- Home

- »

- Automotive & Transportation

- »

-

Active Power Steering Market Size & Share Report, 2030GVR Report cover

![Active Power Steering Market Size, Share & Trends Report]()

Active Power Steering Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Electric Power Steering System, Hydraulic Power Steering System), By Application (Passenger Car, Commercial Vehicle), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-344-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Active Power Steering Market Size & Trends

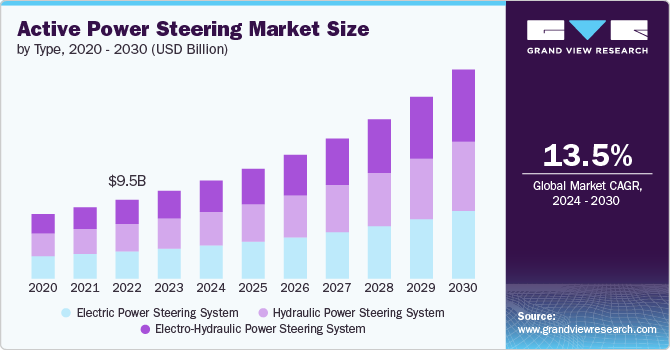

The global active power steering market size was estimated at USD 10.55 billion in 2023 and is expected to grow at a CAGR of 13.5% from 2024 to 2030. Active power steering is an advanced power steering technology that adjusts both the steering ratio and steering force based on driving speed and conditions. This growth of the market is driven by several factors, including the growing demand for advanced steering systems in commercial as well as passenger vehicles, technological innovations in automotive components, and the growing focus on vehicle safety and fuel efficiency. In addition, the integration of active power steering systems with advanced driver assistance systems (ADAS) and other automated driving technologies is anticipated to further drive market growth.

The active power steering system market is increasingly witnessing the integration of ADAS. This integration enhances safety features such as lane-keeping assist, automatic lane changes, and collision avoidance. Automotive manufacturers are leveraging this technology to provide a more intuitive and safer driving experience. As a result, the demand for vehicles equipped with ADAS and active power steering systems is on the rise.

Ongoing technological advancements are driving the growth of active power steering systems market. Innovations such as steer-by-wire technology, which eliminates the mechanical connection between the steering wheel and wheels, are gaining traction. These advancements offer greater design flexibility and improved performance. For instance, in September 2023, Titan, a UK-based company specializing in EV steering systems, launched a steer-by-wire system. This system is designed for an extensive range of low-volume vehicles, spanning from light commercial vehicles and trucks to supercars. Such initiatives by several manufacturers are expected to bode well for the market’s growth.

Furthermore, the market is poised for substantial growth propelled by increasing demand for electric vehicles, and growing focus on the development of autonomous vehicles. Electric vehicles benefit from the efficiency and precision of active power steering, which is essential for optimal performance. Autonomous vehicles requiring advanced steering capabilities are driving further innovations in this technology. This trend is leading to increased investment and development within the active power steering sector.

The utilization of advanced technologies and materials in active power steering systems often results in higher costs, which may hinder their widespread adoption. In addition, integrating active power steering systems into commercial vehicles demands precise engineering and introduces complexities to vehicle design and manufacturing processes. These challenges can be particularly daunting for manufacturers managing a range of vehicle models and specifications. Thus, the high cost of active power steering systems, particularly in commercial vehicles, and the integration complexities of these systems could hamper the growth of the market.

Type Insights

The hydraulic power steering system segment dominated the market in 2023 and accounted for a more than 34% share of global revenue. Hydraulic power steering, commonly known as HPS, is the most traditional and widely used type of power steering system. It functions by using hydraulic fluid and a pump to assist the driver in turning the vehicle's steering wheel. The growing adoption of hydraulic power steering systems in heavy-duty commercial vehicle applications due to their reliability and performance is boosting the growth of the market.

The electric power steering system segment is projected to witness a notable growth from 2024 to 2030. Electric Power Steering (EPS) ensures consistent performance across various driving conditions. This system relies on an electric motor integrated with the steering mechanism and uses sensors to communicate with the Engine Control Unit (ECU). The ECU adjusts the steering settings based on vehicle speed and other factors, optimizing the steering response accordingly. Increasing adoption of EPS in modern electric vehicles due to their ease of integration into the steering column and several benefits is driving the segment’s growth.

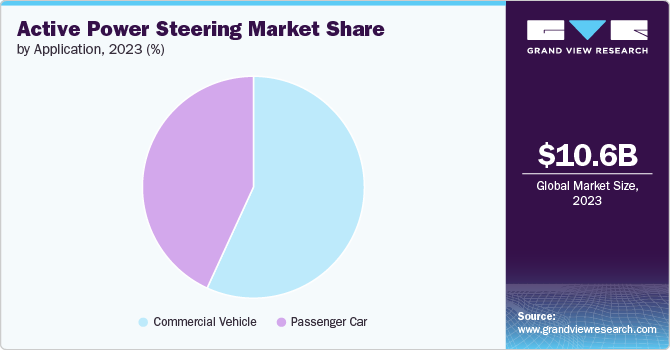

Application Insights

The commercial vehicle segment dominated the market in 2023. The use of active power steering is expanding in the commercial vehicle sector. These systems provide better maneuverability, stability, and safety for light, medium, and heavy commercial vehicles. As logistics and transportation industries grow, there is a greater need for advanced steering solutions to improve driver comfort and operational efficiency. In addition, heavy commercial vehicles need robust steering systems to manage heavy loads and long-distance travel. Thus, the increasing adoption of hydraulic and electro-hydraulic power steering systems in heavy commercial vehicles due to their strength and efficiency can be attributed to the segment growth.

