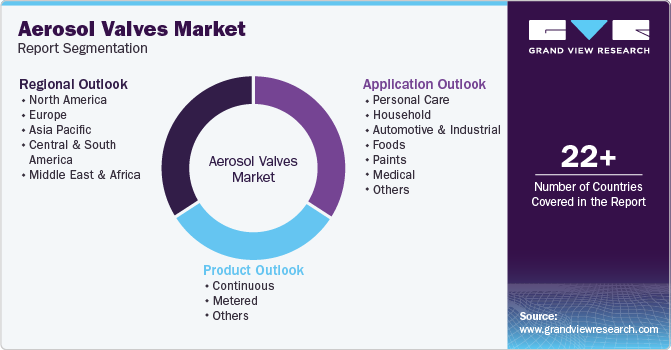

Aerosol Valves Market Size, Share & Trends Analysis Report By Product (Continuous, Metered), By Application (Personal Care, Household, Automotive & Industrial, Foods, Paints, Medical), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-748-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Aerosol Valves Market Size & Trends

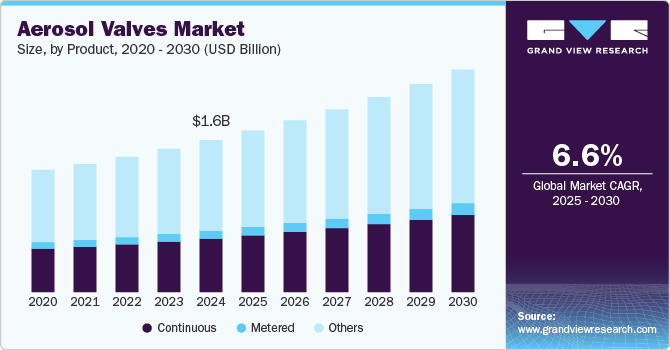

The global aerosol valves market size was estimated at USD 1.64 billion in 2024 and is expected to grow at a CAGR of 6.6% from 2025 to 2030. The rising demand for personal care items such as deodorants, hairsprays, and shaving creams is driving the growth of the market. Additionally, an increasing utilization of pain relief sprays, asthma inhalers, and other spray-based solutions designed for alleviating discomfort, and treating sunburn, insect bites, and itchiness, is projected to accelerate the demand for this product throughout the forecast period.

The increasing demand for convenience in product packaging is positively influencing the growth of the aerosol valves market. Consumers prefer easy-to-use, portable products that offer controlled dispensing, which aerosol valves enable. This trend is particularly prevalent in personal care items such as deodorants, hair sprays, and cosmetics. As consumers seek on-the-go solutions, the market benefits from the rising adoption of such products.

Environmental and sustainability concerns also play a crucial role in driving the market. Manufacturers are focusing on developing eco-friendly aerosol valve systems, including the use of recyclable materials and low-emission propellants. This shift is largely in response to stringent regulations in regions such as Europe and North America, where environmental policies aim to reduce greenhouse gas emissions and non-recyclable waste. For instance, an eco-friendly aerosol valve, known as the Salvalco Eco-Valve, developed by the University of Salford, is utilized in major retail chains across the UK, including Tesco and Boots. This innovative valve allows aerosols to be propelled by harmless gases such as nitrogen or compressed air, while maintaining spray performance comparable to traditional LPG (butane) products.

Additionally, the healthcare sector is a key contributor to the growth of the aerosol valves market. The rising need for metered-dose inhalers (MDIs) for asthma, chronic obstructive pulmonary disease (COPD), and other respiratory conditions is pushing demand for high-precision aerosol valves. MDIs require valves that offer accurate, controlled dosage, which are essential in delivering consistent medication. As respiratory issues continue to rise globally, especially in urbanized areas with high levels of air pollution, the healthcare industry's reliance on aerosol valves is expected to expand.

Furthermore, the automotive and industrial sectors are also fueling demand for aerosol valves. Aerosol products such as lubricants, cleaners, and protective sprays are widely used in maintenance and repair applications, requiring reliable valve systems for efficient, even application. The durability and precision required in these sectors drive innovation in valve design and functionality, supporting market growth. As industrial activities and automobile production increase, particularly in developing regions, the demand for aerosol-based solutions and valves is expected to escalate during the forecast period.

