- Home

- »

- Pharmaceuticals

- »

-

Acute Myeloid Leukemia Treatment Market Size Report, 2030GVR Report cover

![Acute Myeloid Leukemia Treatment Market Size, Share & Trends Report]()

Acute Myeloid Leukemia Treatment Market Size, Share & Trends Analysis Report By Disease (Myeloblastic Leukemia, Myelomonocytic Leukemia), By Treatment (Chemotherapy), By Route Of Administration, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-384-0

- Number of Report Pages: 175

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

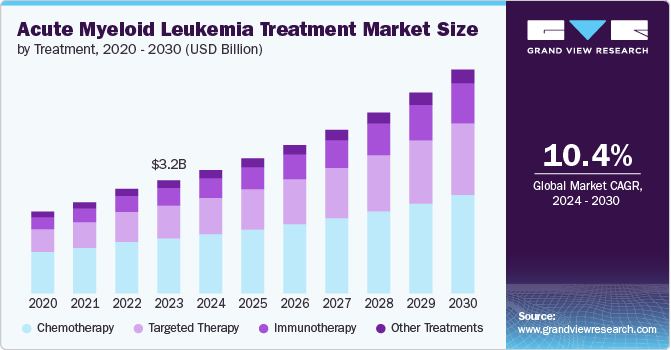

The global acute myeloid leukemia treatment market size was estimated at USD 3.18 billion in 2023 and is expected to grow at a CAGR of 10.44% from 2024 to 2030. The increasing need for advanced therapeutics is also a high-impact rendering driver of this market. Rising incidences of acute myeloid leukemia therapeutics are attributed to factors such as genetic mutations, unhealthy lifestyles, continued exposure to hazardous chemicals such as benzene, and radiation exposure. Moreover, the increasing geriatric population base and growing unmet healthcare needs are expected to boost the market growth further. According to the estimates given by American Cancer Society in 2024, around 20,800 people were diagnosed with Acute Myeloid Leukemia.

The market for Acute Myeloid Leukemia (AML) treatment is driven by several key factors related to therapeutics and treatments. One significant driver is the continuous advancement and approval of novel therapies. For instance, in July 2023, the FDA approved quizartinib (Vanflyta) in combination with standard chemotherapies for the treatment of adult patients with newly diagnosed FLT3-ITD positive AML. This approval highlights the importance of targeted therapies that address specific genetic mutations in AML, improving patient outcomes and expanding treatment options. Such advancements not only enhance the efficacy of treatment regimens but also provide new hope for patients with limited options under conventional therapies.

Another major driver is the significant investment in research and development by pharmaceutical companies. For instance, a USD 6 million grant awarded in December 2023 for developing novel therapies targeting high-risk AML patients reflects the strong commitment to innovation in the field. This investment is crucial for discovering new treatment modalities and improving existing ones, thus driving market growth. Additionally, collaborations and partnerships among pharmaceutical companies, research institutions, and academic centers are pivotal in accelerating the development of new AML therapies, further stimulating market expansion.

Despite these advancements, the AML treatment market faces several restraints. One of the primary challenges is the high cost associated with new therapies. The development, approval, and commercialization of innovative treatments often come with substantial expenses, making them expensive for patients and healthcare systems. This financial burden can limit access to the latest treatments, especially in low- and middle-income countries, thereby hindering the overall market growth.

Another significant restraint is the adverse side effects associated with AML treatments. While chemotherapy remains a cornerstone of AML treatment, it can cause severe side effects such as fatigue, nausea, and increased risk of infections. These side effects can significantly impact the quality of life for patients and sometimes lead to treatment discontinuation. Even newer targeted therapies, despite their precision, can pose challenges to patient tolerance. For instance, the combination of venetoclax with other treatments, while promising, has shown side effects that necessitate careful management.

Furthermore, the stringent regulatory environment poses another challenge. The approval process for new drugs is rigorous, requiring extensive clinical trials to ensure safety and efficacy. While these regulations are essential for patient safety, they can delay the introduction of new therapies to the market. This prolonged approval process can be a barrier to the timely availability of innovative treatments, impacting the market's ability to respond quickly to emerging therapeutic needs.

Disease Insights

The myeloblastic leukemia segment accounted for the largest market share of 42.83% in 2023. This prominence is largely attributed to this disease type's high incidence and prevalence, which drives significant demand for effective treatments. The robust size of this market segment is also supported by the continuous development of new therapies and the improvement of existing treatments. For instance, in July 2023, the FDA approved a new targeted treatment for AML, quizartinib, combined with standard chemotherapies, specifically addressing genetic mutations found in some AML patients.

