- Home

- »

- Medical Devices

- »

-

Advanced Wound Care Market To Reach $17.8Bn By 2033GVR Report cover

![Advanced Wound Care Market Size, Share & Trends Report]()

Advanced Wound Care Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Moist, Antimicrobial), By Application (Chronic Wounds, Acute Wounds), By End Use (Hospitals,Specialty Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-186-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Advanced Wound Care Market Summary

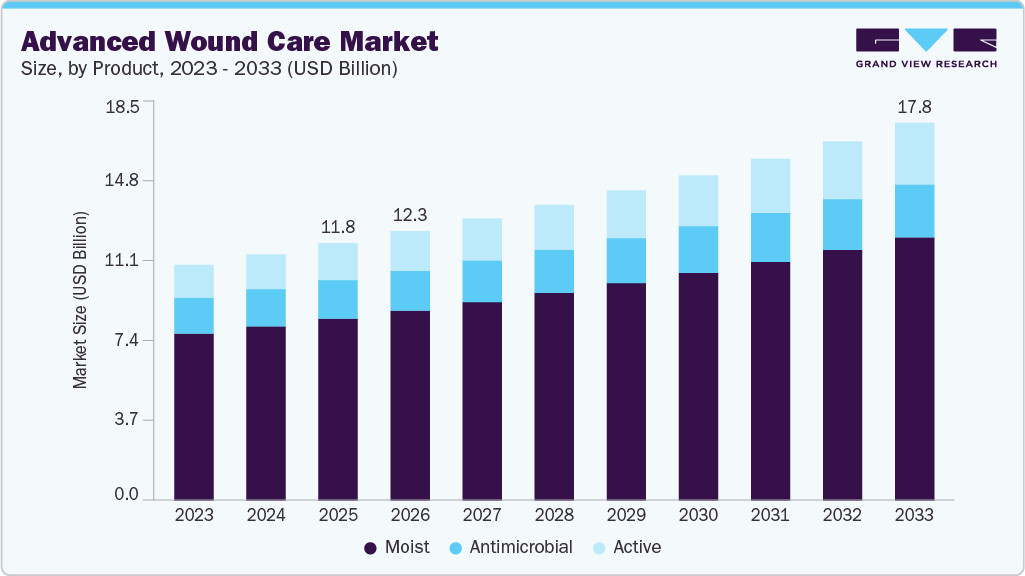

The global advanced wound care market size was estimated at USD 11.7 billion in 2025 and is projected to reach USD 17.8 billion by 2033, growing at a CAGR of 5.44% from 2026 to 2033. The increasing number of surgeries, the augmenting number of road accidents, trauma cases & burns, and the introduction of innovative & advanced wound products are some of the factors driving market growth.

