- Home

- »

- Next Generation Technologies

- »

-

Aerospace 3D Printing Market Size & Share Report, 2030GVR Report cover

![Aerospace 3D Printing Market Size, Share & Trends Report]()

Aerospace 3D Printing Market Size, Share & Trends Analysis Report By Component, By Technology, By Application, By Material (Metal, Polymer, Composite), By End-product, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-267-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Aerospace 3D Printing Market Size & Trends

The global aerospace 3D printing market size was estimated at USD 3.13 billion in 2023 and is projected to grow at a CAGR of 20.6% from 2024 to 2030. The demand for customization and rapid prototyping is driving the adoption of 3D printing in the aerospace sector. Additive manufacturing enables rapid iteration and customization of aerospace components, allowing manufacturers to quickly iterate designs, test prototypes, and accelerate the product development cycle. This agility is particularly valuable in the aerospace industry, where rapidly prototyping and iterating designs can significantly reduce time-to-market and enable faster innovation in aircraft and spacecraft development.

The COVID-19 pandemic had a negative impact on the market growth. One of the immediate effects of the pandemic was the disruption of global supply chains, leading to delays in manufacturing and delivery of aerospace components. Moreover, the pandemic underscored the importance of resilience and adaptability in aerospace manufacturing. As airlines grounded fleets and reduced orders for new aircraft in response to decreased air travel demand, aerospace manufacturers faced declining revenues and increased pressure to cut costs.

The demand for supply chain resilience and cost-effective production is fueling interest in 3D printing technology. Additive manufacturing reduces reliance on traditional manufacturing processes and complex supply chains by enabling on-demand production of aerospace components directly from digital designs. This on-demand manufacturing capability reduces lead times, minimizes inventory costs, and mitigates supply chain disruptions, enhancing the resilience and agility of aerospace supply chains. In addition, the scalability of 3D printing technology allows aerospace manufacturers to produce small batches or customized parts cost-effectively, further driving adoption in the industry.

Regulations related to the global market are still evolving, with a need for standardization and guidelines to address emerging legal issues and ensure safety and quality in the industry. The U.S. and Europe need more specific regulations for additive manufacturing in aerospace. However, efforts are being made to develop standards for 3D printing, particularly in critical areas like materials, and to meet regulatory standards for industries such as aerospace and defense. Organizations such as ASTM and ISO are actively working on establishing standards for additive manufacturing technologies, covering aspects such as materials, processes, equipment, and finished parts.

Market Concentration & Characteristics

The market is significantly fragmented, featuring several global and regional players. The market players are investing in research & development (R&D) to develop advanced solutions and gain a competitive edge in the industry. In January 2024, GKN Aerospace, an aerospace manufacturer, announced an investment of EUR 50 Million (USD 64 Million) to accelerate its additive manufacturing (AM) capabilities at its Trollhättan facility in Sweden. This initiative aims to minimize raw material consumption and create opportunities for significant enhancements in aircraft engine design, resulting in lighter and more efficient engines. Beyond improving GKN Aerospace's sustainability efforts, this substantial investment also marks a stride forward in adopting AM technology to advance supply chain digitalization.

The market growth stage is high, and the pace is accelerating. The degree of innovation is high. The rise of distributed manufacturing networks and digital marketplaces for 3D-printed aerospace components is transforming the aerospace supply chain, enabling greater agility, resilience, and responsiveness to customer demands.

Aerospace 3D printing companies are incorporating mergers and acquisitions to gain substantial market advantage. In June 2023, Agile Space Industries (Agile), a company specializing in propulsion engines for spacecraft, acquired Tronix3D, a 3D printing service bureau. This acquisition aims to enhance Agile's ability to improve speed and quality throughout the aerospace supply chain, particularly in metal 3D printing. Furthermore, Agile plans to optimize its propulsion systems for NASA and SpaceX's forthcoming lunar missions. With the addition of Tronix3D, Agile has a dedicated additive manufacturing (AM) division focused on advancing aerospace 3D printing technology.

