Advanced Phase Change Materials Market Size, Share & Trends Analysis Report By Product (Paraffin, Salt Hydrates), By Application (Building & Construction, HVAC, Commercial Refrigeration), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-021-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

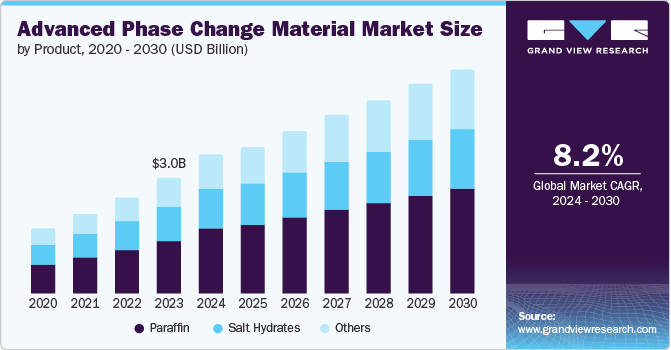

The global advanced phase change materials market size was valued at USD 3.01 billion in 2023 and is anticipated to reach a CAGR of 8.2% from 2024 to 2030. The advanced phase change material demand growth is highly projected based on their effectiveness in construction projects. Other features such as electricity preservation and sustainable enhancement also increase the demand. Besides, the growing awareness of minimizing greenhouse fuel emissions, and innovation in micro and macro-encapsulation technology drives the industry growth.

The significance of advanced phase change materials in the construction sector stems from the ability to store and release thermal energy as it undergoes phase transitions in a more efficient and controlled manner. As more effort is made towards saving energy, more of these materials are expected to be used in the construction purpose to enhance the construction of structures that are sustainable and environmentally friendly.

With the increase in devices, the necessity of cooling systems has grown, and advanced phase change materials (APCM) appear as the best solutions depending on their efficiency in cooling electronic items. Also, phase change materials are incorporated into textiles since they are used for temperature regulation and thermal insulation in textile manufacturing units.

Advanced phase change materials also address the battery performance enhancement and safety of operations. Furthermore, the phase change materials result in low energy consumption and relay high efficiency when applied in electric & hybrid vehicles. The growing interest in electric and hybrid vehicles has augmented the industry demand for applications based on advanced phase change materials for thermal management further stimulating the development of new solutions.

Product Insights

In 2023, the paraffin segment accounted for 46.3% of the global market share. Paraffin exhibits remarkable thermal storage capacity and freezes without supercooling.Paraffin stands out because it is chemically stable in multiple heating andfreezing cycles with a high heat of fusion, and is compatible with extensive structural materials in encapsulation materials. The energy-efficient factors in the construction and building sector enhance paraffin usage and are backed by governmental policies on energy saving. Also, a better understanding of material science and technology induces improvements in paraffin, leading to better properties in end use products.

The salt hydrates segment is expected to witness a CAGR of 6.8% from 2024 to 2030.Salt hydrate materials have become attractive and are often used as high-performance phase change materials for thermal energy storage because of the characteristics they possess. Salt hydrates have latent heat of fusion, moderate melting temperatures, excellent volumetric energy storage densities, and enhanced thermal conductivities over all the other options. Numerous industries are now focusing on thermal management and waste heat recovery applications, and the need for salt hydrates is gradually increasing.

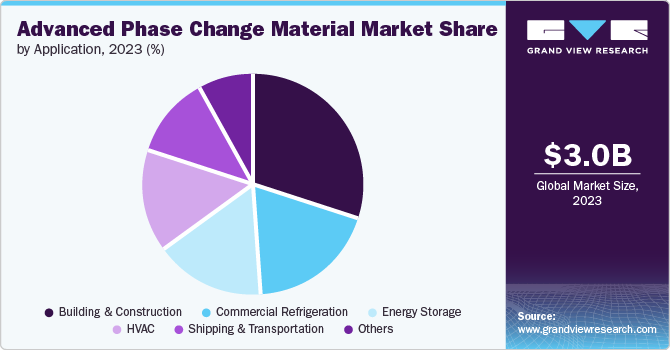

Application Insights

In 2023, the building and construction industry commanded a market share of 29.9%.The building & construction sector is expected to maintain its growth pattern and account for a significant share during the forecast period. The need for power and energy saving proves crucial for buildings to support and conserve energy in the long-term sustainability.

HVAC (Heating, Ventilation, Air-Conditioning) secured a 15.1% revenue share worldwide in 2023. New features that were incorporated into HVAC systems include the incorporation of highly developed phase change material for the storage of thermal energy during high time and the release of the thermal energy. When used in air ducts, this technology helps in controlling air temperature thereby increasing the efficiency of HVAC systems.