Product Insights

Based on product, the global aerosol valves market has been segmented into continuous, metered, and others. The other products segment dominated the overall market with a revenue share of over 59.0% in 2024 and is expected to witness robust growth with a CAGR of 6.8% over the forecast period. The others category includes custom and hybrid valves that are tailored to specific needs outside the conventional continuous and metered valve types. This product category includes valves for industrial aerosols or specialized products such as foam sprays, insecticides, or novelty items. Hybrid valves often combine features of both continuous and metered valves or may be specifically engineered for functions.

Continuous aerosol valves are designed to release a constant flow of product when the actuator is pressed and held. These valves are commonly used in products where consistent application is desired, such as deodorants, hair sprays, and air fresheners. The valve allows for sustained spraying until the user releases the actuator, making it highly suitable for personal care, household, and automotive applications. Hence, the growing demand for convenience in daily-use products is a key driver for continuous aerosol valves.

Metered aerosol valves are designed to deliver a specific, pre-measured dose of the product with each press of the actuator. These valves are often used in products where controlled dispensing is crucial, such as pharmaceutical inhalers, certain air fresheners, and room sprays. Metered valves help avoid product wastage by ensuring that only the necessary amount is released per use. Hence, the increasing need for precision in healthcare products, particularly in pharmaceutical aerosols, is a significant driver for metered valves.

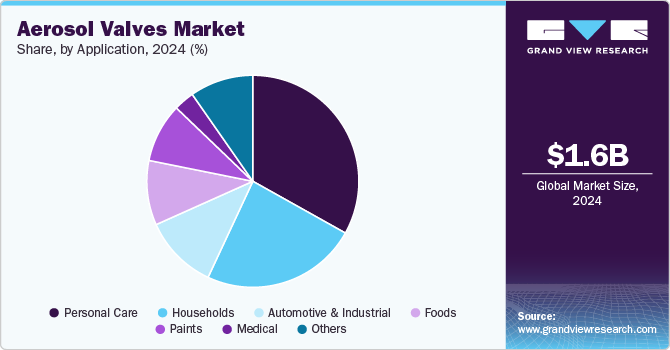

Application Insights

Based on application, the aerosol valves market is segmented into personal care, household, automotive & industrial, foods, paints, medical, and others. Personal care application segment dominated market and accounted for the largest revenue share of over 33.0% in 2024. The driving factors for the personal care segment include the rising demand for grooming products, increasing consumer focus on hygiene and personal aesthetics, and growing urbanization. The convenience of aerosol-based products, along with the trend toward premium, innovative, and travel-friendly packaging, is boosting the demand for aerosol valves in this segment.

In the household sector, aerosol valves are primarily used for products like air fresheners, cleaning agents, disinfectants, and insecticides. The ability of aerosol valves to offer precise and easy application makes them ideal for various household uses, where consumers require effective and efficient solutions.

The automotive & industrial application segment is expected to grow at a fastest CAGR of 8.0% during the forecast period. Aerosol valves are used in automotive and industrial applications for products like lubricants, cleaners, paints, and adhesives. The automotive and industrial segment is driven by increasing vehicle production, growing demand for maintenance products, and industrial expansion in developing regions. The need for convenient, precise, and easy-to-use packaging for specialty products also fuels the demand for aerosol valves in these sectors.

In the food industry, aerosol valves are used for products such as whipped creams, oils, and food sprays. The growing trend of convenience food, the increasing popularity of ready-to-use cooking aids, and the demand for longer shelf life are key driving factors. Additionally, innovations in food-grade aerosol packaging that meet regulatory standards are further fueling demand in the food segment.

Aerosol valves are used in spray paints for both consumer and industrial applications. Spray paints offer even coating and can be applied without the need for brushes or rollers. The ease of application, along with the ability to cover large surfaces efficiently, makes aerosol valves ideal for the paints segment. The driving factors include the growing demand for DIY (Do-It-Yourself) projects, increasing use of paints in automotive and construction industries, and the rising need for portable, ready-to-use paint solutions.