Further investment in research is evident with significant funding, such as the USD 6M grant awarded by Genome Canada in December 2023. This funding is allocated for developing a novel therapy targeting high-risk AML patients, highlighting the ongoing commitment to advancing treatment options in this segment. These strategic initiatives not only enhance the therapeutic landscape but also promise better clinical outcomes, thereby reinforcing the segment's substantial size within the AML market.

The Promyelocytic leukemia segment is expected to grow at the fastest CAGR during the forecast period. This rapid growth is driven by the development of targeted therapies and a growing understanding of the disease's molecular basis, which leads to more effective and tailored treatment approaches. The segment's expansion is catalyzed by innovations in treatment strategies and drugs that specifically target the unique characteristics of promyelocytic leukemia cells.

The market is witnessing a significant transformation with the introduction of drugs like arsenic trioxide and all-trans retinoic acid (ATRA), which have revolutionized the treatment paradigm for this leukemia type. These advancements not only improve survival rates but also reduce the long-term side effects associated with conventional chemotherapy. The focused research on molecular and genetic therapies tailored to treat promyelocytic leukemia further stimulates the rapid development and adoption of new treatments, propelling the growth of this market segment at an unprecedented pace.

Treatment Insights

The chemotherapy segment accounted for the largest market share of 48.67% in 2023. Due to its established role as a primary treatment modality. Despite advancements in targeted therapies, chemotherapy's breadth of application across various AML subtypes solidifies its dominance. The enduring reliance on chemotherapy is underpinned by its proven efficacy in achieving remission in AML patients, particularly when used in induction therapy. Recent FDA approvals, such as quizartinib in combination with standard chemotherapies for specific genetic mutations in AML patients, highlight ongoing advancements within this segment and its critical role in standard care protocols.

Furthermore, the integration of chemotherapy with newer targeted treatments, as seen with the combination of low-dose cytarabine and newer agents like glasdegib, continues to improve outcomes for older adults and those with significant comorbidities, who may not tolerate intensive chemotherapy. This strategic use of chemotherapy, both as a standalone and in combination regimens, ensures its large market share and continued relevance in AML treatment strategies.

The immunotherapy segment is expected to grow at the fastest CAGR of 12.63% during the forecast period. The space is driven by breakthroughs in targeted treatments and monoclonal antibodies that enhance the immune system's ability to combat leukemia cells. The rapid growth of this segment is propelled by clinical success and FDA approvals of treatments such as venetoclax, which targets specific pathways involved in cancer cell survival.

The appeal of immunotherapy lies in its potential to provide durable remissions with fewer side effects compared to conventional chemotherapy. Ongoing clinical trials and research are continuously expanding the application of immunotherapy in AML, focusing on combining it with other treatment modalities to improve efficacy and reduce resistance. The adaptability of immunotherapy, along with significant investments in research and development by major pharmaceutical companies, is setting the stage for its accelerated growth and increasing importance in the AML therapeutic landscape.

Route of Administration Insights

The parenteral route segment accounted for the largest market share of 66.67% in 2023. This dominance is largely because the most effective and commonly used AML chemotherapies, such as cytarabine and anthracycline-based drugs, are administered intravenously. This method allows for quick absorption of the drug into the bloodstream, providing a direct, controlled dose to target cancer cells effectively.

Additionally, the serious nature of AML often requires rapid therapeutic action that parenteral administration can offer, making it essential for initial intensive treatment phases that aim for remission induction. The efficacy and immediate action of intravenous treatments are crucial for managing acute cases, where time plays a critical role in patient outcomes. Advances in parenteral therapies in 2023, such as the FDA's approval of new combinations of existing drugs, continue to underscore the segment's pivotal role in AML treatment.

The oral segment is expected to grow at the fastest CAGR during the forecast period. The segment’s growth is driven by the development and approval of new oral medications that promise ease of administration and the potential for outpatient treatment settings. Oral drugs such as IDH inhibitors (e.g., ivosidenib) and BCL-2 inhibitors (e.g., venetoclax), which have shown efficacy in treating specific subtypes of AML, are at the forefront of this growth. These medications cater to a growing preference for treatments that maintain efficacy while providing greater convenience and quality of life.