Key Market Trends & Insights

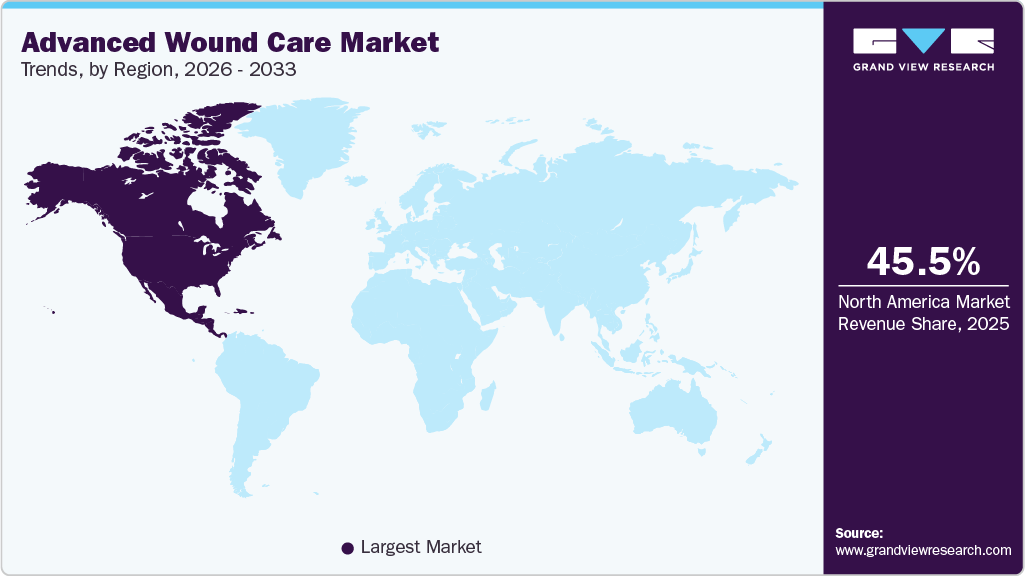

- The North America advanced wound care market dominated the global market and accounted for the largest revenue share of 45.49% in 2025.

- The U.S. led the North American market and held the largest revenue share in 2025.

- Based on product & service, the moist dressing segment dominated the global market, and instruments accounted for the largest revenue share of 70.6% in 2025.

- Based on application, the chronic wound segment held the largest revenue share of 59.7% in 2025.

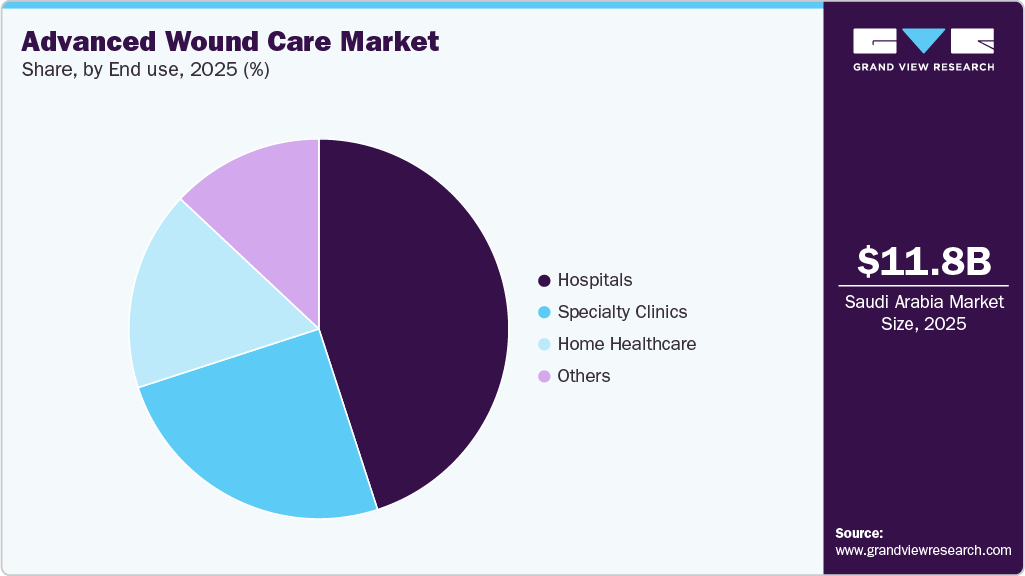

- On the basis of end use, the hospitalssegment held the largest revenue share of 45.4% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 11.7 Billion

