- Home

- »

- Sensors & Controls

- »

-

Advanced Process Control Market Size & Share Report 2030GVR Report cover

![Advanced Process Control Market Size, Share & Trends Report]()

Advanced Process Control Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Technology, By Solution, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-650-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Advanced Process Control Market Summary

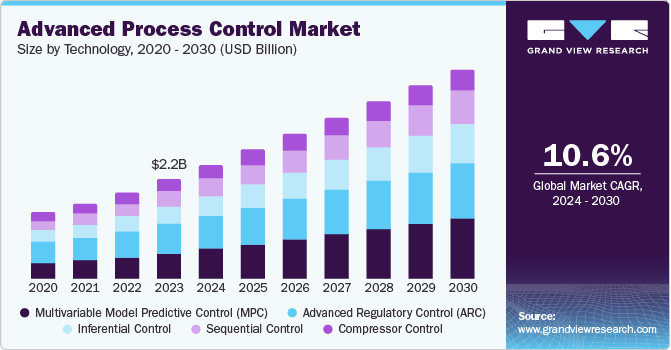

The global advanced process control market size was estimated at USD 2,173.6 million in 2023 and is projected to reach USD 4,545.2 million by 2030, growing at a CAGR of 10.6% from 2024 to 2030. Advanced process control (APC) includes model-based software to enhance and manage complex industrial processes such as chemical processing, power generation, manufacturing, etc.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, hardware accounted for a revenue of USD 2,173.6 million in 2023.

- Hardware is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 2,173.6 Million

- 2030 Projected Market Size: USD 4,545.2 Million

- CAGR (2024-2030): 10.6%

- North America: Largest market in 2023

Implementation of APC is aimed at improving operational effectiveness, quality, safety, productivity, and environmental impact. Unlike traditional processes, APC provides advanced control techniques and requires complex models and algorithms to handle process dynamics effectively.

As industries across multiple domains experience rising competition owing to globalized nature of businesses and liberal markets, companies are focusing in enhancing their processes through adoption of technology while eliminating the potential hurdles including costs, resources, and time taken for particular activity. It has resulted in growing demand for automation technologies worldwide. Numerous businesses are adopting APC solutions to improve productivity, develop efficient processes, reduce costs, and deliver products that meet changing consumer demands.

One of the prominent aspects that has been influencing the global industry is sustainability and energy efficient processes. Growing consumer awareness of buying sustainably developed products & services has encouraged several industries to cut down on high energy consuming procedures. It has led to growing inclination towards embracing energy efficient solutions driven by technologies such as advanced process control.

Component Insights

Based on components, the software segment dominated the market and accounted for a revenue share of 43.5% in 2023. The rising penetration of machine learning algorithms, artificial intelligence (AI), and sensors enhances advanced process control features. Moreover, the flexibility offered by industrial software integrating it with pre-existing control systems and customizable options to resolve any complex problem is driving market growth. Online optimization software commonly utilizes technology to solve multiple equations simultaneously, which is expected to contribute to the rising demand for this type of software.

The services component segment is expected to experience the fastest CAGR of 11.8% during the forecast period. Rising preferences for cloud-based services drive the demand for the advanced process control market growth. The enhanced quality and efficiency offered by the APC has resulted in rising adoption of APC services in industries that are continuously seeking agility and precision. The advancements in sensors and devices technology have significantly boosted the demand for APC services in recent years.

Technology Insights

The advanced regulatory control (ARC) segment accounted for the largest market share in 2023. ARC utilizes advanced control methods to accurately manage industrial operations, enabling instant modifications and adherence to regulations. It optimizes the processes and ensures compliance with regulatory standards in industries such as petrochemical, chemical, oil refining, food processing, mineral refining and mining, pharmaceutics, and others. Also, the market is driven by its application in every field and can be customized according to the industry's needs.

The multivariable model predictive control (MPC) segment is expected to experience the fastest CAGR during the forecast period. It controls complex processes while aligning with regulatory compliance and variable standards. Multivariable predictive process control offers a systematic way to handle process restrictions, such as constraints on valves, rates of temperature and pressure changes. MPC is preferred over other technologies as its increased automation allows operators to concentrate on tasks that are of greater significance, increase process knowledge, and expand the range of control methods to optimize factors essential for the process.

Solution Insights

Asset performance optimization segment dominated the global industry in 2023. APC solutions optimize asset performance by ensuring productive use and preventing resource wastage. They also reduce maintenance and replacement costs by implementing regular maintenance schedules and extending the lifespan of assets, driving the maximum adoption of APC. Rising investments by key companies in automated systems for asset tracking, reporting, and maintenance are driving the market growth.

