AdTech Market Size, Share & Trends Analysis Report By Platform (Mobile, Web), By Solution (Demand-Side Platforms, Supply-Side Platforms), By Advertising Type, By Enterprise Size, By Industry Vertical, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-033-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

AdTech Market Size & Trends

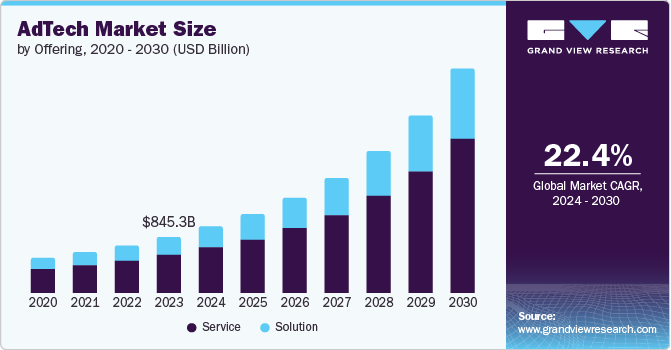

The global AdTech market size was valued at USD 719.62 billion in 2024 and is expected to grow at a CAGR of 14.4% from 2025 to 2030. The growth of this market is fueled by the rising demand for data-driven advertising solutions, advancements in programmatic advertising, and the integration of artificial intelligence (AI) and machine learning. Additionally, the expansion is supported by the need for more efficient targeting and measurement tools, along with the increasing adoption of personalized advertising across digital platforms.

The rapid growth of data-driven advertising has transformed the AdTech industry, with a strong emphasis on utilizing consumer data to improve ad targeting and campaign performance. Marketers are increasingly looking to reach highly specific audiences, leading AdTech products to leverage big data, AI, and machine learning algorithms to enhance targeting accuracy. This has resulted in more sophisticated audience segmentation tools, cross-channel attribution methods, and predictive analytics that aim to maximize the return on investment (ROI) for ad spending. The ability to analyze and access large volumes of data has been a key driver of growth in the AdTech sector.

Another significant trend in the AdTech industry is the shift toward programmatic advertising. Programmatic advertising automates the buying and selling of advertising inventory in real-time, allowing advertisers to bid for impressions based on data-driven insights. This approach has optimized the ad-buying process, making it more efficient and cost-effective. Programmatic advertising is becoming prevalent across various digital platforms, including mobile, video, and display ads. The increasing adoption of programmatic solutions has revolutionized media purchasing and selling, providing more precise control over ad placement and improving targeting accuracy.

Additionally, the AdTech industry faces growing concerns related to privacy laws and data security. With stricter privacy regulations such as the GDPR in Europe and the CCPA in California, businesses must navigate the complexities of responsibly managing user data while delivering personalized advertising. These regulations have prompted AdTech companies to evolve by investing in safer data practices and promoting transparency. Furthermore, as third-party cookies are gradually being phased out, there is a heightened focus on alternative solutions for tracking user activity and serving targeted ads, which will further shape the future of the market.

Market leaders such as Google LLC, Amazon.com, Inc., and Meta are driving the market with sophisticated targeting and AI-based solutions. Players such as The Trade Desk and Magnite specialize in programmatic advertising, offering transparency and control for campaigns. Collaborations between SSPs and media platforms optimize inventory and revenue for publishers. As concerns over privacy mount, firms such as LiveRamp are crafting cookie-less identity solutions to address compliance with such regulations as GDPR and CCPA, allowing efficient advertising while still upholding customer trust and data protection in a fast-changing industry.

Solution Insights

The demand-side platforms (DSPs) segment dominated the market in 2024 with a revenue share of over 33%. DSPs are widely adopted across the industry by advertisers and agencies for programmatic ad purchasing to facilitate real-time bidding and targeting of specific audiences on various channels, such as display, video, mobile, and connected TV (CTV). The marriage of AI and machine learning has boosted the DSPs' functionalities to help advertisers optimize advertising expenditure and deliver better ROI. As programmatic advertising grows all over the world, DSPs are likely to retain their leading position as demand for data-driven and automated advertisement solutions keeps growing.

The data management platforms (DMPs) segment is expected to grow at a faster rate, with a CAGR of 15.6% from 2025 to 2030. DMPs are responsible for gathering, consolidating, and analyzing audience data, which allows advertisers to craft more specific and personalized campaigns. The increased focus on first-party data with the advent of privacy laws such as GDPR and CCPA is propelling the use of DMPs. Moreover, the popularity of CTV and OTT platforms has given rise to the demand for powerful data management solutions to connect cross-channel audience intelligence. As marketers increasingly use data to make decisions and optimize campaigns, DMPs are expected to see strong growth, especially in markets with mature digital ad ecosystems.

