme environmental conditions. Military-specific requirements often necessitate foams that can withstand harsh operational stresses while providing weight savings critical for mission efficiency.

Rotary aircraft, including helicopters used in civil, defense, and emergency services, rely on aerospace foams for vibration control, cabin insulation, and energy-absorbing seating. Given the higher vibration levels and noise intensity in rotary wing operations, foams with superior acoustic and shock-absorbing properties are particularly valued.

Application Insights

Cabin walls & ceilings led the aerospace foam industry, accounting for a revenue share of 26.78% in 2024. Owing to the widespread usage of aerospace foam, especially PU foam, across the chassis of the aircraft. Since the structure of the aircraft encapsulates passengers and cargo, it requires being highly insulated to avoid any wind exchange from within the aircraft and the outside atmosphere. Hence, aerospace foams find a major application usage across the cabin wall & ceilings and are expected to grow at the fastest CAGR over the forecast period.

The flight deck pads segment is expected to grow at a substantial CAGR of 6.7% over the forecast period. These pads, typically made from high-performance polyurethane or polyethylene foams, provide cushioning and ergonomic support for pilots during long flights, reducing fatigue and improving operational efficiency. Additionally, aerospace foams in flight deck pads offer excellent thermal insulation and noise dampening, which help minimize cockpit noise from engines and external aerodynamic forces.

Aircraft seats comprise a major part of air travel in terms of comfort and luxury. Since air travel can vary from a journey of about 2 hours to 20 hours and above, the seats must be highly comfortable for passengers and crew on board. Hence, aerospace foam is mainly used for the manufacturing of aircraft seats since this foam provides high impact absorption properties, comfort in terms of seating, and additionally adds to the manufacturer’s objective of lightweight aircraft.

Regional Insights

North America is the largest and fastest-growing region in the aerospace foam market, dominating with a revenue share of 39.31% in 2024. North America is projected to benefit from the current domination, with the U.S. being a key contributor to market growth due to the rise in the demand for aircraft across the country in the past decade. Hence, the demand for aerospace foam has witnessed a positive impact and is anticipated to follow similar growth trends during the forecast period across the region.

U.S. Aerospace Foam Market Trends

North America, led by the U.S., commands the largest share of the global aerospace foam industry, holding approximately 85.88% of the revenue share in 2024, owing to a strong aerospace sector and robust defense expenditures. The presence of major OEMs like Boeing and Lockheed Martin and a well-established supply chain creates sustained demand for lightweight, fire-retardant foams across commercial, military, and general aviation segments.

Europe Aerospace Foam Market Trends

Europe ranks second globally after North America, accounting for approximately 27% of the aerospace foam industry, with Germany, the UK, and France being key contributors. The region’s focus on passenger comfort, safety certifications under EASA, and innovation in eco-friendly foam materials drive demand, particularly for polyimide and polyurethane foams used in cabin interiors and insulation.

The Germany aerospace foam market plays a pivotal role within Europe, bolstered by its strong aerospace manufacturing industry and firms like BASF and Evonik investing in advanced foam technologies. German innovation in high-performance materials, especially polyimide and metal hybrid foams for cabin walls and acoustic applications, makes it a leading force in sustainable and safety-focused foam solutions.

Asia Pacific Aerospace Foam Market Trends

Asia Pacific, including key markets such as China and India, is the fastest-growing region in the aerospace foam industry, capturing around 11% of global demand. Growth is underpinned by rising aircraft production volumes, expanding defence programs, and rising domestic airline traffic, particularly in China, which leads regional consumption with strong government backing.

The China aerospace foam market dominated Asia Pacific, fueled by rapid expansion in commercial and military aircraft manufacturing. Government initiatives to build a self-reliant aviation ecosystem and aggressive fleet modernization have elevated demand for advanced foam materials in seats, insulation, and structural components.

The aerospace foam market in India is emerging as a high-growth market, benefiting from government defense modernization, increasing commercial aircraft procurements, for instance, the MMRCA 2.0 deal, and investments in aerospace infrastructure. These trends are creating opportunities for suppliers of performance-grade foams tailored to military and commercial aviation needs.

Latin America Aerospace Foam Market Trends

Latin America holds a smaller but stable share in the aerospace foam industry, accounting for roughly 6% of global demand. Brazil and Mexico are the main contributors, driven by regional aircraft production and investments in airline fleet upgrades. However, the growth is moderate due to slower expansion compared to APAC and North America.