The growth is also supported by clinical advancements and regulatory approvals in 2024, enhancing the credibility and adoption of oral therapies in clinical practice. The trend towards oral medications reflects a broader shift in oncology towards less invasive treatment options that can be administered at home, reducing hospital stays and potentially lowering treatment costs. This convenience factor, coupled with improved patient compliance and satisfaction, propels the oral segment as the fastest-growing in the AML treatment market.

End-use Insights

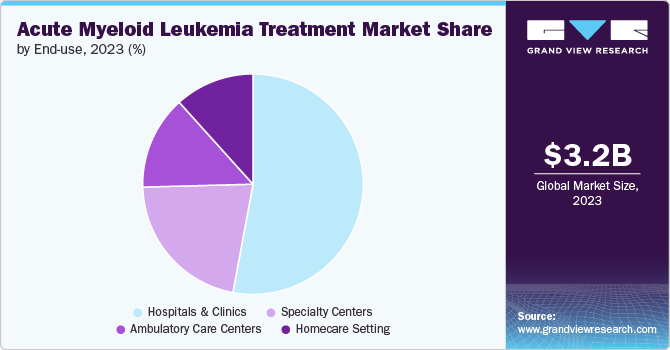

The hospitals and clinics segment accounted for the largest market share of 52.92% in 2023. This is primarily due to the complex nature of AML, which requires sophisticated diagnostic tools, specialized healthcare professionals, and advanced facilities for effective treatment management. Hospitals and clinics are equipped to provide comprehensive care, including high-dose chemotherapy and stem cell transplants, which are often necessary in AML treatment protocols.

The infrastructure of hospitals allows for the integration of multi-disciplinary teams needed for AML management, including hematologists, oncologists, nurses, and support staff, ensuring a coordinated treatment approach. In 2023, the reliance on hospitals for AML treatment was further emphasized with the introduction of newer, advanced therapies requiring controlled administration and monitoring, highlighting their critical role in delivering intensive care.

The homecare segment is expected to grow at the fastest CAGR of 13.31% during the forecast period. This growth is driven by the increasing availability of oral chemotherapeutics and targeted therapies, which can be safely administered at home. The shift towards homecare is facilitated by advancements in telehealth and remote monitoring technologies, allowing healthcare providers to offer continuous support and management of AML patients from a distance.

In 2024, the expansion of homecare services was influenced by healthcare policies aiming to reduce hospital readmissions and the burden on healthcare facilities, while also improving patient quality of life by allowing them to receive treatment in the comfort of their homes. The adoption of homecare settings is further supported by the development of patient education programs and home health services, ensuring that patients receive safe and effective treatment outside of hospital settings.

Regional Insights

North America acute myeloid leukemia treatment market accounted for the largest market share of 37.67% in 2023. In North America, the Acute Myeloid Leukemia (AML) treatment market is witnessing several key trends. One significant trend is the increasing adoption of targeted therapies and immunotherapies in treating AML. These innovative treatments are showing results in clinical trials and are expected to revolutionize AML therapy in the region. Additionally, there is a growing focus on precision medicine approaches, which aim to tailor treatment strategies based on the genetic profile of individual patients.

U.S. Acute Myeloid Leukemia Treatment Market Trends

The acute myeloid leukemia treatment market in the U.S. is influenced by one key trend which is the stringent regulatory environment governing drug approvals and clinical trials in the country. The U.S. Food and Drug Administration (FDA) is crucial in evaluating and approving new AML therapies, ensuring patient safety and efficacy standards are met. Furthermore, the high healthcare expenditure in the U.S. enables patients to access advanced treatments, contributing to the rapid adoption of novel therapies in the market.

Europe Acute Myeloid Leukemia Treatment Market Trends

Europe acute myeloid leukemia treatment market in is characterized by evolving trends shaped by regulatory frameworks and cultural factors unique to the region. One trend is the emphasis on cost-effectiveness and value-based healthcare systems across European countries. Health technology assessment agencies evaluate new therapies based on their clinical benefits and economic impact, influencing market access for AML treatments.

Asia Pacific Acute Myeloid Leukemia Treatment Market Trends

The acute myeloid leukemia treatment market in Asia Pacific presents distinct trends in AML treatment driven by economic factors, regulatory landscapes, and cultural nuances. In countries such as China and Japan, there is a growing demand for innovative therapies due to the increasing prevalence of AML cases, coupled with improved healthcare infrastructure. Regulatory bodies in the Asia Pacific are working towards streamlining approval processes for new drugs to expedite patient access to advanced treatments.