The passenger car segment is projected to witness significant growth from 2024 to 2030. Active power steering systems have gained significant traction in the passenger car segment due to their ability to enhance driving comfort and safety. In addition, advancements in automotive technology, such as electrification and autonomous driving features, are reshaping consumer preferences and driving demand. Furthermore, increasing urbanization and congestion are driving demand for compact and fuel-efficient passenger cars, ultimately driving the demand for active power steering systems in this segment.Regional Insights

The North America active power steering market dominated in 2023 and accounted for a 32.62% share of the global revenue. The increasing demand for electric vehicles in the region, driven by national legislation, subsidies, and the growing emphasis on sustainable transportation is major driver behind the market’s growth. In addition, the integration of advanced steering technologies such as steer-by-wire and ADAS into autonomous vehicles is expected to fuel market growth by improving the performance and safety capabilities of active power steering systems.

U.S. Active Power Steering Market Trends

The active power steering market of the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The automotive sector in the U.S. is undergoing a notable transition towards electric and hybrid vehicles, which prioritize environmental sustainability. These vehicles heavily depend on EPS systems for their energy-efficient characteristics. As the popularity of electric and hybrid vehicles rises, the demand for advanced EPS technology is further expected to increase in the country. Moreover, there is a rising focus on safety and driver assistance features in the U.S. automotive industry, resulting in a growing priority on accident prevention and enhancing driver comfort.

Europe Active Power Steering Market Trends

Europe active power steering marketis expected to grow at a moderate CAGR from 2024 to 2030. The region's strong emphasis on reducing emissions and improving fuel efficiency has spurred the adoption of active power steering systems, which optimize energy use and contribute to eco-friendly driving solutions. Furthermore, increasing consumer demand for enhanced driving comfort and vehicle maneuverability is further propelling market growth as automakers introduce more advanced steering technologies to meet these expectations.

Asia Pacific Active Power Steering Market Trends

The active power steering market of Asia Pacific is expected to register the highest CAGR from 2024 to 2030. The increasing adoption of active power steering systems in passenger cars and commercial vehicles, particularly in countries like China, Japan, and India, is a major driving factor behind the market’s growth. In addition, the growing focus on enhancing vehicle safety and comfort, as well as the demand for reduced emissions and improved fuel efficiency, are further propelling the demand for active power steering technologies in the region.

Key Active Power Steering Company Insights

Key players operating in the market include Ognibene Power SpA, Robert Bosch GmbH, Knorr-Bremse Commercial Vehicle Systems GmbH, AB Volvo, ZF Friedrichshafen AG, NSK Ltd., Nexteer Automotive, MAN, JTEKT Corporation, and thyssenkrupp AG. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Active Power Steering Companies:

The following are the leading companies in the active power steering market. These companies collectively hold the largest market share and dictate industry trends.

- Ognibene Power SpA

- Robert Bosch GmbH

- Knorr-Bremse Commercial Vehicle Systems GmbH

- AB Volvo

- ZF Friedrichshafen AG

- NSK Ltd

- Nexteer Automotive

- MAN

- JTEKT Corporation

- thyssenkrupp AG

Recent Developments

-

In June 2023, Nidec Corporation announced the development of an electric power steering motor power pack (EPS-PP). EPS-PP detects and corrects the torque ripple and friction of the motor and EPS unit as they are generated, effectively resolving the persistent issue of artificial steering feel.

-

In April 2023, Nexteer Automotive unveiled the Modular Rack-Assist Electric Power Steering (mREPS) system, broadening the company's range of modular, cost-effective EPS solutions. Nexteer Automotive’s mREPS offers the flexibility needed to efficiently meet the diverse requirements of OEMs for cutting-edge steering systems in heavier vehicles, including light commercial vehicles and EVs.

Active Power Steering Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.78 billion

Revenue forecast in 2030

USD 25.15 billion

Growth rate

CAGR of 13.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Ognibene Power SpA; Robert Bosch GmbH; Knorr-Bremse Commercial Vehicle Systems GmbH; AB Volvo; ZF Friedrichshafen AG; NSK Ltd.; Nexteer Automotive; MAN; JTEKT Corporation; thyssenkrupp AG

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Active Power Steering Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global active power steering market based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric Power Steering System

-

Hydraulic Power Steering System

-

Electro-Hydraulic Power Steering System

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Car

-

Commercial Vehicle

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global active power steering market size was estimated at USD 10.55 billion in 2023 and is expected to reach USD 11.78 billion in 2024.

b. The global active power steering market is expected to grow at a compound annual growth rate of 13.5% from 2024 to 2030, reaching USD 25.15 billion by 2030.

b. The hydraulic power steering system segment dominated the type segment in 2023. Due to their reliability and performance, these systems are being increasingly adopted in heavy-duty commercial vehicles, thereby boosting the market's growth.

b. Key players operating in the active power steering market include Ognibene Power SpA, Robert Bosch GmbH, Knorr-Bremse Commercial Vehicle Systems GmbH, AB Volvo, ZF Friedrichshafen AG, NSK Ltd., Nexteer Automotive, MAN, JTEKT Corporation, and thyssenkrupp AG.

b. The active power steering market growth is driven by several factors, including the increasing demand for advanced steering systems in both commercial and passenger vehicles and technological innovations in automotive components.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.