Aerospace Engineering Services Outsourcing Market Size, Share & Trends Analysis Report By Service, By Function, By Location, By Component (Hardware, Software), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-643-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

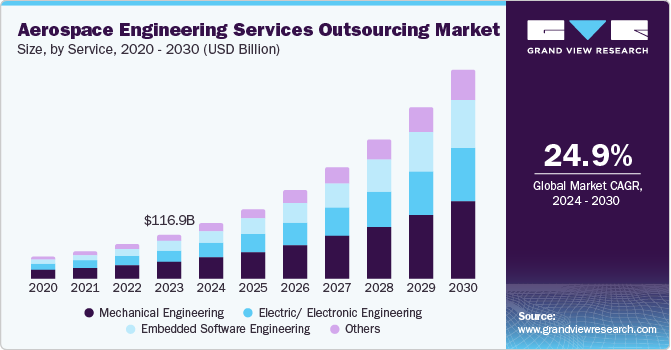

The global aerospace engineering services outsourcing market size was valued at USD 116.95 billion in 2023 and is projected to grow at a CAGR of 24.9% from 2024 to 2030. Organizations are following the increasingly popular practice of engineering services outsourcing (ESO) to assign specific functions or projects to external engineering service providers. These organizations can thus focus on their core competencies by outsourcing these tasks to industry specialists.

The fast-growing air travel industry, particularly in emerging economies such as India, China, and other Southeast Asian countries, is creating a strong demand for modernized aerospace infrastructure. This translates to increased design, development, and maintenance service requirements, propelling the growth of the ESO market in this sector.

Intensifying competition within the aerospace sector and post-recessionary pressures have compelled manufacturers to explore effective cost-reduction strategies, including outsourcing specific processes. For instance, the aviation sector has recovered from the COVID-induced recession that had caused a major decline in global operations. The number of passengers choosing air travel over other modes is also increasing exponentially. As a result, the aviation sector is experiencing a mismatch between its expanding traveler base and the rate of service delivery. Outsourcing engineering services offers a compelling solution in this regard, enabling companies to leverage the expertise of service providers at much lower costs than in-house development.

Significant developments have been made in integrating advanced electronic components and different types of software in aircraft. This has resulted in the aerospace industry requiring more qualified personnel with specialized engineering skills in their on-ground and in-air operations. ESO providers address this demand by offering access to a broader talent pool, ensuring critical aerospace projects have the necessary expertise. As a result, organizations can instead deploy their resources, time, and energy to expand their operations and grow their business. The experts assigned by providers of engineering services handle projects efficiently and in a time-bound manner, making it very convenient for organizations to meet project deadlines and better serve their customers and stakeholders.

Service Insights

The mechanical engineering segment accounted for the highest revenue share of 39.0% in the global market in 2023. The aerospace industry relies heavily on mechanical engineering services such as structural engineering, systems engineering, and fluid & thermodynamics. The increasing complexity of modern aerospace components leads to a constant demand for qualified mechanical engineers across the design, development, and maintenance stages. However, hiring specialized professionals on a permanent basis comes with significant costs, which compels organizations to outsource these services, driving segment growth. Mechanical engineers are required to carry out extensive evaluations regarding the structural integrity, aerodynamics, and operational efficiency of an aircraft, which are critical parameters to ensure its smooth functioning. As this is a time- and resource-intensive process, outsourcing is considered an effective option.

The embedded software engineering segment is expected to register a significant CAGR during the forecast period. Modern aircraft rely heavily on sophisticated embedded software for critical functions such as flight control, navigation, engine control, electronics, and communication. This growing complexity calls for specialized expertise, driving segment expansion. Embedded software engineering firms offer a cost-effective solution by providing access to skilled professionals and efficient development methodologies. For instance, Outsource2India provides engineering solutions such as flight simulation test environment, flight modeling software, and 3D model prototype tools & testing software, among others, while adhering to regulatory standards and offering extensive support and maintenance to its clients. The growing presence of such organizations has helped drive strong growth of the aerospace engineering services outsourcing industry.

