Adhesion Promoter Market Size, Share & Trends Analysis Report By Product (Silane, Maleic Anhydride), By Application (Plastics & Composites, Paints & Coatings), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-882-4

- Number of Report Pages: 145

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Adhesion Promoter Market Size & Trends

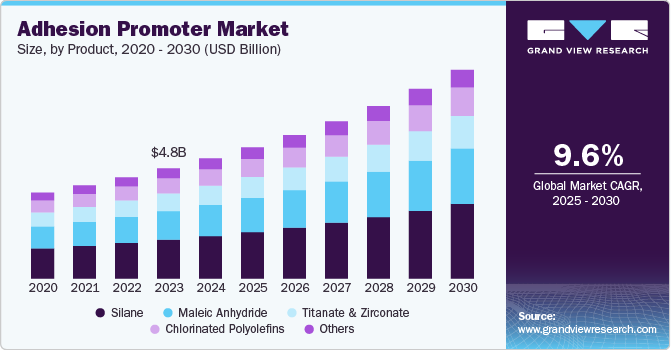

The global adhesion promoter market size was estimated at USD 5.21 billion in 2024 and is projected to grow at a CAGR of 9.6% from 2025 to 2030. Rising demand for better adhesion in the composites & plastics sector is projected to boost the market demand over the forecast period. Technological innovations have introduced new avenues for high-performance waterborne formulations & non-chlorinated promoters that provide higher versatility in curing, with improvised performance in applications such as printing inks, adhesives, plastics & composites, automotive and electronics.

A significant trend in the market is the increasing demand for eco-friendly and sustainable products. With growing environmental concerns and stricter government regulations, industries are shifting towards green alternatives. This is particularly evident in the automotive, construction, and packaging sectors, where businesses are seeking adhesion promoters that are low in volatile organic compounds (VOCs) and free from hazardous chemicals. The adoption of water-based and bio-based adhesion promoters is rising as they meet both performance and regulatory standards, driving their market penetration.

Drivers, Opportunities & Restraints

The expanding automotive and electronics industries are key drivers for the market growth. Adhesion promoters play a crucial role in improving the bond between coatings, inks, or adhesives and the surface of materials such as metals, plastics, and glass. With advancements in automotive design, such as lightweighting and the use of composite materials, the need for reliable adhesion has grown. Similarly, in electronics, miniaturization and complex circuitry require robust adhesion solutions. These industries' steady growth and technological innovations are fueling the demand for high-performance adhesion promoters.

The rise of electric vehicles (EVs) presents a significant opportunity for the market. EVs require advanced materials and lightweight components to improve energy efficiency and range. Adhesion promoters are essential in bonding dissimilar materials, such as metals and plastics, used in battery systems, interior parts, and structural components. As EV production increases globally, particularly in regions like Europe, North America, and Asia-Pacific, there is a growing need for innovative adhesion solutions that enhance durability and performance in these applications, opening up new avenues for market expansion.

Despite its potential, the volatility in raw material prices, particularly petroleum-based resins, remains a significant restraint for the market. One major restraint for the adhesion promoter market is the fluctuation in raw material prices. Adhesion promoters often rely on petrochemical-based feedstocks, which are subject to price volatility due to changes in crude oil prices, supply chain disruptions, and geopolitical tensions. This unpredictability increases manufacturing costs, making it difficult for producers to maintain consistent pricing and profit margins. In addition, the shift toward sustainable alternatives adds further pressure as bio-based raw materials, while eco-friendly, tend to be more expensive, complicating the overall cost structure for manufacturers.

Product Insights

Based on product, the market has been segmented into silane, chlorinated polyolefins, maleic anhydride, and titanate & zirconate. The silane segment accounted for the largest revenue share of 35.4% in 2024, owing to high demand for paints & coatings and rubber applications. Traditionally, silane was used in composite materials as a coating on filler particles to bind them to a resin matrix. It is also widely used as a coupling agent to adhere fibers to certain polymers, thus stabilizing the composite materials. High demand for these products in applications requiring moisture, temperature, and chemical resistance is expected to foster segment growth.

