- Home

- »

- Plastics, Polymers & Resins

- »

-

Adherence Packaging Market Size & Share Report, 2030GVR Report cover

![Adherence Packaging Market Size, Share & Trends Report]()

Adherence Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastics, Paper), By Doses, By Packaging Type (Blisters Packs, Pouches) By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-361-7

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Adherence Packaging Market Summary

The global adherence packaging market size was valued at USD 1.03 billion in 2023 and is projected to reach USD 1.57 billion by 2030, growing at a CAGR of 6.4% from 2024 to 2030. This market growth is propelled by the growing need for effective medication management, particularly for the aging population and patients with chronic conditions.

Key Market Trends & Insights

- The North America dominated the global market in 2023.

- Based on material, the plastics segment dominated the market in 2023.

- Based on doses, the unit doses emerged as the dominant segment in 2023.

- Based on packaging type, the blister packs segment dominated the market in 2023.

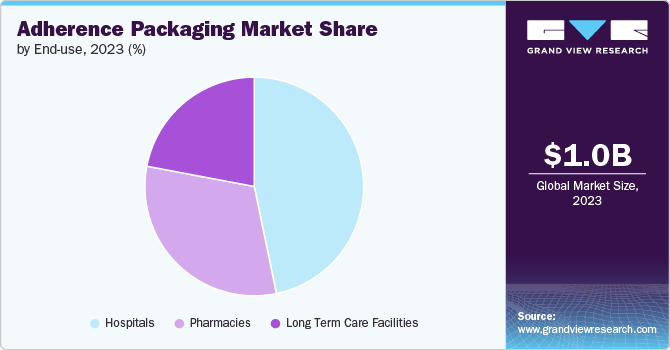

- Based on end use, hospitals emerged as the dominant segment in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.03 billion

- 2030 Projected Market Size: USD 1.57 billion

- CAGR (2024 to 2030): 6.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

This demographic shift increases demand for packaging solutions that ensure correct and timely medication intake, thus driving market growth. Technological advancements and innovations in packaging materials present significant opportunities. The integration of smart packaging solutions, such as QR codes and IoT-enabled devices, is revolutionizing the market. These smart packages provide reminders, real-time adherence tracking, and data analytics, significantly improving medication compliance. For instance, WestRock’s intelligent blister packs and Medisafe's app-integrated packaging are pioneering solutions enhancing patient adherence.

Additionally, the push towards sustainable and eco-friendly packaging materials is a key driver. Consumers and regulatory bodies are increasingly prioritizing environmental impact, prompting companies to develop biodegradable and recyclable packaging. An example is Constantia Flexibles’ launch of eco-friendly blister packs made from sustainable polymers, catering to both ecological concerns and market demands

Material Insights

The plastics segment dominated the market in 2023. Plastic remains the most widely used material in adherence packaging due to its versatility, durability, and cost-effectiveness. Its ability to be moisture resistant further makes it an ideal choice for manufacturing blister packs, pouches, and strips in adherence packaging.

Paper-based packaging is gaining traction for its recyclability and biodegradability. It is often utilized in secondary packaging and is increasingly adopted in sustainable packaging initiatives. Aluminum is valued for its excellent barrier properties, protecting medication from moisture, light, and oxygen. It is predominantly used in blister packs to ensure the integrity of pharmaceutical products.

Doses Insights

Based on doses, the adherence packaging market is segmented into unit doses and multi-doses. Among these, unit doses emerged as the dominant segment in 2023. This segment commands the highest market share and is projected to have the fastest growing CAGR. Unit dose packaging ensures precise medication adherence, reducing the risk of overdose or missed doses, which is crucial for chronic disease management.

Multi-doses packaging provides a comprehensive solution for managing complex medication regimens, though it trails unit dose packaging in market share.

Packaging Type Insights

The blister packs dominated the packaging type segment in 2023. Blister packs are user-friendly, making it easy for patients, especially the elderly, to handle their medications. The clear and organized layout helps patients to see whether they have taken their medication or not, thereby improving compliance. Also, blister packs offer a level of security by showing visible signs if tampered with, which is crucial for patient safety and maintaining the integrity of the medication

Pouches are expected to grow with a significant CAGR from 2024 to 2030. The organized format of pouches, with clear labeling and easy-to-open features, helps patients follow their medication schedules accurately. Additionally, production of pouches can be more cost-effective compared to other packaging types. This makes them a viable option for pharmaceutical companies looking to reduce packaging costs while still providing high-quality, patient-friendly solutions

End-use Insights

Hospitals dominated the end use segment in 2023. Hospitals manage a large number of patients, including those with complex medication regimens. This high volume necessitates efficient medication management systems to ensure all patients receive their medications accurately.

Pharmacies are expected to grow at a significant CAGR from 2024 to 2030. Pharmacies are the final point of contact for medication dispensing. Pharmacies already have the infrastructure and expertise for dispensing medications. Adding adherence packaging requires some adjustments, but they are familiar with handling prescriptions and patient needs. Also, adherence packaging presents a new service to offer and potentially increases profits.

Regional Insights

North America the adherence packaging market dominated the global market in 2023. The region boasts the highest market share, with the U.S. leading due to its advanced healthcare infrastructure and high adoption of innovative packaging solutions. Also, the region dominates the global pharmaceutical market in terms of pharmaceutical production which further contributes to its dominant position.

U.S. Adherence Packaging Market Trends

The adherence packaging market in the U.S. is expected to be a major market and is expected to hold a significant share. The growth of adherence packaging in the country can be attributed to its rising geriatric population. According to the Population Reference Bureau, the U.S. population aged 65 and above is projected to increase to 82 million in 2050 from 58 million in 2022. Thus, the rising geriatric population can drive pharmaceutical manufacturers to adopt adherence packaging which can help cut down the time spent in administering medication to geriatric patients.