Key Acute Myeloid Leukemia Treatment Company Insights

The market is characterized by a dynamic competitive landscape, with pharmaceutical giants, biotechnology innovators, diagnostics companies, and healthcare institutions vying for market share-pharmaceuticals who are launching innovative targeted therapies, immunotherapies, and personalized treatments. For instance, in July 2023, the FDA recently approved quizartinib (Vanflyta) to be used alongside standard chemotherapies to treat newly diagnosed acute myeloid leukemia (AML) in adult patients with a specific genetic mutation known as FLT3-ITD.

Key Acute Myeloid Leukemia Treatment Companies:

The following are the leading companies in the acute myeloid leukemia treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Astellas Pharma Inc.

- Bristol Myers Squibb Company

- Celgene Corporation

- Daiichi Sankyo Company, Limited

- Jazz Pharmaceuticals, plc

- Novartis AG

- Otsuka Pharmaceuticals Co., Ltd.

- Pfizer, Inc.

- Rigel Pharmaceuticals, Inc.

- Merck & Co., Inc.

- Sanofi

Recent Developments

-

In April 2024, Actinium revealed the results of the Phase 3 SIERRA trial for Iomab-B, showing a survival advantage in patients with high-risk relapsed or refractory acute myeloid leukemia who have TP53 mutations. These findings were accepted for oral presentation at the 50th European Bone Marrow Transplant Annual Meeting.

-

In December 2023, Venetoclax combined with Azacitidine and novel targeted therapies resulting from research advancements. The combination of venetoclax and Azacitidine emerged as a significant advancement in the treatment of acute myeloid leukemia (AML), particularly for older patients or those ineligible for intensive chemotherapy.

Acute Myeloid Leukemia Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.47 billion

Revenue forecast in 2030

USD 6.29 billion

Growth rate

CAGR of 10.44% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease, treatment, route of administration, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa;Saudi Arabia UAE; Kuwait

Key companies profiled

Astellas Pharma Inc.; Bristol Myers Squibb Company; Celgene Corporation; Daiichi Sankyo Company; Limited; Jazz Pharmaceuticals, plc; Novartis AG; Otsuka Pharmaceuticals Co., Ltd.; Pfizer, Inc.; Rigel Pharmaceuticals, Inc.; Merck & Co., Inc.; Sanofi

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acute Myeloid Leukemia Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research segmented the global acute myeloid leukemia treatment market report based on disease, treatment, route of administration, end-use, and region.

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Myeloblastic Leukemia

-

Myelomonocytic Leukemia

-

Promyelocytic Leukemia

-

Monocytic Leukemia

-

Other Diseases

-

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemotherapy

-

Anti-metabolites

-

Alkylating Agents

-

Anthracycline Drugs

-

Others

-

-

Targeted Therapy

-

FLT3 Inhibitors

-

Rydapt

-

Vanflyta

-

Xospata

-

-

IDH Inhibitors

-

Tibsovo

-

Rezlidhia

-

Idhifa

-

-

Mylotarg

-

BCL-2 Inhibitor

-

Venclexta

-

-

Hedgehog Pathway Inhibitor

-

Daurismo

-

-

-

Immunotherapy

-

Bispecific Antibodies

-

Antibody-drug Conjugates

-

Immune Checkpoint Inhibitors

-

Chimeric Antigen Receptor (CAR) T-cell Therapy

-

-

Other Treatments

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Parenteral

-

Oral

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital and Clinics

-

Specialty Centers

-

Homecare Settings

-

Ambulatory Care Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global acute myeloid leukemia treatment market size was estimated at USD 3.18 billion in 2023 and is expected to reach USD 3.47 billion in 2030.

b. The global acute myeloid leukemia treatment market is expected to expand at a compound annual growth rate (CAGR) of 10.44% from 2024 to 2030 to reach USD 6.29 billion by 2030.

b. The Myeloblastic leukemia segment accounted for the largest market share of 42.83% in 2023. This prominence is largely attributed to the high incidence and prevalence of this disease type, which drives significant demand for effective treatments

b. Some key players operating in the acute myeloid leukemia treatment market include Astellas Pharma Inc., Bristol Myers Squibb Company, Celgene Corporation, Daiichi Sankyo Company, Limited, Jazz Pharmaceuticals, plc, Novartis AG, Otsuka Pharmaceuticals Co., Ltd., Pfizer, Inc., Rigel Pharmaceuticals, Inc., Merck & Co., Inc., Sanofi

b. Key factors that are driving the market growth include increasing need for advanced therapeutics, rising incidences of acute myeloid leukemia therapeutics, increasing geriatric population base, and growing unmet healthcare needs

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."