Advanced Distribution Management System Market Size, Share & Trends Analysis Report By Offering, By Deployment, By Functionality, By Organization Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-265-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The global advanced distribution management system market size was estimated at USD 3.16 billion in 2023 and is expected to grow at a CAGR of 20.8% from 2024 to 2030. As per the International Energy Agency, the investments in smart grids [G1] rose by 8% in 2022, and the trend is expected to persist over the coming years due to clean energy being considered a priority across the globe. It is expected to propel the demand for advanced distribution management systems (ADMS) as they enhance smart grids by delivering electric utilities with enhanced control capabilities and automation capacities.

The growing demand for energy across different regions is another factor fueling market growth, as these systems aid electric utilities in an array of functions. According to the International Energy Agency, Asia is estimated to witness a considerable surge in demand for energy by 2025. A rising standard of living in countries such as India and China coupled with growing population is expected to propel market growth.

The increasing popularity of electric vehicles has been a driving factor and is projected to continue to make a conducive environment for market growth. As per the International Energy Agency, electric car markets are experiencing a substantial boost, with sales crossing 10 million in 2022. Regulatory agencies in Europe and the U.S., among other regions and countries, are backing the EV market’s growth by framing favorable policies to meet sustainability goals. Subsequently, the demand for advanced distribution management systems is anticipated to grow as they aid in managing power distribution, among other aspects.

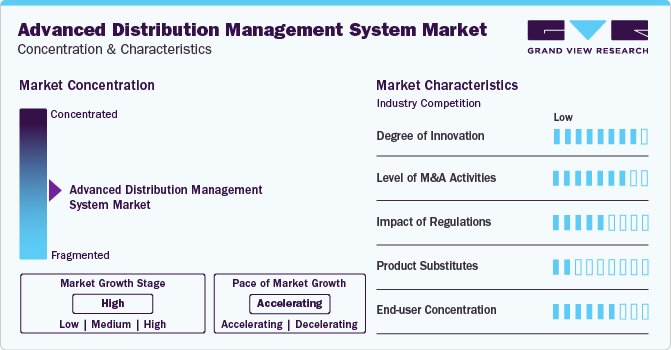

Market Concentration & Characteristics

The industry is moderately fragmented and is characterized by players engaging in various strategies such as acquisitions, mergers, collaborations, and partnerships to expand their market presence.

Launching innovative products is a strategy being employed in the industry to acquire higher profit margins. For instance, GE Grid Solutions, LLC (owned by General Electric) announced the launch of a comprehensive portfolio of grid automation solutions, referred to as GridBeats, in February 2024. GridBeats was developed by the company to equip utilities with capacities such as dividing their grid network into autonomous zones, prescriptive diagnostics, health monitoring, and others.

Data privacy, cybersecurity, and grid interoperability regulations have significant implications for the advanced distribution management system market. As utilities collect and analyze increasing volumes of data from grid sensors, smart meters, and other IoT devices, regulatory compliance becomes a critical consideration in ADMS deployment. Regulations such as the General Data Protection Regulation (GDPR) or the North American Electric Reliability Corporation (NERC) standards impose stringent requirements on data handling, privacy protection, and cybersecurity for utilities and technology providers.

Deployment Insights

The on-premises segment held the dominant position in 2023 and is projected to expand at a rapid CAGR over the forecast period. Privacy and data safety concerns are driving companies to have an on-premises infrastructure. Additionally, on-premises infrastructure grants an enterprise greater control over its applications and data.

The cloud segment is expected to grow at the fastest CAGR over the forecast period due to the benefits associated with the mode of deployment, such as substantial cost-savings, enhanced scalability, easier disaster recovery, and better device synchronization capability.

Functionality Insights

The supervisory control and data acquisition segment accounted for the majority share in 2023 and is expected to witness the fastest CAGR over the forecast period. This particular function is one of the sought-after features of an advanced distribution management system (ADMS) as it enables end-users to access real-time monitoring of power distribution networks and the increasing demand for smart grids.

The voltage/var control segment held a considerable share in 2023 and is estimated to grow at a rapid CAGR over the forecast period. An increasing number of investments concerning renewable energy, such as solar/wind energy, is facilitating the increase of demand for voltage/var control.

Organization Size Insights

Based on the enterprise size, the market is categorized into large enterprises and small & medium enterprises (SMEs). The large enterprise segment dominated the market in 2023 and is projected to grow at a significant CAGR over the forecast period. Large enterprises with budgets are investing in advanced distribution management systems to acquire real-time monitoring benefits and automate processes.

SMEs are expected to witness the fastest CAGR over the forecast period owing to the presence of cloud services, which has been a critical driver of this segment as these solutions help SMEs circumvent the costs associated with on-premises infrastructure, and effectively monitor grid systems, reduce power losses, and enhance network visibility.

