- Home

- »

- Medical Devices

- »

-

Acute Wound Care Market Size, Share, Growth Report, 2030GVR Report cover

![Acute Wound Care Market Size, Share & Trends Report]()

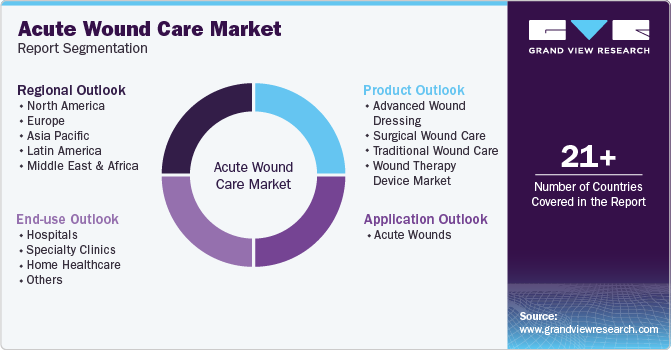

Acute Wound Care Market Size, Share & Trends Analysis Report By Product (Advanced Wound Dressing, Surgical Wound Care), By Application (Surgical & Traumatic Wounds, Burns), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-945-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Acute Wound Care Market Size & Trends

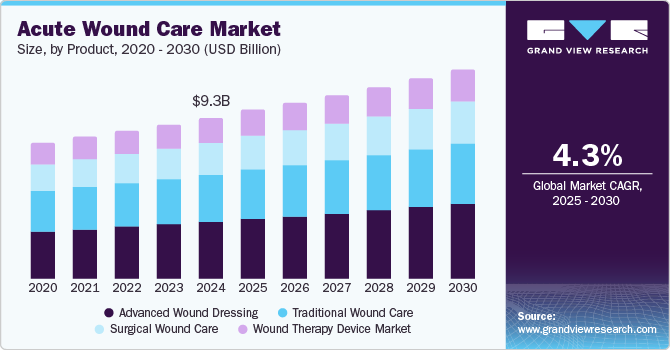

The global acute wound care market size was estimated at USD 9.3 billion in 2024 and is projected to grow at a CAGR of 4.3% from 2025 to 2030. The increase in demand for acute wound care products can be attributed to a rise in surgical cases globally. An increase in the number of accidents, traumatic injuries, and surgeries performed has resulted in the demand for wound care solutions. A growing number of patients suffering from illnesses such as diabetes and obesity has resulted in the increased occurrence of surgical wounds as these disorders increase the chances of wounds and infections. Hence, increased demand for wound management due to these disorders has contributed to the market growth.

In addition, a rise in traumatic accidents such as crush injuries, road accidents, and assaults is expected to drive the market. According to the World Health Organization (WHO), road traffic injuries are the leading cause of death for the population aged between 5 and 29. Therefore, there is an increased demand for wound management and treatments. Major companies are investing in research and development to improve the healing qualities of wound treatment products and therapy devices.

The rising incidence of various burn injuries may also help the market grow. According to WHO, 180,000 deaths are caused by burn injuries. The increasing prevalence of diseases such as diabetes and obesity has led to a rise in patients suffering from chronic wounds. There is an increase in the number of patients with diabetic leg ulcers and foot ulcers. To cope with the rising demand for acute wound care products, the market players are undergoing strategic initiatives such as product launches, conducting awareness programs, geographic expansion, and mergers & acquisitions. Furthermore, development in the healthcare sector and the easy availability of medical treatments have contributed to the market growth.

Product Insights

The advanced wound dressing segment dominated the market in 2024 with a share of 34.9% owing to the rising incidence of burns, the advantages of advanced wound dressing, and increased investments by government and private medical institutes in research and development to improve wound dressing products. There is an increased demand for wound dressing products that aid in fast healing and infection prevention. Furthermore, the rising number of road accidents and crash injuries has increased the demand for wound dressing treatments.

The surgical wound care segment is expected to grow at a CAGR of 4.4% during the forecast period. The global rise in surgical cases is expected to propel market growth. Growth in the healthcare sector has resulted in the availability of technologically advanced surgical procedures and equipment. Therefore, this has increased awareness among the population regarding the availability of surgical procedures. The increasing geriatric population and growing instances of road accidents and crash injuries have further propelled the market growth of this segment. Hence, these factors have resulted in the market growth of this segment.