Advertising Type Insights

The search advertising segment dominated the market in 2024. Search advertising continues to be a fundamental element of online marketing due to its capacity for delivering highly specific ads in relation to user intent. Google Ads and Microsoft Advertising platforms allow companies to target users who are currently looking for goods or services, thus ensuring optimal conversion rates. The combination of artificial intelligence (AI) and machine learning has only served to amplify the effectiveness of search advertising using more intelligent bidding tactics and ad relevance. As companies continue to make performance-led marketing a priority, search advertising is likely to continue its robust growth path.

The mobile advertising segment is expected to witness the highest CAGR from 2025 to 2030, owing to the widespread use of smartphones and the increasing consumption of digital content on mobile devices. Mobile advertising utilizes formats such as in-app ads, mobile video, and location-based targeting to engage users effectively. The advent of 5G technology is expected to enhance mobile ad delivery, allowing for richer and more interactive ad experiences. Moreover, the rising popularity of social media platforms and mobile-first apps is creating new opportunities for advertisers to connect with younger, tech-savvy audiences. As mobile usage continues to surge worldwide, mobile advertising is set to become a dominant force in the digital advertising landscape.

Platform Insights

The mobile segment accounted for the largest market share in 2024, due to the widespread adoption of smartphones, increasing mobile internet penetration, and the growing dominance of mobile-first consumer behavior. The surge in app-based advertising, driven by social media, gaming, and e-commerce platforms, has fueled demand for mobile AdTech solutions. Additionally, advancements in AI and machine learning have enabled highly targeted and personalized mobile ads, improving engagement and conversion rates. The shift toward programmatic advertising and the integration of 5G technology has further enhanced mobile ad performance, making it the preferred platform for advertisers.

The web segment is expected to witness a significant CAGR from 2025 to 2030, due to the continued dominance of e-commerce, content streaming, and digital media consumption through web-based platforms. The increasing use of first-party data strategies, as businesses adapt to evolving privacy regulations and the phase-out of third-party cookies, has driven investment in web-based AdTech solutions. Additionally, advancements in AI-driven contextual advertising, programmatic ad buying, and real-time bidding have enhanced ad targeting and effectiveness. The growing adoption of interactive and rich media ads, combined with improved measurement and attribution tools, has further solidified the web segment’s position as the leading platform for digital advertising.

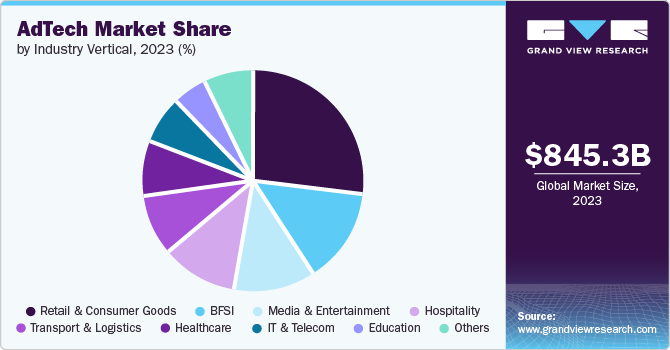

Industry Vertical Insights

The retail and consumer goods segment dominate the AdTech market in 2024, driven by the rapid growth of e-commerce and the increasing adoption of digital advertising strategies aimed at connecting with consumers. Retailers and consumer goods companies are leveraging AdTech solutions such as programmatic advertising, personalized targeting, and retargeting to enhance customer engagement and drive sales. The shift to online shopping, accelerated by the pandemic, has underscored the importance of digital marketing in this sector.

The media and entertainment segment is expected to witness the highest CAGR from 2025 to 2030, due to the rapid expansion of digital content consumption across streaming platforms, social media, and online gaming. The rise of connected TV (CTV) and over-the-top (OTT) advertising, driven by cord-cutting trends and the shift toward ad-supported video-on-demand (AVOD) models, is significantly boosting ad spend in this sector. Additionally, the increasing use of AI and data analytics for personalized content recommendations and targeted advertising is enhancing audience engagement and ad performance. The growing adoption of immersive technologies, such as AR and VR, in entertainment content is also creating new opportunities for innovative ad formats, further fueling market growth.

