- Home

- »

- Medical Devices

- »

-

Active Pharmaceutical Ingredient CDMO Market Report, 2033GVR Report cover

![Active Pharmaceutical Ingredient CDMO Market Size, Share & Trends Report]()

Active Pharmaceutical Ingredient CDMO Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Traditional API, HP-API, Biologics) By Synthesis (Synthetic, Biotech), By Drug (Innovative, Generics), By Application, By Workflow, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-282-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Active Pharmaceutical Ingredient CDMO Market Summary

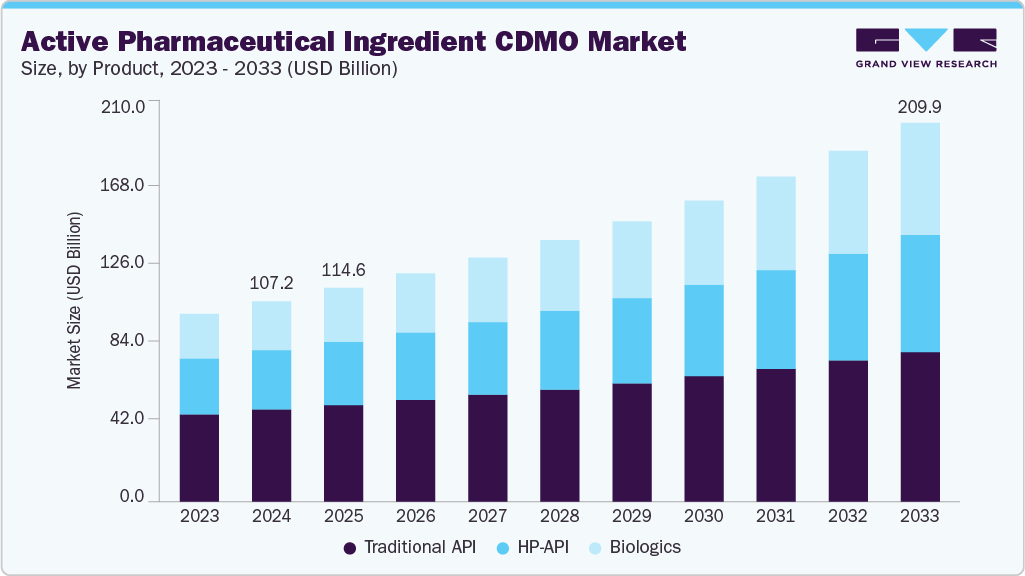

The global active pharmaceutical ingredient CDMO market size was estimated at USD 107.21 billion in 2024 and is projected to reach USD 209.85 billion by 2033, growing at a CAGR of 7.85% from 2025 to 2033. The market is driven due to the increasing demand for scalable and cost-efficient drug development solutions, growing outsourcing trends among pharmaceutical companies to reduce operational costs and focus on core competencies, and increasing R&D activities in specialty and complex APIs.