Application Insights

The surgical and traumatic wound segment dominated the market in 2024 with a share of 80.1%. The market growth is attributed to the rising number of surgical site infections (SSIs). Surgical wounds majorly occur due to SSIs, and the rising incidence rate of SSIs is predicted to boost segment growth. Furthermore, the rising number of non-fatal injuries requiring medical attention and the easy availability of wound treatment products for wound management have contributed to the market growth. Hence, these factors are responsible for the market growth of this segment.

The burns segment is expected to grow at a CAGR of 4.1% during the forecast period, owing to the increasing cases of burn injuries worldwide. According to the American Burn Association, 398,000 burn injuries received medical treatment in the U.S. Moreover, technological advancements have been made to cure burn marks. Major companies are launching wound care products that have improved healing properties. Therefore, these factors aid in the market growth of this segment.

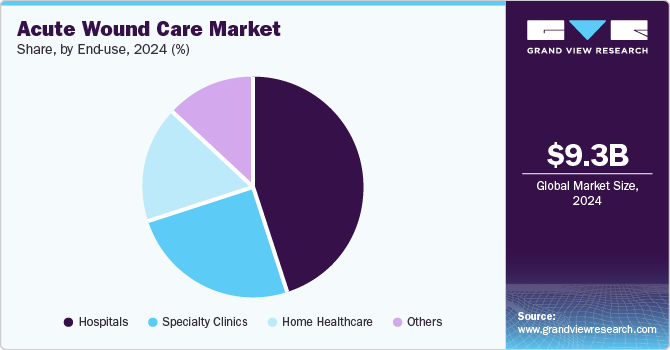

End Use Insights

The hospital segment dominated the market in 2024 with a share of 45.4% of the rising hospitalization and increasing incidence of surgical site infections in hospitals. Development in the healthcare sector has resulted in hospitals adopting the use of technologically advanced surgical equipment and treatments. Initiatives taken by government and private medical institutes to improve the availability of various surgeries to the population have further enhanced the growth of this segment. Furthermore, the increase in disposable income has led to patients seeking costly surgeries available in hospitals. Therefore, there is an increase in the demand for wound management in hospitals. These factors have resulted in the segment’s growth.

The home healthcare segment is projected to grow at a CAGR of 5.0% during the forecast period. This market growth is attributed to the rising geriatric population and increased treatment costs in hospitals and ambulatory surgical centres, which is expected to fuel the demand for home healthcare practice. Increased awareness regarding at-home treatments due to their affordability and customisation to the patient has resulted in major companies investing in producing wound care products compatible with at-home usage. Hence, these factors have contributed to the market growth of this segment.

Regional Insights

North America acute wound care market dominated with the market share of 45.5% in 2024. The growth can be attributed to factors such as several key market players in this region, growing demand for high-quality healthcare services, well-established healthcare infrastructure, and favourable reimbursement policies and regulatory reforms in the healthcare sector. In addition, the rising geriatric population in this region is expected to raise the demand for acute wound care products. According to the Population Reference Bureau, the population above 65 in the U.S. is projected to grow from 58 million in 2022 to 82 million by 2050, an increase of 47.0%. Therefore, there is an increase in surgical procedures and wound management as the senior population is more susceptible to wounds. Thus, these factors have resulted in the market growth of this region.

U.S. Acute Wound Care Market Trends

The U.S. acute wound care market held a substantial revenue share in North America owing to the presence of a developed healthcare sector and major companies in the country. The rising number of road accidents and crash injuries has increased the demand for wound care procedures in the country. According to the National Highway Traffic Safety Administration, 40,990 people died due to vehicle crashes in 2024. Furthermore, the rising geriatric population requiring surgical treatments has contributed to the market growth because geriatric patients are more susceptible to wounds. Hence, these factors contribute to the country's market growth.

Europe Acute Wound Care Market Trends

The Europe acute wound care market was identified as a lucrative region in this industry, with a market share of 26.1% in 2024. This growth was attributed to the growing number of surgical procedures requiring wound management and the presence of major medical facilities in the region. Growth in the healthcare sector and an increase in the disposable income of the population have resulted in increased demand for surgical operations. Hence, this has led to a rise in the demand for wound management. Therefore, these factors have resulted in market growth in this region.

The UK acute wound care market is expected to grow rapidly due to the rising number of surgical procedures and the increasing prevalence of road accidents and other crash injuries among the population. Major companies are investing in the launch of improved wound management products to mitigate the demand from hospitals and in-house treatments. Furthermore, the rising number of patients suffering from wounds caused by diseases such as diabetes and obesity has contributed to the market growth in this country.