Enterprise Size Insights

The large enterprise segment dominated the market in 2024, due to increasing investments in advanced advertising technologies, data-driven marketing strategies, and AI-powered customer insights. Large enterprises have the financial resources to adopt cutting-edge AdTech solutions, including programmatic advertising, real-time bidding, and omnichannel marketing automation, to enhance targeting and maximize ROI. Additionally, the growing emphasis on first-party data collection and privacy-compliant advertising solutions is driving large corporations to develop in-house AdTech capabilities or partner with leading providers. With expanding global reach and the need for personalized, scalable advertising campaigns, large enterprises are set to dominate the adoption of next-generation AdTech solutions.

The small and medium-sized enterprises (SME) sector is anticipated to experience significant growth between 2025 and 2030. due to increasing digital transformation initiatives and the growing adoption of cost-effective, AI-powered advertising solutions. With the rise of self-service AdTech platforms, cloud-based marketing tools, and programmatic advertising, SMEs can now access advanced targeting and automation capabilities that were previously available only to large enterprises. Additionally, the shift toward social media, influencer marketing, and localized digital advertising is enabling SMEs to reach niche audiences more effectively.

Regional Insights

North America AdTech market accounted for the largest market share of more than 35% in 2024. The region has led the way in embracing cutting-edge digital advertising technologies backed by strong infrastructure, high internet penetration, and an established digital ecosystem. Also, the advent of AI and machine learning technology in ad solutions and increased demand for data-driven marketing efforts have helped fuel further growth in the market. North America's growth has also been fostered by the growth of over-the-top (OTT) and connected TV (CTV) platforms, creating new opportunities for marketers.

U.S. AdTech Market Trends

The AdTech market in the U.S. accounted for the largest market share in 2024, fueled by the use of programmatic purchasing, AI-powered targeting, and CTV and OTT platforms. Industry leaders such as Google LLC and The Trade Desk are offering sophisticated solutions for ad optimization, while 5G technology is bolstering ad delivery and interactivity. CCPA and other privacy laws are compelling the use of transparent, opt-in data practices. Cord-cutting phenomena are driving growth in CTV and FAST platforms, providing brands with new methods of engaging viewers. The addition of shoppable commercials and sponsored content is bringing interactive experiences to life, positioning the U.S. as the world leader in digital ad innovation.

Europe AdTech Market Trends

The AdTech market in Europe is expected to witness significant growth, owing to rising digitalization, programmatic advertising growth, and data-driven marketing adoption. The U.K., Germany, and France are spearheading the charge, aided by strong digital infrastructure and high rates of internet penetration. The region is also witnessing a move towards privacy-friendly advertising solutions because of strict regulations such as the General Data Protection Regulation (GDPR). The increasing popularity of over-the-top (OTT) and connected TV (CTV) platforms is opening up new avenues for advertisers, while technological advancements in AI and machine learning are improving ad targeting and personalization.

The AdTech market UK accounted for the largest market share in 2024, due to the country’s advanced digital infrastructure, high internet penetration, and strong adoption of data-driven advertising strategies. The rapid growth of programmatic advertising, the increasing use of AI and machine learning in ad targeting, and the rise of connected TV (CTV) and over-the-top (OTT) platforms are fueling market expansion.

Germany AdTech market is expanding at a fast pace, driven by growing digital ad expenditures and the usage of programmatic advertising. Germany's robust digital infrastructure and high smartphone penetration are driving demand for data-driven marketing solutions. Privacy is still an area of importance, with GDPR compliance influencing the practice of advertising. Artificial intelligence and machine learning are increasingly being utilized to optimize ad targeting and campaign effectiveness. Moreover, the introduction of 5G technology is likely to optimize the delivery of advertisements further, making Germany a central contributor to the European AdTech environment.

Asia Pacific AdTech Market Trends

The AdTech market in Asia Pacific is expected to witness the highest CAGR of 16% from 2025 to 2030, due to rapid digitalization, increasing smartphone penetration, and the explosive growth of e-commerce and social media platforms across the region. Countries like China, India, and Southeast Asian nations are experiencing a surge in digital advertising spend, driven by a growing internet user base and mobile-first consumer behavior. The rise of AI-driven programmatic advertising, video-based content marketing, and influencer-driven campaigns is further fueling market expansion.