Key Market Trends & Insights

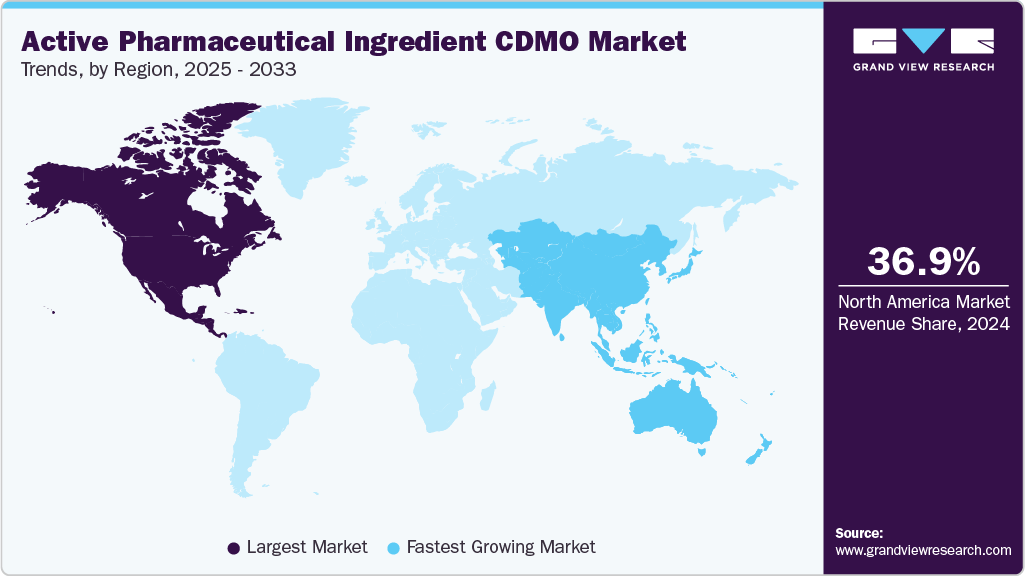

- North America active pharmaceutical ingredient CDMO market held the largest share of 36.92% of the global market in 2024.

- The active pharmaceutical ingredient CDMO industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the traditional active pharmaceutical ingredient (Traditional API) segment led the market with the largest revenue share of 44.52% in 2024.

- Based on synthesis, the synthetic segment led the market with the largest revenue share in 2024.

- Based on drug, the innovative segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 107.21 Billion

- 2033 Projected Market Size: USD 209.85 Billion

- CAGR (2025-2033): 7.85%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

Moreover, the growing biosimilars and biologics segment, increasing prevalence of chronic diseases, patent expirations of blockbuster drugs, and advancements in manufacturing technologies such as continuous manufacturing and high-potency APIs are further contributing to the industry growth. In addition, several pharmaceutical and biotechnology companies are increasingly outsourcing their API manufacturing services to CDMOs, which is also one of the major factors contributing to market growth. The increasing complexity of drug molecules and the cost advantages offered by CDMOs are the major contributors to the shift from in-house capabilities to outsourcing. Furthermore, the increasing prevalence of chronic diseases globally has intensified the demand for innovative therapies, further pushing the CDMOs to focus on large-scale production, faster development, and regulatory compliance.

Furthermore, increasing pipelines of biologics and biosimilars and a growing demand for HPAPIs contribute to the increasing opportunities. CDMOs have higher levels of expertise and advanced technologies, making them the preferred choice for biotechnology and pharmaceutical companies looking for scalable, compliant, and efficient manufacturing solutions. Moreover, patent expirations of branded and blockbuster drugs are boosting the demand for generic APIs. Thus, these factors are changing the market's competitive landscape, further contributing to the market growth.

Opportunity Analysis

Increasing adoption of targeted therapies, monoclonal antibodies, and advanced biologics drugs is fueling the demand for CDMOs, with large-scale biomanufacturing capabilities and biologics expertise. CDMOs are increasingly investing in advanced facilities to meet the growing demand for these specialized therapies, equipped with advanced cell culture platforms, enabling them to offer high-quality and scalable solutions for biotechnology and pharmaceutical companies. Besides, increasing demand for HPAPIs in the field of immunology, oncology, and rare disease treatments further boosts the demand for APIs, contributing to market growth.

Furthermore, patent expirations of blockbuster drugs are driving the demand for APIs in the generics market, as several pharmaceutical companies are increasingly considering cost-effective solutions. Emerging regions such as the Asia Pacific, Latin America, and the Middle East are creating significant opportunities, further supported by government initiatives and local demand for affordable medicines.

Technological Advancements

Technological advancements are enhancing quality, scalability, and efficiency across development and manufacturing stages. Furthermore, flow chemistry and continuous manufacturing are increasingly being adopted to reduce costs, enable faster production cycles, and improve reproducibility. Moreover, advanced bioprocessing platforms such as single-use bioreactors, perfusion systems, and high-density cell culture technologies are accelerating manufacturing of large-scale biologics and complex APIs. Thus, constant advancement in this field is creating significant competitive advantages for CDMOs, enabling them to offer higher quality and more flexible services to meet the growing demand of pharmaceutical companies.