Function Insights

The maintenance process segment accounted for the highest revenue share in the market in 2023. This segment includes after-market functionalities, along with security & certification functions that have become critical for the aerospace industry. Every type of aircraft requires periodic and stringent maintenance schedules to ensure safety, reduced downtime & associated costs, and reliability of service delivery, along with maximum service life. Moreover, the global aircraft fleet is aging, leading to an increased demand for maintenance services. According to an article published by Air Cargo Week in December 2023, around one-third of over 30,000 commercial aircraft operating globally were more than 20 years old, with maintenance costs growing significantly as the aircraft ages. Engineering service outsourcing providers offer specialized skills and experience required to maintain older aircraft fleets and models with cost-effectiveness. This ongoing need for qualified personnel and specialized services fuels the demand for maintenance ESO solutions.

The design segment is expected to register the fastest CAGR from 2024 to 2030. The aerospace industry is undergoing rapid technological advancements through the emergence and adoption of lightweight materials, alternate fuel options, electric and hybrid propulsion systems, and autonomous flight solutions. The design segment plays a critical role in ensuring the incorporation of these innovations into aircraft models. OEMs are increasingly outsourcing processes such as avionics design & development, product design optimization, designing of cabin seating & aircraft interiors, and designing of equipment tooling and harnesses. This trend of outsourcing design functionality to leverage the domain skills and technical proficiency of service providers is expected to fuel segment growth in the coming years.

Location Insights

The on-shore segment held a leading revenue share in the aerospace engineering services outsourcing market in 2023 and is further expected to witness a faster growth rate during the forecast period. Aerospace projects involve the use of susceptible technologies and have a significant volume of classified information. Onshore outsourcing allows companies to retain greater control over data and mitigate potential security risks associated with offshore locations. Additionally, the physical proximity between an outsourcing partner and the original equipment manufacturer (OEM) facilitates closer collaboration and real-time communication. This is crucial for complex engineering projects that require frequent iterations and rapid problem-solving capabilities. Such advantages of on-shore services compel organizations to collaborate with them, driving segment growth.

The offshore segment is projected to witness a significant growth from 2024 to 2030. This is owing to significant cost savings offered by offshore service providers compared to their onshore counterparts. This is primarily driven by lower labor rates for qualified engineers, making it an appealing option for Original Equipment Manufacturers (OEMs) seeking to minimize their expenses. For instance, the talent pool in established offshore ESO hubs such as India, the Philippines, and other developing countries is rapidly expanding. These economies are actively creating a robust resource of skilled engineers, making them well-equipped to handle complex aerospace projects.

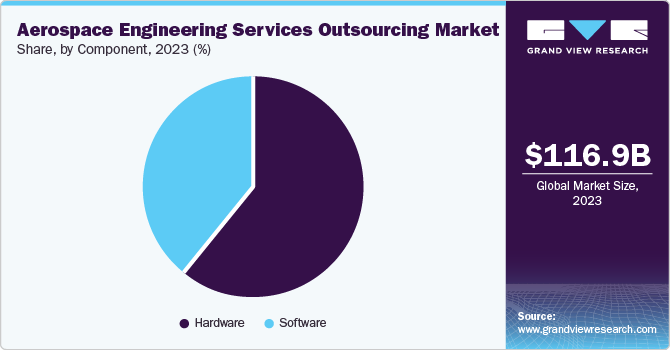

Component Insights

The hardware segment accounted for a leading revenue share in 2023. The aerospace industry relies heavily on complex physical components to function efficiently. These include airframes, engines, avionics, raw materials, forgings, castings, and several other parts of an aircraft or spacecraft. The engineering services outsourcing hardware segment encompasses the design, development, and manufacturing support for these critical components. Additionally, rapid innovations in commercial and defense aircraft technologies pose lucrative opportunities for segment expansion.

The software segment is expected to register the fastest CAGR during the forecast period. This segment expansion can be attributed to a rapidly rising demand for efficiency and optimization in the aerospace industry, as aerospace companies are constantly seeking methods to improve design processes, reduce development timelines, and optimize aircraft performance. Software solutions such as Computer-Aided Design (CAD), Computer-Aided Manufacturing (CAM), and simulation tools enable them to achieve these goals and have become a core part of designing and testing. Furthermore, software plays a critical role in integrating new components, leveraging technologies such as artificial intelligence (AI), machine learning, and big data analytics into aerospace systems.