China AdTech market accounted for the largest market share in 2024, fueled by its enormous digital economy and sophisticated technological infrastructure. The dominance of platforms such as Alibaba, Tencent, and Baidu has led to highly competitive advertising environments. Programmatic advertising and AI-targeted advertising are prevalent, supporting personalized advertising experiences for consumers. Live streaming and social commerce growth are redefining the advertising environment, providing brands with new ways to engage consumers. Nonetheless, stringent data privacy regulations, like the Personal Information Protection Law (PIPL), are impacting AdTech behaviors, with a focus on transparency and user permission. Mobile advertising continues to be a priority owing to high smartphone penetration.

The AdTech market in India is expected to witness the highest CAGR from 2025 to 2030, driven by growing internet penetration, low-cost mobile data, and a youth-driven, tech-savvy populace. The emergence of digital media such as JioSaavn, Hotstar, and Zee5 is boosting demand for video and programmatic advertising. Advertisers are using AI and machine learning to optimize targeting and campaign efficiency. The appeal of short video content and social media platforms is opening up new avenues for brands to interact with consumers. Nevertheless, data privacy issues and changing regulations, like the Digital Personal Data Protection Bill, are influencing AdTech behaviors. The industry is also experiencing a trend towards vernacular and regional content to reach various audiences.

Middle East & Africa AdTech Market Trends

The AdTech market in the Middle East & Africa (MEA) is witnessing consistent growth, fueled by growing digital adoption, rising smartphone penetration, and growing internet access. The region is witnessing a transition towards programmatic advertising, with advertisers using data-driven approaches to target audiences. The increasing popularity of social media and video streaming sites is opening up new avenues for digital advertising. Yet, the market is hampered by diverse levels of digital maturity and differing regulations in different countries. Nonetheless, growth is being driven by the growth of e-commerce and the use of AI-based ad solutions, turning MEA into an emerging hotbed for AdTech innovation.

The UAE AdTech market is expected to witness the highest CAGR from 2025 to 2030, due to its developed digital infrastructure and high internet penetration. Programmatic advertising is becoming popular, with brands leveraging data-driven tools to create personalized ad experiences. Growth in social media platforms and video streaming services is fueling demand for digital advertising, especially in the retail, travel, and entertainment sectors. The UAE's emphasis on smart city projects and digitalization is further accelerating the AdTech ecosystem. Nevertheless, stringent data privacy laws, like the UAE Data Protection Law, are influencing advertising, with a focus on transparency and user consent.

The AdTech industry in Saudi Arabia is expected to witness a significant CAGR from 2025 to 2030, driven by the Vision 2030 program in the country, which focuses on digitalization and economic diversification. Growth in e-commerce and social media use is propelling demand for online advertising, with programmatic tools becoming increasingly popular. Advertisers are using AI and machine learning to optimize targeting and campaign performance. Growth in video streaming services is generating new opportunities for brands to reach consumers. Yet, privacy regulations of personal data, for instance, the Personal Data Protection Law (PDPL), are impacting the practice of AdTech to ensure compliance and user trust. The market is also set to grow more as digital adoption keeps increasing.

Key AdTech Company Insights

Some of the key players in the AdTech market include Google LLC, The Trade Desk, Inc., Adobe Inc., and Magnite, Inc.

-

Google LLC operates within the AdTech space through Google Marketing Platform and Google Ads, providing tools for programmatic advertising, search advertising, and display advertising. Its DoubleClick suite provides solutions for ad serving, analytics, and campaign management. Google's extensive reach across digital platforms and integration with YouTube and other Google-owned properties make it a serious player in the market.

-

The Trade Desk, Inc. offers a self-service platform for programmatic advertising, allowing advertisers to control data-driven campaigns across multiple channels, such as display, video, audio, and connected TV. Its emphasis on transparency and data unification has led it to be the go-to option for agencies and brands that want to maximize ad spend and targeting.

-

Adobe Inc. provides Adobe Advertising Cloud, which is part of its Experience Cloud suite of tools, delivering cross-channel ad capabilities such as search, display, and video. Adobe integration with its overall analytics and creative ecosystem enables the advertiser to consolidate campaign management and assess performance adequately.

-

Magnite, Inc. is a sell-side programmatic ad specialist that offers solutions for publishers to monetize their inventory on desktop, mobile, and connected TV. Its platform accommodates private marketplaces, open auctions, and header bidding to suit the requirements of both publishers and advertisers.

PubMatic, Inc., Criteo S.A., and MediaMath are some of the emerging market participants in the market.

