- Home

- »

- Clothing, Footwear & Accessories

- »

-

Activewear Market Size, Share And Trends Report, 2030GVR Report cover

![Activewear Market Size, Share & Trends Report]()

Activewear Market (2025 - 2030) Size, Share & Trends Analysis Report By End-use (Men, Women, Kids), By Distribution Channel (In-store, Online), By Region (North America, Asia Pacific, Europe), And Segment Forecasts

- Report ID: GVR-4-68039-925-9

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Activewear Market Summary

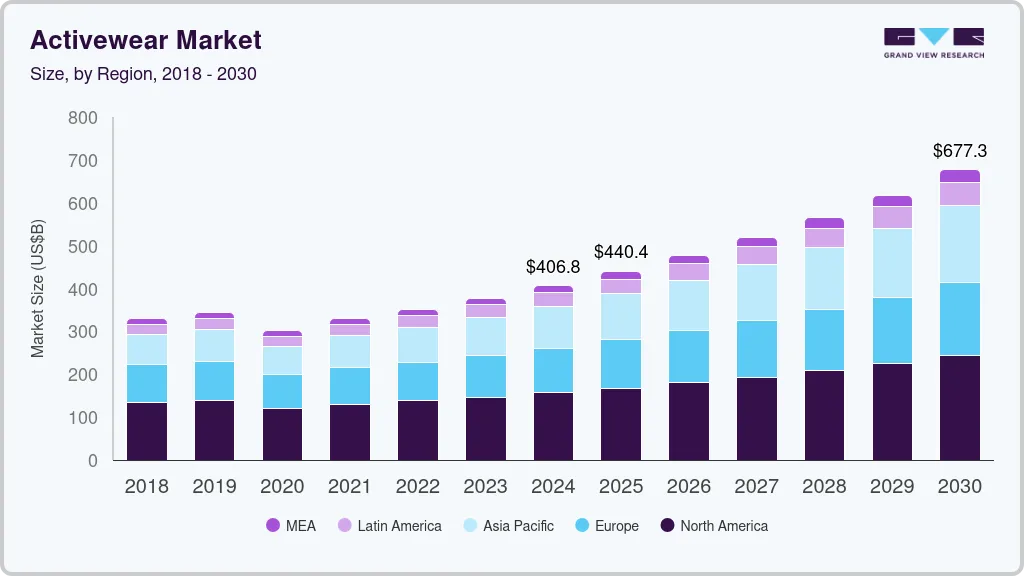

The global activewear market size was estimated at USD 406.83 billion in 2024 and is projected to reach USD 677.26 billion by 2030, growing at a CAGR of 9.0% from 2025 to 2030. The growth is attributed to the rising inclination toward modern clothing in the gym and for everyday activities.

Key Market Trends & Insights

- North America activewear market accounted for a revenue share of 38.46% in 2024.

- The activewear market in the U.S. is expected to grow at a CAGR of 7.6% from 2025 to 2030.

- By end-use, women accounted for a revenue share of 47.62% in 2024.

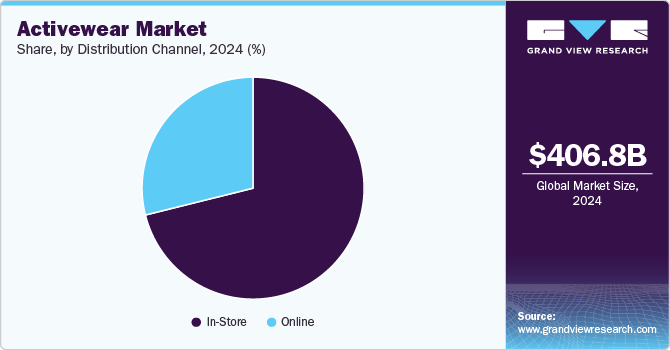

- By distribution channel, sales through in-store accounted for a revenue share of 71.14% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 406.83 Billion

- 2030 Projected Market Size: USD 677.26 Billion

- CAGR (2025-2030): 9.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Consumers are increasingly incorporating sports and fitness activities into their everyday routines owing to their increased health consciousness. As a result of the increasing participation, market dynamics have changed recently, resulting in increased demand for activewear clothing and sports gear.