- 2033 Projected Market Size: USD 17.8 Billion

- CAGR (2026-2033): 5.44%

- North America: Largest Market in 2025

Additionally, the increasing prevalence of chronic diseases that impair wound healing capabilities further enhances the demand for advanced wound products. Moreover, the growing geriatric population is expected to propel market growth, as the geriatric population has slow healing capabilities. For instance, in March 2024, the Albanese Government revealed funding of more than $3 million for new initiatives aimed at addressing the hidden epidemic of chronic wounds in Australia. It is estimated that around 450,000 Australians are currently living with chronic wounds.According to the United Nations Population Fund’s India Ageing Report 2023, the population over 60 is likely to increase from 14.9 crores in 2022 to 34.7 crores by 2050, which is expected to propel market growth. People with diabetic foot ulcers (DFU) are at a high risk of lower-extremity amputation. As per a ScienceDirect article, diabetic foot ulcers may affect more than 25.0% of the diabetic population and may result in amputation in 20.0% of patients. However, advanced wound care products help cure diabetic foot ulcers, which are prevalent in diabetic patients. Thus, an increasing number of diabetic patients is expected to elevate the use of advanced wound care products. These products especially help in moisture retention and facilitate rapid internal and external wound healing. Furthermore, these products help in the absorption of necrotic tissues, which are effective in surgical site infections. Hence, healthcare professionals prefer to use advanced wound care products, which is anticipated to propel global wound care industry growth over the forecast period.

However, the market experienced lucrative growth post-pandemic. Many companies underwent new product launches and mergers and acquisitions, further increasing their product portfolio. For instance, in September 2024, HCAH, a provider of out-of-hospital healthcare solutions in India, partnered with Aroa Biosurgery to launch a new initiative aimed at improving patient outcomes. This collaboration will leverage Aroa Biosurgery's innovative wound care technologies and HCAH's extensive network to enhance patient care and accelerate healing processes.

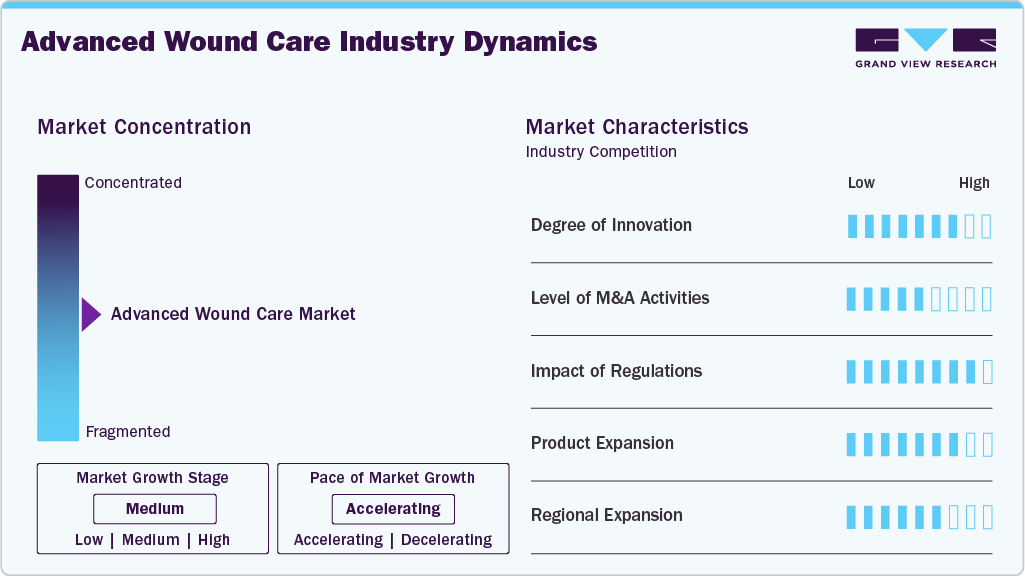

Market Concentration & Characteristics

The market growth stage is high, with an accelerating pace. The market is characterized by a high degree of innovation due to rapid technological advancements in advanced wound care products focused on enhanced safety, efficiency, and usability. Furthermore, with the rising prevalence of chronic diseases, the market players are investing in new product launches to keep up with the growing demand.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players, enabling companies to increase their capabilities, expand product portfolios, and improve competencies.

The advanced wound care industry is likewise under more regulatory inspection. This is because concerns exist regarding the effectiveness, safety, and quality of medical devices for patients. Stringent regulations raise the cost of existing items, creating entry barriers. For instance, prior to approving a new product, FDA guidelines demand rigorous clinical trials that are a costly affair and take several years to complete, as a result making it difficult for smaller businesses to enter the market. These new regulations may significantly impact the advanced wound care industry.