The maleic anhydride segment is expected to grow at the fastest CAGR during the forecast period. The product is used to increase adhesion to polar surfaces while improving water resistance and alkali solubility.

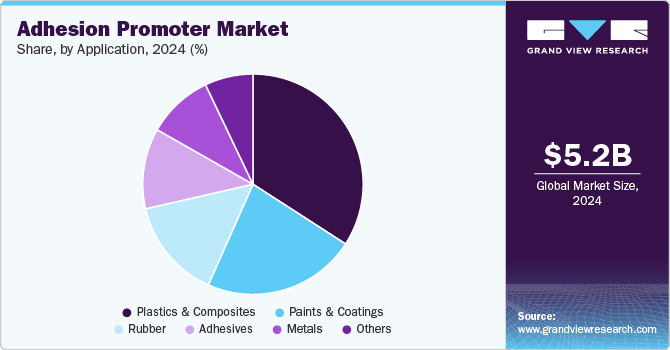

Application Insights

The plastics & composites segment accounted for the largest revenue share of 34.1% in 2024 and is expected to grow at a rapid CAGR over the forecast period. These materials are mainly used to manufacture precision-engineered products, owing to advantageous product properties that include chemical resistance, lightweight, and flexibility.

Plastic components need painting, coating, and joining with adhesive to prevent bond failure at the interface. Segment growth is likely to be driven by the growing consumption of plastics in the automotive industry to foster fuel savings by lowering overall car weight.

Paints and coatings are also likely to present lucrative opportunities for these promoters in construction & building materials. High product penetration is mainly on account of growing awareness regarding enhanced binding capabilities after the application of the product. Increasing demand for architectural, automotive, and industrial coatings shall also be a primary driving force in other applications over the forecast period.

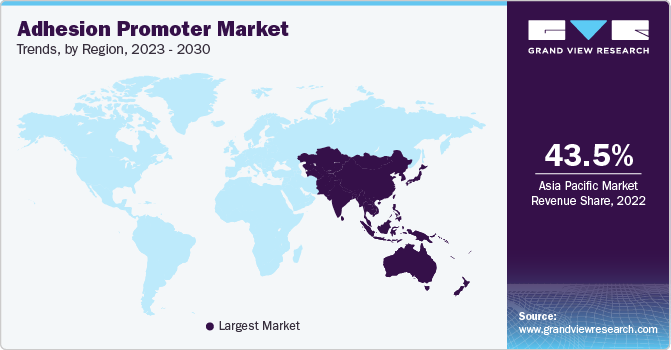

Regional Insights

The adhesion promoter market in North America is anticipated to grow at a lucrative CAGR over the forecast period. North America, a key driver for the automotive plastic compounding market is the growing emphasis on sustainability and recyclability. Consumers and regulators are increasingly focused on reducing the environmental impact of vehicles, and as a result, automakers are seeking plastic compounds that are recyclable or derived from bio-based sources.

U.S. Adhesion Promoter Market Trends

The U.S. adhesion promoter market is driven by the increasing adoption of electric vehicles (EVs) and the growing trend towards vehicle lightweighting. With the government's push for cleaner energy and the rise of EV manufacturers like Tesla, there is a heightened demand for plastic compounds that help reduce vehicle weight, improving energy efficiency and driving range.

Europe Adhesion Promoter Market Trends

The adhesion promoter market in Europe is driven by stringent environmental regulations and the push towards a circular economy. The European Union's strict emissions standards, including the CO2 emission reduction targets for vehicles, are encouraging automakers to adopt lightweight plastic compounds that contribute to reduced emissions.

Asia Pacific Adhesion Promoter Market Trends

Asia Pacific adhesion promoter market dominated the global market with the largest revenue share of 45.35% in 2024, driven by the growing automotive production and the increasing shift towards lightweight materials. Countries like India, Japan, and South Korea are major automobile manufacturing hubs, and as carmakers aim to improve fuel efficiency and meet stringent emission standards, the demand for plastic compounds is rising.

