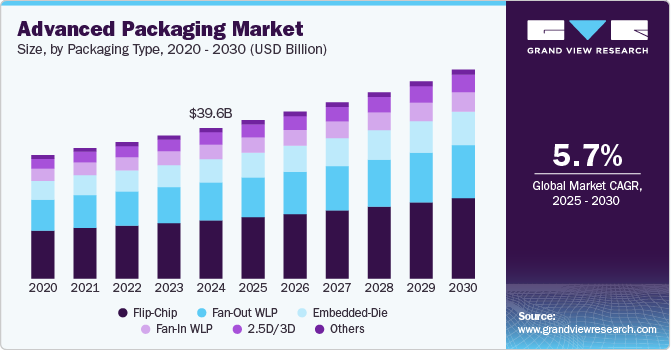

Advanced Packaging Market Size, Share & Trends Analysis Report By Packaging Type (Flip-Chip, Fan-Out WLP, Embedded-Die, Fan-In WLP, 2.5D/3D), By Application (Consumer Electronics, Automotive, Industrial, Healthcare), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-551-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Advanced Packaging Market Size & Trends

The global advanced packaging market size was estimated at USD 39.60 billion in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2030. The market's growth is driven by rising demand for miniaturized and high-performance electronic devices. Additionally, the increasing adoption of AI, IoT, and 5G technologies is accelerating innovation in semiconductor packaging solutions.

The advanced packaging market is driven by several key factors that are reshaping the semiconductor and electronics industries. One of the most prominent drivers is the increasing demand for compact, high-performance electronic devices. Traditional packaging technologies are no longer sufficient as consumers and industries push for faster, smaller, and more efficient devices, ranging from smartphones and tablets to wearables and IoT sensors. Advanced packaging techniques, such as 2.5D/3D IC packaging, system-in-package (SiP), and fan-out wafer-level packaging (FOWLP), enable higher component density, better electrical performance, and lower power consumption, all while minimizing space.

The growth of artificial intelligence (AI), 5G, and high-performance computing (HPC) applications is also contributing to the growth of the market. These technologies demand powerful chips with rapid data processing capabilities and efficient thermal management. Advanced packaging facilitates integration of multiple chips into a single package, significantly reducing signal delay and power usage. For example, chiplet architectures in data centers rely on advanced packaging to interconnect dies efficiently, supporting scalability and performance improvements crucial for AI and HPC workloads.

The automotive and industrial automation sectors are also contributing to market growth. The evolution of electric vehicles (EVs), autonomous driving technologies, and connected car systems increases the need for reliable, high-density semiconductor components. Advanced packaging offers improved durability and heat dissipation, which are essential for electronics in harsh automotive environments. Similarly, factory automation and Industry 4.0 initiatives require robust chips that can endure continuous operation and provide real-time responsiveness.

Moreover, cost optimization and supply chain integration play a critical role. While advanced packaging can initially be more expensive than traditional methods, it ultimately reduces the need for multiple discrete components and enhances manufacturing efficiency by enabling heterogeneous integration. As more foundries, OSATs (outsourced semiconductor assembly and test providers), and IDMs (integrated device manufacturers) invest in advanced packaging technologies, economies of scale are expected to lower costs, further accelerating adoption across sectors.

Packaging Type Insights

The flip chip segment recorded the largest market revenue share of over 38.0% in 2024. Flip-chip packaging involves mounting the semiconductor die face-down onto the substrate using small solder bumps. This eliminates the need for wire bonding and provides a shorter path for electrical signals, which enhances performance and reduces parasitic losses. Flip-chip is driven by increasing demand for high-performance computing (HPC) applications, gaming consoles, and mobile processors that require fast signal transmission, enhanced thermal performance, and compact form factors.

The embedded-die segment is projected to grow at the fastest CAGR of 6.3% during the forecast period. In embedded-die packaging, the semiconductor die is embedded inside the substrate, allowing ultra-thin package profiles with enhanced electrical and thermal performance. This technology offers design flexibility and reduces interconnection length. The main driver is the demand for miniaturized and high-density electronic modules in applications such as medical devices, hearing aids, and IoT sensors.