Product Insights

On the basis of product, the market is classified into traditional API, HP-API, and biologics. The traditional API segment accounted for the largest revenue share of 44.52% in 2024. The segment's growth is attributed to significant applications of these APIs in the generic drug manufacturing, a growing number of patent expirations, and increasing demand for small-molecule drugs. In addition, the relatively lower production cost and cost-effectiveness are further driving the adoption of traditional APIs.

The biologics segment is anticipated to grow at the fastest CAGR during the forecast period. The growth outlook is driven due to the increasing adoption of targeted cancer therapies, the growing pipeline of oncology-based biologics, and the increasing approvals of innovative drugs. Moreover, CDMOs are increasingly investing in advancing their specialized facilities with high containment capabilities, advanced bioconjugation technologies, and scalable manufacturing platforms to support complex biological development, further accelerating the segment growth.

Synthesis Insights

In terms of synthesis, the market is segregated into synthetic and biotech. The synthetic segment held the largest share in 2024. The growth of the segment comes in the wake of increasing use of chemical synthesis to manufacture small molecule APIs, along with the established infrastructure and technical expertise available with CDMOs. Furthermore, the increasing demand for generic drugs, coupled with growing reliance on small molecules to treat chronic conditions, including diabetes, cardiovascular diseases, and infectious diseases, further contributes to the segment’s dominance.

The biotech segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is mainly due to the increasing demand for biosimilars and biologics, increasing prevalence of chronic diseases such as autoimmune disorders and cancers, and the growing shift of pharmaceutical companies towards extensive molecule development. Moreover, several CDMOs are heavily investing to advance their existing facilities, installing single-use bioprocessing technologies, advanced fermentation systems, and cell culture, which may drive the segment's market growth in the upcoming years.

Drug Insights

Based on drug, the market is segregated into innovative and generic. The innovative segment accounted for the largest revenue share in 2024. The growth is largely attributed to increasing investment in novel drug development coupled with growing demand for specialty medicines and biologics. Besides, the growing pipeline of innovative drugs, continuous R&D activities, and favorable regulatory approvals have further solidified the dominance of this segment, as pharmaceutical companies increasingly rely on specialized expertise.

The generics segment is poised to grow at the fastest CAGR during the forecast period. This growth stems against the backdrop of the increasing number of branded drug patent expirations, growing demand for affordable treatment options, and increasing cost-containment pressures in healthcare systems. Moreover, rising government initiatives, expanding access to healthcare in emerging markets, and the significant role of CDMOs in providing cost-efficient large-scale API production would boost the adoption of generic drugs.

Application Insights

With respect to application, the market is segregated into oncology, hormonal, glaucoma, cardiovascular disease, diabetes, and others. The oncology segment registered the largest market share in 2024 due to the increasing burden of cancer globally, rising demand for personalized medicines, and growing investments by pharmaceutical companies in oncology research and development.

The glaucoma segment is expected to grow at the second fastest CAGR during the forecast period. The projection comes on the back of the increasing cases of glaucoma, which is driving the demand for advanced therapies for long-term management. In essence, the rising geriatric population is leading to higher cases of glaucoma, which is further increasing the demand for effective treatment options and driving the need for large-scale manufacturing support from the CDMOs.