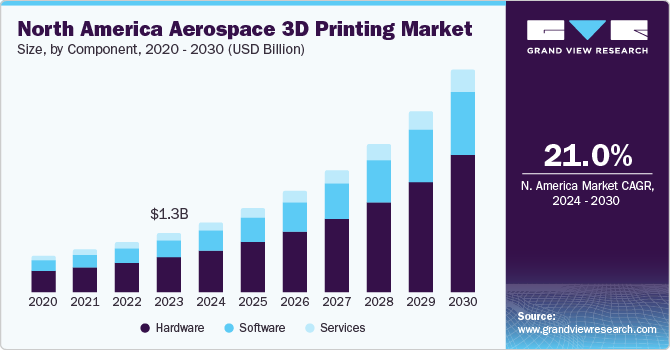

Component Insights

Based on component, the market is further bifurcated into application hardware, software, and services. The hardware segment led the market with the largest revenue share of 63.6% in 2023 and is expected to witness at the fastest CAGR during the forecast period. Growing demand for on-site and on-demand manufacturing capabilities is driving the market growth. Aerospace operators require quick access to spare parts and replacement components to minimize downtime and ensure the continued operation of their aircraft and spacecraft. Additive manufacturing technologies enable the decentralized production of parts and components, allowing aerospace companies to establish local manufacturing facilities or deploy portable 3D printing systems directly to the point of need. This capability enhances supply chain resilience and reduces reliance on centralized manufacturing facilities, improving operational readiness and responsiveness.

The software segment is expected to witness at a significant CAGR during the forecast period. The increasing adoption of digital twins and virtual prototyping in aerospace engineering is driving the adoption of the software segment in aerospace 3D printing. Digital twins are virtual replicas of physical assets or systems that enable real-time monitoring, analysis, and optimization throughout the product lifecycle. By creating digital twins of 3D-printed components and systems, aerospace manufacturers optimize process parameters, predict maintenance needs, and improve overall performance and reliability.

Technology Insights

Based on technology, the market is further bifurcated into selective laser melting (SLM), electron beam melting (EBM), direct metal laser sintering (DMLS), stereolithography (SLA), and others. The selective laser melting (SLM) segment led the market with the largest revenue share of 48.6% in 2023. The demand for innovative design solutions and advanced materials for next-generation aerospace systems is driving the segment's growth. These lightweight and intricately designed components offer significant performance, fuel efficiency, and aerodynamics advantages for aircraft and spacecraft. In addition, advancements in materials science and powder metallurgy are unlocking new possibilities for SLM, enabling the production of high-performance alloys and metal-matrix composites tailored to meet the specific requirements of aerospace applications.

The direct metal laser sintering (DMLS) segment is expected to grow at a significant CAGR during the forecast period. The growing trend toward additive manufacturing and digitalization in aerospace manufacturing processes is accelerating the adoption of DMLS technology. As the industry increasingly adopts Industry 4.0 principles, aerospace companies invest in advanced manufacturing technologies such as DMLS to streamline production workflows, reduce lead times, and lower costs. The ability to rapidly iterate designs, produce on-demand parts, and minimize material waste drives the segment growth.

Application Insights

Based on application, the market is further bifurcated into prototyping, tooling, and functional parts. The prototyping segment led the market with the largest revenue share of 54.8% in 2023. Growing demand to produce functional prototypes that closely mimic the properties of final production parts is driving the segment growth. With advancements in materials science and additive manufacturing processes, aerospace-grade materials can now be utilized for prototyping applications, allowing engineers to evaluate mechanical properties, thermal performance, and other critical characteristics of prototypes under real-world conditions. This capability enables more accurate performance assessments and reduces the risk of design flaws or performance discrepancies during the transition from prototyping to production.

The functional parts segment is expected to grow at the fastest CAGR during the forecast period. The functional parts segment caters to the demand for customized and on-demand production in the aerospace industry. Aircraft manufacturers and operators increasingly adopt personalized solutions to meet specific requirements and optimize performance. 3D printing enables the rapid prototyping and production of customized components, offering flexibility and agility in the manufacturing process. This capability reduces lead times and enhances cost-effectiveness by minimizing material waste and streamlining supply chains.

Materials Insights

Based on materials, the market is further segmented into metal, polymer (plastic), and composite. The metal segment led the market with the largest revenue share of 57.1% in 2023 and is expected to grow at the fastest CAGR during the forecast period. Additive manufacturing techniques eliminate many of the constraints associated with traditional machining processes, such as the need for specialized tooling and extensive material waste. By enabling near-net-shape manufacturing and on-demand production, metal 3D printing reduces lead times, minimizes material consumption, and streamlines supply chains, ultimately driving down manufacturing costs and improving overall operational efficiency.