In the medical sector, aerosol valves are primarily used in products such as inhalers, disinfectants, and wound sprays. The valves enable precise dosage control and ensure the safety and hygiene of medical aerosols. Inhalers for respiratory conditions depend heavily on high-quality aerosol valves for effective drug delivery. The medical segment is driven by the increasing prevalence of respiratory diseases such as asthma and COPD, rising healthcare awareness, and the growing demand for portable medical devices.

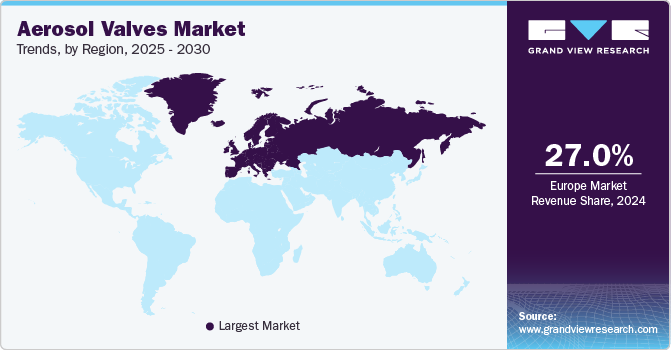

Regional Insights

In North America, the pharmaceutical and healthcare sector has also been a crucial driver for aerosol valve demand. The region's aging population and increased focus on respiratory health has boosted the demand for medical aerosols, particularly metered-dose inhalers (MDIs). Companies such as GSK and Teva Pharmaceuticals have been investing in developing new drug delivery systems that require precise dispensing valves. Additionally, the COVID-19 pandemic has accelerated the adoption of aerosol-based sanitizers and disinfectants, further stimulating market growth.

U.S. Aerosol Valves Market Trends

Aerosol valves market in the U.S. is growing due to its massive personal care and household products industry. Companies such as Procter & Gamble, Johnson & Johnson, and Unilever have extensive manufacturing facilities in the U.S. and drive significant demand for aerosol valves in products ranging from deodorants and hair sprays to air fresheners and cleaning products. The advanced retail infrastructure and high consumer spending power in the U.S. further strengthen this demand.

Europe Aerosol Valves Market Trends

Europe dominated the market and accounted for the largest revenue share of over 27.0% in 2024. Europe's dominance in the aerosol valves market is primarily driven by its robust personal care and cosmetics industry. Countries such as France, Germany, and Italy are home to major cosmetic companies such as L'Oreal, Beiersdorf, and Henkel, which extensively use aerosol packaging for products like deodorants, hair sprays, and dry shampoos. The region's high consumer spending power and strong preference for premium personal care products further amplifies this demand.

Germany aerosol valves market is primarily driven by its robust automotive and industrial sectors, where aerosol products are extensively used for maintenance, coating, and cleaning applications. Major German automotive manufacturers such as Volkswagen, BMW, and Daimler regularly use aerosol-based products in their production processes, from paint applications to lubricants, creating a steady demand for high-quality aerosol valves.

Asia Pacific Aerosol Valves Market Trends

The Asia Pacific region's dominance in the aerosol valves market is primarily driven by rapid urbanization and the expanding middle-class population, particularly in countries like China, India, and Indonesia. This demographic shift has led to increased disposable income and changing consumer preferences, resulting in higher demand for personal care products, household items, and automotive products that use aerosol packaging. For instance, the growing popularity of dry shampoos, deodorants, and air fresheners in countries like China and India has significantly boosted the demand for aerosol valves.

The China aerosol valves market is expected to grow during the forecast period. In China, the surge in domestic demand for personal care products, household cleaners, and automotive aerosols has been a crucial factor for the aerosol valve market growth. Chinese consumers' increasing disposable income and changing lifestyle preferences have led to higher consumption of aerosol-based products. For example, the growing popularity of dry shampoos, deodorants, and air fresheners has created a substantial market for aerosol valves.