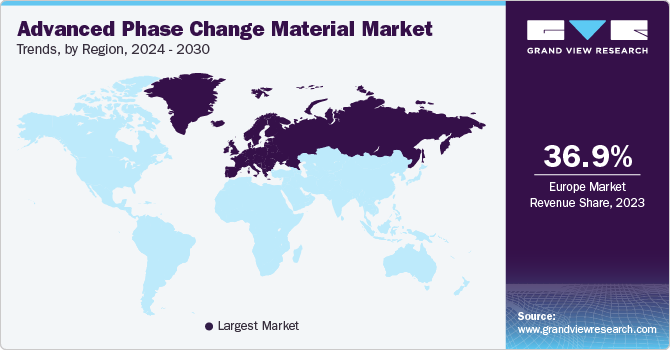

Regional Insights

The North America advanced phase change materials market registered significant growth capturing a significant market share of 27.3% in 2023. The factors that shape the market growth include awareness of sustainable standards and energy saving in the building and construction and electronics industry.

U.S. Advanced Phase Change Material Market Trends

The U.S. advanced phase change material market held a leading position in North America with a share of 66.7% for advanced phase change materials in 2023. This dominance is mainly due to the shift in dynamics in the construction industry, especially in thermal energy storage. These materials are very effective in promoting efficiency, and sustainable building designs.

Europe Advanced Phase Change Material Market Trends

The advanced phase change material market in Europe led globally and accounted for a share of 36.9% in 2023. Europe’s position is also expected to improve in the coming years. The factors are mainly associated with the developments and the increasing demand applicable to building & construction, textiles & apparel, automotive, pharmaceuticals, and others.

The UK advanced phase change materials market accounted for a prominent share in 2023. With a larger population, the United Kingdom holds a key position in the advanced phase change materials industry. Every summer the population faces overheating problems in old buildings and residences. Therefore, the integration of the next-generation phase change material with legacy systems could provide a cooling solution to these problems. Hence, the regional market offers potential prospects for industry growth.

Key Advanced Phase Change Materials Market Company Insights

Key companies in the advanced phase change material market are BASF SE, DuPont, Dow, and others. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

BASF SE is a multinational chemical company that carries out production and sale of plastics, chemicals, and crop protection products. Its product lines involve adhesives, solvents, fuel additives, pigments, and food additives.

-

Advansa Marketing is a German company which offers pioneering of fiber solutions for technical, home, and apparel textiles. The company leverages its fiber expertise to improve its products and processes.

Key Advanced Phase Change Materials Companies:

The following are the leading companies in the advanced phase change materials market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Advansa Marketing

- Honeywell International Inc.

- Outlast Technologies

- DuPont

- PCM Energy Ltd

- Rubitherm Technologies GmbH

- Dow Building Solutions

- Cryopak

- Climator Sweden AB

Recent Developments

-

In June 2023, BASF became the first company to establish a co-located battery materials and recycling center in Schwarzheide, Germany. This includes a robust production facility for cathode active materials and is also a battery recycling plant for black mass.

-

In May 2023, Henkel announced the commercial availability of Bergquist Hi Flow THF 5000UT. This phase change film highlights a significant advancement in the field of thermal management materials, as it creates the ultra-thin bond line at the interface with minimal mechanical pressure.

Advanced Phase Change Materials Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.64 billion |

|

Revenue forecast in 2030 |

USD 5.86 billion |

|

Growth Rate |

CAGR of 8.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segment coverage |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S; Germany; UK; China; India; South Korea; Australia; Brazil |

|

Companies profiled |

BASF SE; Advansa Marketing GmbH; Honeywell International Inc.; Outlast Technologies; DuPont; PCM Energy Ltd; Rubitherm Technologies; Dow Building Solutions; Cryopak; Climator Sweden AB |

|

Customization scope |

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

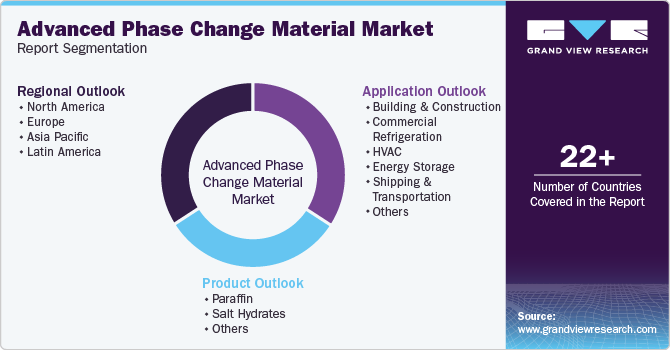

Global Advanced Phase Change Material Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the advanced phase change material market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Paraffin

-

Salt Hydrates

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Commercial Refrigeration

-

HVAC

-

Energy Storage

-

Shipping & Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."