The polymer segment is expected to grow at a significant CAGR during the forecasted period. The polymer segment in aerospace 3D printing is driven by the industry's focus on sustainability and environmental responsibility. Polymers are inherently recyclable and offer the potential for closed-loop manufacturing processes, where waste materials are reclaimed, processed, and reused to produce new components. Additive manufacturing further supports sustainability initiatives by reducing material waste, energy consumption, and carbon emissions compared to traditional manufacturing methods, aligning with the aerospace industry's goals for more eco-friendly and resource-efficient production practices.

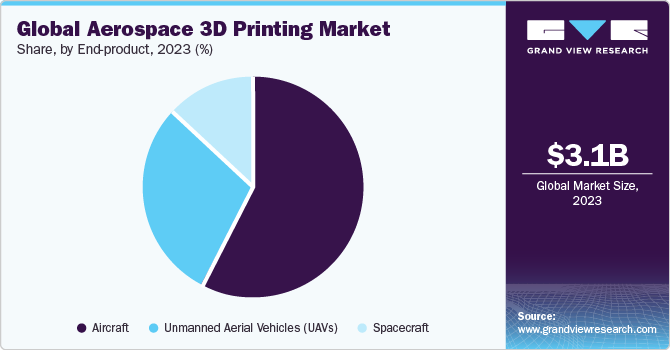

End-product Insights

Based on end product, the market is further bifurcated into aircrafts, unmanned aerial vehicles (UAVs), and spacecraft. The aircraft segment led the market with the largest revenue share of 58.6% in 2023 and is expected to grow at the fastest CARG during the forecast period. While additive manufacturing has demonstrated significant potential for aerospace applications, to ensure the airworthiness of 3D-printed components, stringent safety and quality standards need to be adhered to. Regulatory agencies such as the Federal Aviation Administration (FAA) and the European Aviation Safety Agency (EASA) have been actively working with industry stakeholders to develop standards and certification processes for additive manufacturing in aerospace. As these standards become more established and widely accepted, they will facilitate the broader adoption of 3D printing technologies in aircraft manufacturing, driving further market growth in the aircraft segment.

The unmanned aerial vehicles (UAVs) segment is expected to grow at a significant CAGR during the forecasted period. Drones are increasingly employed for a wide range of tasks, including aerial surveying, infrastructure inspection, crop monitoring, disaster response, and package delivery. As the capabilities and versatility of UAVs continue to evolve, so do the requirements for specialized components and systems. Additive manufacturing enables the rapid production of custom parts and assemblies tailored to specific UAV applications, supporting the continued growth and diversification of the UAV market.

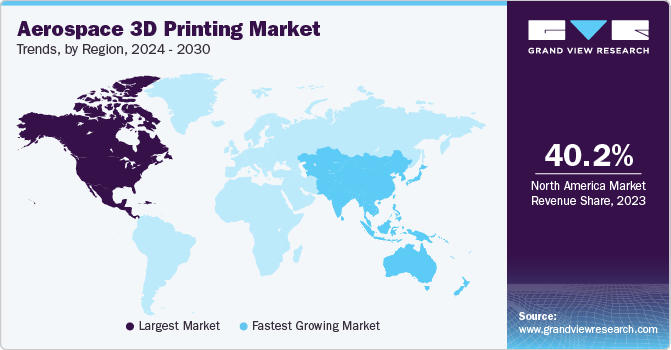

Regional Insights

North America dominated the aerospace 3D printing market with the revenue share of 40.20% in 2023. The growing trend towards digitalization and industry 4.0 initiatives accelerates the adoption of additive manufacturing in the aerospace sector. Additive manufacturing enables digital design and manufacturing workflows, facilitating rapid iteration, prototyping, and customization of aerospace components. This digital approach enhances collaboration between designers, engineers, and manufacturers, accelerating product development cycles and enabling faster time-to-market for new aircraft and spacecraft. As North American aerospace companies embrace digital transformation, additive manufacturing becomes an integral part of their strategy for achieving greater efficiency and competitiveness in the global market.