China adhesion promoter market is being driven by the rapid growth of electric vehicle (EV) production and the country’s commitment to reducing carbon emissions. As the world’s largest EV market, Chinese manufacturers are increasingly using plastic compounds to replace metal parts in EVs to reduce vehicle weight and enhance energy efficiency. Government policies and subsidies aimed at promoting EV adoption, coupled with the domestic demand for cost-effective yet high-performance materials, are fueling the demand for plastic compounds in the automotive sector.

Key Adhesion Promoter Company Insights

The adhesion promoter market is highly competitive, with several key players dominating the landscape. Major companies include 3M, Arkema, Momentive, Eastman Chemical Company, Akzo Nobel N.V., Atlanta AG, Dow, Arkema SA, Air Products and Chemicals, Inc., BASF SE, Evonik Industries AG, and DuPont. The adhesion promoter market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Adhesion Promoter Companies:

The following are the leading companies in the adhesion promoter market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Arkema

- Momentive

- Eastman Chemical Company

- Akzo Nobel N.V.

- Atlanta AG

- Dow

- Arkema SA

- Air Products and Chemicals, Inc.

- BASF SE

- Evonik Industries AG

- DuPont

Recent Developments

-

In July 2023, Eastman Chemical Company introduced a new generation of adhesion promoters to help users of paint and coatings comply with legislative requirements. The Advantis adhesion promoters minimize or eliminate potentially hazardous components, enabling formulators and end users to produce consistent outcomes while enhancing product sustainability and adhering to regulations.

-

In April 2022, PPG Industries, Inc. announced the introduction of its pigmented adhesion promoter, PPG ONECHOICE ADPRO MAX, for the U.S. and Canadian markets. By offering superior topcoat adherence to uncoated bumpers, fascias, and other vehicle plastics, the single-component undercoat, with its time-saving one-coat application, eliminates the requirement to apply a sealer.

Adhesion Promoter Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5688.87 million |

|

Revenue forecast in 2030 |

USD 9.05 billion |

|

Growth rate |

CAGR of 9.6% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Base Year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

October 2024 |

|

Quantitative units |

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue & volume forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S., Canada, Mexico, Germany, France, UK, Italy, China, India, Japan, South Korea, Brazil, Argentina, South Africa, Saudi Arabia |

|

Key companies profiled |

3M, Arkema, Momentive, Eastman Chemical Company, Akzo Nobel N.V., Atlanta AG, Dow, Arkema SA, Air Products and Chemicals, Inc., BASF SE, Evonik Industries AG, DuPont |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Adhesion Promoter Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global adhesion promoter market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Silane

-

Maleic Anhydride

-

Chlorinated Polyolefins

-

Titanate & Zirconate

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics & Composites

-

Paints & Coatings

-

Rubber

-

Adhesives

-

Metals

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global adhesion promoter market size was estimated at USD 5.21 billion in 2024 and is expected to reach USD 5688.87 million in 2025.

b. The global adhesion promoter market is expected to grow at a compound annual growth rate of 9.6% from 2025 to 2030 to reach USD 9.05 billion by 2030.

b. The silane segment accounted for the largest revenue share of 35.4% in 2024, owing to high demand for paints & coatings, and rubber applications. Traditionally, silane was used in composite materials as a coating on filler particles, in order to bind them to a resin matrix. It is also widely used as a coupling agent, to adhere fibers to certain polymers, thus stabilizing the composite materials.

b. Some key players operating in the adhesion promoter market include 3M, Dow Corning Corporation, Arkema SA, Air Products & Chemicals, Inc., BASF SE, Evonik Industries AG, DuPont, and others.

b. Key factors that are driving the market growth include the rising demand for better adhesion in the composites & plastics sector. Additionally, automakers are increasingly attempting to improve road safety and fuel economy by creating ‘green tires’ using adhesion promoters such as silanes in tread compounds.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."