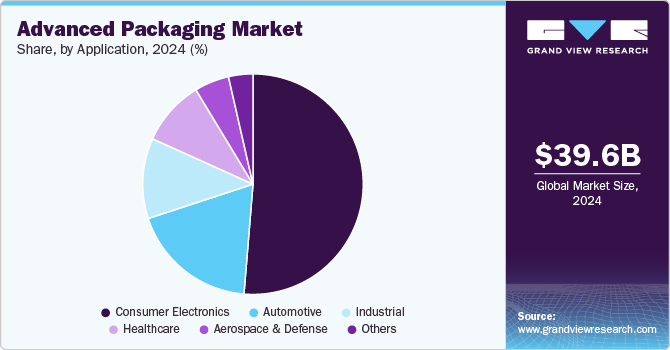

Application Insights

The consumer electronics segment recorded the largest market share of over 51.0% in 2024. This segment includes smartphones, tablets, wearables, laptops, and other smart devices that require compact, high-performance, and energy-efficient semiconductor packages. The main drivers include the growing demand for high-performance and compact electronic devices, increased functionality per chip, and the proliferation of AI and 5G-enabled devices.

The automotive application segment is projected to grow at the fastest CAGR of 6.3% during the forecast period. The automotive sector is increasingly adopting advanced packaging for its growing range of electronic applications, including Advanced Driver Assistance Systems (ADAS), infotainment systems, powertrain control, and electric vehicle (EV) battery management systems. These applications require highly reliable and compact semiconductor components.

The rise of Industry 4.0, increased automation, and the need for smart factory infrastructure are major drivers. Advanced packaging supports edge computing, real-time processing, and energy-efficient performance, all crucial for the modern industrial landscape.

Region Insights

Asia Pacific advanced packaging market dominated the global market and accounted for the largest revenue share of over 43.0% in 2024 and is anticipated to grow at the fastest CAGR of 6.2% over the forecast period. The region hosts the world's largest concentration of semiconductor manufacturing facilities, with powerhouses such as Taiwan Semiconductor Manufacturing Company (TSMC), Samsung Electronics, and China's Semiconductor Manufacturing International Corporation (SMIC) continuously expanding their advanced packaging capabilities. Government policies across Asia Pacific have strategically prioritized semiconductor self-sufficiency and technological advancement. China's "Made in China 2025" initiative, South Korea's "K-Semiconductor Strategy," and Japan's semiconductor revival efforts have channeled billions in subsidies and research funding toward advanced packaging development.

Advanced packaging market in China growthcan be attributed to its substantial investments in semiconductor infrastructure and manufacturing capabilities. The Chinese government has committed hundreds of billions of dollars through initiatives such as the "Made in China 2025" program and the National Integrated Circuit Industry Investment Fund, specifically targeting advanced packaging technologies as a strategic priority to reduce dependence on foreign chip suppliers while building domestic expertise.

North America Advanced Packaging Market Trends

North America’s growth in the advanced packaging market is due to its strong presence in the semiconductor and electronics manufacturing ecosystem, led by the U.S. The region houses several major semiconductor players such as Intel, AMD, Texas Instruments, and Qualcomm, who are heavily investing in cutting-edge packaging technologies such as 3D packaging, fan-out wafer-level packaging (FOWLP), and system-in-package (SiP). Electric vehicles (EVs), autonomous driving systems, and defense-grade electronics require highly reliable and thermally efficient packaging solutions. Companies like Tesla and Lockheed Martin are incorporating custom advanced packaging in their electronics systems, driving further demand.

The U.S. advanced packaging market growth can be attributed to its government's strategic initiatives to re-shore semiconductor manufacturing and packaging capabilities. The CHIPS and Science Act, enacted in 2022, allocated over USD 52 billion to boost domestic semiconductor production, with a significant portion aimed at supporting advanced packaging and heterogeneous integration. This policy push is encouraging not only large companies but also startups and research institutions to focus on innovations in packaging.

Europe Advanced Packaging Market Trends

The region has established itself as a center for automotive and industrial electronics innovation, with companies such as Infineon, STMicroelectronics, and NXP Semiconductors heavily investing in advanced packaging technologies. These companies are developing sophisticated packaging solutions for automotive applications such as advanced driver-assistance systems (ADAS), electric vehicle power modules, and autonomous driving capabilities, which demand higher performance, reliability, and miniaturization than conventional packaging can provide.