-

PubMatic, Inc. specializes in programmatic advertising solutions for publishers, providing inventory management, yield maximization, and header bidding tools. Its transparency and efficiency emphasis have allowed it to pick up speed in the digital advertising economy.

-

Criteo S.A. offers performance marketing solutions, with a concentration on retargeting and personalized advertising. Through its AI-based platform, it enables advertisers to send users targeted adverts based on their browsing activity, eliciting greater engagement and conversion rates.

-

MediaMath has a demand-side platform (DSP) through which advertisers are able to deliver programmatic campaigns over multiple platforms such as display, video, and mobile. With an emphasis on data-informed decision-making and audience segmentation, it is able to act as a credible rival in AdTech.

Key AdTech Companies:

The following are the leading companies in the AdTech market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- Criteo

- Facebook Incorporation

- Google Incorporation

- Microsoft Incorporation

- SpotX

- Twitter Incorporation

- Verizon

Recent Developments

-

In 2025, Taboola partnered with Microsoft to sell display ads across Microsoft's properties, including MSN and Outlook. This collaboration expanded Taboola's native advertising offerings, enabling the company to leverage Microsoft’s first-party data to enhance ad targeting and reach, providing more relevant and personalized ads to users across Microsoft's digital platforms.

-

In 2024, Meta launched its "Immersive Ad Experience" powered by augmented reality (AR) and virtual reality (VR) technologies. This innovation allows advertisers to create interactive and engaging ad formats for the metaverse, targeting users in virtual environments and enhancing brand engagement.

-

In 2024, Microsoft made Copilot generally available in the Microsoft Advertising Platform. This AI-driven feature serves as an assistant to advertisers, making it easy to create high-quality advertising campaigns. Copilot assists users in the process of creating campaigns, responding to questions in real-time and maximizing marketing activities. Through the use of generative AI, Copilot increases productivity, encourages creativity, and provides smart help, allowing marketers to concentrate more on strategic choices and improving overall campaign performance.

-

In 2024, Google launched Shopping Ads on Google Lens, leveraging the platform's 20 billion visual searches per month. The feature enables advertisers to feature products natively within visual search results, reaching users with strong commercial intent. By integrating visual search with commerce, Google diversified its AdTech capabilities, giving advertisers an innovative means to reach consumers and driving retail and e-commerce ad growth.

AdTech Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 805.85 billion |

|

Revenue forecast in 2030 |

USD 1,580.86 billion |

|

Growth rate |

CAGR of 14.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, advertising type, enterprise size, platform, industry vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia; UAE, South Africa |

|

Key companies profiled |

Adobe; Alibaba Group Holding Limited; Amazon.com, Inc.; Criteo; Facebook Incorporation; Google Incorporation; Microsoft Incorporation; SpotX; Twitter Incorporation; Verizon |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global AdTech Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global AdTech market report on the basis of solution, advertising type, enterprise size, platform, industry vertical, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Demand-Side Platforms (DSPs)

-

Supply-Side Platforms (SSPs)

-

Ad Networks

-

Data Management Platforms (DMPs)

-

Others

-

-

Advertising Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Programmatic Advertising

-

Search Advertising

-

Display Advertising

-

Mobile Advertising

-

Email Marketing

-

Native Advertising

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium Enterprise (SME)

-

Large Enterprise

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile

-

Web

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Media & Entertainment

-

BFSI

-

Education

-

Retail & Consumer Goods

-

IT & Telecom

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AdTech market size was estimated at USD 719.62 billion in 2024 and is expected to reach USD 805.55 billion in 2024.

b. The global AdTech market is expected to grow at a compound annual growth rate of 14.4% from 2025 to 2030, reaching USD 1580.86 billion by 2030.

b. North America led the overall market in 2024, gaining a market share of 35.3%, with the U.S. being a major contributor to the industry. The high penetration of digital advertising is one factor propelling the growth of the North American adtech market.

b. Some key players operating in the AdTech market include Adobe, Alibaba Group Holding Limited, Amazon.com, Inc., Criteo, Facebook Incorporation, Google Incorporation, Microsoft Incorporation, SpotX, Twitter Incorporation, and Verizon.

b. The growth of AdTech market is anticipated to grow rapidly in recent years as the market has experienced increasing investment in data, automation, artificial intelligence, and programmatic advertising. The companies in the adtech space are providing solutions that help advertisers to target the right audiences, optimize their ad spending, and measure the performance of their campaigns.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."