The energy management and optimization segment is anticipated to experience the fastest CAGR over the forecast period. Energy management includes actively and methodically monitoring, controlling, and optimizing energy usage. Furthermore, energy optimization aims to reduce waste and enhance efficiency by managing energy consumption. The rising inclination to reach sustainability goals by implementing energy management and optimization solutions has been fueling the demand for APCs to be installed in industries.

Enterprise Size Insights

The large enterprise segment accounted for the largest revenue share in 2023. The large enterprises, equipped with sufficient resources and capabilities are looking to enhance their productivity, reduce costs, and improve sustainability through adoption of advanced process control. APC solutions developed for large enterprises offer a centralized platform that manages control and automation while simplifying operations and reducing human error factor in functions such as manufacturing. Furthermore, large enterprises often depend on scalability to handle continuously increasing and evolving consumer needs and demands, which can be attained efficiently by execution of advanced process control.

Small and medium-sized enterprises (SMEs) are projected to grow at the fastest CAGR over the forecast period. Cloud-based APC solutions, which provide scalability and key management services without requiring significant upfront investments in infrastructure, are particularly popular in SMEs that are looking to enhance productivity while minimizing operational costs. These solutions are specifically designed with consideration of particular requirements associated with key processes that are part of operations in SMEs.

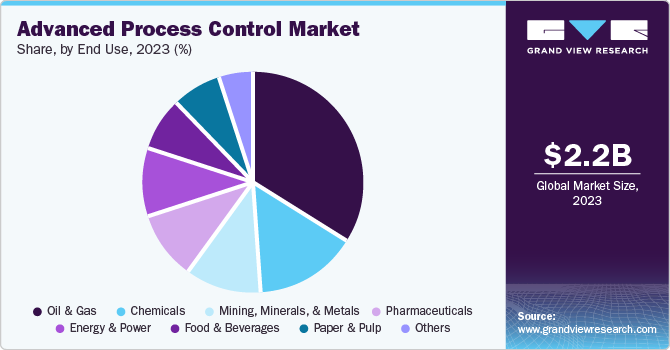

End Use Insights

The oil and gas segment dominated the global market in 2023. The increased adoption of automation and the inherent nature of operations in this industry drive the demand for APC. Companies in this industry are using solutions that provide long-term benefits, such as enhanced efficiency, to boost profits without heavy investment. Oil corporations continue searching for innovative methods to lower expenses and improve profits while boosting annual production rates by implementing APC solutions. According to the Organization of the Petroleum Exporting Countries (OPEC), the global oil demand has experienced an increase by 2.5 million barrels per day (mb/d), year over year, to average 102.2 million barrels per day (mb/d) in 2023, surpassing the pre-pandemic levels.

The pharmaceutical segment is anticipated to experience the fastest CAGR over the forecast period. The enhanced facility performance backed by the APCs is driving the growth in adoption of advanced process control technology in this industry. It helps to determine the real-time quality of products, improve the reliability of manufacturing process and meet the quality specifications. It assists in reducing the process variability and accuracy. The market is driven by the support provided by the APC in the continuous manufacturing of medicines, without human error.

Regional Insights

North America advanced process control market dominated the market with a revenue share of 36.8% in 2023. The rising implementation of sophisticated APC systems and complex technological infrastructure in this region is driving market growth. Moreover, strict regulatory compliance in sectors, such as environmental protection and healthcare fuels the demand for APC technologies to adhere to operational excellence and compliance. The presence of a large number of companies and new entrances exploring the benefits of APC technologies is contributing to the market growth in the region.

U.S. Advanced Process Control Market Trends

The U.S. advanced process control market dominated regional industry in 2023. With continuous focus of companies on innovations and technological developments in various sectors, demand for APCs in the U.S. has experienced significant growth in recent years. The stringent regulations associated with manufacturing practices and compliance requirements have developed growth in inclination towards adoption of advanced process control.

Europe Advanced Process Control Market Trends

Europe advanced process control market was identified as a lucrative region in 2023. The high adoption of APC systems across various industries, such as pharmaceuticals, oil & gas, automotive, and others, is driving the market growth in the region. The introduction of sustainability regulations and awareness regarding clean energy production & consumption have also influenced this regional market. A Set of proposals, named Fit for 55 package that is in the process of development to introduce and update legislation to reach a climate-neutral state by 2050 while reducing the emissions in the EU region by at least 55% is one such example that has encouraged companies to adopt advanced process control increasingly.