U.S. Aerospace 3D Printing Market Trends

The aerospace 3D printing market in U.S. accounted for the revenue share of 28.2% in 2023. Increasing focus on digitalization and industry 4.0 initiatives within the aerospace sector is driving the market growth. Additive manufacturing enables digital design and manufacturing workflows, facilitating rapid iteration, prototyping, and customization of aerospace components. This digital approach enhances collaboration between designers, engineers, and manufacturers, accelerating product development cycles and enabling faster time-to-market for new aircraft and spacecraft. As aerospace companies in the U.S. adopt digital transformation, additive manufacturing emerges as a critical component of their strategy for achieving greater efficiency and competitiveness in the global market.

Asia Pacific Aerospace 3D Printing Market Trends

The aerospace 3D printing market in Asia Pacific is expected to grow at a significant CAGR during the forecast period. The region has robust population growth and significant technological shifts driving software service demand in Australia, China, Japan, and India. The region has an established digital infrastructure that allows firms to modernize legacy systems and increase profits quickly. Increased government investments in technology-related services encourage the adoption of aerospace 3D printing. The highly established Metal and healthcare industries, along with the presence of several large IT firms, contribute to the demand for aerospace 3D printing.

The China aerospace 3D printing market accounted for the revenue share in 2023. China's rapidly expanding aerospace infrastructure, including the development of commercial aviation, satellite technology, and space exploration programs, has created a significant demand for advanced manufacturing solutions like 3D printing. Aerospace companies in China are increasingly leveraging 3D printing technology to produce components for aircraft, satellites, and space exploration missions, driving further market growth.

The aerospace 3D printing market in India is expected to grow at a fastest CAGR during the forecast period. The Indian government's initiatives to promote domestic manufacturing and technology development are playing a significant role in driving the adoption of 3D printing in the aerospace industry. Programs such as "Make in India" and "Atmanirbhar Bharat" aim to boost domestic production and reduce import dependency. 3D printing aligns with these objectives by offering a cost-effective and efficient method for producing aerospace components locally, thereby supporting the country's strategic goals.

Middle East & Africa Aerospace 3D Printing Market Trends

The aerospace 3D printing market in Middle East & Africa is expected to grow at a significant CAGR over the forecast period. Countries such as the United Arab Emirates (UAE), Qatar, and KSA have been investing heavily in aerospace infrastructure, including developing airports, airlines, and defense capabilities. As these countries aim to diversify their economies and reduce dependence on oil revenues, they see aerospace as a strategic sector for growth and innovation. Adopting 3D printing technology in aerospace aligns with their objectives of fostering technological advancement and building a competitive aerospace manufacturing ecosystem in the region.

The UAE aerospace 3D printing market is expected to grow at a fastest CAGR over the forecast period. According to the International Trade Administration, in 2023, the UAE government invested in airport expansion projects. It included allocating USD 8.1 billion for the development of Al Maktoum International Airport in Dubai, USD 7.6 billion for Phase 4 expansion of Dubai International Airport, USD 6.8 billion for the development and expansion of Abu Dhabi Airport, and approximately USD 400 Million for the terminal expansion of Sharjah's International Airport. UAE airports persistently utilize innovative technologies to improve the passenger experience and reinforce their status as pivotal gateways.

Key Aerospace 3D Printing Company Insights

Some of the key players operating in the market includeMelrose Industries, Lockheed Martin, and Thales.

-

Melrose Industries is a British-based industrial conglomerate. The company operates across various sectors, including automotive, aerospace, energy, and manufacturing. Through its subsidiary GKN Aerospace, Melrose Industries offers additive manufacturing technology in the aerospace industry. By combining GKN Aerospace's aerospace capabilities with Melrose's operational expertise, the company aims to drive innovation and deliver value to its customers in the rapidly evolving aerospace market

-

Thales Group is a multinational company specializing in aerospace, defense, security, and transportation. Thales' expertise in aerospace systems and technology positions the company well to explore the potential of 3D printing in aerospace manufacturing. Thales enhances its capabilities in producing advanced aerospace components with improved efficiency and flexibility by integrating additive manufacturing techniques into its existing product development and manufacturing processes

-

Lockheed Martin Corporation specializes in aerospace, defense, and technology. Lockheed Martin's Aeronautics division is responsible for designing, manufacturing, and servicing advanced military aircraft, including fighter jets and military transport planes. The company used 3D printing to produce the F-35 Lightning II, a fifth-generation multi-role fighter aircraft. Lockheed Martin utilized 3D printing technology to manufacture various components of the F-35, including certain structural parts and engine components. In addition, the company has partnered with NASA and other organizations to analyze the feasibility of using additive manufacturing to produce spacecraft components, habitats for space exploration, and even rocket engines

Key Aerospace 3D Printing Companies:

The following are the leading companies in the aerospace 3D printing market. These companies collectively hold the largest market share and dictate industry trends.