Middle East & Africa Aerospace Foam Market Trends

The growth of the Middle East & Africa aerospace foam industry is supported by growth in Gulf nations’ airline fleets, MRO bases, and defense procurement. Demand is driven by new aircraft deliveries and refurbishment programs, particularly in the GCC, although infrastructure limitations in Africa temper overall expansion.

The Saudi Arabia aerospace foam market is witnessing increased demand for aerospace foams due to its ambitious aviation and defence modernization agendas. Investments in national carriers, MRO capabilities, and strategic partnerships in aircraft production are spurring demand for certified, high-performance foam materials in cabin interiors, insulation, and vibration-damping applications.

Key Aerospace Foam Company Insights

The presence of several players such as Boyd Corporation, Evonik Industries AG, ERG Aerospace Corporation, SABIC, BASF SE, ZOTEFOAMS PLC, General Plastics Manufacturing Company, and Solvay characterizes the global aerospace foam market. Key players in the market are actively involved in adopting strategies targeted towards attaining sustainable transition, sales execution, and efficient pricing. Such players offer broad capabilities as well as capacities that enable them to cater to diversified needs arising across multiple end use industries.

Key Aerospace Foam Companies:

The following are the leading companies in the aerospace foam market. These companies collectively hold the largest market share and dictate industry trends.

- Boyd Corporation

- Evonik Industries AG

- ERG Aerospace Corporation

- SABIC

- BASF SE

- ZOTEFOAMS PLC

- General Plastics Manufacturing Company

- Solvay

- UFP Technologies, Inc.

- Recticel NV/SA

- NCFI Polyurethanes

- DuPont

- Rogers Corporation

- ARMACELL

Recent Developments

-

In April 2025, Insperial, a portfolio company under Adagia Partners, acquired MGR Foamtex, a UK-based manufacturer specializing in advanced soft-goods and passenger upholstery systems for aircraft interiors. The acquisition integrates MGR’s engineering and manufacturing expertise with Insperial’s global sales footprint, positioning the combined group to enhance growth, innovation, and market reach across the aerospace interior segment.

-

In February 2025, Trelleborg Sealing Solutions expanded its aerospace portfolio by acquiring Aero‑Plastics Inc., a U.S. manufacturer specializing in precision injection molding, thermoforming, and machining of high-performance polymers for aircraft interiors, including window reveals and blind assemblies. The deal, valued at approximately SEK 150 million (~USD 15.3 million) and finalized in April 2025, adds significant capacity, technical expertise, and value-added services like assembly, engraving, and painted finishes.

Aerospace Foam Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.89 billion

Revenue forecast in 2033

USD 11.71 billion

Growth rate

CAGR of 6.8% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Foam type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

Boyd Corporation; Evonik Industries AG; ERG Aerospace Corporation; SABIC; BASF SE; ZOTEFOAMS PLC; General Plastics Manufacturing Company; Solvay; UFP Technologies, Inc.; Recticel NV/SA; NCFI Polyurethanes; DuPont; Rogers Corporation; ARMACELL

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace Foam Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global aerospace foam market report based on foam type, application, end-use, and region:

-

Foam Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyurethane Foam

-

Polyethylene Foam

-

Melamine Foam

-

Metal Foam

-

Polyimide Foam

-

Polyethylene Terephthalate Foam

-

Polyvinyl Chloride Foam

-

Specialty High Performance Foam

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Flight Deck Pads

-

Cabin Walls & Ceilings

-

Aircraft Seats

-

Aircraft Floor

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

General Aviation

-

Commercial Aviation

-

Military Aircraft

-

Rotary Aircraft

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

- South Africa

-

-

Frequently Asked Questions About This Report

b. The global aerospace foam market size was estimated at USD 6.48 billion in 2024 and is expected to reach USD 6.89 billion in 2025.

b. The global aerospace foam market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2033 to reach USD 11.71 billion by 2033.

b. North America dominated the aerospace foam market with a share of 39.31% in 2024. This is attributable to the strong growth in the U.S. aerospace industry and the presence of major aircraft manufacturers across the region.

b. Some key players operating in the aerospace foam market include Boyd Corporation, Evonik Industries AG, ERG Aerospace Corporation, SABIC, BASF SE, ZOTEFOAMS PLC, General Plastics Manufacturing Company, Solvay, UFP Technologies, Inc., Recticel NV/SA, NCFI Polyurethanes, DuPont, Rogers Corporation, and ARMACELL

b. Key factors that are driving the market growth include increasing demand for lightweight aircraft in lieu with increasing fuel prices, along with increased air travel in recent years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.