Advanced wound care solutions have several alternatives, such as home remedies, traditional wound dressings, and other medical treatments. While home remedies and traditional wound dressings may provide temporary relief, they may not be sufficient for proper wound healing in some cases. Moreover, market players are continuously investing appropriate resources in clinical trials and working around regulatory submissions to obtain required regulatory approval for pipeline products.

The industry is experiencing moderate regional growth, attributed to the rising demand for chronic and acute wound care products. In addition, developing countries are making notable investments in enhancing healthcare infrastructure, which is expected to increase demand for wound care products.

Product Insights

Based on product, the moist wound care segment held the largest revenue share of 70.6% in 2025. This dominance can be attributed to an increase in the number of wound cases and an increase in the number of surgeries globally. For instance, as per a report by Mass General Brigham Incorporated, in November 2024, each year, over 900,000 cardiac surgeries, such as coronary bypass surgeries, are conducted in the U.S., with even higher numbers worldwide. These surgeries involve the heart and its major blood vessels, including the pulmonary arteries and aorta.

The active wound care segment is expected to register growth at the fastest CAGR during the forecast period. The rising incidence of chronic illnesses like diabetes and obesity, which can cause wounds to heal slowly, is one of the main factors driving the segment growth over the forecast period. In addition, the market for active wound care is expanding due to the rise in the geriatric population and an increase in surgical procedures carried out globally. These factors are expected to propel the segment growth over the forecast period.

Application Insights

In terms of application, the chronic wounds segment dominated the market with the largest revenue share of 59.7% in 2025. An increasing prevalence of venous pressure ulcers, diabetic foot ulcers, and other chronic wounds is anticipated to fuel the segment’s growth. For instance, according to the Agency for Healthcare Research & Quality, more than 2.5 million people in the U.S. develop pressure ulcers every year. Also, according to the NCBI, the incidence of pressure ulcers in a clinical setting may range from 4.0% to 38.0%. In addition, the report by the American Heart Association, Inc. in 2024 revealed a significant prevalence of diabetes in the U.S. adult population. Approximately 29.3 million adults have been diagnosed with diabetes, while an estimated 9.7 million adults remain undiagnosed, highlighting the critical public health challenge posed by this condition. The rise in the diabetic population is expected to increase the number of diabetic foot ulcer patients, thereby boosting chronic wound care market growth. Furthermore, the acute wounds segment is expected to witness the fastest CAGR of 4.91% during the forecast period. The increasing number of different traumatic wounds, such as road accidents, is the major factor driving the segment growth.

End Use Insights

Based on end use, the hospital segment dominated the market with the largest revenue share of 45.4% in 2025. The growth of this segment can be attributed to an upsurge in surgical procedures and an increase in the number of hospital admissions. For instance, according to the Australian Institute of Health and Welfare, the number of hospitalizations in Australia has increased. For instance, according to Business Insider, nearly 1 million plastic surgery procedures are carried out in South Korea. Moreover, according to estimates by a similar source, one in three women between 19 and 29 have had plastic surgery. Therefore, the increase in the number of surgeries may lead to an increase in the use of advanced wound care products, which may further propel the market growth.

The home healthcare segment is expected to witness the fastest CAGR over the forecast period. During the COVID-19 pandemic, there was an increase in the demand for home healthcare advanced wound care products. Moreover, an increase in the geriatric population is anticipated to propel advanced wound care products further. The elderly population is more susceptible to chronic wounds and with an increase in age, the wound healing ability of the body slows down. Moreover, according to the Wound Care Learning Network, elderly people are more likely to be diagnosed with pressure ulcers. Thus, a rise in the elderly population may help the market propel.