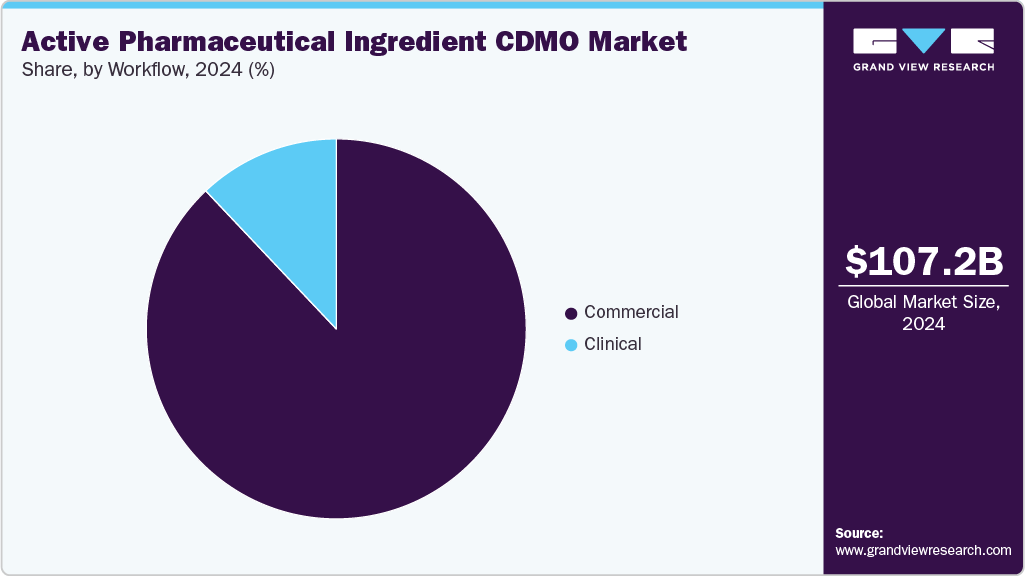

Workflow Insights

With regards to workflow, the market is segregated into clinical and commercial. The commercial segment held the largest revenue share in the global market in 2024, owing to the large-scale production requirements of approved drugs, rising demand for contract manufacturing of generics and biosimilars, and the cost advantages that pharmaceutical companies gain. In addition, the presence of well-established manufacturing facilities, advanced technologies for high-volume production, and the ability of CDMOs to ensure regulatory compliance and global supply chain distribution is also contributing to market growth.

The clinical segment is anticipated to grow at the fastest CAGR over the forecast period. The segment growth is driven by the growing number of drug candidates entering clinical trials, increasing investments in research and development activities by pharmaceutical companies, and growing reliance on CDMOs for early-stage development and small-batch manufacturing. Moreover, increasing demand for CDMOs in clinical workflows, which offer specialized services such as formulation development, analytical testing, and regulatory support, is also projected to contribute to the segment's growth.

Regional Insights

The North America active pharmaceutical ingredient CDMO industry accounted for the largest revenue share of 36.92% in 2024. This is attributed to the regions advanced manufacturing facilities, higher concentration of clinical trials, and growing spending in research and development activities by the pharmaceutical companies.

U.S. Active Pharmaceutical Ingredient CDMO Market Trends

The active pharmaceutical ingredient CDMO industry in the U.S. held the largest share in 2024. The country’s growth is due to high R&D spending, strong venture funding, and rapid commercialization of CAR-T and gene therapies. The country’s robust network of CDMOs, along with early regulatory approvals, fuels consistent outsourcing demand.

Europe Active Pharmaceutical Ingredient CDMO Market Trends

The Europe active pharmaceutical ingredient CDMO industry is expected to grow significantly due to the region’s favorable policies, such as the EMA’s PRIME designation and strong academic-industry collaborations. The region is witnessing steady growth in clinical pipelines, with CDMOs investing heavily in capacity expansion.

The active pharmaceutical ingredient CDMO industry in Germany captured a notable share in 2024, owing to the country’s strong biopharma R&D, clinical trial activity, and government incentives for advanced therapies. Its manufacturing base and skilled workforce make it a preferred hub for CDMO expansion.

The UK active pharmaceutical ingredient CDMO industry held a significant share in 2024. The growth of the market is due to investments in advanced therapy medicinal products (ATMP) infrastructure.

Asia Pacific Active Pharmaceutical Ingredient CDMO Market Trends

The Asia Pacific active pharmaceutical ingredient CDMO industry is anticipated to witness the fastest CAGR over the estimated timeline. The regional growth is attributed to rising biotech investments, expanding patient pools, and lower manufacturing costs. Governments in countries such as China, Japan, and South Korea are actively supporting local ATMP manufacturing hubs.

The active pharmaceutical ingredient CDMO industry in China held the largest share in 2024. The growth is due to the country’s surge in clinical trials, growing domestic biotech companies, and government-backed funding for cell and gene therapy infrastructure. Strategic alliances with international CDMOs are further boosting the market’s scale-up capacity.

The Japan active pharmaceutical ingredient CDMO industry is expected to grow over the forecast period due toits accelerated regulatory approval system for regenerative medicines. The country’s focus on stem cell and gene-modified therapies, along with partnerships with global CDMOs, is driving rapid market growth.