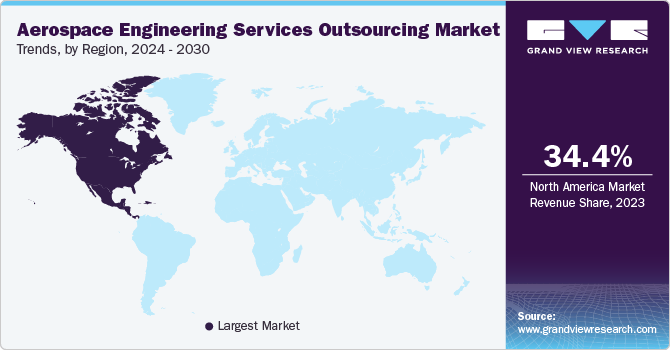

Regional Insights

North America aerospace engineering services outsourcing market held the largest revenue share of 34.4% in the global market in 2023. This region possesses a highly developed aerospace ecosystem, owing to the presence of prominent airlines such as Delta Air Lines, United Airlines, Air Canada, Aeroméxico, and Spirit Airlines, among others. The availability of a well-established infrastructure in the region facilitates efficient collaboration and project execution, making it an attractive location for companies seeking engineering services outsourcing solutions. The intense competition within North America's commercial aviation sector has necessitated a constant push for advancements in efficiency, performance, and optimal passenger experience. This competitive landscape results in a heightened demand for specialized ESO services to optimize aircraft design, manufacturing processes, and operational costs.

U.S. Aerospace Engineering Services Outsourcing Market Trends

The U.S. encompasses a vast network of local and international airlines, which has highlighted a constant need for ESO providers. According to the May 2024 report by the Federal Aviation Administration, its Air Traffic Organization (ATO) delivers service to around 45,000 flights daily, handling approximately 3 million travelers. Additionally, the U.S. possesses a well-established research and development base within the aerospace industry. This focus on innovation requires access to a skilled ESO workforce capable of handling cutting-edge technologies and adhering to stringent aerospace standards, driving substantial industry growth in the economy.

Europe Aerospace Engineering Services Outsourcing Market Trends

Europe aerospace ESO market has been identified as a lucrative region for market growth. This region has a long history in aerospace engineering, being the headquarters of major players such as Airbus (Netherlands) and Rolls-Royce (the UK). This accounts for a strong ecosystem of ESO providers in Europe, with deep expertise in both software and hardware components of an aircraft. European nations such as Germany, the UK, and France are known for their highly skilled workforce in engineering and related disciplines. This readily available talent pool and a well-developed airline sector have made Europe a promising region for further advancements in the aerospace engineering services outsourcing industry.

The presence of some of the world's busiest airports in the UK, such as Heathrow Airport and Gatwick Airport, has encouraged organizations to opt for industry best practices for efficient and cost-effective service delivery. The aviation industry in the country adheres to stringent safety and quality regulations, resulting in ESO providers offering a high standard of service and making them a reliable choice for clients worldwide. Additionally, constant support from bodies such as the North West Aerospace Alliance (NWAA), which advocates for policies and initiatives that benefit the industry's growth and competitiveness, makes the economy a highly preferred destination for stakeholders.

Asia Pacific Aerospace Engineering Services Outsourcing Market Trends

Asia Pacific is expected to witness the fastest CAGR during the forecast period in the industry. The region is experiencing rapid economic growth, led by the implementation of a range of initiatives in economies such as India, Japan, and China. Air travelers in the region are increasing exponentially, leading to a surging demand for commercial aircraft and new airports to accommodate this growing traffic. This fuels the need for robust engineering capabilities, driving the demand for ESO services. Moreover, regional countries are increasingly investing in research and development activities within the aerospace sector. These factors have acted favorably in expanding market growth in Asia Pacific.