The global demand for activewear is also being driven by increased awareness of health and fitness, along with a shift toward more active lifestyles. This trend is particularly noticeable among women, who are seeking to counter the effects of sedentary lifestyles by engaging in leisure activities such as running and cycling. The growing interest in active lifestyles has led more women to spend time in gyms and yoga centers, boosting the demand for activewear. Additionally, rapid urbanization and rising disposable incomes in developed countries are further encouraging women to purchase sportswear.

For millennials and Gen Z, activewear represents a lifestyle choice that aligns with their values of health, wellness, and convenience. These younger generations prioritize physical fitness and often engage in various activities that require flexible and durable clothing. Moreover, the rise of athleisure, where activewear is stylish enough to be worn outside of the gym, has made it socially acceptable to wear these garments in a variety of settings. The emphasis on mental and physical well-being, along with the demand for multi-purpose fashion that supports an active, on-the-go lifestyle, has fueled the popularity of activewear among these age groups. Additionally, the influence of social media and celebrity endorsements has further popularized activewear, making it a staple in the wardrobes of many young people.

In the U.S., millennial and Gen Z females allocate more spending to women's athleisure than to men's and children's athleisure combined, highlighting a strong affinity for athleisure among younger generations. Millennials, in particular, are willing to invest significantly in fitness, with lifetime spending projected to be around USD 112,000, a substantial portion of which goes toward activewear.

Moreover, as customers become more environmentally conscious, they expect transparency and ethical sourcing from brands. This shift in consumer preference emphasizes the importance of using recycled materials, reducing waste, and improving supply chain efficiency. Such practices not only support corporate social responsibility objectives but also appeal to ecologically concerned customers, build brand loyalty, and differentiate companies in a crowded market. Adopting sustainability has evolved beyond a mere trend; it is now a strategic necessity for future-proofing businesses and mitigating risks associated with changing customer preferences and environmental concerns.

Several brands are embracing this trend. For instance, in June 2023, Teijin Frontier, a subsidiary of Teijin Limited, developed a new stretchable and sustainable fabric for the sportswear market. The fabric, called Solotex Stretch, is made from recycled polyester and features high elasticity and shape retention properties. It is designed to provide comfort and freedom of movement for active wear. The fabric is also environmentally friendly, as it is produced using a low-impact manufacturing process. This new fabric innovation from Teijin Frontier aims to meet the growing demand for sustainable and performance-driven materials in the activewear industry.

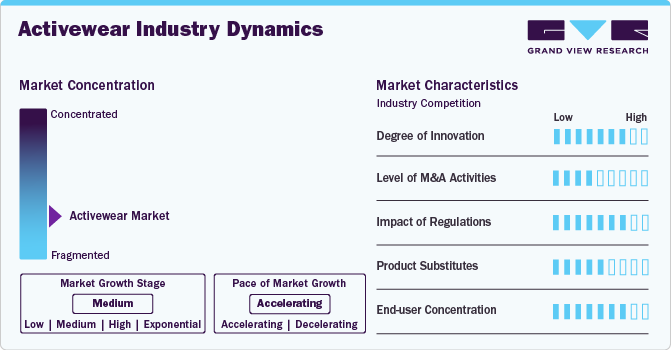

Market Concentration & Characteristics

Manufacturers in the activewear market are actively engaged in various initiatives to meet evolving consumer demands and market trends. The market shows a medium to high degree of innovation as manufacturers are constantly striving to enhance product performance, durability, and user experience through innovative technologies and designs.

Manufacturers are investing heavily in research and development (R&D) to introduce paddles made of advanced materials such as carbon fiber, fiberglass, and hybrid materials to improve power, control, and responsiveness.

Furthermore, manufacturers are also focusing on ergonomics and customization by offering paddles with varied grip sizes, shapes, and weight distributions to accommodate different playing styles and preferences.

End-use Insights

Women accounted for a revenue share of 47.62% in 2024. There is an increasing demand for activewear that not only enhances performance but also prioritizes comfort and functionality for women. A 2022 study commissioned by Adidas and conducted by Vitreous World highlighted significant consumer insights. Among female respondents aged 16 to 24 from the U.K., U.S., Japan, and China, 92% reported difficulty focusing on workouts due to uncomfortable apparel. While 58% of respondents experienced frequent interruptions to adjust leggings, 49% encountered skin irritation from tight-fitting activewear.