The advanced packaging market in Germany is primarily driven by its automotive industry, dominated by global leaders such as BMW, Mercedes-Benz, and Volkswagen, has been a primary catalyst for advanced packaging market growth. As vehicles increasingly incorporate sophisticated driver assistance systems, electrification technologies, and autonomous capabilities, German automakers demand semiconductor packages that can withstand harsh operating environments while delivering exceptional performance. For example, Bosch's sensor packages for ADAS systems require advanced packaging solutions that can endure temperature extremes and vibration while maintaining nanometer-level precision.

Key Advanced Packaging Company Insights

The competitive environment of the advanced packaging market is characterized by intense rivalry among key players, driven by rapid technological advancements, increasing demand for miniaturized and high-performance electronic devices, and the shift toward heterogeneous integration. Leading companies such as ASE Technology, Amkor Technology, Intel, and TSMC dominate the landscape through continuous innovation, strategic partnerships, and significant investments in R&D to develop advanced solutions. Emerging players and startups are also entering the market with niche capabilities, further intensifying competition. Additionally, the market is witnessing consolidation trends as firms seek to strengthen their technological capabilities and global footprint.

-

In November 2024, Applied Materials, Inc. announced plans to expand its global EPIC (Extensible Platform for Integrated Collaboration) innovation platform with a new collaboration model aimed at accelerating the commercialization of advanced chip packaging technologies. This initiative, called EPIC Advanced Packaging, is designed to address the challenges posed by the dramatic rise in connected devices and the emergence of AI, which are creating both growth opportunities and energy consumption concerns for the chip industry.

-

In October 2024, Amkor Technology and Taiwan Semiconductor Manufacturing Co. (TSMC) signed a memorandum of understanding to expand their partnership and collaborate on advanced packaging and test capabilities in Arizona. This collaboration aims to enhance the region's semiconductor ecosystem by providing turnkey advanced packaging and test services from Amkor's planned facility in Peoria, Arizona.

Key Advanced Packaging Companies:

The following are the leading companies in the advanced packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amkor Technology Inc.

- Advanced Semiconductor Engineering (ASE)

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Intel

- Samsung Electronics

- JCET Group

- ASMPT SMT Solutions

- IPC International, Inc.

- SEMICON

- Yole Group

- Prodrive Technologies B.V.

Advanced Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 41.69 billion |

|

Revenue forecast in 2030 |

USD 55.00 billion |

|

Growth rate |

CAGR of 5.7% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Packaging type, application, region |

|

States scope |

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa |

|

Key companies profiled |

Amkor Technology Inc.; Advanced Semiconductor Engineering (ASE); Taiwan Semiconductor Manufacturing Company (TSMC); Intel; Samsung Electronics; JCET Group; ASMPT SMT Solutions; IPC International, Inc.; SEMICON; Yole Group; Prodrive Technologies B.V. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Advanced Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global advanced packaging market report based on packaging type, application, and region:

-

Packaging Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Flip-Chip

-

Fan-Out WLP

-

Embedded-Die

-

Fan-In WLP

-

2.5D/3D

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Automotive

-

Industrial

-

Healthcare

-

Aerospace & Defense

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global advanced packaging market was estimated at around USD 39.60 billion in the year 2024 and is expected to reach around USD 41.69 billion in 2025.

b. The global advanced packaging market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2030 to reach around USD 55.0 billion by 2030.

b. Consumer electronics dominated the advanced packaging market in 2024 with a 51.0% value share due to rising demand for compact, high-performance devices. Increased adoption of AI, IoT, and 5G technologies further fueled the need for advanced semiconductor packaging solutions.

b. The key players in the advanced packaging market include Amkor Technology Inc.; Advanced Semiconductor Engineering (ASE); Taiwan Semiconductor Manufacturing Company (TSMC); Intel; Samsung Electronics; JCET Group; ASMPT SMT Solutions; IPC International, Inc.; SEMICON; Yole Group; Prodrive Technologies B.V.

b. The advanced packaging market is driven by the rising demand for compact, high-performance electronic devices and the growing adoption of AI, IoT, and 5G technologies. Additionally, the need for improved power efficiency and performance in semiconductor components fuels its growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."