The presence of a huge talent base of a technologically equipped and skillfully trained workforce in India makes it a preferred destination for outsourcing engineering services. Furthermore, with rapid economic growth, the middle-income population has witnessed a sharp growth in disposable income levels in the country. This has propelled the demand for local and international air travel, which is evident from an increasing number of airports and surged air traffic over the last decade. Furthermore, favorable government initiatives such as the Regional Connectivity Scheme (RCS) - UDAN, launched in 2017, have made India a lucrative investment market for global players, which is expected to drive the domestic engineering services outsourcing industry.

Key Aerospace Engineering Services Outsourcing Company Insights

Some key companies involved in the aerospace engineering services outsourcing market include Honeywell International Inc., Altair Engineering Inc., and Alten Group, among others.

-

Altair Engineering Inc. is an American multinational IT company that provides services to the aerospace industry by leveraging its software and cloud-based solutions for data analytics, artificial intelligence, simulation, and high-performance computing (HPC). Its expertise in simulation technology enables computerized testing of aircraft parts for improved safety, while HPC allows for design analysis and optimization. The company’s solutions are used for reducing weight, improving engine efficiency, reducing drag and energy consumption, offering predictive maintenance, optimizing production processes, and reducing MRO costs.

-

Alten Group is a French engineering outsourcing and consulting company that serves multiple industries such as aeronautics, space, defense, automotive, life sciences, telecom, and banking. The company caters to the aerospace industry by providing solutions in digital transformation, supply chain management, cost optimization, predictive maintenance, and related areas. Alten offers expertise in domains including manufacturer, OEM, maintenance repair and operations, and operators.

Key Aerospace Engineering Services Outsourcing Companies:

The following are the leading companies in the aerospace engineering services outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Altair Engineering Inc.

- Alten Group

- Capgemini

- Bertrandt AG

- EWI

- Honeywell International Inc.

- ITK Engineering GmbH

- L&T Technology Services Limited

- LISI GROUP

- Teledyne Technologies Incorporated

- BAE Systems

- L3Harris Technologies, Inc.

- Elbit Systems Ltd.

- RTX

View a comprehensive list of companies in the Aerospace Engineering Services Outsourcing Market

Recent Developments

-

In June 2024, Honeywell announced that it had signed an agreement for the acquisition of CAES Systems Holdings LLC, a manufacturer of advanced electronics components in the aerospace and defense industry. This strategic development is expected to enhance the defense technology solutions portfolio of Honeywell across air, land, sea, and space, as well as bring in innovative electromagnetic defense technologies to effectively manage end-to-end RF signals.

-

In May 2024, L&T Technology Services inaugurated the Simulation Centre of Excellence for Airbus in the city of Bangalore, India. This facility is expected to facilitate the development of highly advanced simulation services by leveraging the latest simulation technology software and engineering machinery and infrastructure. The center is focusing on the unification and standardization of processes across every Airbus business unit in Europe and aircraft programs, thus improving efficiency and productivity.

Aerospace Engineering Services Outsourcing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 147.68 billion |

|

Revenue Forecast in 2030 |

USD 560.90 billion |

|

Growth Rate |

CAGR of 24.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Service, function, location, component, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, South Korea, India, Brazil, South Africa, Saudi Arabia |

|

Key companies profiled |

Altair Engineering Inc.; Alten Group; Capgemini; Bertrandt AG; EWI; Honeywell International Inc.; ITK Engineering GmbH; L&T Technology Services Limited; LISI GROUP; Teledyne Technologies Incorporated; BAE Systems; L3Harris Technologies, Inc.; Elbit Systems Ltd.; RTX |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Aerospace Engineering Services Outsourcing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aerospace engineering services outsourcing market report based on service, function, location, component, and region.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mechanical Engineering

-

Electric/ Electronic Engineering

-

Embedded Software Engineering

-

Others

-

-

Function Outlook (Revenue, USD Billion, 2018 - 2030)

-

Design

-

Simulation & Digital Validation

-

Production Process

-

Maintenance Process

-

-

Location Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-shore

-

Off-shore

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Software Licensing

-

Software Services

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."