In response to these insights, Adidas took proactive steps to align its product offerings with consumer needs. The Spring/Summer 2023 collection was specifically designed to mitigate these challenges, incorporating advanced features like four-way stretch materials, customizable fits, enhanced support structures, and improved airflow management in key pieces such as bras and leggings. These enhancements reflect a broader industry shift toward more ergonomic and performance-driven activewear solutions.

The men's segment is expected to grow at a CAGR of 8.7% from 2025 to 2030. The higher participation of men in outdoor physical activities and their subsequent demand for comfort wear have been driving this end-user segment. The key to superior activewear lies in advanced technologies such as moisture-wicking textiles, temperature-regulating materials, and Far Infrared technology. For instance, Arctic Cool in the U.S. offers men's activewear with HydroFreeze X for immediate cooling, UPF 50 protection, 4-way stretch, anti-microbial properties, and activewick features.

Distribution Channel Insights

Sales through in-store accounted for a revenue share of 71.14% in 2024. A major factor driving in-store sales channels is the increasing consumer preference for purchasing high-end activewear from retail stores. This purchasing mode offers consumers a rich shopping experience and makes it easier for them to understand the exact size and quality of the apparel. In addition, retail stores and company-operated stores are associated with genuine products, and companies can curb the infiltration of counterfeit products through these sales channels. The availability of various brands under one roof, which helps in the easy comparison of products in terms of price and specifications, is a key factor driving the growth of retail stores in the activewear market.

Consumers prioritize product life cycle and price/value when purchasing activewear and find retail shops that are most convenient for trying and checking products before buying. The knowledgeable staff at these stores attracts first-time buyers with expertise in product specialties driving the sales of activewear through in-store channels during the forecast period.

Sales of activewear through online channels are expected to grow with a CAGR of 9.9% from 2025 to 2030. This is driven by the increasing number of consumers who prefer online shopping for its convenience. Shoppers favor online portals and official websites for purchasing premium products due to benefits such as easy return policies, cash-on-delivery options, and comprehensive customer services. Furthermore, consumers prefer online portals and company-specific websites to purchase activewear owing to value-added services like convenient return policies, cash on delivery, and integrated and centralized customer services. E-commerce is anticipated to witness significant growth in the coming years due to the availability of a large number of online vendors offering a variety of products at the best prices.

Regional Insights

North America activewear market accounted for a revenue share of 38.46% in 2024. The activewear market in North America, particularly in the U.S., is experiencing significant growth driven by a surge in health and wellness awareness. This growth accelerated during the pandemic as consumers prioritized exercise and comfort, leading to increased spending on activewear for both home and office settings. Major brands like Nike, Adidas, and Under Armour dominate the market, with clothing and footwear being the primary segments.

Women are the predominant consumers, although the men’s segment is growing rapidly. Brands such as Lululemon have successfully expanded their offerings to attract more male customers, reflecting a broader trend toward inclusivity in the activewear market. The increasing popularity of women's sports and the stylish nature of activewear that transcends gym use have sustained interest among female consumers, driving continued market expansion in the region.

U.S. Activewear Market Trends

The activewear market in the U.S. is expected to grow at a CAGR of 7.6% from 2025 to 2030. The rising participation in physical activity in the U.S. has significantly boosted activewear demand. According to the 2024 Sports, Fitness, and Leisure Activities Topline Participation Report, nearly 80% of Americans aged six and older engaged in sports or fitness activities in 2023, a 2.2% increase from 2022. This upward trend, continuing for a decade, saw an additional 5 million participants in 2023.

Many consumers prefer athletic apparel made with natural fibers like cotton due to its comfort and softness. As a result, numerous brands, from luxury to fast fashion, are incorporating cotton into their activewear lines. For instance, in 2023, Able Made used cotton fabric provided by Burberry for its Made2.01 collection. Meanwhile, fast fashion retailer Forever 21 offers various cotton-rich activewear pieces, including biker shorts, crop tops, and a full-body jumpsuit with moisture-wicking fabric.