Key Aerosol Valves Company Insights

The competitive environment of the aerosol valves market is characterized by the presence of several key players, both global and regional, vying for market share through innovation, strategic partnerships, and product differentiation. Major companies focus on expanding their product portfolios with sustainable and eco-friendly valve options to meet growing environmental concerns. They also emphasize research and development to enhance valve performance, such as ensuring precision in spray patterns and compatibility with various aerosol products. Additionally, intense competition drives cost optimization and efficiency improvements in manufacturing processes. Market players often engage in mergers, acquisitions, and collaborations to strengthen their market position and gain a competitive advantage over the other market players.

-

In July 2024, Salvalco announced the launch of its latest product, the Valve Eco Dose, designed to enhance sustainability in dispensing liquids. This innovative valve aims to reduce waste while providing precise dosing, making it an eco-friendly solution for various applications. The Valve Eco Dose reflects Salvalco's commitment to environmental responsibility and efficient resource use, catering to industries seeking sustainable alternatives.

-

In May 2024, Roz, a luxury haircare brand known for its nature-inspired products, launched a new root lift spray that incorporates Eco-Valve technology. This product represents Roz's first foray into aerosol formulations, utilizing an inert gas-propelled Eco-Valve, which is designed to be a more sustainable alternative to traditional liquefied petroleum gas (LPG) options.

Key Aerosol Valves Companies:

The following are the leading companies in the aerosol valves market. These companies collectively hold the largest market share and dictate industry trends.

- LINDAL Group

- Ehrensperger AG

- Coster Tecnologie Speciali S.p.A.

- Precision Valve Corporation

- Summit Packaging Systems

- MITANI VALVE CO., LTD

- AptarGroup, Inc.

- The Salford Valve Company Ltd. (Salvalco)

- The YingBo Aerosol Valve (ZhongShan) Co., Ltd.

- Newman Green Inc.

- Jinxing Aerosol Valve Manufacture Co., Ltd.

- Power Container Corp.

- Clayton Corp.

- Aroma Industries

- EC Pack Industrial Limited

- Majesty Packaging Systems Limited

- ECPlaza Network Inc.

Aerosol Valves Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.74 billion |

|

Revenue forecast in 2030 |

USD 24.01 billion |

|

Growth rate |

CAGR of 6.6% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in billion/million units, revenue in USD million, and CAGR from 2025 to 2030 |

|

Report coverage |

Volume forecast, Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

LINDAL Group; Ehrensperger AG; Coster Tecnologie Speciali S.p.A.; Precision Valve Corporation; Summit Packaging Systems; MITANI VALVE CO., LTD; AptarGroup, Inc.; The Salford Valve Company Ltd. (Salvalco); The YingBo Aerosol Valve (ZhongShan) Co., Ltd.; Newman Green Inc.; Jinxing Aerosol Valve Manufacture Co., Ltd.; Power Container Corp.; Clayton Corp.; Aroma Industries; EC Pack Industrial Limited; Majesty Packaging Systems Limited; ECPlaza Network Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Aerosol Valves Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the aerosol valves market report based on product, application, and region:

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Continuous

-

Metered

-

Others

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Personal Care

-

Household

-

Automotive & Industrial

-

Foods

-

Paints

-

Medical

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aerosol valves market size was estimated at USD 1.64 billion in 2024 and is expected to reach USD 1.74 billion in 2025.

b. The global aerosol valves market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030, reaching USD 24.01 billion by 2030.

b. Personal care dominated the aerosol valves market with a share of 33.0% in 2024, owing to rising demand for grooming products, increasing consumer focus on hygiene and personal aesthetics, and growing urbanization.

b. Some of the key players operating in the aerosol valves market include LINDAL Group, Coster Tecnologie Speciali S.p.A., Precision Valve Corporation, Summit Packaging Systems, and MITANI VALVE CO., LTD.

b. The key factors that are driving the aerosol valves market include its rising usage in the medical industry. In addition, the growing utilization of aerosol valves in asthma inhalers and pain relief sprays is further expected to fuel demand over the coming years.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."