- Spirit AeroSystems

- Thales

- Lockheed Martin

- Melrose Industries

- Booz Allen Hamilton

- Stratasys

- EOS GmbH

- Danaher

- Formlabs

- ExOne

Recent Developments

-

In March 2024, 3DEO, a startup specializing in metal 3D printing, announced an investment from IHI Aerospace Co., Ltd., a Japanese manufacturing firm IHI subsidiary. This partnership represents a significant advancement in integrating state-of-the-art additive manufacturing (AM) capabilities, particularly 3DEO's innovative Intelligent Layering process, into Japan's precision-oriented aerospace sector. The collaboration between 3DEO and IHI Aerospace emphasizes a deliberate initiative to integrate Japan's engineering capabilities with cutting-edge AM technologies, paving the way for enhanced productivity and manufacturing opportunities in North America and Japan

-

In November 2023, Markforged, a 3D printing original equipment manufacturer, launched the FX10 and Vega. Equipped with two printhead-mounted optical sensors, including a novel vision module for quality assurance, the FX10 is optimized for the FX20 system. Similarly, Vega, although compatible with the FX20, embodies the concept of versatility. It is specifically crafted to empower aerospace clients to replace aluminum parts with composite-based counterparts

-

In July 2022, The Peekay Group partnered with Bengaluru Airport City Limited (BACL) to launch a 3D printing facility, prioritizing engineering, design, and collaborative efforts. This initiative is poised to accelerate the transformation of the Airport City into a vibrant technology center. With applications ranging from healthcare to eco-friendly construction and aerospace, 3D printing fosters a culture of ingenuity and expands the potential for innovation across various sectors. As part of their strategy, the Peekay Group intends to establish a specialized metal 3D printing unit to meet the specific needs of the aerospace industry

-

In May 2022, EOS, a manufacturer of 3D printers, collaborated with Hyperganic, a company specializing in engineering design software, to enhance the design and functionality of 3D-printed aerospace parts. Within this partnership, Hyperganic Core, an AI-powered algorithmic engineering software developed by Hyperganic, was integrated with EOS' laser powder bed fusion 3D printers. This integration allows EOS customers to create designs for their aerospace propulsion components using algorithmic models, eliminating the need for conventional part design methods

Aerospace 3D Printing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.70 billion

Revenue forecast in 2030

USD 11.38 billion

Growth rate

CAGR of 20.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, material, end-product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; UAE; KSA; South Africa

Key companies profiled

Spirit AeroSystems; Thales; Lockheed Martin; Melrose Industries; Booz Allen Hamilton; Stratasys; EOS GmbH; Danaher; Formlabs; ExOne

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace 3D Printing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global aerospace 3D printing market report based on component, technology, application, material, end-product and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

Design Software

-

Inspection Software

-

Printer Software

-

Scanning Software

-

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Selective Laser Melting (SLM)

-

Electron Beam Melting (EBM)

-

Direct Metal Laser Sintering (DMLS)

-

Stereolithography (SLA)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Prototyping

-

Tooling

-

Functional Parts

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Metal

-

Polymer (Plastic)

-

Composite

-

-

End-Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Aircraft

-

Unmanned Aerial Vehicles (UAVs)

-

Spacecraft

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aerospace 3D printing market size was estimated at USD 3.13 billion in 2023 and is expected to reach USD 3.70 billion in 2024

b. The global aerospace 3D printing market is expected to grow at a compound annual growth rate of 20.6% from 2024 to 2030, reaching USD 11.38 billion by 2030

b. North America dominated the aerospace 3D printing market, with a revenue share of 40.20% in 2023. Regional growth is attributed to the growing trend towards digitalization and industry 4.0 initiatives, which accelerate the adoption of additive manufacturing in the aerospace sector.

b. Some key players operating in the aerospace 3D printing market include the growing trend towards digitalization and industry 4.0 initiatives accelerate the adoption of additive manufacturing in the aerospace sector

b. Factors such as the growing demand for customization and rapid prototyping are driving the growth of the aerospace 3D printing market

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."