Regional Insights

North America advanced wound care market dominated globally with the largest revenue share of 45.49% in 2025. This dominance can be attributed to a well-developed healthcare infrastructure and an increase in the number of surgical procedures. For instance, according to the American Society of Plastic Surgeons, approximately 23.6 million people in the U.S. underwent minimally invasive cosmetic surgical procedures in 2022. Advanced wound care products, thus, are increasingly being used to prevent surgical site infections. In addition, the increasing incidence of accidents such as road accidents, burns, and trauma events across the region is anticipated to drive the market growth.

U.S. Advanced Wound Care Market Trends

The U.S. advanced wound care industry held the largest revenue share in the North America market in 2025. The increased utilization of surgical procedures and the high prevalence of chronic disorders are some of the major factors fueling the market. For instance, as per a report by the National Center for Chronic Disease Prevention and Health Promotion last reviewed in May 2023, six in ten people in the U.S. lived with at least one chronic disorder, such as cancer, diabetes, strokes, and heart disease. These factors are expected to drive the demand for advanced wound care. Thus propel the segment over the forecast period.

Europe Advanced Wound Care Market Trends

The Europe advanced wound care industry is driven by factors such as high disposable income, the presence of a well-established healthcare infrastructure, and the availability of skilled professionals. Moreover, the presence of favorable reimbursement coverage has increased the adoption of surgical procedures. In addition, the increasing geriatric population and rising cases of burns & trauma are also anticipated to drive the market growth.

The advanced wound care industry in the UK is expected to grow over the forecast period. The country has a reputation for quality solutions. Hence, medical devices manufactured in-house are anticipated to witness significant demand in the forecast period. Major companies operating in the market are Smith & Nephew PLC and ConvaTec Group PLC. These companies are adopting several strategies to increase their market share, including launching innovative products in the market and expanding research & development and manufacturing facilities.

The Germany advanced wound care industryis anticipated to grow significantly over the forecast period. Germany has a lucrative environment for technologically innovative startups. Around 80% of the medical device manufacturers, including companies operating in wound care products, are SMEs in the country. Moreover, many companies are entering into strategic alliances, such as partnerships, mergers, agreements, and product launches.

France advanced wound care industry is anticipated to witness growth at a significant CAGR over the forecast period, owing to an increase in the prevalence of diabetes and thepresence of several key players in the market. The French government is undertaking initiatives to improve the healthcare structure in France. Hence, major international players are collaborating with local players to launch, market, and distribute their products in the market. Therefore, owing to these collaborations, local players are gaining significant market share in the region.

Asia Pacific Advanced Wound Care Market Trends

Asia Pacific advanced wound care industry is anticipated to witness the fastest CAGR of 6.07% during the forecast period. This can be attributed to the presence of major key players, the increasing prevalence of chronic disorders, and rising healthcare expenditure. According to a report published by Insurance Asia, APAC’s healthcare spending is expected to surge 9.9% in 2024. These factors are expected to drive the segment’s growth over the forecast period. Moreover, the India market is expected to grow at a lucrative CAGR over the forecast period.

Japan advanced wound care industry is moderately competitive, with some major companies offering wound care products. Key players in the market are adopting several strategies, such as mergers & acquisitions and partnerships and collaborations, to stay competitive. Furthermore, companies are investing in R&D, which is expected to increase awareness and demand for advanced wound care products.

China advanced wound care industry accounted for the largest revenue share of the Asia Pacific market in 2025. The increasing prevalence of chronic disorders and the rising geriatric population propel market growth. According to the data published by THE STATE COUNCIL of THE PEOPLE’S REPUBLIC OF CHINA in October 2024, China's aging population is a significant demographic shift, with nearly 297 million individuals aged 60 and above in 2023, constituting 21.1% of the total population. These factors fuel market growth.

The advanced wound care industry in India is anticipated to grow rapidly over the forecast period due to the rising prevalence of diabetes. In addition, an increasing number of surgeries and the growing prevalence of chronic diseases are boosting the number of hospital admissions, leading to increased demand for advanced wound care products and driving market growth.

