Adult Day Care Market Size, Share & Trends Analysis Report By Funding (Private, Public), By Service (Adult Social Day Services, Adult Day Healthcare Services, Specialized Day Care Services), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-092-3

- Number of Report Pages: 168

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Adult Day Care Market Size & Trends

The global adult day care market size was valued at USD 16.5 billion in 2022 and is anticipated to grow a compound annual growth rate (CAGR) of 5.10% over the forecast period. The growing geriatric population globally and the demand for transitional care among elderly and Alzheimer's patients are expected to drive the growth of the market over the forecast period. According to the World Population Ageing 2020 report by United Nations, in 2020, there were around 727 million people aged 65 years and above globally. The major economies and developing countries are rapidly aging. This demographic shift has increased the demand for elderly care services.

Moreover, with the shift from traditional family structure to nuclear families, majorly in the Asia Pacific countries, many elderly people are living alone or with limited support. Urbanization has promoted the nucleation of families and has substantially decreased care and support for the elderly population. However, Adult Day Care (ADC) centers offer opportunities to improve social support and contact with such individuals to provide daily living support, nutritional support, and mental health.

Furthermore, the demand for transitional care is rising globally among patients with Alzheimer's and developmental disabilities. Hence, these centers are offering more and more disease-specific programs to cater to the demand of these patient cohorts with an increased focus on health and prevention maintenance. For instance, according to the article published in AgingInPlace.org in April 2023, in the U.S., around 90% of the centers offer cognitive stimulation programs, around 80% offer memory training programs, and around 75% and above offer educational programs for such a population.

The funding for ADC varies from country and is complex in nature. The majority of service providers rely on a combination of public and private funding, donations, and grants to cover the cost. For instance, according to the article published in the National Library of Medicine in July 2021, around 65% of the cost is covered by Medicaid in the U.S. This is to divert the expenditure from expensive nursing homes to home- and community-based care.

The COVID-19 pandemic adversely impacted the market due to the suspension of operations in the early phase of the pandemic. Traveling and physical restrictions resulted in a decrease in visits as these populations were at high risk. Hence, many centres closed their operations in 2020. For instance, according to a survey of 30 ADC centers in 2020 published by the National Library of Medicine, around 95.5% of the facilities were closed due to the traveling and physical restrictions led due to the pandemic. However, in 2021, with the ease of restrictions and policies led down by the government for the prevention of the spread of the virus, many facilities started providing services. For instance, in the UK, the guidance for regular COVID-19 testing for DC was published by the UK Health Security Agency. The guidance mandated daily testing of staff using rapid lateral flow test (LFT) two days a week for the service users.

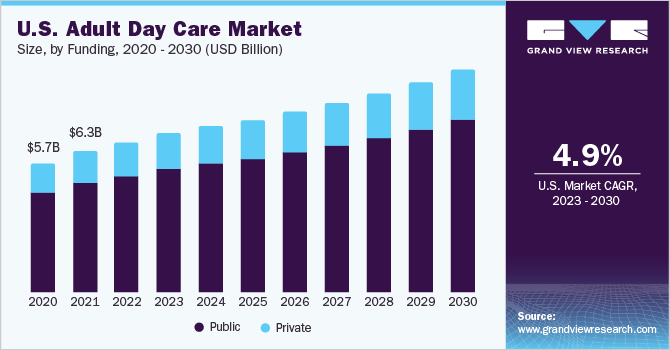

Funding Insights

The public segment dominated the market and accounted for the largest revenue share of 72.30% in 2022. The high share of the segment can be attributed to the growing investment by the government to increase the adoption of institutional care for patients with special needs. According to the BMC Journal, in 2018, around 87.7% of the municipalities in Norway offered ADC services for dementia patients. Based on the funding, the market is bifurcated into public and private.

Moreover, some governments have mandated social organizations to offer different types of ADC to their population suffering from dementia. For instance, since 2020, all municipalities in Norway have been mandated to offer ADC to dementia patients. Many offer variations in the type of services, including Farm-based daycare that provide outdoor activities rather than regular daycare.

However, the private segment is expected to witness fastest growth over the forecast period due to the growing demand for care services and the market's high potential with the lower number of private players. For instance, in 2022, Town Square Sandy Springs opened an innovative adult day care center in Atlanta, U.S. offering cognitive and memory care services and experiential adult day enrichment services.