End-use Insights

The manufacturing segment dominated the market in 2023 and is estimated to grow at a significant CAGR over the forecast period. The demand for advanced distribution management systems is being fueled by large-scale manufacturers that consume substantial amounts of electricity.

The healthcare and life sciences segment is expected to be the fastest-growing segment over the forecast period. Medical institutions' growing emphasis on monitoring biological samples, vaccines, and medication and maintaining quality and safety drives the segment’s growth.

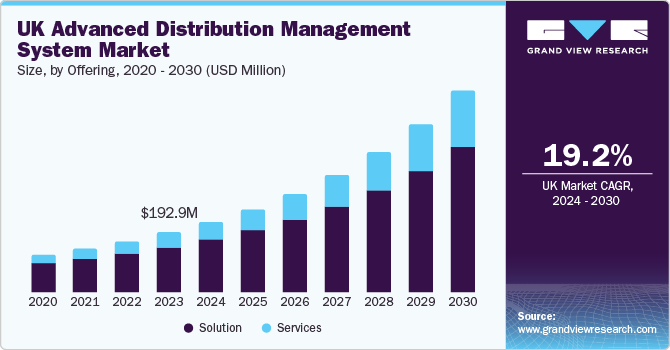

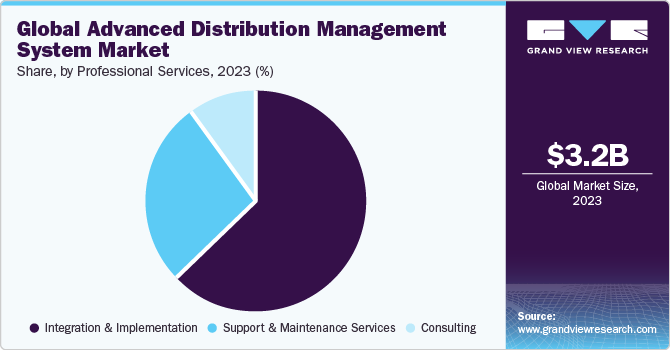

Offering Insights

Based on offering, the solution segment dominated the market in 2023 and is estimated to witness a rapid CAGR of 20.1% over the forecast period, owing to the high demand for energy management systems and meter data management systems.

The services segment is projected to grow at the fastest CAGR over the forecast period due to the high demand for managed services along with integration and support services.

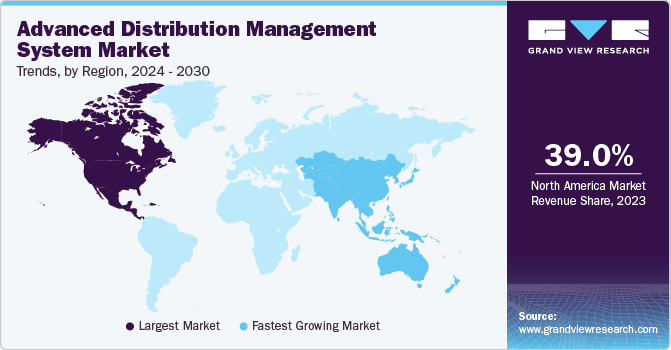

Regional Insights

North America dominated the market, accounting for a 39% share in 2023. Energy consumption in the region has been substantially high which has been a significant contributing factor to market growth. Moreover, the increasing adoption of smart grids has been playing a positive role in the adoption of advanced distribution management systems across the region.

U.S. Advanced Distribution Management System Market Trends

The advanced distribution management system market in the U.S. is primarily driven by the high energy consumption of the nation. The country accounted for 29.4% of the global advanced distribution management system market in 2023. According to the U.S. Energy Information Administration, in 2021, the primary energy consumption in the U.S. was approximately 98 quadrillion British thermal units (Btu), equal to around 16% of the global primary energy consumption.

Asia Pacific Advanced Distribution Management System Market Trends

The advanced distribution management system market in Asia Pacific is expected to expand at the fastest CAGR over the forecast period. The increasing demand for efficient and effective energy distribution networks coupled with a surge in smart grid initiatives is fueling the adoption of ADMS solutions. Moreover, the escalating demand for renewable energy sources is propelling market growth as efficient energy distribution networks are essential to manage the intermittent nature of renewables.

The China advanced distribution management system market held the dominant share in Asia Pacific market in 2023. As per the International Energy Agency (IEA), in 2023, the nation commissioned solar PV capacity equivalent to the capacity commissioned by the world in 2022 and installed 66% more wind turbines in 2023 than in 2022.

The advanced distribution management system market in India is projected to be the fastest-growing over the forecast period due to favorable government policies. In 2021, the government of India launched the Revamped Distribution Sector Scheme (RDSS) to transform the nation’s electricity distribution sector. With an outlay of USD 40 billion, the scheme aims to upgrade the distribution infrastructure and offer financial support for other related aspects.