Asia Pacific Acute Wound Care Market Trends

The acute wound care market in Asia Pacific held a share of 16.1% in 2024. The growth can be accredited to the rising population, road accidents, and increasing surgical procedures in this region. The rising number of surgical procedures has increased the risk of surgical site infections, increasing demand for high-quality wound management dressings and treatments. Furthermore, the rising population in countries such as China, India, and Japan has increased the number of surgical procedures performed, resulting in the increased usage of wound management products. Therefore, these factors aid in the market growth in this region.

China acute wound care market dominated the Asia Pacific in 2024. The factors responsible for the market growth in the country are the rising geriatric population requiring surgical procedures and the increase in the number of crash injuries among the population. The rise in the number of patients suffering from wounds caused by diseases such as diabetes has further increased the demand for wound management. Furthermore, increased awareness regarding surgical procedures and favourable reimbursement policies given by the government has increased the number of surgeries performed in the country. Hence, this has led to an increase in the demand for wound care treatments and products.

Key Acute Wound Care Company Insights

Some major companies in the market are 3M, Coloplast Corp, Medline Industries, Inc., Smith + Nephew, Medtronic, and others. To strengthen their foothold in the market, companies are adopting strategies such as mergers and acquisitions, partnerships, and new product launches.

-

ConvaTec Group PLC is a company that produces medical products and technologies. The company focuses on solutions for managing chronic conditions, advanced wound care, ostomy care, continence care, and infusion care.

-

Coloplast Corp is a medical company that develops products and services for medical conditions. The company specializes in ostomy, urology, continence, and wound care services.

Key Acute Wound Care Companies:

The following are the leading companies in the acute wound care market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Coloplast Corp

- Medline Industries, Inc.

- Smith + Nephew

- Medtronic

- ConvaTec Group PLC

- Integra LifeSciences

- Ethicon (Johnson & Johnson)

- Baxter

- Molnlycke Health Care AB

View a comprehensive list of companies in the Acute Wound Care Market

Recent Developments

-

In May 2024, ConvaTec Group PLC. announced the clinical results from a multinational, randomized controlled trial (RCT) showcasing the advancements in healing venous leg ulcers with AQUACEL Ag+ Extra compared to standard care dressing. The study found that AQUACEL Ag+ Extra aided in the healing of the venous leg ulcer, with a 31% chance of completely healing the wound in 12 weeks.

-

In January 2023, Coloplast Corp. announced the launch of Biatain Silicone Fit for pressure injury prevention and wound management in the U.S. The launch was aimed at expanding the company's position in advanced wound care by launching a new silicone foam that will benefit healthcare professionals and patients.

Acute Wound Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.69 billion

Revenue forecast in 2030

USD 11.96 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

3M; Coloplast Corp.; Smith & Nephew; Medtronic; ConvaTec Group PLC; Derma Sciences (Integra LifeSciences); Ethicon (Johnson & Johnson); Baxter International; Molnlycke Health Care AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acute Wound Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global acute wound care market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Wound Dressing

-

Foam Dressing

-

Hydrocolloid Dressing

-

Film Dressing

-

Alginate Dressing

-

Hydrogel Dressing

-

Collagen Dressing

-

Other Advanced Dressing

-

-

Surgical Wound Care

-

Sutures & Staples

-

Tissue Adhesive & Sealants

-

Anti-infective Dressing

-

-

Traditional Wound Care

-

Medical Tapes

-

Cleansing Agents

-

Others

-

-

Wound Therapy Device Market

-

Negative Pressure Wound Therapy

-

Oxygen & Hyperbaric Oxygen Equipment

-

Electric Stimulation Devices

-

Pressure Relief Devices

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global acute wound care market size was estimated at USD 9.3 billion in 2024 and is expected to reach USD 9.69 billion in 2025.

b. The global acute wound care market is expected to grow at a compound annual growth rate of 4.3% from 2025 to 2030 to reach USD 11.96 billion by 2030

b. The advanced wound dressing dominated the acute wound care market in 2024 with a market share of 34.7% and is expected to witness the fastest growth over the forecast period due to technological advancements, rising cases of acute wounds, and an increase in the number of sports-related injuries.

b. Some key players operating in the wound care market include 3M, Coloplast Corp., Medline Industries, Smith & Nephew, Medtronic, ConvaTec Group PLC, Derma Sciences (Integra LifeSciences), Ethicon (Johnson & Johnson), Baxter International, Molnlycke Health Care AB

b. Key factors that are driving the acute wound care market growth include the increasing prevalence of traumatic accidents , the increase in a number of surgical procedures, and changing lifestyles are anticipated to drive the growth of the wound care market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."