Asia Pacific Adherence Packaging Market Trends

The Asia Pacific adherence packaging market is the fastest-growing market. Countries in the Asia Pacific region, such as China, India, and Japan, are significantly increasing their healthcare spending. This rise in healthcare investment is driving the demand for advanced healthcare solutions, including adherence packaging, to improve patient outcomes and reduce healthcare costs.

The adherence packaging market in China is expanding at a high pace, owing to the growing population and a well-established manufacturing base for packaging materials and pharmaceuticals. This translates to a readily available supply chain and potentially lower production costs for adherence packaging compared to other countries in the region.

Europe Adherence Packaging Market Trends

Europe has a growing geriatric population which often requires complex medication regimens. This can drive the demand for driving the demand for adherence packaging products since they help ensure providing dosage information on the packaging. Medication non-adherence is a significant problem in Europe, costing billions of euros annually. Adherence packaging addresses this issue by simplifying medication routines and providing visual reminders to take medications on schedule.

The adherence packaging market in Germany is expected to grow at a significant CAGR from 2024 to 2030. The introduction of various programs encouraging the creation of a national medication plan for patients on multiple medications. This plan can raise awareness of medication adherence and potentially make adherence packaging a more attractive option.

Key Adherence Packaging Company Insights

The market is characterized by intense competition among several key players and numerous smaller companies. Major pharmaceutical packaging firms and healthcare technology companies dominate the landscape, constantly innovating to improve medication adherence solutions. Besides, the market is witnessing an increase in consolidation through mergers and acquisitions as key players are seeking to expand their product portfolios and geographical reach. Additionally, emerging players are entering the market with new product launches, further intensifying the competitive environment.

Key Adherence Packaging Companies:

The following are the leading companies in the adherence packaging market. These companies collectively hold the largest market share and dictate industry trends.

- WestRock Company

- Medicine-On-Time, LLC

- Parata Systems, LLC

- Omnicell, Inc.

- AARDEX Group

- Jones Healthcare Group

- Cardinal Health

- MCKESSON CORPORATION

- Baxter

- BD

- Euclid Medical Products

- Aptar CSP Technologies, Inc.

- AmerisourceBergen Corporation

- Synergy Medical

- Manrex Ltd.

Recent Developments

-

In April 2024, Gerresheimer AG, a global provider of pharmaceutical packaging and drug delivery systems, partnered with the US digital health company RxCap to offer connected adherence solutions. Under the agreement, Gerresheimer's subsidiary Centor will receive exclusive distribution rights for pharmacies in the US for RxCap's suite of connected prescription vial closure devices and complementary cloud-based software. The partnership aims to help patients stay adherent to their medications and improve health outcomes.

-

In February 2024, Capsa Healthcare launched NexPak, an automated packaging system designed to simplify medication packaging for pharmacies. The system automates daily medication packaging into strip packaging, saving time for nurses and offering convenience and safety for patients with accurate dosages. NexPak is available as a Central Pharmacy unit and an In-Facility unit, allowing pharmacies to manage dispensing and delivery centrally or install the system inside the facility for on-demand, patient-specific pouch packets.

-

In January 2024, Jones Healthcare Group launched two new medication adherence solutions, namely FlexRx Gen 2 and FlexRx Reseal. These products are designed to improve pharmacy efficiency and flexibility. FlexRx Gen 2 features an enhanced design that allows for easier filling, sealing, and dispensing of medications. FlexRx Reseal is a new resealable medication adherence solution that enables pharmacies to repackage and reseal medications. Both the FlexRx Gen 2 and FlexRx Reseal products are aimed at helping pharmacies streamline their medication adherence processes and better serve their patients.

Adherence Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.09 billion

Revenue forecast in 2030

USD 1.57 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue Forecast, Competitive Landscape, Growth Factors and Trends

Segments covered

Material, doses, packaging type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

WestRock Company; Medicine-On-Time, LLC; Parata Systems, LLC; Omnicell, Inc.; AARDEX Group; Jones Healthcare Group; Cardinal Health; MCKESSON CORPORATION; Baxter; BD; Euclid Medical Products; Aptar CSP Technologies, Inc.; AmerisourceBergen Corporation; Synergy Medical; Manrex Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Adherence Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented global adherence packaging market report based on the material, doses, packaging type, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Paper

-

Aluminum

-

-

Doses Outlook (Revenue, USD Million, 2018 - 2030)

-

Unit-Dose Packaging

-

Multi-dose Packaging

-

-

Packaging Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pouches

-

Blister Packs

-

Strips

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Pharmacies

-

Long-term Care Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global adherence packaging market size was estimated at USD 1.03 billion in 2023 and is expected to reach USD 1.09 billion in 2024.

b. The global adherence packaging market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030, reaching USD 1.57 billion by 2030.

b. The adherence packaging market is segmented into unit doses and multi-doses based on doses. In 2023, unit doses emerged as the dominant segment. This segment commands the highest market share and is projected to have the fastest-growing CAGR. Unit dose packaging ensures precise medication adherence, reducing the risk of overdose or missed doses, which is crucial for chronic disease management.

b. Key players in the market include WestRock Company; Medicine-On-Time, LLC; Parata Systems, LLC; Omnicell, Inc.; AARDEX Group; Jones Healthcare Group; Cardinal Health; MCKESSON CORPORATION; Baxter; BD; Euclid Medical Products; Aptar CSP Technologies, Inc.; AmerisourceBergen Corporation; Synergy Medical; and Manrex Ltd.

b. The global Adherence Packaging market growth is propelled by the growing need for effective medication management, particularly for the aging population and patients with chronic conditions. This demographic shift increases demand for packaging solutions that ensure correct and timely medication intake, thus driving market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.