Europe Advanced Distribution Management System Market Trends

The advanced distribution management system market in Europe is estimated to witness a rapid CAGR over the forecast period. The region has some of the most advanced energy distribution networks globally, leading to an increased demand for sophisticated systems to manage them. Moreover, the surge in renewable energy sources due to the government's focus on clean energy is expected to necessitate advanced distribution management systems.

Key Advanced Distribution Management System Company Insights

Some of the key players operating in the market include General Electric and Schneider Electric. GE Vernova, a part of General Electric, is involved in developing and selling electrification software. As per a report conducted by U.S. Energy Information Administration in 2022, 90% of the power transmission utilities are equipped with GE Vernova technology as per.

Schneider Electric is involved in the development of various IT solutions related to an array of areas such as building automation and control, residential and small businesses, and voltage distribution and grid control among others. The company’s ADMS is called EcoStruxure ADMS and is utilized by 75 utility companies that cater to 70 million end-customers across the globe.

Key Advanced Distribution Management System Companies:

The following are the leading companies in the advanced distribution management system market. These companies collectively hold the largest market share and dictate industry trends.

- GE Vernova (GE Electric)

- Survalent Technology Corporation

- Schneider Electric

- Siemens

- Hitachi Energy Ltd. (Hitachi, Ltd.)

- Aspen Technology Inc (Emerson Electric Co.)

- Trimble Inc.

- Operation Technology, Inc.

- Oracle

- Itron Inc.

- Landis+Gyr. (TOSHIBA CORPORATION)

- Minsait ACS, Inc. (Indra)

- Wipro

- Elipse Software

- Tantalus

- Hexagon AB

- Eaton.

- Mitsubishi Electric Corporation

- QUALUS

Recent Developments

-

In August 2023, GE Vernova (GE Electric) announced the acquisition of Greenbird Integration Technology AS, a company involved in data integration platforms for utilities. The acquisition is expected to enable the company in making a beeline for its plan to invest in talent and technologies that will be valuable in the acceleration of the sustainable energy grid.

-

In September 2022, Siemens announced its new deal of equipping the Alexandria (2nd largest city in Egypt) with advanced distribution management systems and smart metering infrastructure. The project is funded by the Japanese International Cooperation Agency (JICA) is valued at about USD 49.6 million.

-

In June 2022, GE Vernova (GE Electric) announced its partnership with Climavision, a weather technology company, to offer the latter’s weather forecasting capabilities in its ADMS. This collaboration is aimed to enhance the ability of the utility customers of GE Vernova to predict weather and have well-calculated plans for severe weather events.

Advanced Distribution Management System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.77 billion |

|

Revenue forecast in 2030 |

USD 11.70 billion |

|

Growth rate |

CAGR of 20.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, deployment, functionality, organization size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

GE Vernova (GE Electric); Survalent Technology Corporation; Schneider Electric; Siemens; Hitachi Energy Ltd. (Hitachi, Ltd.); Aspen Technology Inc. (Emerson Electric Co.); Trimble Inc.; Operation Technology, Inc.; Oracle; Itron Inc.; Landis+Gyr. (TOSHIBA CORPORATION); Minsait ACS, Inc. (Indra); Wipro; Elipse Software; Tantalus; Hexagon AB; Eaton.; Mitsubishi Electric Corporation; and QUALUS. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Advanced Distribution Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global advanced distribution management system market report based on offering, deployment, functionality, organization size, end-use and region.

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Energy Management System

-

Meter Data Management System

-

Distributed Energy Resources Management System

-

Geographic Information System

-

Customer Information System

-

Outage Management System

-

-

Service

-

Managed Services

-

Professional Services

-

-

Integration and Implementation

-

Support and Maintenance Services

-

Consulting

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premises

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

SMEs

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Healthcare And Life Sciences

-

Retail

-

IT & Telecommunication

-

Government And Defense

-

Automotive

-

Energy & Utility

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global advanced distribution management system market size was estimated at USD 3.16 billion in 2023 and is expected to reach USD 3.77 billion in 2024

b. The global advanced distribution management system market is expected to grow at a compound annual growth rate of 20.8% from 2024 to 2030, reaching USD 11.70 billion by 2030

b. North America dominated the advanced distribution management system market with a revenue share of 39.0% in 2023. Regional growth is attributed to the increasing adoption of smart grids has been playing a positive role in the adoption of advanced distribution management systems across the region.

b. Some key players operating in the advanced distribution management system market include GE Vernova (GE Electric), Survalent Technology Corporation, Schneider Electric, Siemens, Hitachi Energy Ltd. (Hitachi, Ltd.), Aspen Technology Inc (Emerson Electric Co.), Trimble Inc., Operation Technology, Inc., Oracle, Itron Inc., Landis+Gyr. (TOSHIBA CORPORATION), Minsait ACS, Inc. (Indra), Wipro, Elipse Software, Tantalus, Hexagon AB, Eaton., Mitsubishi Electric Corporation, and QUALUS..

b. Factors such as the increasing investments in smart grids are driving the growth of the advanced distribution management system market

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."