Asia Pacific Activewear Market Trends

The activewear market in Asia Pacific is expected to grow at a CAGR of 10.9% from 2025 to 2030. The Asia Pacific region is witnessing a surge in demand for activewear driven by a growing emphasis on health and wellness. This trend is fueled by increased participation in sports and fitness activities, encouraging consumers to seek practical yet stylish apparel. Athleisure, blending functionality with fashion, has emerged as a key category, including popular items like yoga pants and sweatshirts. Retailers are capitalizing on this trend by expanding their product lines and enhancing customer experiences. For instance, ASICS in Tokyo offers in-store yoga sessions and personalized product consultations, integrating technology for enhanced customer engagement.

Key Activewear Company Insights

The market is characterized by numerous well-established and emerging players. Manufacturers in the activewear market are engaging in a variety of strategic initiatives to keep pace with evolving consumer demands and market trends. They are developing fabrics that wick away sweat, keeping the wearer cool and dry during workouts. Many activewear brands incorporate technologies like Dri-FIT (Nike) or Climalite (Adidas) that enhance performance by regulating body temperature. Furthermore, in response to increasing consumer demand for sustainable products, brands are shifting to eco-friendly materials, including recycled polyester, organic cotton, and biodegradable fabrics. This trend is part of the larger push toward circular fashion, where garments are designed to be durable, reusable, and recyclable.

Key Activewear Companies:

The following are the leading companies in the activewear market. These companies collectively hold the largest market share and dictate industry trends.

- Adidas AG

- Nike Inc.

- PUMA SE

- The Columbia Sportswear Company

- VF Corporation

- PVH Corp.

- ASICS Corporation

- Skechers U.S.A., Inc.

- Under Armour, Inc.

- Hanesbrands Inc.

Recent Developments

-

In June 2024, PUMA announced a global partnership with HYROX, solidifying its position as the official apparel and footwear partner for HYROX races spanning from 2024 to 2027. It plans to create a new line of HYROX clothing using its advanced Cloudspun technology featuring dryCELL moisture-wicking capabilities. In addition, PUMA will introduce customized versions of its existing footwear models, such as the Velocity NITRO 3, the Deviate NITRO Elite 3, and the Deviate NITRO 3, in special HYROX color schemes to optimize athlete performance at HYROX competitions.

-

In April 2024, Nike introduced a new wearable pump-compatible sports bra and EasyOn shoe aimed at providing more support and convenience for mothers. These products are designed to cater to the needs of active mothers who require both functionality and comfort in their athletic wear.

-

In April 2024, Under Armour launched a new brand platform in Australia called ‘Live in UA’. This platform is designed exclusively for the Australian market and features an expanded range of footwear, accessories, and apparel catering to every aspect of an athlete’s journey, from training, recovery to everyday living. The campaign showcases versatile pieces for various activities, such as running, Pilates, or casual outings. The collection includes men’s and women’s essentials crafted using quality fabrics and innovative design techniques to ensure comfort, durability, and style.

Activewear Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 440.39 billion

Revenue forecast in 2030

USD 677.26 billion

Growth rate

CAGR of 9.0% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; & South Africa

Key companies profiled

Adidas AG; Nike Inc.; PUMA SE; The Columbia Sportswear Company; VF Corporation; PVH Corp.; ASICS Corporation; Skechers U.S.A., Inc.; Under Armour, Inc.; Hanesbrands Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Activewear Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global activewear market report on the basis of end use, distribution channel, and region.

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

In-Store

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global activewear market size was estimated at USD 406.83 billion in 2024 and is expected to reach USD 440.39 billion in 2025.

b. The global activewear market is expected to grow at a compound annual growth rate of 9.0% from 2025 to 2030 to reach USD 677.26 billion by 2030.

b. North America dominated the activewear market with a share of 38.46% in 2024. This is attributable to the presence of significant industry competitors such as Nike and Adidas along with the popularity of sports like basketball and soccer.

b. Some key players operating in the activewear market include Adidas AG; Nike Inc.; PUMA SE; The Columbia Sportswear Company; VF Corporation; PVH Corp.; ASICS Corporation; Skechers U.S.A., Inc.; Under Armour, Inc.; and Hanesbrands Inc.

b. Key factors that are driving the activewear market growth include rising inclination towards modern clothing in the gym and everyday activities and increased engagement of women in domestic and professional sports and fitness activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.