Middle East and Africa Advanced Wound Care Market Trends

The Middle East & Africa advanced wound care industry growth is driven by the growing geriatric population, increasing number of surgeries, and rising incidence of sports-related injuries. In addition to the increasing government initiatives to develop healthcare infrastructure, the region is expected to witness a rise in the number of surgeries, leading to an increase in demand for advanced wound care products for postoperative care.

The advanced wound care industry in Saudi Arabiais expected to grow over the forecast period due to an increase in the number of surgeries and rising healthcare expenditure.

The South Africa advanced wound care industry is anticipated to witness growth over the forecast period. The rising prevalence of chronic diseases and increasing healthcare expenditure are expected to boost the demand for advanced wound care products in South Africa.

Key Advanced Wound Care Company Insights

Key market players operating in the advanced wound care industry are undertaking multiple initiatives to strengthen their market presence and improve their product and product reach. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Advanced Wound Care Companies:

The following are the leading companies in the advanced wound care market. These companies collectively hold the largest Market share and dictate industry trends.

- ConvaTec Group PLC

- Smith & Nephew PLC

- Mölnlycke Health Care AB

- B. Braun Melsungen AG

- 3M

- URGO

- Coloplast

- Integra LifeSciences

- Medline Industries, Inc.

Recent Developments

-

In January 2024, Coloplast launched Biatain Silicone Fit in the U.S. market. This innovative silicone foam dressing is designed for both pressure injury prevention and wound management, offering healthcare professionals a valuable tool for improving patient outcomes.

-

In October 2023, DuPont launched a novel soft skin adhesive (SSA), DuPont Liveo MG 7-9960, that boasts higher adhesion and lower cyclic silicone. This advanced adhesive has been specifically designed to be used in wound care dressings and for attaching medical devices to the skin, allowing for extended wear time and gentle removal

-

In June 2023, JeNaCell (Evonik) introduced the wound dressing- epicite balance to the German market. The dressing is especially well-suited and adapted for the management of chronic wounds with low to medium levels of exudation, including soft tissue lesions, diabetic foot ulcers, venous leg ulcers, and arterial leg ulcers.

Advanced Wound Care Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 12.3 billion

Revenue forecast in 2033

USD 17.8 billion

Growth rate

CAGR of 5.44% from 2026 to 2033

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ConvaTec Group PLC; Smith & Nephew PLC; Mölnlycke Health Care AB; B. Braun Melsungen AG; 3M; URGO; Coloplast Corp.; Integra LifeSciences; Medline Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Advanced Wound Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global advanced wound care market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Moist

-

Foam Dressings

-

Hydrocolloid Dressings

-

Film Dressings

-

Alginate Dressings

-

Hydrogel Dressings

-

Collagen Dressings

-

Other Advanced Dressings

-

-

Antimicrobial

-

Silver

-

Non-silver

-

-

Active

-

Biomaterials

-

Skin-substitute

-

Growth Factors

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global advanced wound care market size was estimated at USD 11.7 billion in 2025 and is expected to reach USD 12.3 billion in 2026.

b. The global advanced wound care market is expected to grow at a compound annual growth rate of 5.44% from 2026 to 2033 to reach USD 17.8 billion by 2033.

b. The moist wound care segment held the largest market share in 2025 as they are majorly recommended for chronic injuries, such as pressure ulcers, diabetic ulcers, and other slow-healing injuries.

b. Key players operating in the advanced wound care market include Smith & Nephew, Molnlycke Health Care AB, ConvaTec Group PLC, Baxter International, URGO Medial, Coloplast Corp., Medtronic, 3M, Derma Sciences (Integra Lifesciences), and Medline Industries.

b. The increasing prevalence of chronic injuries, rising surgical procedures, and increase in the number of traumatic wounds are some major factors that drive the growth of the advanced wound care market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.