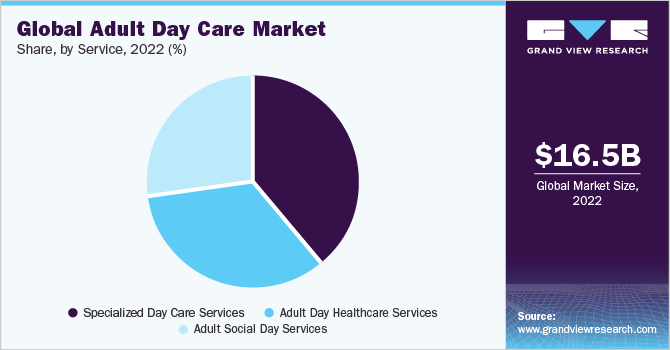

Services Insights

The specialized day care services segment dominated the market with the largest revenue share of 38.44% in 2022 and is expected to witness the fastest growth over the forecast period. This can be attributed to the growing demand for ADC among Alzheimer's and dementia patients. According to the article published in the BMC Journal in 2022, day care is an important aspect of community care for dementia patients, and around 10% to 18% of patients with dementia are utilizing these services globally. Moreover, in Ireland, around 13% of the expenditure for community care for dementia is spent on ADC. Based on the services, the market is segmented into adult social day services, adult day healthcare services, and specialized day care services.

Moreover, many providers are launching specialized centers only offering services for patients with special needs, such as dementia patients. For instance, in August 2022, the Devika Dementia Day Center was launched at Castor Lodge Care Home in Petersburg, U.S. The center offers services to mid- to late-stage dementia patients to assist with activities of daily living.

Adult day healthcare services are expected to grow significantly over the forecast period. These are medical services licensed by countries, including nursing services, intensive health services, therapeutic services, therapy services, and other medical services. Hence, many such service providers are expanding their business to gain a competitive edge in the market. For instance, in February 2023, Rainbow Adult Day Health Care opened a second facility at the public housing complex, Quincy location.

Regional Insights

North America region dominated the market with the largest revenue share of 45.01% in 2022. ADC programs are a growing source of long-term care, and the number of centers offering services is rapidly increasing in the region. According to the National Adult Day Services Association (NADSA), in 2022, there were more than 7,500 ADC centers in the U.S., from around 5,000 in 2020.

Asia Pacific region is expected to witness the fastest growth over the forecast period. This can be attributed to the growing proportion of the elderly population in the region which is at greater risk of developing chronic disease and experiencing a decline in functional and mental capacities. For instance, according to an article published in the National Library of Medicine, ADC services are popular among the disabled population in Japan, and around 1.13 million people visited these centers in 2018.

Europe held significant market share in 2022. The rise in the aging population in the region is expected to drive the market during the forecast period. For instance, according to the 2021 Long-term care report, the potential individual requiring long-term care in the EU is anticipated to reach 38.1 million in 2050 from 30.8 million in 2019 owing to the aging population. With the aging population, the mental and physical disability prevalence increases, which leads to dependency on aid for instrumental and/or activities for daily living. This is expected to contribute to the growth of the market over the forecast period.

Key Companies & Market Share Insights

The market is not mature as these services are mainly provided by the home healthcare and nursing home providers. Although, the public institutions dominate the majority of the market; owing to its growing demand, many private players are stepping up to gain a competitive share of the market. Hence, companies are continuously launching new facilities at different locations to cater to the growing demand for ADC. For instance, in January 2023, The New Jewish Home opened Adult Day Health Care program for the vulnerable, community-based older adults of New York. Some of the prominent players in the adult day care market include:

-

Active Day/Senior Care, Inc.

-

Adult Life Programs, Inc.

-

Ascension Living Saint Joseph Village Adult Day Center

-

CCACC Joyful Day Care Center

-

Age U.K.

-

Care Futures

-

GerHogar

-

Deutsches Altenheim

-

Badisa

-

Grace Adult Health Care

Adult Day Care Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 17.5 billion |

|

Revenue forecast in 2030 |

USD 24.8 billion |

|

Growth rate |

CAGR of 5.10% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Funding, services, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Israel; Kuwait |

|

Key companies profiled |

Active Day/Senior Care, Inc.; Adult Life Programs, Inc.; Ascension Living Saint Joseph Village Adult Day Center; CCACC Joyful Day Care Center; Age UK; Care Futures; GerHogar; Deutsches Altenheim; Badisa; Grace Adult Health Care |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Adult Day Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global adult day care market report on the basis of funding, services, and region:

-

Funding Outlook (Revenue, USD Billion, 2018 - 2030)

-

Private

-

Public

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Adult Social Day Services

-

Adult Day Healthcare Services

-

Specialized Day Care Services

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Israel

-

-

Frequently Asked Questions About This Report

b. The adult day care market size was estimated at USD 16.5 billion in 2022 and is expected to reach USD 17.5 billion in 2023.

b. The adult day care market is expected to grow at a compound annual growth rate of 5.10% from 2023 to 2030 to reach USD 24.8 billion by 2030.

b. North America dominated the adult day care market with a share of 45.01% in 2022 owing to the growing presence of non-profit public centers and increased funding for these centers.

b. Some key players operating in the adult day care market include Active Day/Senior Care, Inc.; Adult Life Programs, Inc.; Ascension Living Saint Joseph Village Adult Day Center; CCACC Joyful Day Care Center; Age U.K.; Care Futures; GerHogar; Deutsches Altenheim; Badisa; Grace Adult Health Care.

b. Key factors that are driving the adult day care market growth include growing geriatric population, increasing prevalence of Alzheimer’s globally, and demand for transitional care among elderly population.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."