The active pharmaceutical ingredient CDMO industry in India is anticipated to grow at the lucrative CAGR over the forecast period. The country’s market growth is due to the lower operational costs, skilled scientific workforce, and growing R&D investments from both domestic and multinational companies.

Key Active Pharmaceutical Ingredient CDMO Company Insights

The major players operating across the market are focused on adopting inorganic strategic initiatives such as mergers & acquisitions and partnerships. Moreover, companies have emphasized technological innovations to augment their market position. For instance, in November 2023, Hovione expanded its nasal drug delivery through a partnership with IDC (Industrial Design Consultancy), introducing innovative nasal powder devices for local, systemic, and nose-to-brain drug delivery. The partnership enhanced Hovione's integrated nasal drug development and manufacturing services.

Key Active Pharmaceutical Ingredient CDMO Companies:

The following are the leading companies in the active pharmaceutical ingredient CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Cambrex Corporation

- Recipharm AB

- Thermo Fisher Scientific Inc.

- CordenPharma International

- Samsung Biologics

- Lonza

- Catalent, Inc

- Siegfried Holding AG

- Piramal Pharma Solutions

- Boehringer Ingelheim International GmbH

Recent Developments

-

In June 2025, Recipharm announced that it had secured several major product development contracts, which aimed to further strengthen the company’s leadership in Blow-Fill-Seal (BFS) technology.

-

In December 2024, Cambrex inked an agreement with Lilly which aimed to deliver faster access to clinical development capabilities for Lilly’s biotech collaborators.

Active Pharmaceutical Ingredient CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 114.61 billion

Revenue forecast in 2033

USD 209.85 billion

Growth rate

CAGR of 7.85% from 2025 to 2033

Actual data

2018 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, synthesis, drug, application, workflow, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE; Oman; Qatar

Key companies profiled

Cambrex Corporation; Recipharm AB; Thermo Fisher Scientific Inc. (Pantheon); CordenPharma International; Samsung Biologics; Lonza; Catalent, Inc.; Siegfried Holding AG; Piramal Pharma Solutions; Boehringer Ingelheim International GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Active Pharmaceutical Ingredient CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global active pharmaceutical ingredient CDMO market report based on product, synthesis, drug, application, workflow, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Traditional Active Pharmaceutical Ingredient (Traditional API)

-

Highly Potent Active Pharmaceutical Ingredient (HP-API)

-

Biologics

-

-

Synthesis Outlook (Revenue, USD Billion, 2021 - 2033)

-

Synthetic

-

Biotech

-

-

Drug Outlook (Revenue, USD Billion, 2021 - 2033)

-

Innovative

-

Generics

-

-

Workflow Outlook (Revenue, USD Billion, 2021 - 2033)

-

Clinical

-

Commercial

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Oncology

-

Hormonal

-

Glaucoma

-

Cardiovascular disease

-

Diabetes

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global active pharmaceutical ingredient CDMO market size was estimated at USD 107.21 billion in 2024 and is expected to reach USD 114.6 billion in 2025.

b. The global active pharmaceutical ingredient CDMO market is expected to grow at a compound annual growth rate of 7.85% from 2025 to 2033 to reach USD 209.85 billion by 2033

b. Some of the key market players include Lonza, LabCorp, Thermo Fisher Scientific, Inc., Recipharm AB, Catalent, Inc., Siegfried Holding AG, Samsung Biologics, Piramal Pharma Solutions, WuXi AppTec, Inc., Bushu Pharmaceuticals Ltd., CordenPharma International, Cambrex Corporation, Boehringer Ingelheim International GmbH

b. Key factors that are driving the market growth include increasing pharmaceutical R&D investments, demand for genetic drugs, biologic innovations, and the rise in the prevalence of cancer and age-related disorders.

b. North America dominated the active pharmaceutical ingredient CDMO market and accounted for the largest revenue share of 36.9% in 2024. The regions growth is attributed to the strong presence of leading pharmaceutical and biotechnology companies, well-established manufacturing infrastructure, and significant investments in advanced technologies such as continuous manufacturing and high-potency API production.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.