The UK advanced process control market is expected to grow rapidly in the approaching years. This market is primarily driven by rising investments of key industries in APC technologies to optimize their productivity and reduce costs. Advanced process control systems also contribute to enhancing quality and assisting businesses to sustain their competitive edge. Increasing availability of APC providers, growing need for cost reduction solution as economy challenges experienced by the country’s economy impact the industries and accessibility to advanced technology solutions is expected to develop growth for this market.

Asia Pacific Advanced Process Control Market Trends

Asia Pacific advanced process control market is anticipated to experience the fastest growth during the forecast period. This market is primarily driven by the progress and advancements experienced by the industries such as automotive production, manufacturing of consumer goods, electronics, military & defense, paints and coating, and pharmaceuticals in countries such as China and India. The businesses are actively seeking advanced technology solution to optimize their energy consumption and enhance processes such as production, procurement, assembly management to reach improved productivity. The availability of multiple APC providers in the region also contributes to the growth of this market.

The advanced process control market in China held a substantial revenue share in 2023. The market growth is attributed to the numerous benefits offered by APC technology in various industries such as pharmaceutical, chemicals, petrochemicals, oil & gas, and others. Owing to the extensive infrastructure developments and growing demand for efficient technology solution to improve productivity, the market is expected to experience significant growth during the forecast period. Innovation in process controls and ongoing advancements in research are expected to improve the execution of controlled manufacturing operations, leading to enhanced product quality. Increase in safety control, reduction in emission, and elimination of unnecessary costs through embracing APCs have driven growth for this market in China.

Key Advanced Process Control Company Insights

Some of the key companies in the advanced process control market are ABB, General Electric Company, Honeywell International Inc., Mitsubishi Electric Corporation, Panasonic Corporation, Rockwell Automation, and others. Major industry participants in advanced process control market are implementing strategies such as partnerships, mergers & acquisitions, enhancing service quality, and maintaining competitive prices to expand the revenue share.

-

ABB, a global company, specializes in the automation technology market and provides advanced process control solutions in different sectors. Their wide range of projects ensures successful implementation. ABB holds many process automation systems globally and distributes control systems for petrochemicals, oil & gas, refining, pulp and paper chemicals, and minerals.

-

Yokogawa Electric Corporation, a prominent organization in industrial automation market, offers variety of solutions such as supply chain optimization, asset operations and optimization, energy management, carbon management, digital plant operations intelligence and others. Its control products include improvement software, devices, quality control system, and safety system offered as OpreX brand.

Key Advanced Process Control Companies:

The following are the leading companies in the advanced process control market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Aspen Technology Inc (Emerson Electric Co.)

- AVEVA Group Limited (Schneider Electric group)

- General Electric Company

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Rockwell Automation

- Rudolph Technology (Onto Innovation)

- SAP SE

- Siemens

- Yokogawa Electric Corporation

Recent Developments

-

In February 2024, GE Vernova, a subsidiary of General Electric Company, announced the release of Proficy, a novel software solution aimed at assisting manufacturers to attain sustainability goals, while enhancing productivity and profitability. The AI-powered software integrates operational and sustainability data to assist industrial companies in optimizing resource usage and ensuring regulatory compliance with climate metrics.

-

In January, 2024, ABB announced its plan to acquire majority of stake in software service provider company, Meshmind, with the purpose to enhance its Industrial IoT, Artificial Inteligence (AI), machine vision research and development capabilities. ABB is expected to bring together engineering expertise, AI, and software knowledge from this acquisition to establish a new global R&D center to enhance the development of cutting-edge automation solutions in its Machine Automation sector (B&R).

Advanced Process Control Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.49 billion

Revenue forecast in 2030

USD 4.55 billion

Growth Rate

CAGR of 10.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, solution, enterprise size, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, South Arabia, UAE, and South Africa

Key companies profiled

ABB; Aspen Technology Inc. (Emerson Electric Co.); AVEVA Group Limited (Schneider Electric group); General Electric Company; Honeywell International Inc.; Mitsubishi Electric Corporation; Panasonic Corporation; Rockwell Automation; Rudolph Technology (Onto Innovation); SAP SE; Siemens; Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Advanced Process Control Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global advanced process control market report based on component, technology, solution, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Control Systems

-

Interface and Display

-

Computing Systems

-

Others

-

-

Software

-

Service

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Regulatory Control (ARC)

-

Multivariable Model Predictive control (MPC)

-

Sequential control

-

Inferential control

-

Compressor control

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy Management and Optimization

-

Asset Performance Optimization

-

Process Performance

-

Operation Management

-

Workforce Management

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil and Gas

-

Chemicals

-

Pharmaceuticals

-

Energy & Power

-

Paper & Pulp

-

Mining, Minerals, and Metals

-

Food & Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.